SIMONE DEL ROSARIO: IS PRESIDENT BIDEN’S STAB AT THE STUDENT DEBT CRISIS PUTTING MORE FUEL ON THE FIRE OF INFLATION?

THAT’S THE WORRY AFTER HE WIPED DEBT FOR MILLIONS OF AMERICANS.

MAYA MACGUINEAS: so when you’re saying to somebody you no longer have to pay down your debt and that creates more money for spending right now that’s exactly the opposite of what the economy needs when you’re in an inflationary environment.

SIMONE DEL ROSARIO: MAYA MACGUINEAS IS PRESIDENT OF THE COMMITTEE FOR A RESPONSIBLE FEDERAL BUDGET.

SHE CALLED BIDEN’S ORDER “GALLINGLY RECKLESS.”

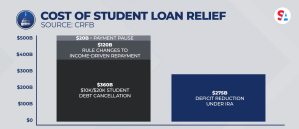

THE NONPARTISAN BUDGET WATCHDOG ESTIMATES LOAN CANCELLATION WILL COST THE GOVERNMENT $360 BILLION OVER THE NEXT 10 YEARS.

ADD BIDEN’S RULE CHANGES TO INCOME DRIVEN REPAYMENT, AND ONE LAST PAYMENT PAUSE THROUGH THE REST OF THE YEAR, AND THE TOTAL COST IS NEARLY DOUBLE THE AMOUNT SAVED THROUGH THE RECENTLY PASSED INFLATION REDUCTION ACT, QUOTE “COMPLETELY ELIMINATING ANY DISINFLATIONARY BENEFIT FROM THE BILL.”

INFLATION RIGHT NOW IS AT 8.5% – ALREADY NEAR A 40-YEAR-HIGH. A WELLS FARGO ECONOMIST SAYS STUDENT DEBT RELIEF COULD DRIVE UP INFLATION EVEN HIGHER BY 0.1 TO .3 PERCENTAGE POINTS.

THAT ESTIMATE IS IN LINE WITH BLOOMBERG ECONOMICS AND PENN WHARTON ECONOMIST KENT SMETTERS.

KENT SMETTERS: that is not going to be $10,000 in your pocket this year that’s going to be spread out and so we’re not going to get some big macro demand surge from this but it certainly would be positive on inflation but maybe 1/10th of 1% maybe even up to 2/10ths of 1% that they get more generous.

SIMONE DEL ROSARIO: BIG PICTURE: NOT A HUGE BOOST. BUT WHEN INFLATION’S ALREADY THIS HIGH – IT’S DEFINITELY THE WRONG DIRECTION.

NOT TO MENTION, MULTIPLE EXPERTS SPECULATE CANCELING DEBT WILL ONLY INFLATE THE COST OF COLLEGE.

I’M SIMONE DEL ROSARIO AND IT’S JUST BUSINESS.