3 things to know now that Supreme Court blocked Biden’s student loan cancellation

By Simone Del Rosario (Business Correspondent), Ryan Tiedgen (Editor)

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below.

Learn more about this dataLeft 33%

Center 50%

Right 18%

Bias Distribution

Supreme Court Overturns Joe Biden’s Student Loan Debt Forgiveness Plan

Click to see story on HuffPost

Supreme Court Continues Cruelty Crusade by Killing Student Debt Relief Plan

Click to see story on RollingStone

Biden plans ‘swift’ response to Supreme Court shooting down student loan debt relief

Click to see story on Alternet

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Daily Kos

Supreme Court strikes down Biden student loan relief plan

Click to see story on MSNBC

ACLU Comment on Supreme Court’s Ruling Against Student Debt Relief Plan

Click to see story on Common Dreams

Supreme Court Strikes Down Biden’s Student Loan Forgiveness Plan

Click to see story on Vanity Fair

So you have to pay your student loans. What’s next, in 5 charts.

Click to see story on Vox

Supreme Court’s Right Wing Strikes Down Biden Student Debt Relief Plan

Click to see story on Talking Points Memo

The Supreme Court Can’t Kill Student-Loan Relief

Click to see story on New York Magazine

The Supreme Court just struck down Biden’s plan to cancel student debt

Click to see story on Mother Jones

Supreme Court Case to End Biden’s Student Loan Cancellation Plan Relies on “Unwilling Participant”

Click to see story on Democracy Now!

Durbin expresses concern as Supreme Court strikes down Biden administration’s student loan debt relief plan in overreaching decision

Click to see story on chicagocrusader.com

Biden student debt relief plan DOA at Supreme Court – National Zero

Click to see story on National Zero

US Supreme Court rules against Biden administration student loan debt relief plan – Wisconsin Examiner

Click to see story on Wisconsin Examiner

Click to close

US supreme court rules against Biden’s student loan relief program

Click to see story on The Guardian

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Hindu

Biden speaks after his student loan debt plan struck down by Supreme Court

Click to see story on The Independent

Defeat for Biden as U.S. Supreme Court rejects plan to cancel $400B in student loans

Click to see story on CBC News

Joe Biden’s $400 Billion Student Debt Cancellation Plan Rejected

Click to see story on NDTV

As recession threatens, Supreme Court student loan forgiveness ruling may hurt the economy

Click to see story on USA Today

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Associated Press News

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on CNN

Supreme Court strikes down Biden’s student loan forgiveness plan as unlawful

Click to see story on CBS News

Supreme Court halts Joe Biden’s student loan forgiveness program

Click to see story on Metro News

Supreme Court rejects President Biden’s student loan relief plan

Click to see story on NY Daily News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Toronto Star

Supreme Court strikes down Biden’s plan to forgive millions of student loans

Click to see story on Los Angeles Times

Supreme Court Throws Out Biden’s Student-Loan Relief Plan

Click to see story on Bloomberg

Supreme Court dismisses student loan challenge on standing

Click to see story on npr

USA: Supreme Court stops debt relief for students

Click to see story on Sueddeutsche Zeitung

Supreme Court strikes down President Biden’s student loan forgiveness program

Click to see story on The Mercury news

How Supreme Court student loans decision affects you

Click to see story on abc 6 Philadelphia

How Supreme Court student loans decision affects you

Click to see story on abc 13 Houston

The U.S. Supreme Court canceled Biden’s student loan relief program. Here’s what borrowers should know.

Click to see story on Star Tribune

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Alaska Highway News

How Supreme Court student loans decision affects you

Click to see story on abc 7 News

How Supreme Court student loans decision affects you

Click to see story on abc11 Raleigh

How Supreme Court student loans decision affects you

Click to see story on abc30 News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Japan Today

US Supreme Court blocks Biden student loan forgiveness

Click to see story on GMA Filipino News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Chicago Sun Times

Supreme Court rejects Joe Biden’s student loan forgiveness plan

Click to see story on Bangor Daily News

USA: Supreme Court stops Joe Biden’s plan for student loan waiver

Click to see story on Zeit Online

Supreme Court strikes down Biden administration’s student loan debt relief program – Boston News, Weather, Sports

Click to see story on WHDH

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Koco News5

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Times Colonist

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Hampshire Gazette

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on North Shore News

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Town And Country Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Delta Optimist

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on New West Record

Supreme Court strikes down Biden’s student debt relief plan

Click to see story on Politico

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WISH-TV

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Flin Flon Reminder

WATCH LIVE: Biden speaks after Supreme Court strikes down student loan relief plan

Click to see story on PBS NewsHour

US SC blocks Joe Biden’s bid to cancel $430 billion in student debt

Click to see story on Deccan Herald

North Texas borrowers react to SCOTUS ruling on student loan forgiveness

Click to see story on NBC Dallas-Fort Worth

Michiganders react to Supreme Court rejecting student loan forgiveness plan

Click to see story on Detroit Free Press

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Times of Israel

Mass. politicians react to Supreme Court striking down Biden’s student loan forgiveness plan

Click to see story on Boston.com

How the Supreme Court student loan decision affects you

Click to see story on NBC New York

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – WSVN 7News | Miami News, Weather, Sports

Click to see story on WSVN

More than 1M N.J. borrowers will have to pay their full debt under Supreme Court loan forgiveness ruling

Click to see story on nj

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on SooToday.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Salt Lake Tribune

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Barrie Today

The Supreme Court blocked Biden’s student loan forgiveness plan. What does that mean for borrowers?

Click to see story on Inquirer

Supreme Court strikes down Biden’s student loan foregiveness plan

Click to see story on NBC Washington

Watch live: President Biden speaks after Supreme Court rejects his student loan forgiveness plan – The Boston Globe

Click to see story on Boston Globe

The Supreme Court’s student loan decision is out. Here’s what it means for you

Click to see story on The Courier-Journal

In decision affecting 685,000 Wisconsin borrowers, Supreme Court strikes down student loan forgiveness

Click to see story on Journal Sentinel

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on News & Record

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Arizona Daily Sun

U.S. Supreme Court blocks Biden’s student loan forgiveness plan

Click to see story on Philly Voice

Biden Vows to ‘Find Other Ways’ to Offer Relief After Supreme Court Ends His Student Debt Program

Click to see story on Mediaite

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on The Sacramento Bee

Citing harm to Missouri, Supreme Court kills Biden’s student loan forgiveness

Click to see story on Kansas City Star

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – Austin Daily Herald

Click to see story on Austin Daily Herald

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Delaware County Daily Times

AG Tim Griffin celebrates Supreme Court ruling against student debt relief

Click to see story on Arkansas Times

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The Charlotte Observer

U.S. Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Colorado Sun

Kentucky, what does the Supreme Court decision on student loan forgiveness mean to you?

Click to see story on Lexington Herald Leader

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Longmont Times-Call

Supreme Court rejects Biden’s student loan forgiveness plan

Click to see story on The Week

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The Herald

Joe Biden announces new plan to forgive student loans following Supreme Court ruling

Click to see story on The Fresno Bee

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on The Tribune

U.S. Supreme Court blocks Biden’s plan to cancel student debts

Click to see story on NRC Handelsblad

Nearly 1.4 million Texans could be impacted by U.S. Supreme Court decision blocking student loan forgiveness

Click to see story on The Texas Tribune

‘It’s absurd’: Kent State students disappointed Supreme Court rejected loan forgiveness

Click to see story on Akron Beacon Journal

Biden’s $430 billion student debt forgiveness program has lost the Supreme Court battle

Click to see story on Quartz

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Southernminn.com

Supreme Court nixes student loan relief for 208K CT borrowers

Click to see story on The CT Mirror

Supreme Court votes to strike down Biden’s proposed student debt forgiveness plan

Click to see story on The Michigan Daily

Supreme Court strikes down Biden’s plan to forgive millions of student loans

Click to see story on The Victoria Advocate

The Supreme Court Killed Biden’s Student Loan Forgiveness Plan. What Does That Mean For 2024?

Click to see story on FiveThirtyEight

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on News and Tribune

Court tosses student loan forgiveness plan

Click to see story on The Tifton Gazette

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Reporter.net

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Bluefield Daily Telegraph

US Supreme Court rules against Biden administration student loan debt relief plan

Click to see story on Arizona Mirror

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on modbee.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on unionrecorder.com

Click to close

US Supreme Court strikes down student loan forgiveness plan

Click to see story on BBC News

The Supreme Court just ruled on Biden’s student loan forgiveness plan

Click to see story on CNBC

US Supreme Court deals setback to LGBT rights, blocks Biden’s student-loan plan

Click to see story on South China Morning Post

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on KRDO

Here’s when your student loan payments will start again

Click to see story on KIFI

Supreme Court strikes down Biden’s student debt forgiveness plan

Click to see story on The Hill

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KVIA

The Supreme Court Just Killed Biden’s Student Loan Plan. Here’s What’s Next for Education Debt Forgiveness

Click to see story on c|net

Biden’s Student Loan Forgiveness Was Always a Sham

Click to see story on Newsweek

US Supreme Court junks Biden’s $400bn student debt cancellation plan

Click to see story on WION

US Supreme Court blocks President Joe Biden’s plans to forgive student loan debt

Click to see story on Sky News UK

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Winnipeg Free Press

Supreme Court rejects Biden’s plan to erase student loan debt

Click to see story on Star Advertiser

Supreme Court Rejects Biden’s Plan to Wipe Away Student Loans

Click to see story on VOA News

Supreme Court blocks Biden’s student debt forgiveness program

Click to see story on UPI

US Supreme Court blocks Biden’s student debt forgiveness push

Click to see story on Al Jazeera

Supreme Court rejects Biden plan to wipe away $400 billion in student loan debt

Click to see story on Pioneer Press

How Supreme Court student loans decision affects you

Click to see story on abc 7 Chicago

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KCRA 3

US Supreme Court rejects Biden’s $400 billion student loan cancellation plan

Click to see story on Live Mint

U.S. Supreme Court blocks Biden’s student loan forgiveness plan

Click to see story on The Globe & Mail

How Supreme Court student loans decision affects you

Click to see story on abc 7 LA

How Supreme Court student loans decision affects you

Click to see story on abc 7 NY

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on News 4 JAX

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on WPLG

WATCH LIVE: Biden speaks after SCOTUS strikes down student loan forgiveness plan

Click to see story on WKMG

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Click on Detroit

Student loan forgiveness: Supreme Court strikes down Biden’s plan

Click to see story on Chicago Tribune

Student Loan Forgiveness: What is Biden’s back up plan for student loans?

Click to see story on Marca

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Post and Courier

How the Supreme Court student loan decision affects you

Click to see story on Portland Press Herald

Supreme Court strikes down student loan debt plan

Click to see story on Las Vegas Review-Journal

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WCVB

‘A lot of chaos’: Locals react to strikedown of Biden’s student loan forgiveness plan

Click to see story on Wral News

Justices Strike Down Biden’s Student Loan Plan

Click to see story on Political Wire

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WLWT

Biden’s Student Loan Forgiveness Struck Down For Maryland Borrowers

Click to see story on Patch

5 key dates: Student loan repayments starting in October

Click to see story on Michigan Live

US Supreme Court blocks Biden student loan forgiveness

Click to see story on Inforum

NH borrowers react to Supreme Court blocking student loan forgiveness

Click to see story on WMUR

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Washington Top News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WLKY

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WESH

When do student loan payments resume? What to know after Supreme Court ruling

Click to see story on NBC Chicago

Supreme Court strikes down Biden’s student loan plan, withholding relief from millions of Texans

Click to see story on Houston Chronicle

Biden turns to Higher Education Act for next move on student loans after Supreme Court rejects forgiveness plan

Click to see story on MarketWatch

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WDSU

Students react after Supreme Court ruling knocks down student loan forgiveness

Click to see story on WTAE

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KETV

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Detroit News

Supreme Court Rejects Student Loan Forgiveness—Here’s What We Know Before Payments Restart This Fall

Click to see story on Forbes

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WYFF

How the Supreme Court student loan decision affects you

Click to see story on The Billings Gazette

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Denver Post

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KCCI

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KMBC

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Lincoln Journal Star

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Dallas News

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WBAL-TV

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Sask Today

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WISN

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Missoulian

Student Loan forgiveness blocked

Click to see story on WTEN

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WPTZ

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WMTW

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on PIX 11

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WVTM

Supreme Court rejects Biden’s student loan debt forgiveness plan

Click to see story on Deseret News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WAPT

Here’s when your student loan payments will start again

Click to see story on KWWL

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Helena Independent Record

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Montana Standard

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KOAT

Supreme Court rejects Biden’s $400 billion student debt forgiveness plan

Click to see story on The Oregonian

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Tulsa World

Supreme Court blocks Biden’s student loan forgiveness plan

Click to see story on Fortune

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WRIC

Supreme Court ends Biden’s plan to erase student loan debt

Click to see story on Penn Live

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on CP24

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WPRI 12

The Supreme Court ended Biden’s student loan debt forgiveness plan; read the ruling here

Click to see story on Mass Live

Tampa Bay area residents react to SCOTUS striking down student loan forgiveness

Click to see story on WFLA-TV

Missouri officials take credit for overturned student loan forgiveness plan

Click to see story on Fox 2 Now St Louis

Florida lawmakers, student loan borrower react to SCOTUS ruling

Click to see story on NY1

Supreme Court strikes down President Biden’s plan to wipe away $400 billion in student loans

Click to see story on Syracuse NY

Joe Biden’s Program Forgiving Students of Debt Rejected by U.S. Supreme Court

Click to see story on Digi 24

How the Supreme Court student loan decision affects you

Click to see story on KOB 4

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on OPB

Louisiana leaders talk about US Supreme Court decision on student loan debt relief

Click to see story on BRPROUD

Pacific Northwest lawmakers react to SCOTUS striking down student loan relief

Click to see story on KOIN 6

South Dakota delegation on student debt Supreme Court ruling

Click to see story on KELO

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Camera

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Sun (Lowell)

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Columbian

High Court student loan forgiveness ruling hits home

Click to see story on WCAX-TV

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Fox 59 Indianapolis

How the Supreme Court student loan decision affects you

Click to see story on KCRG

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Tucson

Nebraskans split on Supreme Court striking down Biden’s student loan forgiveness plan

Click to see story on Omaha World-Herald

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Fox8

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on East Idaho News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WPBF

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on NWAHOMEPAGE

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WANE-TV

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Sentinel

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on KTSM

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on HDR | Hickory Daily Record

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Freeman

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Chico Enterprise-Record

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Rapid City Journal Media Group

What Supreme Court rejection of student loan relief means

Click to see story on The Christian Science Monitor

Still paying student loans? How the Supreme Court student loan decision affects you

Click to see story on Nola

SC leaders react to Supreme Court blocking student loan forgiveness plan

Click to see story on WSPA

U.S. Supreme Court rejected Biden student loan cancellation plan

Click to see story on Eesti Rahvusringhääling

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Virginian Pilot

US Supreme Court strikes down Biden’s student loan forgiveness scheme

Click to see story on Financial Times

Supreme Court rejects Biden plan to wipe away student loan debt

Click to see story on KVRR Local News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WGAL

Supreme Court spikes student loan forgiveness

Click to see story on Florida Politics

Supreme Court Strikes Down Biden’s Student Loan Plan

Click to see story on Barron's

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WXII

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on ABC FOX Montana

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on McDowellNews.com

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The News & Observer

Supreme Court student loan ruling draws mixed reaction in Kentucky

Click to see story on The Center Square

Huntsville attorney provides insight after Supreme Court strikes down student loan forgiveness plan

Click to see story on waaytv.com

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Daily Gazette

US Supreme Court blocks Biden student loan forgiveness

Click to see story on Colorado Springs Gazette

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Oakland Press

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Sentinel-Tribune

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KSBW

Oklahoma reacts to SCOTUS striking down student loan forgiveness

Click to see story on KJRH

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on Albany Herald

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The Herald Sun

Supreme Court says no to Biden student loan forgiveness plan. How that affects Idahoans

Click to see story on Idaho Statesman

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Morning Journal

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on MYSTATELINE

Supreme Court rules Biden’s student loan forgiveness plan unconstitutional

Click to see story on MinnPost

Supreme Court strikes down President Biden’s student loan forgiveness program

Click to see story on Red Bluff Daily News

Mass. leaders react to court ruling blocking loan forgiveness

Click to see story on Eagle-Tribune

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on abc12/WJRT

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Reporter

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Pottstown Mercury

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Local News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on vaildaily.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Sentinel and Enterprise

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – American Press

Click to see story on Lake Charles American Press

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KHBS

“He’s not allowed to do that.” Rep. Johnson praises SCOTUS ruling striking down Biden’s student loan forgiveness program

Click to see story on WTRF

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Times Herald

Student loan forgiveness struck down

Click to see story on Longview News-Journal

Supreme Court strikes down student loan forgiveness plan, but Biden vows to continue fight

Click to see story on Pensacola News Journal

U.S. Supreme Court Strikes Down Student Loan Forgiveness

Click to see story on WBOC 16

Supreme Court strikes down Biden student loan forgiveness

Click to see story on Straight Arrow News

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on McClatchy DC Bureau

Supreme Court strikes Biden’s student debt forgiveness plan – News Facts Network

Click to see story on News Facts Network

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Shaw Local

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on castanet.net

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Norfolk Daily News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on mywabashvalley.com

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on wfft.com

No, Supreme Court ruling does not eliminate other student loan forgiveness programs

Click to see story on verifythis.com

Click to close

US Supreme Court blocks Biden student loan forgiveness

Click to see story on Times of India

US Supreme Court Rejects USD 400 Billion Student Debt Cancellation Plan, Biden ‘Strongly’ Disagrees

Click to see story on News18 India

US Supreme Court hands Biden defeat as it blocks student loan forgiveness deal

Click to see story on Independent.ie

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Washington Times

US Supreme Court blocks Joe Biden’s $400bn student debt relief plan

Click to see story on The Telegraph

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Financial Post

SCOTUS overturns Biden’s plan to forgive student loans

Click to see story on News

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on MY Northwest

Massachusetts Democrats slam Supreme Court for rejecting Biden’s student loan cancellation plan

Click to see story on Boston Herald

Supreme Court rejects Biden plan to wipe away $400 billion in student loans

Click to see story on OC Register

High Court Rejects Biden’s Student Loan Forgiveness Plan

Click to see story on Real Clear Politics

What the Supreme Court’s Student-Loan Decision Means for You

Click to see story on Wall Street Journal

Supreme Court strikes down Biden student loan forgiveness plan

Click to see story on Alabama Live

Biden fails: Supreme Court blocks student loan issuance

Click to see story on Frankfurter Allgemeine

Supreme Court to Biden: You can’t just forgive $400 billion in student loan debt without asking Congress

Click to see story on Reason

Supreme Court strikes down Biden’s studen loan forgiveness plan (NASDAQ:SOFI)

Click to see story on Seeking Alpha

More SCOTUS: Biden’s student-loan forgiveness plan is dead, 6-3

Click to see story on Hot Air

Supreme Court strikes down Biden’s student loan relief plan

Click to see story on Kusi

Supreme Court strikes down Biden’s plan to forgive millions of student loans

Click to see story on UnionLeader.com

Supreme Court strikes down Biden’s student loan forgiveness plan – what’s next?

Click to see story on Fox Business

VOTE: Do you agree with the Supreme Court’s decision to block Biden’s student debt forgive

Click to see story on The National Desk

SCOTUS strikes down student loan forgiveness plan

Click to see story on Courier Mail

Liberals MELTDOWN after Supreme Court strikes down student loan forgiveness, demand Biden to use ‘every tool available’ to relieve debt

Click to see story on The Post Millennial

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Blade

Supreme Court strikes down Biden student loan debt forgiveness plan

Click to see story on christianpost.com

Supreme Court rules that Joe Biden’s executive order forgiving student loan debt unconstitutional

Click to see story on Alabama Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Press

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Republican-American

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – Odessa American

Click to see story on Odessa American

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – Record Herald

Click to see story on The Record Herald

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on dailyjournal.net

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Idaho State Journal

Click to close

Supreme Court news: Justices save Biden student loan case for final day

Click to see story on Washington Examiner

‘Expand The Court’: ‘Squad’ Democrats React To SCOTUS Striking Down Biden’s Loan Giveaway

Click to see story on The Daily Caller

SCOTUS rules on student loan forgiveness

Click to see story on OAN

LIVE NOW: Outside the Supreme Court After Justices Strike Down Biden Student Loan Forgiveness Program

Click to see story on The Epoch Times

U.S. Supreme Court rejects Biden’s $400-billion student loan forgiveness plan

Click to see story on Toronto Sun

Read the Student Loan Supreme Court Decision Here

Click to see story on National Review

BREAKING: SCOTUS Rules Against Biden Administration on Student Loan Forgiveness

Click to see story on RedState

Supreme Court Nukes $400 Billion Biden Student Loan Bailout

Click to see story on The Federalist

Supreme Court Strikes Down Biden’s Multibillion Dollar Student Loan Forgiveness Plan – The Ohio Star

Click to see story on The Ohio Star

Supreme Court Rejects Biden’s Plan to Erase $400 Billion in Student Loans

Click to see story on CBN

Supreme Court Strikes Down Student Loan Relief — Here’s Who’s Most Affected

Click to see story on Zero Hedge

Supreme Court Strikes Down Biden’s Student Loan Program

Click to see story on Washington Free Beacon

BREAKING: Student Loan Forgiveness Scheme Unlawful

Click to see story on The Daily Signal

BREAKING: Supreme Court Delivers Blockbuster Ruling on Biden’s Student Loan Forgiveness

Click to see story on Conservative Brief

Supreme Court Rejects $400 Billion Biden Student Loan Amnesty Plan

Click to see story on The New York Sun

Tennessee Congressional Members Respond to SCOTUS Ruling on Biden Administration’s Student Loan Forgiveness Program – Tennessee Star

Click to see story on Tennessee Star

Vivek Ramaswamy Reacts to SCOTUS Ruling on Biden Administration’s Student Loan Forgiveness Program – The Michigan Star

Click to see story on themichiganstar.com

Supreme Court Strikes Down Biden’s Multibillion Dollar Student Loan Forgiveness Plan – The Florida Capital Star

Click to see story on floridacapitalstar.com

RFK blames Supreme Court student loan handout smackdown on Biden’s ‘failure’

Click to see story on Fox News

Supreme Court Strikes Down Studen Loan Handouts, What Now?

Click to see story on Breitbart

Click to close

“I Think the Court Misinterpreted the Constitution” – Angry Joe Biden After Supreme Court Strikes Down His Student Loan Bailout Program

Click to see story on The Gateway Pundit

Supremes block Biden’s plan to stick taxpayers with $400 billion in student loan debt

Click to see story on WND

BREAKING: SCOTUS rules against Biden on student loan forgiveness and CUE the screeching

Click to see story on Twitchy

SCOTUS Strikes Down Biden Student Loan Forgiveness Plan

Click to see story on InfoWars

Joe Biden Reacts to Supreme Court Restraining His Unilateral Power to Forgive Student Loans… – The Last Refuge

Click to see story on The Last Refuge

Click to close

Untracked Bias

U.S. Supreme Court overturns Biden’s proposed forgiveness of more than $400 billion in student debt

Click to see story on Globo

U.S. Supreme Court blocks Biden’s student debt relief program

Click to see story on UOL

US Supreme Court Blocks Biden’s $400 Billion Student Loan Relief Plan: Report

Click to see story on ABP News

U.S. Supreme Court Rejects Biden Student Loan Relief Program

Click to see story on 大纪元 www.epochtimes.com

Metro Detroit college students react to SCOTUS striking down Biden debt canceling plan

Click to see story on The Mercury

U.S. Supreme Court weakens gay couples’ rights and blocks student debt forgiveness

Click to see story on Publico

U.S. Supreme Court undermines Biden’s plan to cancel student debts

Click to see story on Het Nieuwsblad

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Tri-City News

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Pique

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Squamish Chief

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on St. Albert Gazette

US Supreme Court blocks Biden student loan forgiveness

Click to see story on PerthNow

U.S. Supreme Court blocks cancelling billions in student debt

Click to see story on NU

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Sudbury

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Bay Today

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Rocky Mountain Outlook

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on My Mother Lode

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Orillia Matters

Supreme Court strikes down Biden student loan debt forgiveness program – ABC Columbia

Click to see story on ABC Columbia

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Newmarket Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Midland Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Collingwood Today

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WBRZ

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Elora Fergus Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Thorold Today

Student loans in the USA: Supreme Court slows down Biden

Click to see story on Neue Zürcher Zeitung

The Supreme Court Rejects Biden’s Plan To Wipe Away $400 Billion In Student Loan Debt – WCCB Charlotte’s CW

Click to see story on WCCB Charlotte

U.S. Supreme Court scraps Biden’s plan to forgo student debt

Click to see story on Politiken

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on ABC News 8 Lincoln KLKN

U.S. Supreme Court rejects Biden plan to forgive student loan debts

Click to see story on IOL Portugal

U.S. Supreme Court ends Biden’s plan to cancel student debt

Click to see story on El Tiempo

Against student relief – US Supreme Court overturns Biden’s partial waiver of student loans

Click to see story on Schweizer Radio und Fernsehen (SRF)…

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – WNKY News 40 Television

Click to see story on WNKY

Supreme Court Rules Against Canceling Student Loans

Click to see story on KXL

US Supreme Court rejects Biden’s plan of forgiving $400 billion in student loans

Click to see story on OpIndia

The United States Supreme Court has blocked President Joe Biden’s plan to cancel student loan debts

Click to see story on Il Post

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on tribtoday.com

A landmark decision by the US Supreme Court!

Click to see story on wpolityce.pl

Supreme Court strikes down Biden student loan debt forgiveness program

Click to see story on Western Iowa Today 96.5 KSOM KS 95.7

U.S. Supreme Court Rules with Nebraska and Five Other States in Challenge to Student Loan Forgiveness Program – KFOR FM 101.5 1240 AM

Click to see story on KFOR FM 103.3 1240 AM

Supreme Court rules against Biden in student loan relief case

Click to see story on KMGH

Supreme Court Rules 6-3 to Block President Biden’s Federal Student Loan Forgiveness Program – Space Coast Daily

Click to see story on Space Coast Daily

Supreme Court Student Loans

Click to see story on The Daily Citizen

How the Supreme Court student loan decision affects you

Click to see story on KHQ Right Now

Supreme Court Strikes Down President Biden’s Student Loan Forgiveness, A Plan Aimed To Decrease America’s Racial Wealth Gap

Click to see story on Atlanta Daily World

How the Supreme Court student loan decision affects you

Click to see story on Jacksonville Journal-Courier

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WDHN – DothanFirst.com

Supreme Court’s student loan ruling throws wrench in Biden’s plan to aid borrowers as payments resume

Click to see story on The Wenatchee World

U.S. Supreme Court blocks Biden’s student loan forgiveness

Click to see story on De Morgen

Supreme Court rejects Biden’s plan to wipe away $400B in student loan debt

Click to see story on Olean Times Herald

Supreme Court rejects Biden’s plan to wipe away student loan debt

Click to see story on TheDerrick.com

The U.S. Supreme Court refuses to relieve student debt

Click to see story on rts.ch

Supreme Court Strikes Down Biden’s $10,000 Student Debt Plan As Unconstitutional

Click to see story on The Florida Star | The Georgia Star

US Supreme Court rules against Biden administration student loan debt relief plan – Now Habersham

Click to see story on Now Habersham

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Temple Daily Telegram

How the Supreme Court student loan decision affects you

Click to see story on WUFT

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Robesonian

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WJCL

Supreme Court strikes down student debt forgiveness

Click to see story on The Temple News

US Supreme Court strikes down plan for student loan forgiveness plan

Click to see story on IslanderNews.com

US Supreme Court rejects Biden’s student debt cancellation plan

Click to see story on Carolina Journal

Supreme Court Strikes Down Student Debt Cancellation. Now What?

Click to see story on nerdwallet.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Transylvania Times

Supreme Court blocks plan to forgive student loans

Click to see story on The Daily Illini

UO declines to comment on Supreme Court student loan ruling

Click to see story on Daily Emerald

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Duncan Banner

Supreme Court strikes student loan forgiveness plan

Click to see story on OU Daily

Nearly 1.4 million Texans could be impacted by U.S. Supreme Court decision blocking student loan forgiveness

Click to see story on Fort Worth Business Press

The Supreme Court rejects Biden’s student loan plan

Click to see story on Sahan Journal

Supreme Court Overturns Biden’s Student Debt Relief Plan

Click to see story on La Opinion

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Vancouver Is Awesome

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Powell River Peak

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Bradford Today

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness – The Morning Sun

Click to see story on communityq.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Timmins Today

SCOTUS strikes down student loan forgiveness plan

Click to see story on weeklytimesnow.com.au

Supreme Court rejects Biden’s plan to wipe away $400B in student loans – Maryland Daily Record

Click to see story on Maryland Daily Record

US Supreme Court rejected Biden’s plan to cancel student debt

Click to see story on Los Tiempos

Supreme Court Slows Biden’s Student Loan Forgiveness Plan

Click to see story on eltiempolatino.com

Supreme Courts blocks Student Loan Forgiveness

Click to see story on mynews13.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on accesswdun.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Juneau Empire

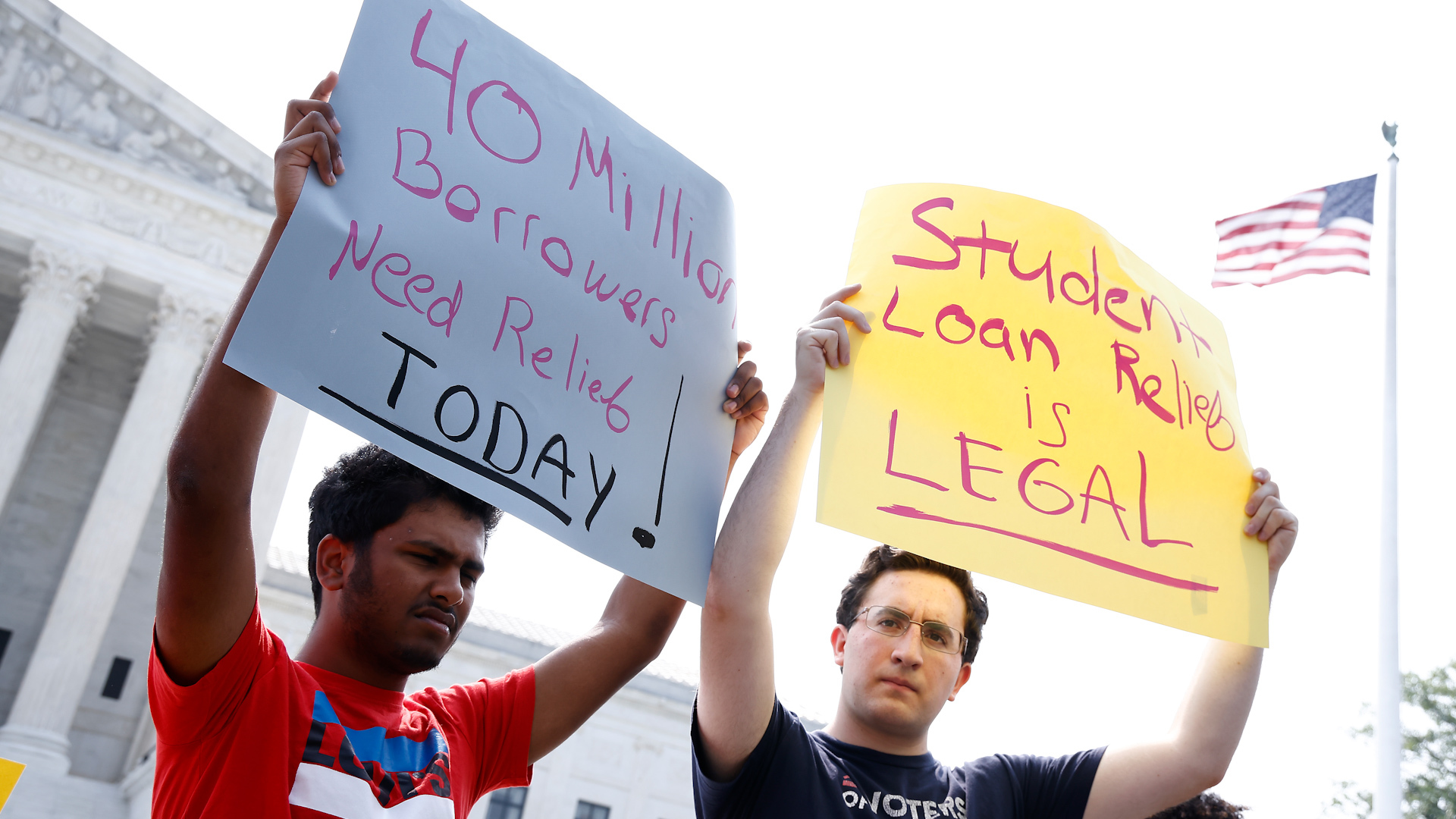

Student loan borrowers and advocates gather for the People’s Rally to Cancel Student Debt during the Supreme Court hearings on student debt relief on Feb. 28, 2023, in Washington, D.C..

Click to see story on acquiremedia.com

Joe Biden announces new plan to forgive student loans following Supreme Court ruling

Click to see story on mercedsunstar.com

Nearly 1.4 million Texans could be impacted by U.S. Supreme Court decision blocking student loan forgiveness

Click to see story on The Gilmer Mirror

Supreme Court strikes down Biden’s student loan forgiveness plan: NYSBA responds

Click to see story on Brooklyn Daily Eagle

SupCo rules against Biden administration student loan debt relief

Click to see story on Missoula Current

Breaking News: Supreme Court Dismantles Biden’s Plan To Wipe Away $400B in Student Loans

Click to see story on The Michigan Chronicle

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Himalayan Times

Why the Supreme Court’s Harvard decision matters

Click to see story on thespectator.com

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – The Gloversville Leader Herald

Click to see story on leaderherald.com

Florida Senator Shevrin Jones Issues Statement on U.S. Supreme Court Decision Blocking President Biden’s Student Loan Forgiveness

Click to see story on capitalsoup.com

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on mor-tv.com

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on MediaNews Group

Biden student loan relief plan struck down. What’s next?

Click to see story on reckon.news

Click to close

420 other sources covering this story

Total News Sources

420

Leaning Left

106

Center

162

Leaning Right

57

Last Updated

1 year ago

The Supreme Court blocked President Joe Biden’s plan to cancel up to $20,000 each in federal student loan debt for millions of borrowers on Friday, June 30. In a 6-3 decision, the conservative majority ruled the Biden administration overstepped its authority with the plan, which would have cost around $400 billion, according to budget office estimates.

Now that the Supreme Court has made its determination, here are three things student loan borrowers need to know.

When will payments resume?

After more than three years of 0% interest due to a pandemic-related pause, federal student loans will start accruing interest again on Sept. 1.

This resumption date was agreed upon in the debt ceiling deal reached by Biden and House Speaker Kevin McCarthy, which Congress passed in early June.

While interest will start accruing in September, first payments will not be due until October, according to the Education Department. Borrowers will want to use the coming months to reconnect to their student loan servicers and update their accounts and payment information.

“Safety net period” is on horizon

The Education Department is carving out a “safety net period” to ease back into repayment. The plan promises a 12-month “on-ramp” period where borrowers’ credit scores won’t get dinged if they fail to make payments on their loans starting in October.

Borrowers who can make payments should as payments will resume & interest will accrue, but the on-ramp to repayment helps borrowers avoid the harshest consequences of missed, partial, or late payments like negative credit reports & having loans referred to collection agencies.

— Secretary Miguel Cardona (@SecCardona) June 30, 2023

The Biden administration is worried about an overwhelming amount of delinquencies and defaults once repayment resumes.

Republicans, meanwhile, have blasted reports of the plan. Louisiana Sen. Bill Cassidy called it a “direct violation of the debt ceiling agreement” in an interview with Politico.

Changes to income-driven repayment intact, for now

The Supreme Court decision does not touch the planned changes to income-driven repayment, which could cut participants’ payments in half.

If opted in, the plan calculates the monthly amount due based on the borrower’s income. Those individuals making less than $32,805 per year would have a monthly payment of $0.

It will cut monthly payments to zero dollars for millions of low-income borrowers, save all other borrowers at least $1,000 per year, and stop runaway interest that leaves borrowers owing more than their initial loan.

— Secretary Miguel Cardona (@SecCardona) June 30, 2023

Borrowers hoping to enroll in the income-driven repayment plan, forbearance or other options will want to connect with their student loan servicer before repayment resumes this fall.

One more thing

On Friday afternoon, Biden announced he would attempt to cancel student debt for “as many borrowers as possible” using authority through the Higher Education Act.

“This new path is legally sound,” Biden said. “It’s going to take longer, but in my view, it’s the best path that remains.”

Borrowers who previously applied and were approved for one-time student debt relief would not necessarily qualify under the new program. The department said it is still working out specific parameters and that borrowers should plan on paying loans in the meantime.

First, I'm announcing a new path to provide student debt relief to as many borrowers as possible, as quickly as possible, grounded in the Higher Education Act.

— President Biden (@POTUS) June 30, 2023

Just moments ago, @SecCardona took the first official step to initiate this new approach.

We aren’t wasting any time.

SIMONE DEL ROSARIO: AT LONG LAST, WE HAVE CLARITY ON CANCELING STUDENT DEBT.

AND WHILE IT’S NOT THE RESULT MILLIONS OF BORROWERS WERE HOPING FOR – AT LEAST THE GUESSING GAME IS MOSTLY OVER.

HERE ARE THREE THINGS TO KNOW NOW THAT THE SUPREME COURT HAS BLOCKED PRESIDENT BIDEN’S $400 BILLION DOLLAR PLAN TO CANCEL FEDERAL STUDENT DEBT.

AFTER MORE THAN THREE YEARS OF 0% INTEREST, LOANS WILL START ACCRUING INTEREST AGAIN ON SEPTEMBER FIRST.

FIRST PAYMENTS WILL BE DUE A MONTH AFTER THAT.

SO YOU’VE GOT A COUPLE OF MONTHS TO DIG UP THAT LOGIN INFO FOR YOUR STUDENT LOAN SERVICER AND SET UP THAT AUTOMATIC PAYMENT.

ACCORDING TO POLITICO, THE EDUCATION DEPARTMENT IS CARVING OUT A “SAFETY NET PERIOD” TO EASE BACK INTO REPAYMENT.

AT LEAST 90 DAYS WHERE BORROWERS’ CREDIT SCORES WON’T GET DINGED IF THEY FAIL TO MAKE PAYMENTS ON THEIR LOANS.

THE ADMINISTRATION’S WORRIED ABOUT AN OVERWHELMING AMOUNT OF DELINQUENCIES AND DEFAULTS ONCE REPAYMENT RESUMES.

WHILE REPUBLICANS ARE BLASTING THE PLAN. LOUISIANA SENATOR BILL CASSIDY, CALLING IT “A DIRECT VIOLATION OF THE DEBT CEILING AGREEMENT.”

POLITICO SAYS THE EDUCATION DEPARTMENT WILL REVEAL MORE DETAILS IN THE COMING WEEKS.

THE SUPREME COURT DECISION DOES NOT TOUCH THE PLANNED CHANGES TO INCOME-DRIVEN REPAYMENT, WHICH COULD CUT PARTICIPANTS’ PAYMENTS IN HALF.

THE PLAN CALCULATES THE MONTHLY AMOUNT DUE BASED ON YOUR INCOME.

ANOTHER REASON TO CONNECT WITH YOUR STUDENT LOAN SERVICER TO FIGURE OUT YOUR PLAN FOR REPAYMENT BEFORE FALL.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below.

Learn more about this dataLeft 33%

Center 50%

Right 18%

Bias Distribution

Supreme Court Overturns Joe Biden’s Student Loan Debt Forgiveness Plan

Click to see story on HuffPost

Supreme Court Continues Cruelty Crusade by Killing Student Debt Relief Plan

Click to see story on RollingStone

Biden plans ‘swift’ response to Supreme Court shooting down student loan debt relief

Click to see story on Alternet

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Daily Kos

Supreme Court strikes down Biden student loan relief plan

Click to see story on MSNBC

ACLU Comment on Supreme Court’s Ruling Against Student Debt Relief Plan

Click to see story on Common Dreams

Supreme Court Strikes Down Biden’s Student Loan Forgiveness Plan

Click to see story on Vanity Fair

So you have to pay your student loans. What’s next, in 5 charts.

Click to see story on Vox

Supreme Court’s Right Wing Strikes Down Biden Student Debt Relief Plan

Click to see story on Talking Points Memo

The Supreme Court Can’t Kill Student-Loan Relief

Click to see story on New York Magazine

The Supreme Court just struck down Biden’s plan to cancel student debt

Click to see story on Mother Jones

Supreme Court Case to End Biden’s Student Loan Cancellation Plan Relies on “Unwilling Participant”

Click to see story on Democracy Now!

Durbin expresses concern as Supreme Court strikes down Biden administration’s student loan debt relief plan in overreaching decision

Click to see story on chicagocrusader.com

Biden student debt relief plan DOA at Supreme Court – National Zero

Click to see story on National Zero

US Supreme Court rules against Biden administration student loan debt relief plan – Wisconsin Examiner

Click to see story on Wisconsin Examiner

Click to close

US supreme court rules against Biden’s student loan relief program

Click to see story on The Guardian

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Hindu

Biden speaks after his student loan debt plan struck down by Supreme Court

Click to see story on The Independent

Defeat for Biden as U.S. Supreme Court rejects plan to cancel $400B in student loans

Click to see story on CBC News

Joe Biden’s $400 Billion Student Debt Cancellation Plan Rejected

Click to see story on NDTV

As recession threatens, Supreme Court student loan forgiveness ruling may hurt the economy

Click to see story on USA Today

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Associated Press News

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on CNN

Supreme Court strikes down Biden’s student loan forgiveness plan as unlawful

Click to see story on CBS News

Supreme Court halts Joe Biden’s student loan forgiveness program

Click to see story on Metro News

Supreme Court rejects President Biden’s student loan relief plan

Click to see story on NY Daily News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on The Toronto Star

Supreme Court strikes down Biden’s plan to forgive millions of student loans

Click to see story on Los Angeles Times

Supreme Court Throws Out Biden’s Student-Loan Relief Plan

Click to see story on Bloomberg

Supreme Court dismisses student loan challenge on standing

Click to see story on npr

USA: Supreme Court stops debt relief for students

Click to see story on Sueddeutsche Zeitung

Supreme Court strikes down President Biden’s student loan forgiveness program

Click to see story on The Mercury news

How Supreme Court student loans decision affects you

Click to see story on abc 6 Philadelphia

How Supreme Court student loans decision affects you

Click to see story on abc 13 Houston

The U.S. Supreme Court canceled Biden’s student loan relief program. Here’s what borrowers should know.

Click to see story on Star Tribune

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Alaska Highway News

How Supreme Court student loans decision affects you

Click to see story on abc 7 News

How Supreme Court student loans decision affects you

Click to see story on abc11 Raleigh

How Supreme Court student loans decision affects you

Click to see story on abc30 News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Japan Today

US Supreme Court blocks Biden student loan forgiveness

Click to see story on GMA Filipino News

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Chicago Sun Times

Supreme Court rejects Joe Biden’s student loan forgiveness plan

Click to see story on Bangor Daily News

USA: Supreme Court stops Joe Biden’s plan for student loan waiver

Click to see story on Zeit Online

Supreme Court strikes down Biden administration’s student loan debt relief program – Boston News, Weather, Sports

Click to see story on WHDH

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Koco News5

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Times Colonist

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Daily Hampshire Gazette

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on North Shore News

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Town And Country Today

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Delta Optimist

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on New West Record

Supreme Court strikes down Biden’s student debt relief plan

Click to see story on Politico

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WISH-TV

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Flin Flon Reminder

WATCH LIVE: Biden speaks after Supreme Court strikes down student loan relief plan

Click to see story on PBS NewsHour

US SC blocks Joe Biden’s bid to cancel $430 billion in student debt

Click to see story on Deccan Herald

North Texas borrowers react to SCOTUS ruling on student loan forgiveness

Click to see story on NBC Dallas-Fort Worth

Michiganders react to Supreme Court rejecting student loan forgiveness plan

Click to see story on Detroit Free Press

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Times of Israel

Mass. politicians react to Supreme Court striking down Biden’s student loan forgiveness plan

Click to see story on Boston.com

How the Supreme Court student loan decision affects you

Click to see story on NBC New York

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – WSVN 7News | Miami News, Weather, Sports

Click to see story on WSVN

More than 1M N.J. borrowers will have to pay their full debt under Supreme Court loan forgiveness ruling

Click to see story on nj

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on SooToday.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Salt Lake Tribune

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Barrie Today

The Supreme Court blocked Biden’s student loan forgiveness plan. What does that mean for borrowers?

Click to see story on Inquirer

Supreme Court strikes down Biden’s student loan foregiveness plan

Click to see story on NBC Washington

Watch live: President Biden speaks after Supreme Court rejects his student loan forgiveness plan – The Boston Globe

Click to see story on Boston Globe

The Supreme Court’s student loan decision is out. Here’s what it means for you

Click to see story on The Courier-Journal

In decision affecting 685,000 Wisconsin borrowers, Supreme Court strikes down student loan forgiveness

Click to see story on Journal Sentinel

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on News & Record

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Arizona Daily Sun

U.S. Supreme Court blocks Biden’s student loan forgiveness plan

Click to see story on Philly Voice

Biden Vows to ‘Find Other Ways’ to Offer Relief After Supreme Court Ends His Student Debt Program

Click to see story on Mediaite

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on The Sacramento Bee

Citing harm to Missouri, Supreme Court kills Biden’s student loan forgiveness

Click to see story on Kansas City Star

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt – Austin Daily Herald

Click to see story on Austin Daily Herald

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Delaware County Daily Times

AG Tim Griffin celebrates Supreme Court ruling against student debt relief

Click to see story on Arkansas Times

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The Charlotte Observer

U.S. Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Colorado Sun

Kentucky, what does the Supreme Court decision on student loan forgiveness mean to you?

Click to see story on Lexington Herald Leader

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Longmont Times-Call

Supreme Court rejects Biden’s student loan forgiveness plan

Click to see story on The Week

Supreme Court strikes down student loan forgiveness. When do NC borrowers have to pay?

Click to see story on The Herald

Joe Biden announces new plan to forgive student loans following Supreme Court ruling

Click to see story on The Fresno Bee

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on The Tribune

U.S. Supreme Court blocks Biden’s plan to cancel student debts

Click to see story on NRC Handelsblad

Nearly 1.4 million Texans could be impacted by U.S. Supreme Court decision blocking student loan forgiveness

Click to see story on The Texas Tribune

‘It’s absurd’: Kent State students disappointed Supreme Court rejected loan forgiveness

Click to see story on Akron Beacon Journal

Biden’s $430 billion student debt forgiveness program has lost the Supreme Court battle

Click to see story on Quartz

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Southernminn.com

Supreme Court nixes student loan relief for 208K CT borrowers

Click to see story on The CT Mirror

Supreme Court votes to strike down Biden’s proposed student debt forgiveness plan

Click to see story on The Michigan Daily

Supreme Court strikes down Biden’s plan to forgive millions of student loans

Click to see story on The Victoria Advocate

The Supreme Court Killed Biden’s Student Loan Forgiveness Plan. What Does That Mean For 2024?

Click to see story on FiveThirtyEight

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on News and Tribune

Court tosses student loan forgiveness plan

Click to see story on The Tifton Gazette

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Reporter.net

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Bluefield Daily Telegraph

US Supreme Court rules against Biden administration student loan debt relief plan

Click to see story on Arizona Mirror

Supreme Court says no to Biden student loan forgiveness plan. How the decision affects you

Click to see story on modbee.com

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on unionrecorder.com

Click to close

US Supreme Court strikes down student loan forgiveness plan

Click to see story on BBC News

The Supreme Court just ruled on Biden’s student loan forgiveness plan

Click to see story on CNBC

US Supreme Court deals setback to LGBT rights, blocks Biden’s student-loan plan

Click to see story on South China Morning Post

Supreme Court blocks Biden’s student loan forgiveness program

Click to see story on KRDO

Here’s when your student loan payments will start again

Click to see story on KIFI

Supreme Court strikes down Biden’s student debt forgiveness plan

Click to see story on The Hill

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KVIA

The Supreme Court Just Killed Biden’s Student Loan Plan. Here’s What’s Next for Education Debt Forgiveness

Click to see story on c|net

Biden’s Student Loan Forgiveness Was Always a Sham

Click to see story on Newsweek

US Supreme Court junks Biden’s $400bn student debt cancellation plan

Click to see story on WION

US Supreme Court blocks President Joe Biden’s plans to forgive student loan debt

Click to see story on Sky News UK

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Winnipeg Free Press

Supreme Court rejects Biden’s plan to erase student loan debt

Click to see story on Star Advertiser

Supreme Court Rejects Biden’s Plan to Wipe Away Student Loans

Click to see story on VOA News

Supreme Court blocks Biden’s student debt forgiveness program

Click to see story on UPI

US Supreme Court blocks Biden’s student debt forgiveness push

Click to see story on Al Jazeera

Supreme Court rejects Biden plan to wipe away $400 billion in student loan debt

Click to see story on Pioneer Press

How Supreme Court student loans decision affects you

Click to see story on abc 7 Chicago

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KCRA 3

US Supreme Court rejects Biden’s $400 billion student loan cancellation plan

Click to see story on Live Mint

U.S. Supreme Court blocks Biden’s student loan forgiveness plan

Click to see story on The Globe & Mail

How Supreme Court student loans decision affects you

Click to see story on abc 7 LA

How Supreme Court student loans decision affects you

Click to see story on abc 7 NY

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on News 4 JAX

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on WPLG

WATCH LIVE: Biden speaks after SCOTUS strikes down student loan forgiveness plan

Click to see story on WKMG

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Click on Detroit

Student loan forgiveness: Supreme Court strikes down Biden’s plan

Click to see story on Chicago Tribune

Student Loan Forgiveness: What is Biden’s back up plan for student loans?

Click to see story on Marca

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Post and Courier

How the Supreme Court student loan decision affects you

Click to see story on Portland Press Herald

Supreme Court strikes down student loan debt plan

Click to see story on Las Vegas Review-Journal

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WCVB

‘A lot of chaos’: Locals react to strikedown of Biden’s student loan forgiveness plan

Click to see story on Wral News

Justices Strike Down Biden’s Student Loan Plan

Click to see story on Political Wire

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WLWT

Biden’s Student Loan Forgiveness Struck Down For Maryland Borrowers

Click to see story on Patch

5 key dates: Student loan repayments starting in October

Click to see story on Michigan Live

US Supreme Court blocks Biden student loan forgiveness

Click to see story on Inforum

NH borrowers react to Supreme Court blocking student loan forgiveness

Click to see story on WMUR

Supreme Court ruling brings bitterness for borrowers counting on student loan forgiveness

Click to see story on Washington Top News

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WLKY

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WESH

When do student loan payments resume? What to know after Supreme Court ruling

Click to see story on NBC Chicago

Supreme Court strikes down Biden’s student loan plan, withholding relief from millions of Texans

Click to see story on Houston Chronicle

Biden turns to Higher Education Act for next move on student loans after Supreme Court rejects forgiveness plan

Click to see story on MarketWatch

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on WDSU

Students react after Supreme Court ruling knocks down student loan forgiveness

Click to see story on WTAE

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KETV

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on The Detroit News

Supreme Court Rejects Student Loan Forgiveness—Here’s What We Know Before Payments Restart This Fall

Click to see story on Forbes

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on WYFF

How the Supreme Court student loan decision affects you

Click to see story on The Billings Gazette

Student loan payments start again soon. Supreme Court’s ruling means higher bills for many

Click to see story on Denver Post

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KCCI

Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on KMBC

Supreme Court strikes down Biden’s plan to wipe away $400 billion in student loan debt

Click to see story on Lincoln Journal Star

The Supreme Court rejects Biden’s plan to wipe away $400 billion in student loans

Click to see story on Dallas News