3 things to know now that Supreme Court blocked Biden’s student loan cancellation

By Simone Del Rosario (Business Correspondent), Ryan Tiedgen (Editor)

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Untracked Bias

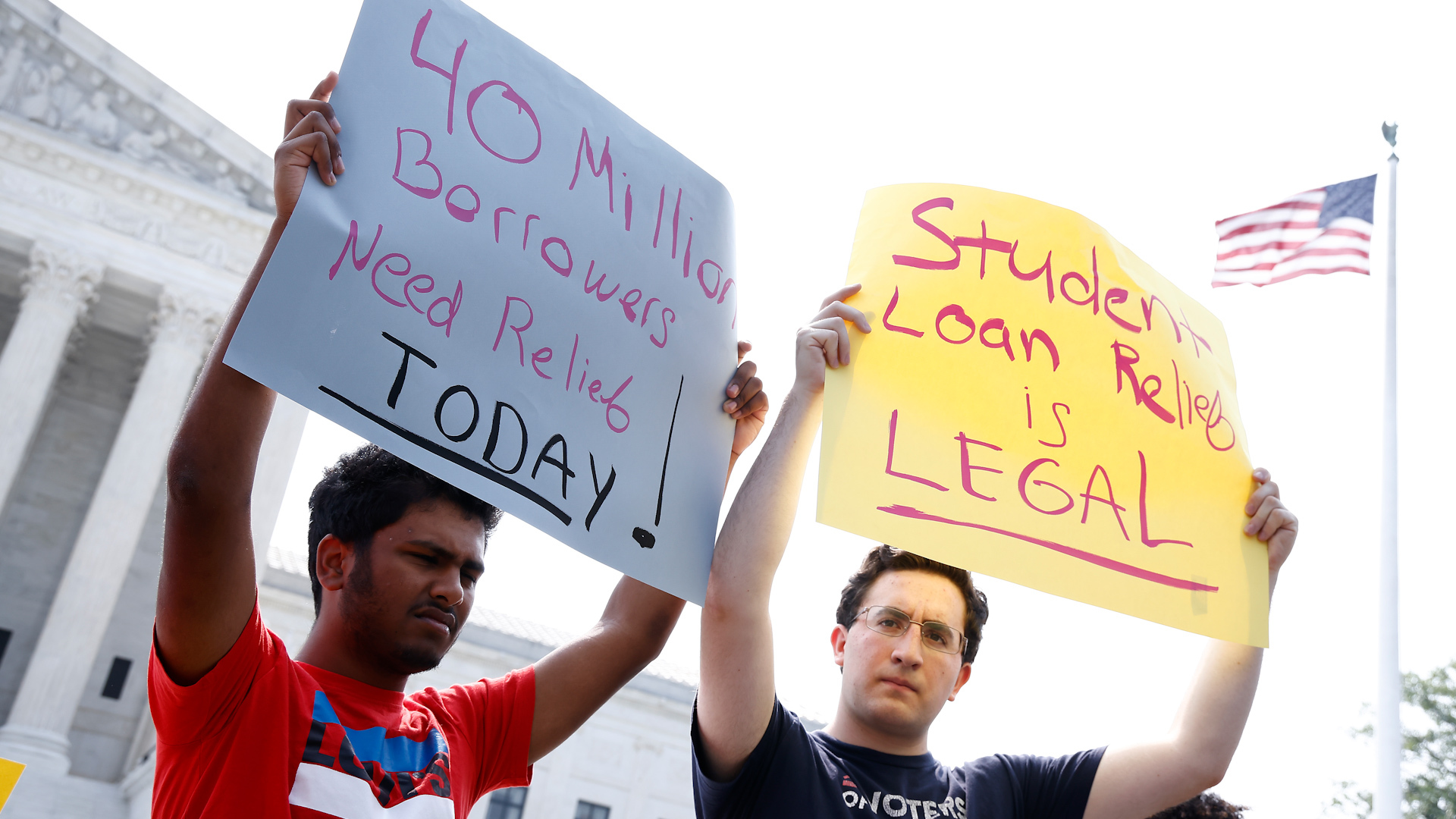

The Supreme Court blocked President Joe Biden’s plan to cancel up to $20,000 each in federal student loan debt for millions of borrowers on Friday, June 30. In a 6-3 decision, the conservative majority ruled the Biden administration overstepped its authority with the plan, which would have cost around $400 billion, according to budget office estimates.

Now that the Supreme Court has made its determination, here are three things student loan borrowers need to know.

When will payments resume?

After more than three years of 0% interest due to a pandemic-related pause, federal student loans will start accruing interest again on Sept. 1.

This resumption date was agreed upon in the debt ceiling deal reached by Biden and House Speaker Kevin McCarthy, which Congress passed in early June.

While interest will start accruing in September, first payments will not be due until October, according to the Education Department. Borrowers will want to use the coming months to reconnect to their student loan servicers and update their accounts and payment information.

“Safety net period” is on horizon

The Education Department is carving out a “safety net period” to ease back into repayment. The plan promises a 12-month “on-ramp” period where borrowers’ credit scores won’t get dinged if they fail to make payments on their loans starting in October.

Borrowers who can make payments should as payments will resume & interest will accrue, but the on-ramp to repayment helps borrowers avoid the harshest consequences of missed, partial, or late payments like negative credit reports & having loans referred to collection agencies.

— Secretary Miguel Cardona (@SecCardona) June 30, 2023

The Biden administration is worried about an overwhelming amount of delinquencies and defaults once repayment resumes.

Republicans, meanwhile, have blasted reports of the plan. Louisiana Sen. Bill Cassidy called it a “direct violation of the debt ceiling agreement” in an interview with Politico.

Changes to income-driven repayment intact, for now

The Supreme Court decision does not touch the planned changes to income-driven repayment, which could cut participants’ payments in half.

If opted in, the plan calculates the monthly amount due based on the borrower’s income. Those individuals making less than $32,805 per year would have a monthly payment of $0.

It will cut monthly payments to zero dollars for millions of low-income borrowers, save all other borrowers at least $1,000 per year, and stop runaway interest that leaves borrowers owing more than their initial loan.

— Secretary Miguel Cardona (@SecCardona) June 30, 2023

Borrowers hoping to enroll in the income-driven repayment plan, forbearance or other options will want to connect with their student loan servicer before repayment resumes this fall.

One more thing

On Friday afternoon, Biden announced he would attempt to cancel student debt for “as many borrowers as possible” using authority through the Higher Education Act.

“This new path is legally sound,” Biden said. “It’s going to take longer, but in my view, it’s the best path that remains.”

Borrowers who previously applied and were approved for one-time student debt relief would not necessarily qualify under the new program. The department said it is still working out specific parameters and that borrowers should plan on paying loans in the meantime.

First, I'm announcing a new path to provide student debt relief to as many borrowers as possible, as quickly as possible, grounded in the Higher Education Act.

— President Biden (@POTUS) June 30, 2023

Just moments ago, @SecCardona took the first official step to initiate this new approach.

We aren’t wasting any time.

SIMONE DEL ROSARIO: AT LONG LAST, WE HAVE CLARITY ON CANCELING STUDENT DEBT.

AND WHILE IT’S NOT THE RESULT MILLIONS OF BORROWERS WERE HOPING FOR – AT LEAST THE GUESSING GAME IS MOSTLY OVER.

HERE ARE THREE THINGS TO KNOW NOW THAT THE SUPREME COURT HAS BLOCKED PRESIDENT BIDEN’S $400 BILLION DOLLAR PLAN TO CANCEL FEDERAL STUDENT DEBT.

AFTER MORE THAN THREE YEARS OF 0% INTEREST, LOANS WILL START ACCRUING INTEREST AGAIN ON SEPTEMBER FIRST.

FIRST PAYMENTS WILL BE DUE A MONTH AFTER THAT.

SO YOU’VE GOT A COUPLE OF MONTHS TO DIG UP THAT LOGIN INFO FOR YOUR STUDENT LOAN SERVICER AND SET UP THAT AUTOMATIC PAYMENT.

ACCORDING TO POLITICO, THE EDUCATION DEPARTMENT IS CARVING OUT A “SAFETY NET PERIOD” TO EASE BACK INTO REPAYMENT.

AT LEAST 90 DAYS WHERE BORROWERS’ CREDIT SCORES WON’T GET DINGED IF THEY FAIL TO MAKE PAYMENTS ON THEIR LOANS.

THE ADMINISTRATION’S WORRIED ABOUT AN OVERWHELMING AMOUNT OF DELINQUENCIES AND DEFAULTS ONCE REPAYMENT RESUMES.

WHILE REPUBLICANS ARE BLASTING THE PLAN. LOUISIANA SENATOR BILL CASSIDY, CALLING IT “A DIRECT VIOLATION OF THE DEBT CEILING AGREEMENT.”

POLITICO SAYS THE EDUCATION DEPARTMENT WILL REVEAL MORE DETAILS IN THE COMING WEEKS.

THE SUPREME COURT DECISION DOES NOT TOUCH THE PLANNED CHANGES TO INCOME-DRIVEN REPAYMENT, WHICH COULD CUT PARTICIPANTS’ PAYMENTS IN HALF.

THE PLAN CALCULATES THE MONTHLY AMOUNT DUE BASED ON YOUR INCOME.

ANOTHER REASON TO CONNECT WITH YOUR STUDENT LOAN SERVICER TO FIGURE OUT YOUR PLAN FOR REPAYMENT BEFORE FALL.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Untracked Bias

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

DHS sees leadership shakeup amid ICE operation leaks

Read5 hrs ago -

Reuters

Reuters

Pope Francis health update: gradual improvement

ReadYesterday -

Reuters

Reuters

Protester climbs Big Ben with Palestinian flag causing Westminster Bridge closure

ReadYesterday -

Reuters

Reuters

House Republicans unveil CR 1 week before govt. shutdown

ReadYesterday