[karah rucker]

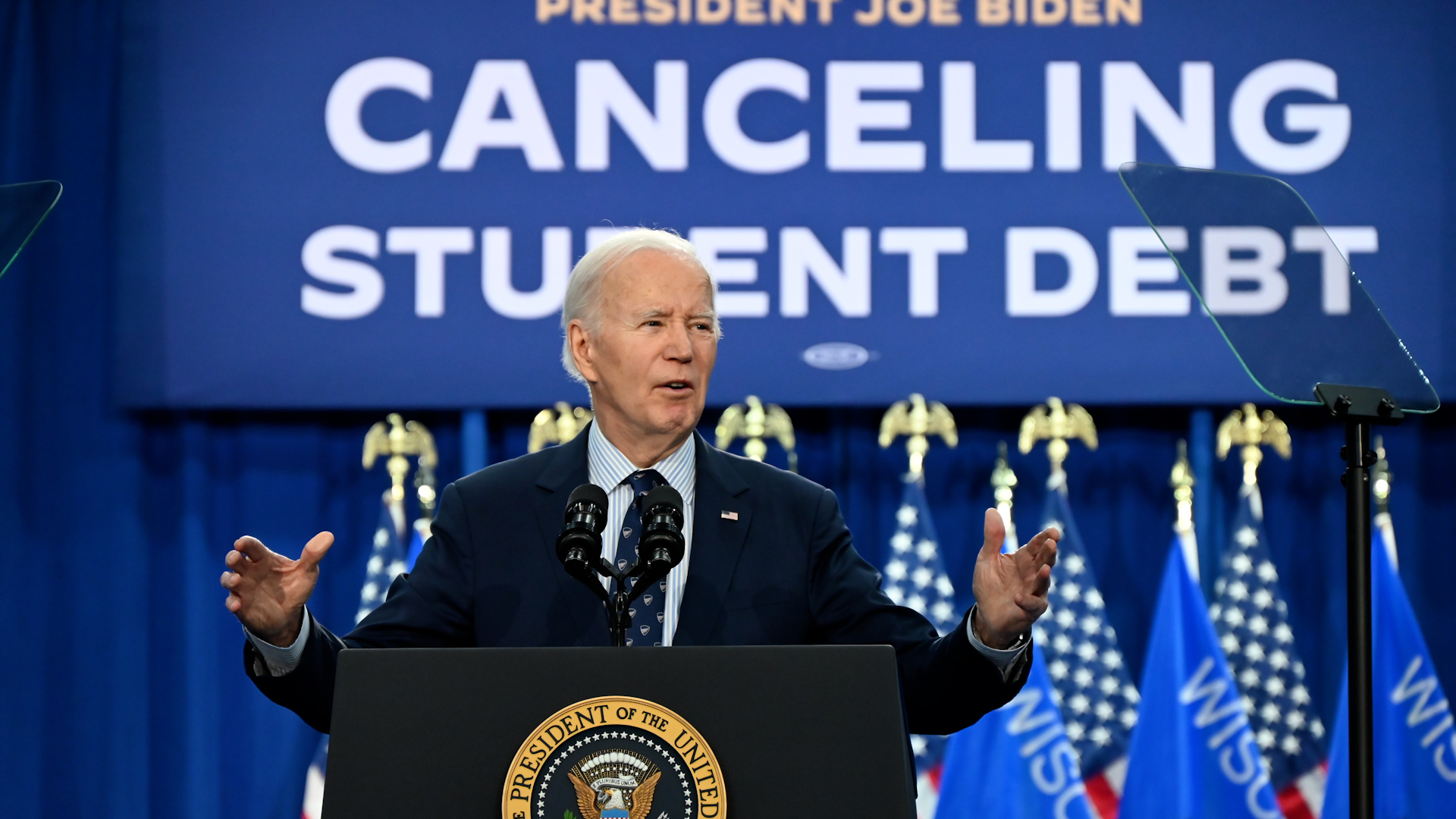

TWO FEDERAL JUDGES IN KANSAS AND MISSOURI HAVE BLOCKED KEY ASPECTS OF PRESIDENT JOE BIDEN’S STUDENT DEBT RELIEF PLAN THAT LOWERS PAYMENTS.

MONDAY’S RULINGS WILL STOP THE BIDEN ADMINISTRATION FROM ANY FURTHER IMPLEMENTATION OF ITs “SAVE PROGRAM” — THE PLAN THAT TIES HOW MUCH SOMEONE PAYS EACH MONTH TO WHAT THEIR INCOME IS.

THE PLAN HAS BEEN IN PLACE FOR ALMOST A YEAR.

THIS MEANS THE SECOND PHASE OF THE PLAN — WHICH WOULD’VE REDUCED MONTHLY PAYMENTS FROM 10 PERCENT OF A BORROWER’S DISCRETIONARY INCOME TO 5 PERCENT — IS ON PAUSE.

SO IS ANY FURTHER CANCELLATION OF DEBT FOR PEOPLE WHO TOOK OUT SMALLER INITIAL LOAN PAYMENTS AND HAVE BEEN PAYING FOR 10-PLUS YEARS.

HOWEVER — THE 8 MILLION PEOPLE WHO ARE ALREADY ENROLLED — CAN KEEP USING THE SAVE PLAN UNTIL THE CASES ARE FULLY LITIGATED.