DOJ accuses Visa of monopolizing debit card market in new antitrust lawsuit

By Lauren Taylor (Anchor/Reporter), Emma Stoltzfus (Video Editor)

This report was created with support from enhanced software.

The Department of Justice (DOJ) filed an antitrust lawsuit against Visa. In the suit, it accused the company of monopolizing the debit card market through anticompetitive practices. The government claimed these actions have potentially cost consumers and businesses billions of dollars.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below. Learn more about this dataBias Distribution

Left

DOJ sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Associated Press NewsU.S. sues Visa over alleged debit card monopoly – National

Click to see story on Global NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on abc NewsUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on CNNVisa accused of violating antitrust law with payment processing deals

Click to see story on The Washington PostVisa monopolizes debit cards, hurting consumers and businesses, Justice Department says

Click to see story on CBS NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Coast ReporterUS Justice Department hits Visa with antitrust lawsuit over its debit card business

Click to see story on Business InsiderDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Sask TodayJustice Department accuses Visa of stifling competition in the debit card business

Click to see story on nprDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Rocky Mountain OutlookDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 6 PhiladelphiaDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 13 HoustonDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on SooToday.comDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Barrie TodayDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc30 NewsUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’ – Boston News, Weather, Sports

Click to see story on WHDHThe US government is suing Visa for competition infringement

Click to see story on TVA NouvellesGarland announces antitrust lawsuit against Visa over debit card competition

Click to see story on PBS NewsHourDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WCSHDOJ sues Visa for allegedly monopolizing debit card markets

Click to see story on Fast CompanyDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Thompson CitizenWhy Visa’s antitrust battle could be so worrying to Wall Street

Click to see story on RocketNewsUS accuses Visa of debit card monopoly

Click to see story on BBC NewsUS accuses Visa of monopolizing debit card swipes

Click to see story on ReutersUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KRDOUS accuses Visa of monopolizing debit card swipes

Click to see story on Channel News AsiaJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on CNBCJustice Department accuses Visa of monopolizing debit market in antitrust lawsuit

Click to see story on The HillUS Justice Department sues Visa, saying it monopolizes debit card markets

Click to see story on VOA NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on WPLGDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 ChicagoDOJ sues Visa, alleging card issuer monopolizes market

Click to see story on Portland Press HeraldDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 LADepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 NYThe US Antitrust is suing Visa: illegal monopoly on debit cards

Click to see story on Corriere Della SeraDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KOB 4Federal government sues Visa, alleging monopoly on debit card market

Click to see story on The OregonianWhy Visa’s antitrust battle could be so worrying to Wall Street

Click to see story on MarketWatchDepartment of Justice sues Visa, claims debit card monopoly

Click to see story on Spectrum Local NewsThe US government is suing Visa for competition infringement

Click to see story on La LibreDOJ to accuse Visa of illegally monopolizing US debit card market

Click to see story on FortuneUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KWWLDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on 9NEWS DenverDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on The Baltimore SunDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WLTXDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WKYCDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WBIRDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Krem2 NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on WMBDDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Wood TVDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Scripps NewsDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KTVBDOJ hits Visa with antitrust lawsuit over monopoly concerns

Click to see story on QuartzUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KESQDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on NewsdayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on KMIZDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on TechXploreDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Fort Smith/Fayetteville NewsDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets – KION546

Click to see story on KIONDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KYTXDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on New Orleans CityBusinessNancy Pelosi’s husband sold more than $500K worth of Visa stock — just weeks before DOJ’s antitrust lawsuit

Click to see story on New York PostFeds sues Visa, saying company is driving up card costs for businesses, consumers

Click to see story on OC RegisterUS accuses Visa of monopolizing debit card swipes

Click to see story on New Hampshire Union LeaderDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Winnipeg SunDepartment of Justice Sues Visa for Alleged Monopolization of Debit Card Markets

Click to see story on The Epoch TimesVisa accused of causing higher prices for customers with ‘illegal’ monopoly in shock DOJ lawsuit

Click to see story on The US SunPelosi Family Under Fire After New Scandal Is Revealed

Click to see story on TrendingPoliticsRight

Untracked Bias

Department of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on My Mother LodeDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Orillia MattersDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Midland TodayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Collingwood TodayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Thorold TodayThe American government launches antitrust action against the giant Visa

Click to see story on 20 MinutesDOJ sues Visa over alleged payments monopoly

Click to see story on CointelegraphDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets – The Morning Sun

Click to see story on Morning SunDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WBALThe US files a monopoly case against Visa

Click to see story on DRDOJ files antitrust lawsuit against Visa

Click to see story on Crypto BriefingHow a DOJ suit against Visa is a lifeline for bank tech sellers

Click to see story on American BankerBiden DOJ slaps Visa with antitrust suit over debit card dominance

Click to see story on PressNewsAgencyDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on InnisfilToday.caWhy the Justice Department says Visa has monopoly over debit cards

Click to see story on News Talk 94.1/AM 1600CoinStats – DOJ files antitrust lawsuit against Visa, all…

Click to see story on coinstats.appJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on JingletreeJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on KahawaTunguDOJ files antitrust suit against Visa over debit card business : NPR

Click to see story on SecularTimesDOJ sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on RecentlyHeard: Breaking News, Latest News, Coronavirus NewsJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on Stockxpo – A professional network of traders, investors and analystsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Bradford TodayAmerican authorities initiate proceedings against Visa

Click to see story on dagsavisen.noDOJ files antitrust lawsuit against Visa, alleging monopoly over debit networks

Click to see story on CryptopolitanVisa sinks more than 5% on pending DOJ antitrust lawsuit

Click to see story on FXStreetJustice Dept. sues Visa for stifling credit and debit card competition

Click to see story on Brooklyn Daily EagleDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Oakville NewsNancy Pelosi dumps $1M in this stock 2 months before huge lawsuit

Click to see story on Bitcoin Ethereum NewsJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on Daily Expert NewsVisa sued by Department of Justice for dominating debit card markets – Internewscast Journal

Click to see story on InternewscastUS accuses Visa of debit card monopoly

Click to see story on ecnetnews.comDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on fitzhugh.caDOJ sues Visa over alleged payments monopoly – TECHTELEGRAPH

Click to see story on TECHTELEGRAPHDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on burlingtontoday.comVisa shares slide 5% after DoJ sues for monopolizing the Debit Card market

Click to see story on FX News GroupUS Department of Justice hits Visa with antitrust lawsuit over its debit card business – DNKL

Click to see story on asce-si.chDOJ: Visa debit monopoly impacts price of ‘nearly everything’ – New York Times Post

Click to see story on nytimespost.comDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on haltonhillstoday.caJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on fortunemagnate.comUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on Phil's Stock WorldDOJ Accuses Visa Of Monopolizing Debit Card Market – USA Herald

Click to see story on USA HeraldDOJ Files Antitrust Suit Over Visa Debit Card Fees

Click to see story on napco.comFinancial News Network – DOJ sues Visa over debit card market monopoly

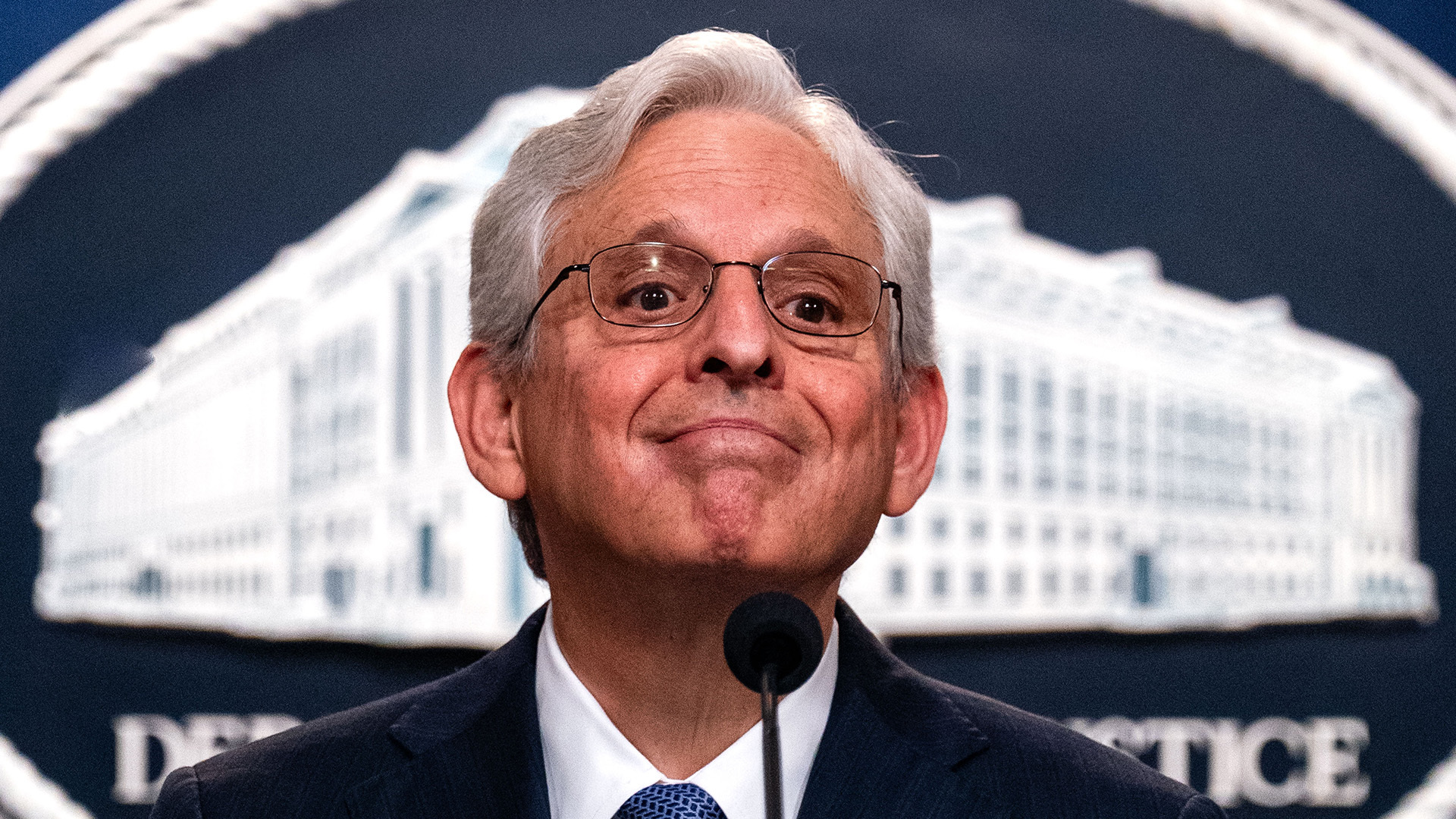

Click to see story on financialnewsnetwork.comU.S. Attorney General Merrick Garland said that Visa controls over 60% of U.S. debit transactions. He said the alleged monopoly allowed the company to charge $7 billion annually in processing fees.

Download the SAN app today to stay up-to-date with Unbiased. Straight Facts™.

Point phone camera here

The DOJ alleged that Visa abused its dominant position for over a decade by forcing businesses to use its network and blocking new alternatives from entering the market.

“We alleged that to maintain this monopoly power, Visa deploys a web of unlawful and anticompetitive agreements to penalize merchants and banks for using competing payment networks,” Garland said. “At the same time, it coerces would-be market entrants into unlawful agreements not to compete by threatening high fees if they do not cooperate and promising big payoffs if they do. The result is a debit market where Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market. Merchants and banks pass those costs to consumers.”

The DOJ’s lawsuit reveals a range of alleged anticompetitive practices employed by Visa to maintain its market dominance.

Visa allegedly penalizes merchants and banks that opt for alternative payment processing technologies and imposes volume commitments on merchants, banks and financial institutions that issue debit cards. It also reportedly offers monetary incentives to potential competitors to become partners instead of rivals.

The DOJ argued that Visa’s practices inflated prices across a wide range of goods and services. Additionally, it argued Visa stifled competition through exclusivity agreements.

As a consequence, consumers may face higher prices or reduced quality of goods and services as businesses attempt to offset Visa’s fees.

Visa has not yet commented on the lawsuit.

[LAUREN TAYLOR]

THE DEPARTMENT OF JUSTICE FILED AN ANTITRUST LAWSUIT AGAINST VISA, ACCUSING THE COMPANY OF MONOPOLIZING THE DEBIT CARD MARKET THROUGH ANTICOMPETITIVE PRACTICES. THE GOVERNMENT CLAIMS THE COMPANY’S ACTIONS HAVE POTENTIALLY COST CONSUMERS AND BUSINESSES BILLIONS OF DOLLARS.

US ATTORNEY GENERAL MERRICK GARLAND SAYS VISA CONTROLS OVER 60% OF U.S. DEBIT TRANSACTIONS, ALLOWING IT TO CHARGE $7 BILLION ANNUALLY IN PROCESSING FEES.

THE DOJ ALLEGES THAT VISA HAS ABUSED ITS DOMINANT POSITION FOR OVER A DECADE BY FORCING BUSINESSES TO USE ITS NETWORK AND BLOCKING NEW ALTERNATIVES FROM ENTERING THE MARKET.

“WE ALLEGED THAT TO MAINTAIN THIS MONOPOLY POWER, VISA DEPLOYS A WEB OF UNLAWFUL AND ANTICOMPETITIVE AGREEMENTS TO PENALIZE MERCHANTS AND BANKS FOR USING COMPETING PAYMENT NETWORKS,” GARLAND SAID. AT THE SAME TIME, IT COERCES WOULD BE MARKET ENTRANCE INTO UNLAWFUL AGREEMENTS NOT TO COMPETE BY THREATENING HIGH FEES IF THEY DO NOT COOPERATE AND PROMISING BIG PAYOFFS IF THEY DO. THE RESULT IS A DEBIT MARKET WHERE VISA HAS UNLAWFULLY AMASSED THE POWER TO EXTRACT FEES THAT FAR EXCEED WHAT IT COULD CHARGE IN A COMPETITIVE MARKET. MERCHANTS AND BANKS PASS THOSE COSTS TO CONSUMERS.”

THE DOJ’S LAWSUIT REVEALS A RANGE OF ALLEGED ANTICOMPETITIVE PRACTICES EMPLOYED BY VISA TO MAINTAIN ITS MARKET DOMINANCE.

VISA ALLEGEDLY PENALIZES MERCHANTS AND BANKS WHO OPT FOR ALTERNATIVE PAYMENT PROCESSING TECHNOLOGIES, IMPOSES VOLUME COMMITMENTS ON MERCHANTS, BANKS, AND FINANCIAL INSTITUTIONS THAT ISSUE DEBIT CARDS, AND REPORTEDLY OFFERS MONETARY INCENTIVES TO POTENTIAL COMPETITORS TO BECOME PARTNERS INSTEAD OF RIVALS.

THE DOJ ARGUES THAT VISA’S PRACTICES HAVE INFLATED PRICES ACROSS A WIDE RANGE OF GOODS AND SERVICES AND STIFLED COMPETITION THROUGH EXCLUSIVITY AGREEMENTS.

AND AS A CONSEQUENCE, CONSUMERS MAY FACE HIGHER PRICES OR REDUCED QUALITY OF GOODS AND SERVICES AS BUSINESS ATTEMPT TO OFFSET VISA’S FEES.

VISA HAS YET TO COMMENT ON THE LAWSUIT.

FOR STRAIGHT ARROW NEWS, I’M LAUREN TAYLOR.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below. Learn more about this dataBias Distribution

Left

DOJ sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Associated Press NewsU.S. sues Visa over alleged debit card monopoly – National

Click to see story on Global NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on abc NewsUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on CNNVisa accused of violating antitrust law with payment processing deals

Click to see story on The Washington PostVisa monopolizes debit cards, hurting consumers and businesses, Justice Department says

Click to see story on CBS NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Coast ReporterUS Justice Department hits Visa with antitrust lawsuit over its debit card business

Click to see story on Business InsiderDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Sask TodayJustice Department accuses Visa of stifling competition in the debit card business

Click to see story on nprDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Rocky Mountain OutlookDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 6 PhiladelphiaDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 13 HoustonDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on SooToday.comDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Barrie TodayDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc30 NewsUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’ – Boston News, Weather, Sports

Click to see story on WHDHThe US government is suing Visa for competition infringement

Click to see story on TVA NouvellesGarland announces antitrust lawsuit against Visa over debit card competition

Click to see story on PBS NewsHourDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WCSHDOJ sues Visa for allegedly monopolizing debit card markets

Click to see story on Fast CompanyDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Thompson CitizenWhy Visa’s antitrust battle could be so worrying to Wall Street

Click to see story on RocketNewsUS accuses Visa of debit card monopoly

Click to see story on BBC NewsUS accuses Visa of monopolizing debit card swipes

Click to see story on ReutersUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KRDOUS accuses Visa of monopolizing debit card swipes

Click to see story on Channel News AsiaJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on CNBCJustice Department accuses Visa of monopolizing debit market in antitrust lawsuit

Click to see story on The HillUS Justice Department sues Visa, saying it monopolizes debit card markets

Click to see story on VOA NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on WPLGDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 ChicagoDOJ sues Visa, alleging card issuer monopolizes market

Click to see story on Portland Press HeraldDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 LADepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on abc 7 NYThe US Antitrust is suing Visa: illegal monopoly on debit cards

Click to see story on Corriere Della SeraDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KOB 4Federal government sues Visa, alleging monopoly on debit card market

Click to see story on The OregonianWhy Visa’s antitrust battle could be so worrying to Wall Street

Click to see story on MarketWatchDepartment of Justice sues Visa, claims debit card monopoly

Click to see story on Spectrum Local NewsThe US government is suing Visa for competition infringement

Click to see story on La LibreDOJ to accuse Visa of illegally monopolizing US debit card market

Click to see story on FortuneUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KWWLDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on 9NEWS DenverDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on The Baltimore SunDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WLTXDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WKYCDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WBIRDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Krem2 NewsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on WMBDDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Wood TVDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Scripps NewsDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KTVBDOJ hits Visa with antitrust lawsuit over monopoly concerns

Click to see story on QuartzUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on KESQDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on NewsdayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on KMIZDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on TechXploreDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on Fort Smith/Fayetteville NewsDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets – KION546

Click to see story on KIONDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on KYTXDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on New Orleans CityBusinessNancy Pelosi’s husband sold more than $500K worth of Visa stock — just weeks before DOJ’s antitrust lawsuit

Click to see story on New York PostFeds sues Visa, saying company is driving up card costs for businesses, consumers

Click to see story on OC RegisterUS accuses Visa of monopolizing debit card swipes

Click to see story on New Hampshire Union LeaderDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Winnipeg SunDepartment of Justice Sues Visa for Alleged Monopolization of Debit Card Markets

Click to see story on The Epoch TimesVisa accused of causing higher prices for customers with ‘illegal’ monopoly in shock DOJ lawsuit

Click to see story on The US SunPelosi Family Under Fire After New Scandal Is Revealed

Click to see story on TrendingPoliticsRight

Untracked Bias

Department of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on My Mother LodeDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Orillia MattersDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Midland TodayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Collingwood TodayDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Thorold TodayThe American government launches antitrust action against the giant Visa

Click to see story on 20 MinutesDOJ sues Visa over alleged payments monopoly

Click to see story on CointelegraphDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets – The Morning Sun

Click to see story on Morning SunDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on WBALThe US files a monopoly case against Visa

Click to see story on DRDOJ files antitrust lawsuit against Visa

Click to see story on Crypto BriefingHow a DOJ suit against Visa is a lifeline for bank tech sellers

Click to see story on American BankerBiden DOJ slaps Visa with antitrust suit over debit card dominance

Click to see story on PressNewsAgencyDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on InnisfilToday.caWhy the Justice Department says Visa has monopoly over debit cards

Click to see story on News Talk 94.1/AM 1600CoinStats – DOJ files antitrust lawsuit against Visa, all…

Click to see story on coinstats.appJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on JingletreeJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on KahawaTunguDOJ files antitrust suit against Visa over debit card business : NPR

Click to see story on SecularTimesDOJ sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on RecentlyHeard: Breaking News, Latest News, Coronavirus NewsJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on Stockxpo – A professional network of traders, investors and analystsDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Bradford TodayAmerican authorities initiate proceedings against Visa

Click to see story on dagsavisen.noDOJ files antitrust lawsuit against Visa, alleging monopoly over debit networks

Click to see story on CryptopolitanVisa sinks more than 5% on pending DOJ antitrust lawsuit

Click to see story on FXStreetJustice Dept. sues Visa for stifling credit and debit card competition

Click to see story on Brooklyn Daily EagleDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on Oakville NewsNancy Pelosi dumps $1M in this stock 2 months before huge lawsuit

Click to see story on Bitcoin Ethereum NewsJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on Daily Expert NewsVisa sued by Department of Justice for dominating debit card markets – Internewscast Journal

Click to see story on InternewscastUS accuses Visa of debit card monopoly

Click to see story on ecnetnews.comDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on fitzhugh.caDOJ sues Visa over alleged payments monopoly – TECHTELEGRAPH

Click to see story on TECHTELEGRAPHDepartment of Justice sues Visa, saying the card issuer monopolizes debit card markets

Click to see story on burlingtontoday.comVisa shares slide 5% after DoJ sues for monopolizing the Debit Card market

Click to see story on FX News GroupUS Department of Justice hits Visa with antitrust lawsuit over its debit card business – DNKL

Click to see story on asce-si.chDOJ: Visa debit monopoly impacts price of ‘nearly everything’ – New York Times Post

Click to see story on nytimespost.comDepartment of Justice sues Visa, alleges the card issuer monopolizes debit card markets

Click to see story on haltonhillstoday.caJustice Department accuses Visa of debit network monopoly that impacts price of ‘nearly everything’

Click to see story on fortunemagnate.comUS Justice Department accuses Visa of illegal monopoly that adds to the price of ‘nearly everything’

Click to see story on Phil's Stock WorldDOJ Accuses Visa Of Monopolizing Debit Card Market – USA Herald

Click to see story on USA HeraldDOJ Files Antitrust Suit Over Visa Debit Card Fees

Click to see story on napco.comFinancial News Network – DOJ sues Visa over debit card market monopoly

Click to see story on financialnewsnetwork.comStraight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

ICE to launch immigration raids in Chicago day after inauguration: Reports

Read3 hrs ago -

Getty Images

Getty Images

Thousands of Capital One customers locked out before 3-day weekend

Watch 1:3110 hrs ago -

Getty Images

Getty Images

CNN loses defamation trial, docs reveal network finances in steep decline

Watch 3:1511 hrs ago -

AP Images

AP Images

Supreme Court unanimously upholds TikTok ‘ban,’ app plans shutdown in US

Watch 2:1716 hrs ago