Top 3 takeaways from JPMorgan Chase’s First Republic Bank acquisition

By Simone Del Rosario (Business Correspondent), Brent Jabbour (Producer), Emma Stoltzfus (Editor)

Media Landscape

This story is a Media Miss by the right as only 22% of the coverage is from right leaning media.

Learn more about this dataLeft 29%

Center 49%

Right 22%

Bias Distribution

Regulators Seize First Republic Bank, Sell To JPMorgan Chase

Click to see story on HuffPost

US regulators seize California’s First Republic in latest banking failure

Click to see story on Raw Story

First Republic Bank is taken over by FDIC and sold to JPMorgan

Click to see story on MSNBC

First Republic Sold to JPMorgan Chase as Regulators Step In

Click to see story on The Daily Beast

How the Second-Biggest Bank Failure in History Happened

Click to see story on Slate

Click to close

US banking titan JP Morgan to snap up most of First Republic

Click to see story on The Guardian

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on The Hindu

JPMorgan Chase to buy distressed First Republic Bank in deal brokered by U.S. regulator

Click to see story on CBC News

First Republic Bank seized by US regulators and sold to JP Morgan Chase

Click to see story on The Independent

US Regulators Seize Troubled First Republic Bank, JPMorgan To Acquire It

Click to see story on NDTV

First Republic Bank seized, sold to JPMorgan Chase: Here’s what to know

Click to see story on USA Today

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on Associated Press News

JPMorgan Chase to assume all deposits of First Republic Bank

Click to see story on abc News

JPMorgan Chase comprará la mayoría de los activos del First Republic Bank tras su colapso en marzo

Click to see story on CNN

JPMorgan buys First Republic Bank after bank seized by regulators

Click to see story on Sydney Morning Herald

What to know about First Republic and the banking crisis

Click to see story on The Washington Post

Troubled First Republic Bank seized and sold to JPMorgan Chase

Click to see story on CBS News

US authorities ‘auction’ First Republic Bank to JPMorgan after second biggest bank failure in history

Click to see story on ABC Australia

US regulator seizes First Republic Bank, to sell assets to JP Morgan

Click to see story on Indian Express

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on NY Daily News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Los Angeles Times

JPMorgan Chase to take over deposits and most of the assets of First Republic Bank

Click to see story on npr

JPMorgan Ends First Republic’s Turmoil After FDIC Seizure

Click to see story on Bloomberg

JP Morgan acquires First Republic Bank

Click to see story on Sueddeutsche Zeitung

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Mercury news

JPMorgan is buying First Republic Bank after it was taken over by regulators

Click to see story on Business Insider

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 6 Philadelphia

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 13 Houston

El regulador financiero de California toma posesión del First Republic Bank

Click to see story on Infobae

California regulators seize troubled First Republic Bank

Click to see story on Irish Examiner

First Republic Bank is taken over by FDIC and sold to JPMorgan in third major bank failure of 2023

Click to see story on NBC News

First Republic Bank is safe: Jp Morgan buys it

Click to see story on La Repubblica

JPMorgan Chase to take over most assets of First Republic Bank

Click to see story on abc 7 News

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc11 Raleigh

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc30 News

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Japan Today

First Republic Bank seized and sold to JPMorgan Chase

Click to see story on Bangor Daily News

Regulators Seize First Republic Bank, Sell to JPMorgan Chase in Third Major Bank Failure of 2023

Click to see story on NBC Chicago

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WHDH

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Alaska Highway News

JPMorgan buys First Republic Bank after being intervened by US authorities

Click to see story on El Pais

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Koco News5

The road to First Republic Bank’s collapse

Click to see story on Inquirer

Bankenkrise: First Republic Bank wird an JPMorgan verkauft

Click to see story on Zeit Online

JPMorgan buys First Republic Bank sale: What you need to know

Click to see story on Politico

First Republic Bank Seized, Sold to JP Morgan. What It Means for Mass. Customers

Click to see story on NBC Boston

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WISH-TV

WATCH LIVE: White House holds briefing as First Republic Bank seized by regulators

Click to see story on PBS NewsHour

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Times Colonist

US seizes assets of First Republic Bank, third to collapse in 2 months

Click to see story on The Times of Israel

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Lakeland Today

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Airdrie Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Mountainview Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Town And Country Today

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Burnaby Now

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WSVN

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Delta Optimist

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Coast Reporter

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Salt Lake Tribune

First Republic Bank Seized by Regulators and Sold to JPMorgan Chase

Click to see story on Time Magazine

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on SooToday.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Barrie Today

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Arizona Daily Sun

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on News & Record

Regulators seize First Republic Bank, with JPMorgan Chase acquiring it

Click to see story on AM New York

(S+) First Republic Bank: JP Morgan Chase acquires bankruptcy bank

Click to see story on Spiegel

Another bank goes down: First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Delaware County Daily Times

Regulators seize First Republic Bank, sell JPMorgan ‘substantially all’ remaining assets

Click to see story on The Week

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WCSH

US First Republic Bank also falls, is held by JP Morgan

Click to see story on NRC Handelsblad

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on unionrecorder.com

JP Morgan taking over First Republic after its collapse

Click to see story on scrippsnews.com

Click to close

First Republic: JP Morgan snaps up major US bank

Click to see story on BBC News

Regulators seize First Republic Bank, sell assets to JPMorgan

Click to see story on Reuters

JP Morgan set to acquire assets of First Republic Bank after its closure

Click to see story on Hindustan Times

Regulators sell First Republic to JPMorgan Chase

Click to see story on NZ Herald

JPMorgan Chase Takes Over First Republic After Biggest U.S. Bank Failure Since 2008

Click to see story on CNBC

US regulators seize First Republic Bank and sell it to JPMorgan Chase

Click to see story on South China Morning Post

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KRDO

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on KIFI

JPMorgan wins government auction to buy seized First Republic Bank

Click to see story on Channel News Asia

Deal reached to sell ailing First Republic to JP Morgan

Click to see story on RTÉ

JP Morgan’s acquisition of First Republic may put it among the top banks in Mass.

Click to see story on The Business Journals

JPMorgan to acquire San Francisco-based bank First Republic as US regulators announce deal

Click to see story on WION

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Star Advertiser

U.S. Regulator Seizes First Republic Bank, to Sell Assets to JP Morgan

Click to see story on VOA News

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Winnipeg Free Press

First Republic Bank seized by regulators, sold to JPMorgan Chase

Click to see story on UPI

JPMorgan to buy First Republic Bank as regulators seize control

Click to see story on Al Jazeera

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 Chicago

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCRA 3

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 LA

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 NY

First Republic Bank shuts down, JP Morgan to take over assets

Click to see story on Live Mint

US regulator seizes First Republic Bank, sells to JPMorgan – DW – 05/01/2023

Click to see story on Deutsche Welle

First Republic Bank Folds As Banking Crisis Claims Third Victim – PNC Finl Servs Gr (NYSE:PNC), First Republic Bank (NYSE:FRC), JPMorgan Chase (NYSE:JPM)

Click to see story on Benzinga

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Chicago Tribune

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Portland Press Herald

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WCVB

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Las Vegas Review-Journal

US regulators seize California’s First Republic in latest banking failure

Click to see story on France24

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WLWT

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WMUR

First Republic Bank saved by JP Morgan: acquisition of assets worth 229 billion

Click to see story on Corriere Della Sera

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WLKY

Regulators close First Republic Bank, JPMorgan named as the buyer of $330B assets and deposits, FDIC on the hook for $13B

Click to see story on TechCrunch

JPMorgan to take over First Republic after regional bank was closed

Click to see story on MarketWatch

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WESH

Regulators seize First Republic Bank

Click to see story on Taipei Times

Salvataggio per First Republic Bank, l’acquisirà JpMorgan

Click to see story on ANSA

JPMorgan Chase Agrees To Acquire First Republic Bank’s Deposits After FDIC Intervenes

Click to see story on Forbes

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WDSU

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Detroit News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WTAE

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KETV

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WYFF

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCCI

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KSAT 12

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KMBC

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on Washington Top News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WBAL-TV

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on The Billings Gazette

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WISN

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Lincoln Journal Star

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPTZ

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WMTW

Regulators seize First Republic in 3rd major U.S. bank failure in 2 months

Click to see story on Deseret News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WVTM

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WAPT

First Republic Bank acquired by JPMorgan after being seized by American authorities

Click to see story on La Libre

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Missoulian

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Tulsa World

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KOAT

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Helena Independent Record

First Republic Bank seized by feds, sold to JPMorgan Chase

Click to see story on The Oregonian

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WRIC

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Montana Standard

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Sask Today

First Republic seized by regulators as bid accepted from JP Morgan

Click to see story on The National

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPRI 12

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on NY1

JP Morgan buys First Republic Bank

Click to see story on Le Soir

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on ABC6

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Penn Live

Another bank falls in the US: Regulator seizes First Republic Bank and hands it over to JPMorgan

Click to see story on El Financiero

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Syracuse NY

JP Morgan Chase acquires US bank First Republic

Click to see story on Tagesschau

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WFAA 8abc

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCRG

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on First Coast

JP Morgan takes over First Republic, the third largest US bank to collapse in recent months

Click to see story on Digi 24

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on KOB 4

California’s First Republic Bank Sold to JPMorgan in 2nd-Largest U.S. Bank Failure

Click to see story on Times of San Diego

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Tucson

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WFSB

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Devdiscourse

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Staten Island Advance

Regulator seized First Republic bank

Click to see story on 24ur.com

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on The Sentinel

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KTSM

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Omaha World-Herald

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPBF

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WTNH

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Winston-Salem Journal

First Republic Seized by Regulators, to Be Sold to JPMorgan (1)

Click to see story on Bloomberg Law

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on HDR | Hickory Daily Record

US Regulators Seize California’s First Republic Bank

Click to see story on Barron's

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WXII

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WLTX

First Republic seized by regulators as bid accepted from JP Morgan

Click to see story on Financial Times

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WNDU

Regulators seize ailing First Republic Bank, sell remains to JPMorgan

Click to see story on SentinelSource.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Krem2 News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Rapid City Journal Media Group

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on GoDanRiver.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WUSA9

First Republic up in air as regulators juggle bank’s fate

Click to see story on Hawaii Tribune-Herald

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on McDowellNews.com

SF’s First Republic Bank Seized and Quickly Sold to JPMorgan Chase In Largest Bank Failure of the Year

Click to see story on SFist

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WBIR

First Republic fails, and is snapped up by JPMorgan Chase

Click to see story on The Economist

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KGW 8

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KSDK

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on Albany Herald

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KMOV St.Louis

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Red Bluff Daily News

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on The Daily Nonpareil – Council Bluffs, Iowa…

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on abc12/WJRT

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Auburn Citizen

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Journal Times

Headline Unavailable

Click to see story on Nasdaq

First Republic Bank seized, sold to JPMorgan Chase – Metro Philadelphia

Click to see story on Metro Philadelphia

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Valley News Live

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Glens Falls Post-Star

JPMorgan to buy First Republic after regulators seize control – Blue Water Healthy Living

Click to see story on AFP

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on castanet.net

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on kotatv.com

Click to close

JPMorgan to buy embattled First Republic Bank after seizure by regulators

Click to see story on Times of India

First Republic Bank Seized by Regulators, JPMorgan To Acquire

Click to see story on News18 India

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Washington Times

First Republic taken over by JP Morgan as third US bank falls

Click to see story on The Telegraph

US regulator seizes First Republic Bank, to sell assets to JP Morgan

Click to see story on New York Post

JP Morgan to buy First Republic’s assets and assume deposits

Click to see story on Financial Post

First Republic regulators rush to fix crisis as banks make bids

Click to see story on The Straits Times

Another US bank closed, JPMorgan to acquire assets of First Republic

Click to see story on Gulf News

JPMorgan to buy First Republic Bank as regulators seize control

Click to see story on News

JPMorgan buys First Republic after regulators seize control

Click to see story on Bangkok Post

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on MY Northwest

First Republic Bank closed by US regulators, JPMorgan to acquire assets

Click to see story on Anadolu Ajansı

Another bank crumbles: First Republic seized by feds, sold in fire sale to JPMorgan

Click to see story on Boston Herald

US regulator seizes First Republic Bank, to sell assets to JPMorgan

Click to see story on Times Live

JPMorgan among bidders for ailing First Republic

Click to see story on The West Australian

San Francisco-based First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Al Arabiya

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on OC Register

First Republic Bank Is Seized, Sold to JPMorgan in Second-Largest U.S. Bank Failure

Click to see story on Wall Street Journal

JPMorgan acquires struggling First Republic Bank

Click to see story on Die Presse

PNC was one of First Republic Bank bidders, reports say

Click to see story on Alabama Live

JPMorgan Chase bought First Republic Bank

Click to see story on RIA Novosti [🇷🇺-affiliated]

Regulators seize First Republic Bank and sell it to JPMorgan Chase

Click to see story on Reason

First Republic Bank wird an JP Morgan verkauft

Click to see story on Frankfurter Allgemeine

Federal regulators seize, sell First Republic Bank to JPMorgan – Just the News Now

Click to see story on justthenews.com

JP Morgan acquires substantial majority of First Republic Bank’s assets

Click to see story on UnionLeader.com

JPMorgan buys First Republic: Bank shares rise as deal reached

Click to see story on Fox Business

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Albuquerque Journal

Crisis-hit First Republic Bank gets taken over by big bank

Click to see story on berlingske.dk

First Republic Bank Seized by FDIC, Sold to JPMorgan Chase

Click to see story on Jewish Press

JP Morgan buys First Republic Bank after being rescued in the US

Click to see story on la Nacion

JPMorgan Chase agrees to purchase First Republic

Click to see story on WKRC

First Republic Bank Is Almost Down. JPMorgan or PNC May Be Its Buyers

Click to see story on The Street

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WPDE

Click to close

Regulators take control of First Republic Bank and sell it to JPMorgan Chase

Click to see story on Washington Examiner

Biden Responds To First Republic Bank Closure

Click to see story on The Daily Caller

JPMorgan to buy First Republic’s assets and assume deposits

Click to see story on OAN

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Toronto Sun

NTD Good Morning (May 1): Manhunt Underway in Texas After 5 Murdered; JPMorgan Chase Buys Failed First Republic Bank

Click to see story on The Epoch Times

First Republic Bank Seized, Sold to JP Morgan Chase; Second-Biggest Bank Failure in US History

Click to see story on Latestly

Regulators Seize First Republic in Second Largest Bank Failure in U.S. History

Click to see story on National Review

Feds Seize First Republic Bank in Second Biggest Bank Failure in U.S. History, JPMorgan to Assume Control

Click to see story on RedState

US regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Daily Sabah

2nd largest bank failure in US: First Republic Bank seized, sold to JPMorgan

Click to see story on PressTV

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Ohio Star

Click to see story on The Ohio Star

In 3rd Major Bank Collapse, Regulators Seize First Republic Bank, Sell It to JPMorgan Chase

Click to see story on CBN

Fallen First Republic Bank comes into the hands of JPMorgan

Click to see story on De Telegraaf

JPMorgan buys First Republic after regulators seize control

Click to see story on The Daily Telegraph

First Republic Bank Seized by Regulators and Sold to JPMorgan

Click to see story on Washington Free Beacon

JPMorgan Chases Acquires First Republic Bank After Seizure by Regulators

Click to see story on The New York Sun

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – Tennessee Star

Click to see story on Tennessee Star

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Michigan Star

Click to see story on themichiganstar.com

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Florida Capital Star

Click to see story on floridacapitalstar.com

Click to close

First Republic Bank Taken Over by FDIC and Sold to JPMorgan – Largest Lender to Collapse Since 2008

Click to see story on The Gateway Pundit

Federal regulators seize and sell major bank to financial giant

Click to see story on WND

JPMorgan to Acquire First Republic Bank After Seizure by US Regulators

Click to see story on InfoWars

Click to close

Untracked Bias

US regulators seize troubled First Republic Bank

Click to see story on Shropshire Star

Bank shares rise in NY amid J.P. Morgan’s purchase of First Republic Bank

Click to see story on Globo

JP Morgan Buys Assets of First Republic Bank Seized by U.S. Regulators

Click to see story on bisnis.com

JP Morgan to buy First Republic Bank assets and take deposits

Click to see story on Publico

JP Morgan Chase übernimmt First Republic Bank

Click to see story on Berliner Morgenpost

North American bank First Republic closes and deposits are sold to JP Morgan

Click to see story on Jornal Expresso

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Richmond News

Banking crisis: JP Morgan acquires First Republic Bank

Click to see story on handelsblatt.com

U.S. First Republic Bank is sold to JPMorgan

Click to see story on Het Nieuwsblad

The US intervenes the First Republic Bank and sells it to JP Morgan

Click to see story on La Vanguardia

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on North Shore News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on AlbertaPrimeTimes.com

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Tri-City News

US regulator secretly auctions First Republic bank: CNN

Click to see story on Aristegui Noticias

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Pique

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Squamish Chief

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on New West Record

Finanzopsiicht annoncéiert: JP Morgan Chase iwwerhëlt First Republic Bank

Click to see story on rtl.lu

First Republic: Second largest bank failure in US history

Click to see story on ORF.at News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Flin Flon Reminder

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on St. Albert Gazette

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Sudbury

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Bay Today

U.S. First Republic Bank is sold to JPMorgan

Click to see story on Het Belang van Limburg

JPMorgan To Acquire Troubled Lender First Republic Bank

Click to see story on BQ

US markets volatile after JP Morgan’s purchase of First Republic

Click to see story on Bloomberg Linea

Another US Bank Collapses: Regulators Seize First Republic Bank, Sell to JPMorgan Chase

Click to see story on NewsClick

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Orillia Matters

JPMorgan erhält Zuschlag für First Republic Bank

Click to see story on Kurier

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Newmarket Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Midland Today

JP Morgan to acquire First Republic Bank after US financial authorities seize the lender

Click to see story on Zee Business

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Collingwood Today

JPMorgan wins contract for First Republic Bank

Click to see story on der Standard AT

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Elora Fergus Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Thorold Today

JP Morgan and First Republic agreement ends the second largest bank failure in the US

Click to see story on larepublica.co

Regulator seized First Republic bank

Click to see story on siol.net

JP Morgan buys First Republic, the fourth bank to fall since the banking crisis began

Click to see story on Cadena SER

JPMorgan Chase Bank takes deposits and assets from First Republic Bank

Click to see story on Noticias ao Minuto

JP Morgan takes over First Republic, the third largest US bank to collapse in the last six weeks

Click to see story on Libertatea.ro

First Republic Bank in the hands of US authorities and sold to JPMorgan

Click to see story on Jornal de Negócios

First Republic Bank in the USA: JP Morgan Chase goes bankrupt

Click to see story on TAZ

J.P. Morgan buys First Republic Bank

Click to see story on Ekstra Bladet

Fifth Third Bancorp bid for First Republic before sale to JPMorgan -sources

Click to see story on WTVB

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Rocky Mountain Outlook

JP Morgan buys the assets of First Republic Bank and avoids the financial crisis

Click to see story on La Información

First Republic Bank seized, sold in fire sale to JPMorgan – WNKY News 40 Television

Click to see story on WNKY

Salvation of a drowning person. JPMorgan buys troubled American bank First Republic

Click to see story on Новое Время

First Republic Bank seized by authorities and bought by JPMorgan

Click to see story on 20 Minutes

JP Morgan to take over First Republic Bank in second largest US bank collapse ever

Click to see story on City AM

CS takeover by UBS – JP Morgan Chase acquires ailing First Republic Bank

Click to see story on Schweizer Radio und Fernsehen (SRF)…

JP Morgan übernimmt angeschlagene First Republic Bank

Click to see story on focus.de

First Republic Bank Seized, Sold In Fire Sale To JPMorgan

Click to see story on KXL

JPMorgan Chase Bank takes deposits and assets from First Republic Bank

Click to see story on IOL Portugal

JPMorgan to buy First Republic Bank as regulators step in

Click to see story on Ak�am

JP Morgan Chase übernimmt First Republic Bank

Click to see story on nordbayern.de

Crisis-hit First Republic is being taken over by JPMorgan

Click to see story on E24

Another US bank closed, JP Morgan to acquire assets of First Republic Bank

Click to see story on OpIndia

Mon. 8:48 a.m.: First Republic Bank seized, sold to JPMorgan Chase

Click to see story on tribtoday.com

First Republic: the second biggest bank failure ever for a bank in the USA

Click to see story on SIC Notícias

First Republic Bank Seized, Sold In Fire Sale To JPMorgan – KFOR FM 101.5 1240 AM

Click to see story on KFOR FM 103.3 1240 AM

Regulators seize First Republic Bank, third bank to fail in two months

Click to see story on NXST

First Republic Bank goes bankrupt in the USA; JP Morgan will buy the assets and take deposits

Click to see story on Brasil 247

First Republic bank collapses, JPMorgan to take over, FDIC says

Click to see story on Western Iowa Today 96.5 KSOM KS 95.7

JPMorgan takes over ailing First Republic

Click to see story on De Tijd

JPMorgan Chase takes over plagued First Republic Bank

Click to see story on fd.nl

A third U.S. bank failed in three months. California’s First Republic Bank

Click to see story on aktuality.sk

JPMorgan acquires First Republic, a bank that rekindled fears about the sector’s crisis

Click to see story on Bloomberg Línea Brasil

First Republic Bank cracker — seized and sold to big bank

Click to see story on borsen.dk

A US Bank to Purchase First Republic Bank’s Assets: Report

Click to see story on tn.ai

First Republic Bank disappears, JPMorgan takes over almost all assets and assets

Click to see story on De Morgen

Banking turmoil: JP Morgan Chase buys struggling First Republic

Click to see story on wiwo.de

First+Republic+Bank+seized%2C+sold+to+JPMorgan+Chase

Click to see story on The Journal Record

First Republic Bank seized, sold in fire sale to JPMorgan – Finance & Commerce

Click to see story on Finance & Commerce

JP Morgan Chase acquires First Republic Bank

Click to see story on inFranken.de

First Republic Bank collapses and Wall Street giants take over

Click to see story on 工商時報

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Fort Worth Business Press

FDIC Says “Sell in May” — First Republic Seized and Sold to JPMorgan

Click to see story on Market Rebellion

First Republic Bank is sold to JPMorgan Chase

Click to see story on La Opinion

Another bank collapses in America, regulators seize First Republic Bank

Click to see story on News8Plus

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Vancouver Is Awesome

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Powell River Peak

JPMorgan acquires First Republic Bank

Click to see story on Salzburger Nachrichten

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Bradford Today

Contract awarded: JPMorgan acquires First Republic Bank

Click to see story on nachrichten.at

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Timmins Today

JPMorgan buys First Republic Bank embargoed by U.S. UU.

Click to see story on Diario El Mundo

First Republic Bank went bankrupt. JPMorgan buys it and saves it

Click to see story on quotidiano.net

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Maryland Daily Record

JPMorgan wins the tender to acquire the assets of First Republic

Click to see story on Vozpópuli

JPMorgan buys First Republic after regulators seize control

Click to see story on weeklytimesnow.com.au

First Republic Bank collapses and is sold to JPMorgan

Click to see story on De Limburger

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on westernwheel.ca

JP Morgan to take over failed First Republic Bank

Click to see story on La Prensa Latina Media

First Republic Bank was acquired by regulators and sold to JPMorgan – Union Daily

Click to see story on Dziennik Związkowy | Polish Daily News

First Republic Bank: What we know about the second largest bank failure in US history

Click to see story on www.cnews.fr

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on cochraneeagle.ca

JPMorgan Acquires First Republic in Largest Bank Failure Since 2008 Crisis: US Regulators Step In

Click to see story on swissfinancialtime.com

Regulators Seize First Republic Bank, Sell Assets To JPMorgan

Click to see story on thetechee.com

Click to close

353 other sources covering this story

Total News Sources

353

Leaning Left

73

Center

125

Leaning Right

55

Last Updated

1 year ago

Move over, Silicon Valley Bank. First Republic Bank is now the second-largest bank failure in U.S. history. Three of the top 30 U.S. banks have now failed in less than two months.

The bidding process stretched into the night. Early Monday morning, federal authorities approved JPMorgan Chase’s bid to take over First Republic’s assets. Here are three things to know about Chase’s takeover.

Exception to the rule

JPMorgan Chase, already the nation’s largest bank, will now take over First Republic Bank, which had $229.1 billion in assets and $103.9 billion in deposits as of April 13, according to the FDIC. The FDIC said Chase agreed to purchase “substantially all” of First Republic’s assets, in addition to assuming all deposits.

That said, authorities had to carve out an exception to allow the largest U.S. bank to get even bigger. The 1994 Riegle-Neal Act prohibits banks from making acquisitions that would push its share of nationwide deposits over 10%. Chase already holds more than 10% of the nation’s deposits, which would have technically made it ineligible. But authorities were prepared to make that exception, specifically requesting that JPMorgan Chase make a bid for First Republic.

In the end, Chase’s offer to take nearly the entire bank was reportedly the cleanest and best deal for the FDIC, which expects its deposit insurance fund to take a $13 billion hit. Bloomberg reports that other bids would have cost the FDIC billions more.

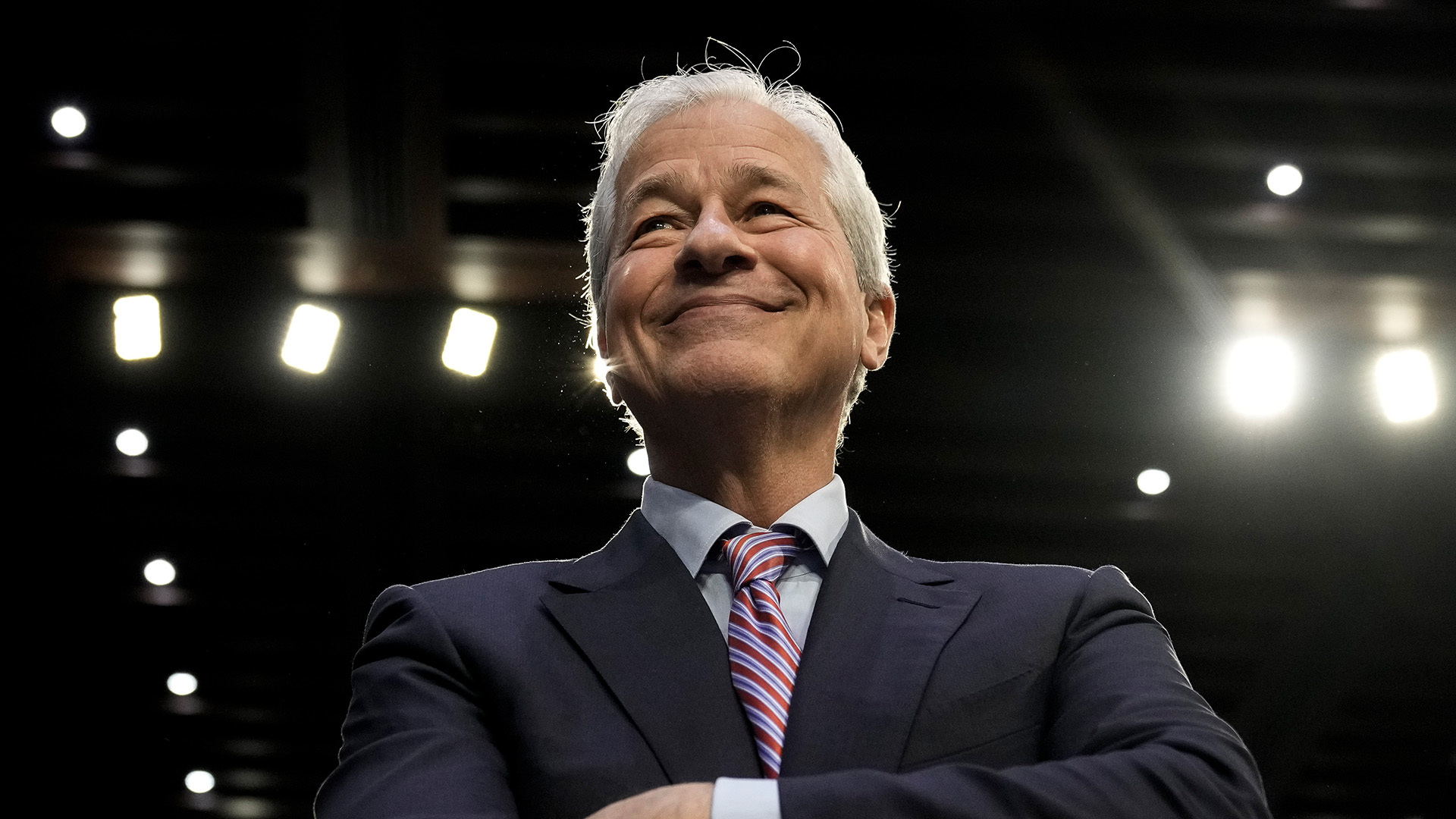

Chase to the rescue: Take two

It’s not the first time JPMorgan Chase has come to First Republic’s rescue. Back in March, CEO Jamie Dimon led efforts to inject $30 billion in deposits into First Republic when it was first starting to falter following the collapses of SVB and Signature Bank. In all, 11 of the biggest U.S. banks rallied behind a rescue package to stabilize First Republic, including Bank of America, Citigroup and Wells Fargo. Of the $30 billion provided, Chase ponied up $5 billion.

On Monday, Chase leaders insisted there is no conflict of interest between the bank being an adviser to First Republic, followed by a bidder for First Republic. In an analyst call, executives said the two teams were separate. Chase CFO Jeremy Barnum vowed Monday to repay the other banks for the rescue deposits they contributed.

Chase’s complicated bank buyout history

JPMorgan Chase’s history of helping failing financial institutions likely led to it carving out some protections this time around. Following the 2008 financial crisis, federal regulators requested that JPMorgan step in and rescue investment bank Bear Stearns and Washington Mutual, the latter of which remains the largest bank failure in U.S. history.

Coming to the feds’ aid in 2008 burned Dimon pretty hard in the years that followed. Chase was held legally liable for billions of dollars in fines and settlements levied against the banks it inherited. Ultimately, Dimon said that he regretted saving the banks for that reason and wouldn’t have made the same decision again.

With First Republic’s saga now complete, Dimon said Monday, “This part of the crisis is over.” But he still left the door open for a smaller institution to fail, noting that bank failures will always happen.

SIMONE DEL ROSARIO: MOVE OVER, SILICON VALLEY BANK. FIRST REPUBLIC BANK IS NOW THE SECOND BIGGEST BANK FAILURE IN U-S HISTORY. THREE OF THE TOP 30 U.S. BANKS HAVE NOW FAILED IN LESS THAN TWO MONTHS. HERE ARE THREE THINGS TO KNOW ABOUT THE LARGEST U-S BANK BUYING FIRST REPUBLIC.

JPMORGAN CHASE WON THE OVERNIGHT BIDDING FOR FIRST REPUBLIC’S ASSETS, WHICH TOTAL AROUND 229 BILLION DOLLARS, WITH 104 BILLION IN TOTAL DEPOSITS. BUT AUTHORITIES HAD TO CARVE OUT AN EXCEPTION TO ALLOW THE NATION’S LARGEST BANK TO GET EVEN BIGGER. THE 1994 RIEGLE-NEAL ACT PROHIBITS BANKS FROM MAKING ACQUISITIONS THAT’LL PUSH ITS SHARE OF NATIONWIDE DEPOSITS OVER 10%. CHASE ALREADY HAS MORE THAN 10% OF THE NATION’S DEPOSITS, WHICH SHOULD HAVE TECHNICALLY MADE IT INELIGIBLE. BUT FEDS WERE PREPARED TO MAKE THAT EXCEPTION, SPECIFICALLY REQUESTING THAT JPMORGAN CHASE MAKE A BID. IN THE END, CHASE’S OFFER TO TAKE NEARLY THE ENTIRE BANK WAS REPORTEDLY THE CLEANEST AND BEST DEAL FOR THE FDIC. THE FDIC EXPECTS ITS DEPOSIT INSURANCE FUND TO TAKE A 13 BILLION DOLLAR HIT, WHILE OTHER BIDS WOULD HAVE REPORTEDLY COST IT BILLIONS MORE.

THIS ISN’T THE FIRST TIME CHASE HAS COME TO FIRST REPUBLIC’S RESCUE. BACK IN MARCH, CEO JAMIE DIMON LED EFFORTS TO INJECT 30 BILLION DOLLARS IN DEPOSITS INTO FIRST REPUBLIC, WHEN IT WAS FIRST STARTING TO FALTER FOLLOWING THE COLLAPSES OF SVB AND SIGNATURE BANK. IN ALL, 11 OF THE BIGGEST U-S BANKS RALLIED BEHIND A RESCUE PACKAGE TO STABILIZE FIRST REPUBLIC, INCLUDING BANK OF AMERICA, CITIGROUP AND WELLS FARGO. OF THE $30 BILLION, CHASE HAD PONIED UP $5. CHASE INSISTS THERE’S NO CONFLICT OF INTEREST BETWEEN THE BANK BEING AN ADVISER TO FIRST REPUBLIC, FOLLOWED BY A BIDDER FOR FIRST REPUBLIC. LEADERS SAID THE TWO TEAMS WERE SEPARATE.

WHILE CHASE’S CFO VOWED MONDAY TO REPAY THE OTHER BANKS FOR THE RESCUE DEPOSITS THEY CONTRIBUTED.

LASTLY, CHASE’S STORIED HISTORY OF HELPING FAILING FINANCIAL INSTITUTIONS LIKELY LED TO IT CARVING OUT SOME PROTECTIONS THIS TIME AROUND. FOLLOWING THE 2008 FINANCIAL CRISIS, FEDERAL REGULATORS REQUESTED THAT JPMORGAN STEP IN AND RESCUE INVESTMENT BANK BEAR STEARNS AND WASHINGTON MUTUAL – WHICH IS THE LARGEST BANK FAILURE IN U-S HISTORY. COMING TO THE FEDS’ AID IN 2008 BURNED DIMON PRETTY HARD IN THE YEARS THAT FOLLOWED. CHASE WAS HELD LEGALLY LIABLE FOR BILLIONS OF DOLLARS IN FINES AND SETTLEMENTS LEVIED AGAINST THE BANKS HE INHERITED. ULTIMATELY, DIMON SAID HE REGRETTED SAVING THE BANKS FOR THAT REASON AND WOULDN’T DO IT AGAIN.

WITH THE FIRST REPUBLIC BANK SAGA NOW COMPLETE, WHAT’S NEXT? DIMON SAID MONDAY, “THIS PART OF THE CRISIS *IS OVER.” BUT STILL LEFT THE DOOR OPEN FOR A SMALLER BANK TO FAIL.

I’M SIMONE DEL ROSARIO, IN NEW YORK IT’S JUST BUSINESS.

Media Landscape

This story is a Media Miss by the right as only 22% of the coverage is from right leaning media.

Learn more about this dataLeft 29%

Center 49%

Right 22%

Bias Distribution

Regulators Seize First Republic Bank, Sell To JPMorgan Chase

Click to see story on HuffPost

US regulators seize California’s First Republic in latest banking failure

Click to see story on Raw Story

First Republic Bank is taken over by FDIC and sold to JPMorgan

Click to see story on MSNBC

First Republic Sold to JPMorgan Chase as Regulators Step In

Click to see story on The Daily Beast

How the Second-Biggest Bank Failure in History Happened

Click to see story on Slate

Click to close

US banking titan JP Morgan to snap up most of First Republic

Click to see story on The Guardian

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on The Hindu

JPMorgan Chase to buy distressed First Republic Bank in deal brokered by U.S. regulator

Click to see story on CBC News

First Republic Bank seized by US regulators and sold to JP Morgan Chase

Click to see story on The Independent

US Regulators Seize Troubled First Republic Bank, JPMorgan To Acquire It

Click to see story on NDTV

First Republic Bank seized, sold to JPMorgan Chase: Here’s what to know

Click to see story on USA Today

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on Associated Press News

JPMorgan Chase to assume all deposits of First Republic Bank

Click to see story on abc News

JPMorgan Chase comprará la mayoría de los activos del First Republic Bank tras su colapso en marzo

Click to see story on CNN

JPMorgan buys First Republic Bank after bank seized by regulators

Click to see story on Sydney Morning Herald

What to know about First Republic and the banking crisis

Click to see story on The Washington Post

Troubled First Republic Bank seized and sold to JPMorgan Chase

Click to see story on CBS News

US authorities ‘auction’ First Republic Bank to JPMorgan after second biggest bank failure in history

Click to see story on ABC Australia

US regulator seizes First Republic Bank, to sell assets to JP Morgan

Click to see story on Indian Express

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on NY Daily News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Los Angeles Times

JPMorgan Chase to take over deposits and most of the assets of First Republic Bank

Click to see story on npr

JPMorgan Ends First Republic’s Turmoil After FDIC Seizure

Click to see story on Bloomberg

JP Morgan acquires First Republic Bank

Click to see story on Sueddeutsche Zeitung

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Mercury news

JPMorgan is buying First Republic Bank after it was taken over by regulators

Click to see story on Business Insider

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 6 Philadelphia

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 13 Houston

El regulador financiero de California toma posesión del First Republic Bank

Click to see story on Infobae

California regulators seize troubled First Republic Bank

Click to see story on Irish Examiner

First Republic Bank is taken over by FDIC and sold to JPMorgan in third major bank failure of 2023

Click to see story on NBC News

First Republic Bank is safe: Jp Morgan buys it

Click to see story on La Repubblica

JPMorgan Chase to take over most assets of First Republic Bank

Click to see story on abc 7 News

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc11 Raleigh

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc30 News

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Japan Today

First Republic Bank seized and sold to JPMorgan Chase

Click to see story on Bangor Daily News

Regulators Seize First Republic Bank, Sell to JPMorgan Chase in Third Major Bank Failure of 2023

Click to see story on NBC Chicago

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WHDH

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Alaska Highway News

JPMorgan buys First Republic Bank after being intervened by US authorities

Click to see story on El Pais

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Koco News5

The road to First Republic Bank’s collapse

Click to see story on Inquirer

Bankenkrise: First Republic Bank wird an JPMorgan verkauft

Click to see story on Zeit Online

JPMorgan buys First Republic Bank sale: What you need to know

Click to see story on Politico

First Republic Bank Seized, Sold to JP Morgan. What It Means for Mass. Customers

Click to see story on NBC Boston

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WISH-TV

WATCH LIVE: White House holds briefing as First Republic Bank seized by regulators

Click to see story on PBS NewsHour

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Times Colonist

US seizes assets of First Republic Bank, third to collapse in 2 months

Click to see story on The Times of Israel

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Lakeland Today

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Airdrie Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Mountainview Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Town And Country Today

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Burnaby Now

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WSVN

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Delta Optimist

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Coast Reporter

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Salt Lake Tribune

First Republic Bank Seized by Regulators and Sold to JPMorgan Chase

Click to see story on Time Magazine

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on SooToday.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Barrie Today

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Arizona Daily Sun

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on News & Record

Regulators seize First Republic Bank, with JPMorgan Chase acquiring it

Click to see story on AM New York

(S+) First Republic Bank: JP Morgan Chase acquires bankruptcy bank

Click to see story on Spiegel

Another bank goes down: First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Delaware County Daily Times

Regulators seize First Republic Bank, sell JPMorgan ‘substantially all’ remaining assets

Click to see story on The Week

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WCSH

US First Republic Bank also falls, is held by JP Morgan

Click to see story on NRC Handelsblad

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on unionrecorder.com

JP Morgan taking over First Republic after its collapse

Click to see story on scrippsnews.com

Click to close

First Republic: JP Morgan snaps up major US bank

Click to see story on BBC News

Regulators seize First Republic Bank, sell assets to JPMorgan

Click to see story on Reuters

JP Morgan set to acquire assets of First Republic Bank after its closure

Click to see story on Hindustan Times

Regulators sell First Republic to JPMorgan Chase

Click to see story on NZ Herald

JPMorgan Chase Takes Over First Republic After Biggest U.S. Bank Failure Since 2008

Click to see story on CNBC

US regulators seize First Republic Bank and sell it to JPMorgan Chase

Click to see story on South China Morning Post

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KRDO

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on KIFI

JPMorgan wins government auction to buy seized First Republic Bank

Click to see story on Channel News Asia

Deal reached to sell ailing First Republic to JP Morgan

Click to see story on RTÉ

JP Morgan’s acquisition of First Republic may put it among the top banks in Mass.

Click to see story on The Business Journals

JPMorgan to acquire San Francisco-based bank First Republic as US regulators announce deal

Click to see story on WION

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Star Advertiser

U.S. Regulator Seizes First Republic Bank, to Sell Assets to JP Morgan

Click to see story on VOA News

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Winnipeg Free Press

First Republic Bank seized by regulators, sold to JPMorgan Chase

Click to see story on UPI

JPMorgan to buy First Republic Bank as regulators seize control

Click to see story on Al Jazeera

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 Chicago

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCRA 3

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 LA

FDIC accepts JPMorgan Chase Bank’s purchase of First Republic Bank

Click to see story on abc 7 NY

First Republic Bank shuts down, JP Morgan to take over assets

Click to see story on Live Mint

US regulator seizes First Republic Bank, sells to JPMorgan – DW – 05/01/2023

Click to see story on Deutsche Welle

First Republic Bank Folds As Banking Crisis Claims Third Victim – PNC Finl Servs Gr (NYSE:PNC), First Republic Bank (NYSE:FRC), JPMorgan Chase (NYSE:JPM)

Click to see story on Benzinga

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Chicago Tribune

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Portland Press Herald

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WCVB

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Las Vegas Review-Journal

US regulators seize California’s First Republic in latest banking failure

Click to see story on France24

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WLWT

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WMUR

First Republic Bank saved by JP Morgan: acquisition of assets worth 229 billion

Click to see story on Corriere Della Sera

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WLKY

Regulators close First Republic Bank, JPMorgan named as the buyer of $330B assets and deposits, FDIC on the hook for $13B

Click to see story on TechCrunch

JPMorgan to take over First Republic after regional bank was closed

Click to see story on MarketWatch

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WESH

Regulators seize First Republic Bank

Click to see story on Taipei Times

Salvataggio per First Republic Bank, l’acquisirà JpMorgan

Click to see story on ANSA

JPMorgan Chase Agrees To Acquire First Republic Bank’s Deposits After FDIC Intervenes

Click to see story on Forbes

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WDSU

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on The Detroit News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WTAE

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KETV

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WYFF

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCCI

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KSAT 12

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KMBC

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on Washington Top News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WBAL-TV

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on The Billings Gazette

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WISN

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Lincoln Journal Star

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPTZ

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WMTW

Regulators seize First Republic in 3rd major U.S. bank failure in 2 months

Click to see story on Deseret News

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WVTM

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WAPT

First Republic Bank acquired by JPMorgan after being seized by American authorities

Click to see story on La Libre

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Missoulian

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Tulsa World

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KOAT

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Helena Independent Record

First Republic Bank seized by feds, sold to JPMorgan Chase

Click to see story on The Oregonian

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WRIC

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Montana Standard

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Sask Today

First Republic seized by regulators as bid accepted from JP Morgan

Click to see story on The National

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPRI 12

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on NY1

JP Morgan buys First Republic Bank

Click to see story on Le Soir

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on ABC6

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Penn Live

Another bank falls in the US: Regulator seizes First Republic Bank and hands it over to JPMorgan

Click to see story on El Financiero

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Syracuse NY

JP Morgan Chase acquires US bank First Republic

Click to see story on Tagesschau

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WFAA 8abc

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on KCRG

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on First Coast

JP Morgan takes over First Republic, the third largest US bank to collapse in recent months

Click to see story on Digi 24

California regulators seize First Republic Bank; JP Morgan Chase is taking over all deposits and most assets

Click to see story on KOB 4

California’s First Republic Bank Sold to JPMorgan in 2nd-Largest U.S. Bank Failure

Click to see story on Times of San Diego

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Tucson

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WFSB

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Devdiscourse

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Staten Island Advance

Regulator seized First Republic bank

Click to see story on 24ur.com

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on The Sentinel

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KTSM

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Omaha World-Herald

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WPBF

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WTNH

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Winston-Salem Journal

First Republic Seized by Regulators, to Be Sold to JPMorgan (1)

Click to see story on Bloomberg Law

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on HDR | Hickory Daily Record

US Regulators Seize California’s First Republic Bank

Click to see story on Barron's

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on WXII

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WLTX

First Republic seized by regulators as bid accepted from JP Morgan

Click to see story on Financial Times

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WNDU

Regulators seize ailing First Republic Bank, sell remains to JPMorgan

Click to see story on SentinelSource.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Krem2 News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Rapid City Journal Media Group

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on GoDanRiver.com

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WUSA9

First Republic up in air as regulators juggle bank’s fate

Click to see story on Hawaii Tribune-Herald

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on McDowellNews.com

SF’s First Republic Bank Seized and Quickly Sold to JPMorgan Chase In Largest Bank Failure of the Year

Click to see story on SFist

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WBIR

First Republic fails, and is snapped up by JPMorgan Chase

Click to see story on The Economist

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KGW 8

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KSDK

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on Albany Herald

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on KMOV St.Louis

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Red Bluff Daily News

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on The Daily Nonpareil – Council Bluffs, Iowa…

JPMorgan Chase to buy most First Republic assets after bank fails

Click to see story on abc12/WJRT

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Auburn Citizen

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Journal Times

Headline Unavailable

Click to see story on Nasdaq

First Republic Bank seized, sold to JPMorgan Chase – Metro Philadelphia

Click to see story on Metro Philadelphia

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Valley News Live

First Republic Bank seized, sold to JPMorgan Chase; ‘zero leads’ in Texas manhunt; Met Gala mania is here; and more morning headlines

Click to see story on Glens Falls Post-Star

JPMorgan to buy First Republic after regulators seize control – Blue Water Healthy Living

Click to see story on AFP

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on castanet.net

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on kotatv.com

Click to close

JPMorgan to buy embattled First Republic Bank after seizure by regulators

Click to see story on Times of India

First Republic Bank Seized by Regulators, JPMorgan To Acquire

Click to see story on News18 India

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Washington Times

First Republic taken over by JP Morgan as third US bank falls

Click to see story on The Telegraph

US regulator seizes First Republic Bank, to sell assets to JP Morgan

Click to see story on New York Post

JP Morgan to buy First Republic’s assets and assume deposits

Click to see story on Financial Post

First Republic regulators rush to fix crisis as banks make bids

Click to see story on The Straits Times

Another US bank closed, JPMorgan to acquire assets of First Republic

Click to see story on Gulf News

JPMorgan to buy First Republic Bank as regulators seize control

Click to see story on News

JPMorgan buys First Republic after regulators seize control

Click to see story on Bangkok Post

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on MY Northwest

First Republic Bank closed by US regulators, JPMorgan to acquire assets

Click to see story on Anadolu Ajansı

Another bank crumbles: First Republic seized by feds, sold in fire sale to JPMorgan

Click to see story on Boston Herald

US regulator seizes First Republic Bank, to sell assets to JPMorgan

Click to see story on Times Live

JPMorgan among bidders for ailing First Republic

Click to see story on The West Australian

San Francisco-based First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Al Arabiya

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on OC Register

First Republic Bank Is Seized, Sold to JPMorgan in Second-Largest U.S. Bank Failure

Click to see story on Wall Street Journal

JPMorgan acquires struggling First Republic Bank

Click to see story on Die Presse

PNC was one of First Republic Bank bidders, reports say

Click to see story on Alabama Live

JPMorgan Chase bought First Republic Bank

Click to see story on RIA Novosti [🇷🇺-affiliated]

Regulators seize First Republic Bank and sell it to JPMorgan Chase

Click to see story on Reason

First Republic Bank wird an JP Morgan verkauft

Click to see story on Frankfurter Allgemeine

Federal regulators seize, sell First Republic Bank to JPMorgan – Just the News Now

Click to see story on justthenews.com

JP Morgan acquires substantial majority of First Republic Bank’s assets

Click to see story on UnionLeader.com

JPMorgan buys First Republic: Bank shares rise as deal reached

Click to see story on Fox Business

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Albuquerque Journal

Crisis-hit First Republic Bank gets taken over by big bank

Click to see story on berlingske.dk

First Republic Bank Seized by FDIC, Sold to JPMorgan Chase

Click to see story on Jewish Press

JP Morgan buys First Republic Bank after being rescued in the US

Click to see story on la Nacion

JPMorgan Chase agrees to purchase First Republic

Click to see story on WKRC

First Republic Bank Is Almost Down. JPMorgan or PNC May Be Its Buyers

Click to see story on The Street

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on WPDE

Click to close

Regulators take control of First Republic Bank and sell it to JPMorgan Chase

Click to see story on Washington Examiner

Biden Responds To First Republic Bank Closure

Click to see story on The Daily Caller

JPMorgan to buy First Republic’s assets and assume deposits

Click to see story on OAN

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Toronto Sun

NTD Good Morning (May 1): Manhunt Underway in Texas After 5 Murdered; JPMorgan Chase Buys Failed First Republic Bank

Click to see story on The Epoch Times

First Republic Bank Seized, Sold to JP Morgan Chase; Second-Biggest Bank Failure in US History

Click to see story on Latestly

Regulators Seize First Republic in Second Largest Bank Failure in U.S. History

Click to see story on National Review

Feds Seize First Republic Bank in Second Biggest Bank Failure in U.S. History, JPMorgan to Assume Control

Click to see story on RedState

US regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Daily Sabah

2nd largest bank failure in US: First Republic Bank seized, sold to JPMorgan

Click to see story on PressTV

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Ohio Star

Click to see story on The Ohio Star

In 3rd Major Bank Collapse, Regulators Seize First Republic Bank, Sell It to JPMorgan Chase

Click to see story on CBN

Fallen First Republic Bank comes into the hands of JPMorgan

Click to see story on De Telegraaf

JPMorgan buys First Republic after regulators seize control

Click to see story on The Daily Telegraph

First Republic Bank Seized by Regulators and Sold to JPMorgan

Click to see story on Washington Free Beacon

JPMorgan Chases Acquires First Republic Bank After Seizure by Regulators

Click to see story on The New York Sun

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – Tennessee Star

Click to see story on Tennessee Star

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Michigan Star

Click to see story on themichiganstar.com

Federal Regulators Seize, Sell Major Bank to JPMorgan Chase – The Florida Capital Star

Click to see story on floridacapitalstar.com

Click to close

First Republic Bank Taken Over by FDIC and Sold to JPMorgan – Largest Lender to Collapse Since 2008

Click to see story on The Gateway Pundit

Federal regulators seize and sell major bank to financial giant

Click to see story on WND

JPMorgan to Acquire First Republic Bank After Seizure by US Regulators

Click to see story on InfoWars

Click to close

Untracked Bias

US regulators seize troubled First Republic Bank

Click to see story on Shropshire Star

Bank shares rise in NY amid J.P. Morgan’s purchase of First Republic Bank

Click to see story on Globo

JP Morgan Buys Assets of First Republic Bank Seized by U.S. Regulators

Click to see story on bisnis.com

JP Morgan to buy First Republic Bank assets and take deposits

Click to see story on Publico

JP Morgan Chase übernimmt First Republic Bank

Click to see story on Berliner Morgenpost

North American bank First Republic closes and deposits are sold to JP Morgan

Click to see story on Jornal Expresso

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Richmond News

Banking crisis: JP Morgan acquires First Republic Bank

Click to see story on handelsblatt.com

U.S. First Republic Bank is sold to JPMorgan

Click to see story on Het Nieuwsblad

The US intervenes the First Republic Bank and sells it to JP Morgan

Click to see story on La Vanguardia

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on North Shore News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on AlbertaPrimeTimes.com

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Tri-City News

US regulator secretly auctions First Republic bank: CNN

Click to see story on Aristegui Noticias

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Pique

Regulators seize First Republic Bank, sell to JPMorgan Chase

Click to see story on Squamish Chief

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on New West Record

Finanzopsiicht annoncéiert: JP Morgan Chase iwwerhëlt First Republic Bank

Click to see story on rtl.lu

First Republic: Second largest bank failure in US history

Click to see story on ORF.at News

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Flin Flon Reminder

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on St. Albert Gazette

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Sudbury

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Bay Today

U.S. First Republic Bank is sold to JPMorgan

Click to see story on Het Belang van Limburg

JPMorgan To Acquire Troubled Lender First Republic Bank

Click to see story on BQ

US markets volatile after JP Morgan’s purchase of First Republic

Click to see story on Bloomberg Linea

Another US Bank Collapses: Regulators Seize First Republic Bank, Sell to JPMorgan Chase

Click to see story on NewsClick

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Orillia Matters

JPMorgan erhält Zuschlag für First Republic Bank

Click to see story on Kurier

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Newmarket Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Midland Today

JP Morgan to acquire First Republic Bank after US financial authorities seize the lender

Click to see story on Zee Business

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Collingwood Today

JPMorgan wins contract for First Republic Bank

Click to see story on der Standard AT

First Republic Bank seized, sold to JPMorgan Chase

Click to see story on Elora Fergus Today

First Republic Bank seized, sold in fire sale to JPMorgan

Click to see story on Thorold Today

JP Morgan and First Republic agreement ends the second largest bank failure in the US

Click to see story on larepublica.co

Regulator seized First Republic bank

Click to see story on siol.net

JP Morgan buys First Republic, the fourth bank to fall since the banking crisis began