New EV tax credit exemption will benefit US consumers, but also China

Media Landscape

This story is a Media Miss by the right as only 8% of the coverage is from right leaning media.

Learn more about this dataLeft 50%

Center 42%

Right 8%

Jack Alymer:

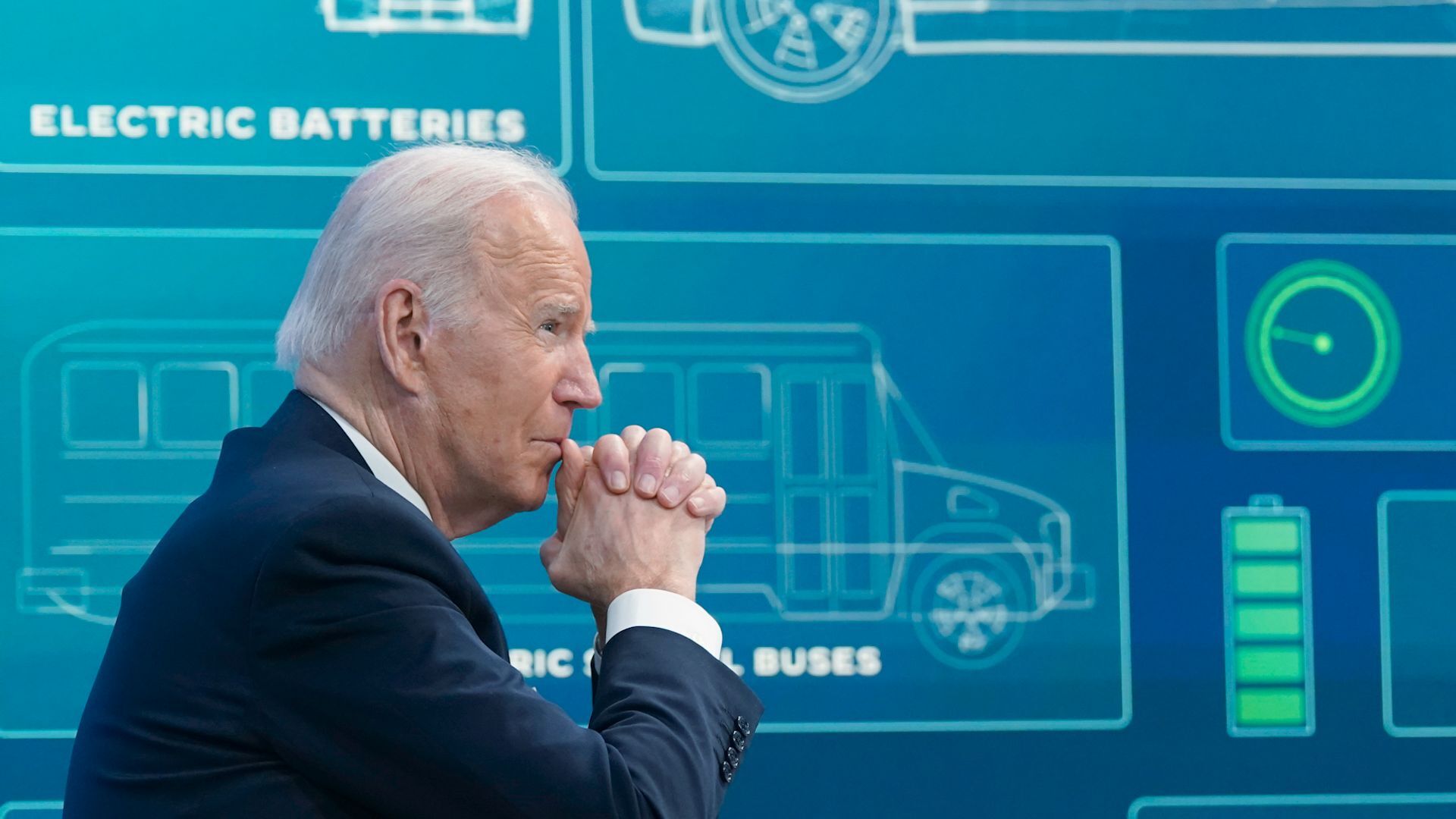

WITH E-V SALES DROOPING IN 20-24 – THE WHITE HOUSE IS HOPING TO JOLT AMERICAN CAR-BUYING HABITS.MAKING IT POTENTIALLY CHEAPER TO BUY A LOT OF MODELS.

IT’S A MOVE THAT BENEFITS CONSUMERS, BUT ALSO CHINA.

AT THE BEGINNING OF THIS YEAR, THE BIDEN ADMINISTRATION ADDED SOURCING REQUIREMENTS THAT EVS MUST MEET IN ORDER TO QUALIFY FOR FEDERAL TAX CREDITS.

THESE NEW RULES WERE AIMED AT PREVENTING CHINA, WHICH DOMINATES THE EV BATTERY SUPPLY CHAIN, FROM PROFITING OFF THE U.S. ELECTRIC VEHICLE PUSH.

BUT MANY AUTOMAKERS HAVE STRUGGLED TO COMPLY.

THOSE NEW REQUIREMENTS MADE 24 EV VARIATIONS NO LONGER ELIGIBLE FOR TAX CREDITS.

ONLY FIVE EV MODELS AND ONE PLUG-IN HYBRID OPTION REMAINED AVAILABLE TO RECEIVE THE FULL CREDIT.

SO, BIDEN IS CHANGING COURSE.

NOW GRANTING A TWO YEAR EXEMPTION ON THE RULE FOR SOME LOW PRICED MINERALS THAT GO INTO EV BATTERIES.

THIS INCLUDES GRAPHITE, WHICH EVERY AVERAGE ELECTRIC VEHICLE BATTERY NEEDS ABOUT 200 POUNDS OF TO BUILD.

CHINA IS ALSO RESPONSIBLE FOR PRODUCING NEARLY TWO THIRDS OF THE WORLD’S SUPPLY.

ENERGY SECURITY GROUPS BELIEVE THE EXEMPTION IS A CONTINUATION OF U.S. DEPENDENCE ON FOREIGN ADVERSARIES FOR THESE MATERIALS.

SAYING IT FURTHER UNDERMINES THE COMPETITIVENESS OF AMERICAN CRITICAL MINERALS PROJECTS.