SCOTT BUCHANAN: we are really sort of down to the wire here.

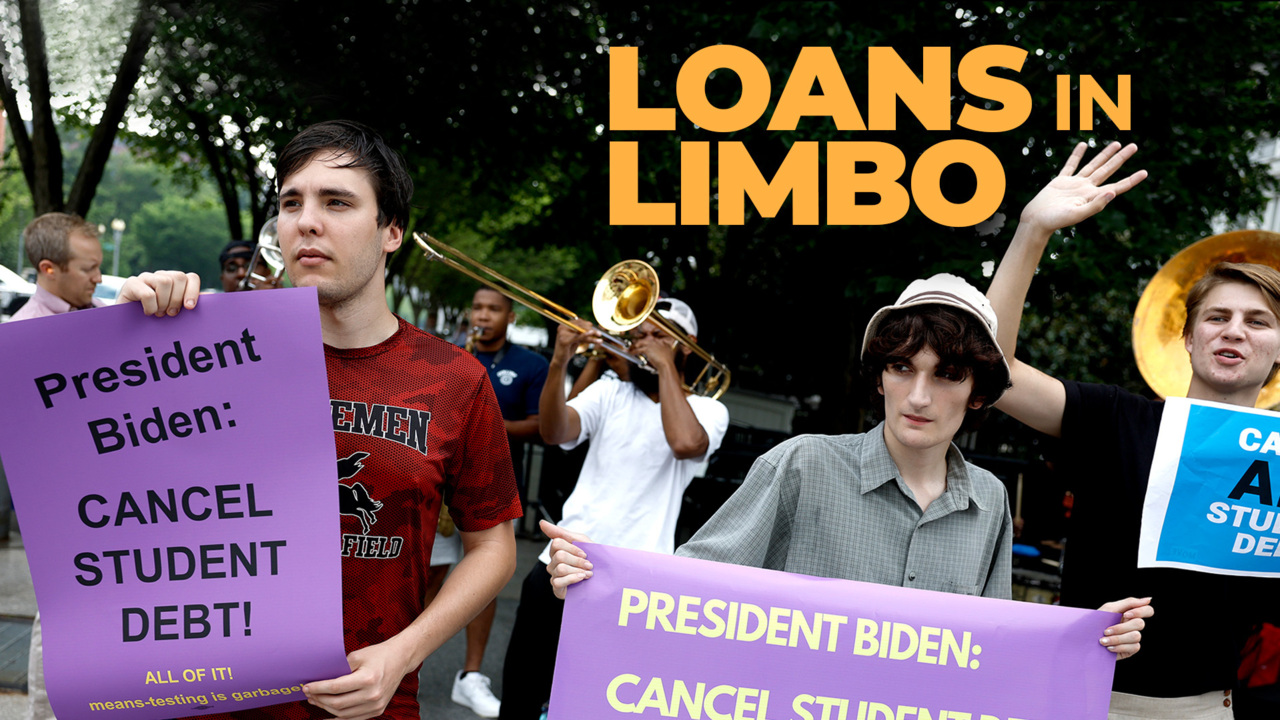

SIMONE DEL ROSARIO: WITH JUST ONE WEEK BEFORE STUDENT LOAN PAYMENTS THEORETICALLY START FOR 45 MILLION PEOPLE…

THE BIDEN ADMINISTRATION HAS LEFT BOTH BORROWER AND SERVICER IN THE DARK.

LINDSAY CLARK: the fact that it’s waited this long, we’re sort of cutting this close, is kind of unprecedented, in my opinion.

SIMONE DEL ROSARIO: LINDSAY CLARK WORKS FOR SAVI – A TECH STARTUP HELPING STUDENT LOAN BORROWERS NAVIGATE EXISTING LOAN FORGIVENESS PROGRAMS.

LINDSAY CLARK: most importantly, for borrowers, it’s about clarity, right? Whether or not he’s going to forgive 10,000 or not, whether he’s going to turn payments back on or not, borrowers just need to know.

SIMONE DEL ROSARIO: AND THEY’RE NOT THE ONLY ONES.

SCOTT BUCHANAN: we have not been given advance notice about that. And we’re the ones who actually have to do the work of implementing those programs.

SIMONE DEL ROSARIO: SCOTT BUCHANAN IS EXECUTIVE DIRECTOR OF THE TRADE GROUP STUDENT LOAN SERVICING ALLIANCE.

SCOTT BUCHANAN: these things are going to take months to figure out.

SIMONE DEL ROSARIO: TIME THE BIDEN ADMINISTRATION HAS SO FAR – NOT GIVEN THEM. WHETHER IT’S BRINGING 45 MILLION BORROWERS BACK INTO REPAYMENT, OR CANCELING SOME TYPES OF LOANS.

SCOTT BUCHANAN: if there is some announcement about loan forgiveness, probably when you log into your account tomorrow, the balance is going to be the same.

LINDSAY CLARK: I think we’re in for a real couple of tumultuous months, after something like this is announced and trying to figure out where the pieces fall, how we can make sure that all borrowers who are supposed to benefit are actually benefiting.

SIMONE DEL ROSARIO: IF CURRENT LOAN FORGIVENESS PROGRAMS ARE ANY INDICATION – THAT COULD BE THE MOST CUMBERSOME PART OF ALL.

I’M SIMONE DEL ROSARIO AND IT’S JUST BUSINESS.