The Biden Administration launched a new Beta website for its income driven repayment program called SAVE that was announced after the Supreme Court struck down its student loan forgiveness plan.

According to the Education Department, the new plan will help the typical borrower save more than $1,000 per year on payments, allow many borrowers to make $0 monthly payments, and ensure borrowers don’t see their balances grow from unpaid interest.

The plan caps the required payment amount for undergraduate loans at 5% of a borrower’s discretionary income. It also raises the amount of income considered non-discretionary so people making the equivalent of $15 dollars an hour won’t have to make a payment.

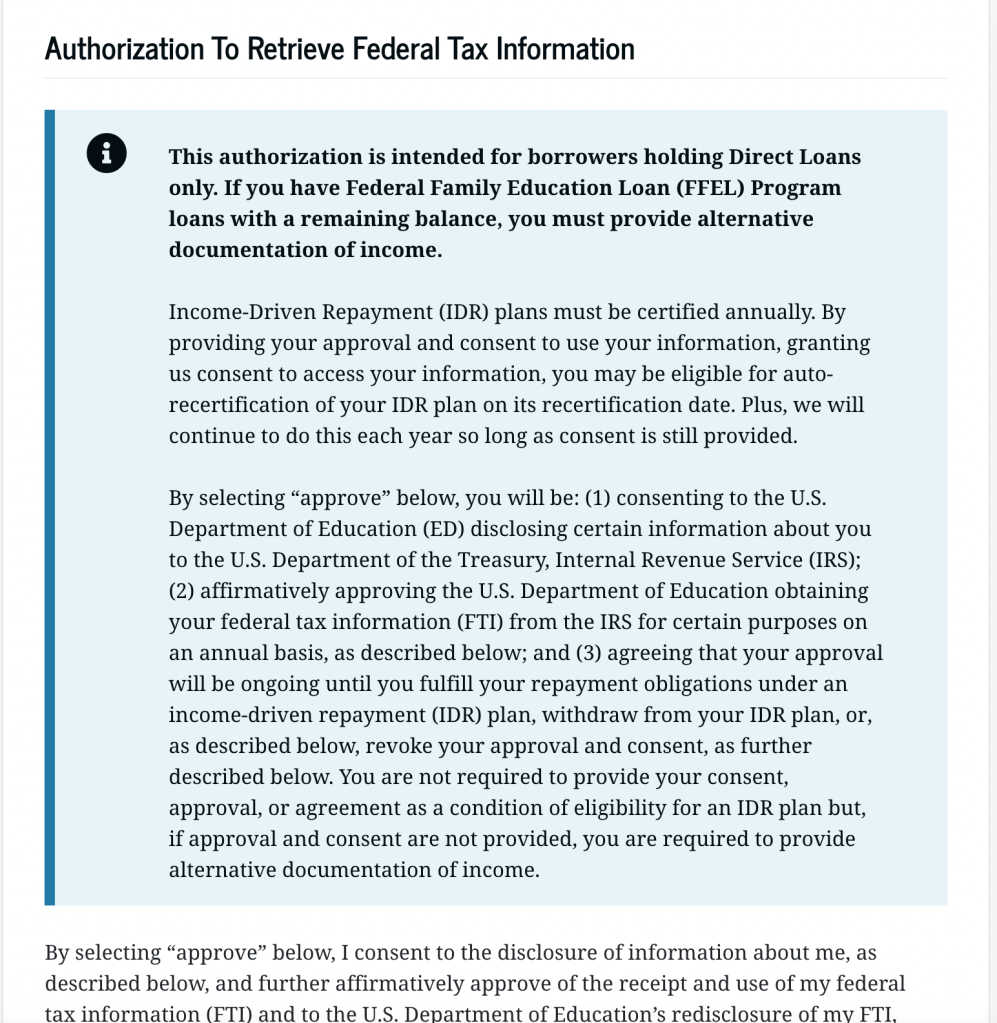

Step one:

Authorize the Department of Education to retrieve your federal tax documents.

As the application states: You are required to provide income information to determine your eligibility.

Authorizing the Department of Education allows them to certify your income, and recertify every year to make sure you still qualify.

If you do not approve, you’ll have to provide all the required documents yourself and submit them year after year to recertify.

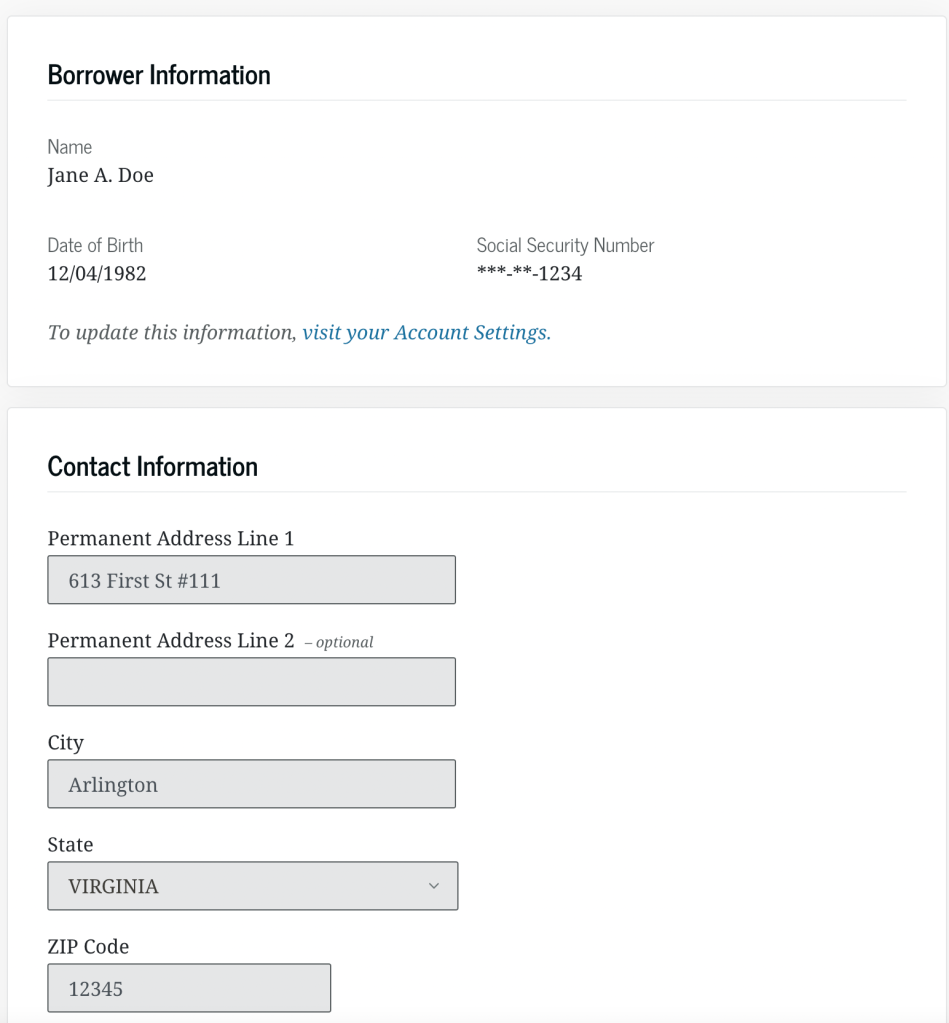

Step two:

Enter your name, DOB, SSN and contact information,

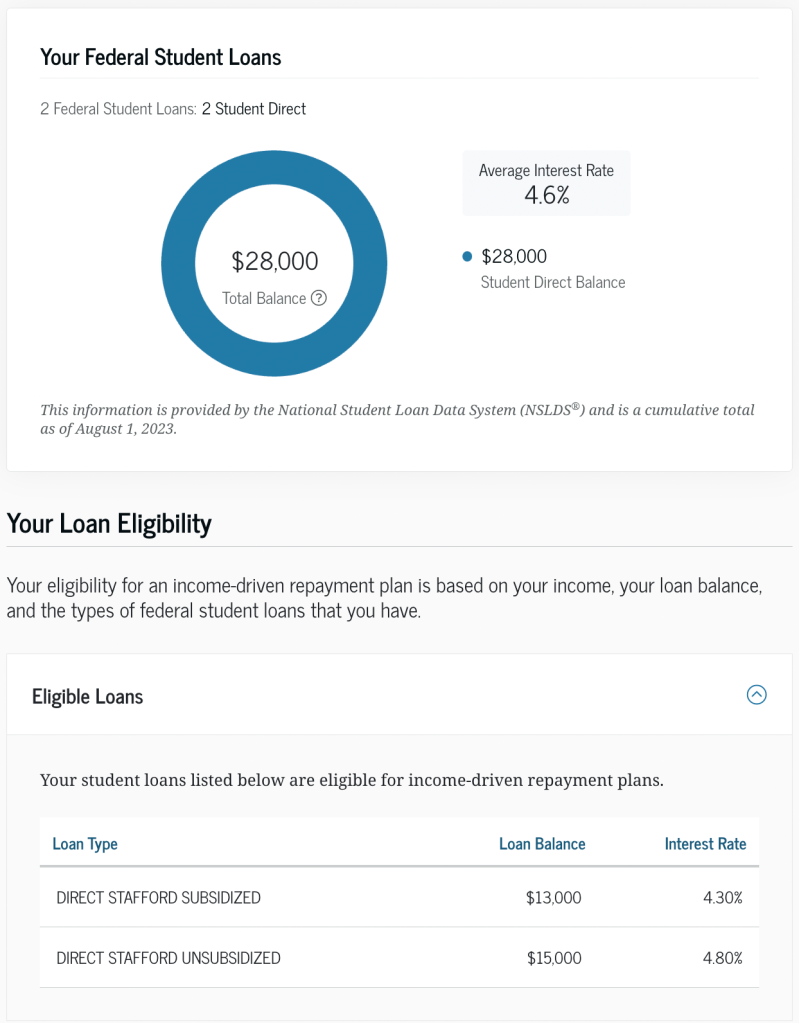

Next: review your loans and eligibility.

Then answer a few more questions about your marital and family status.

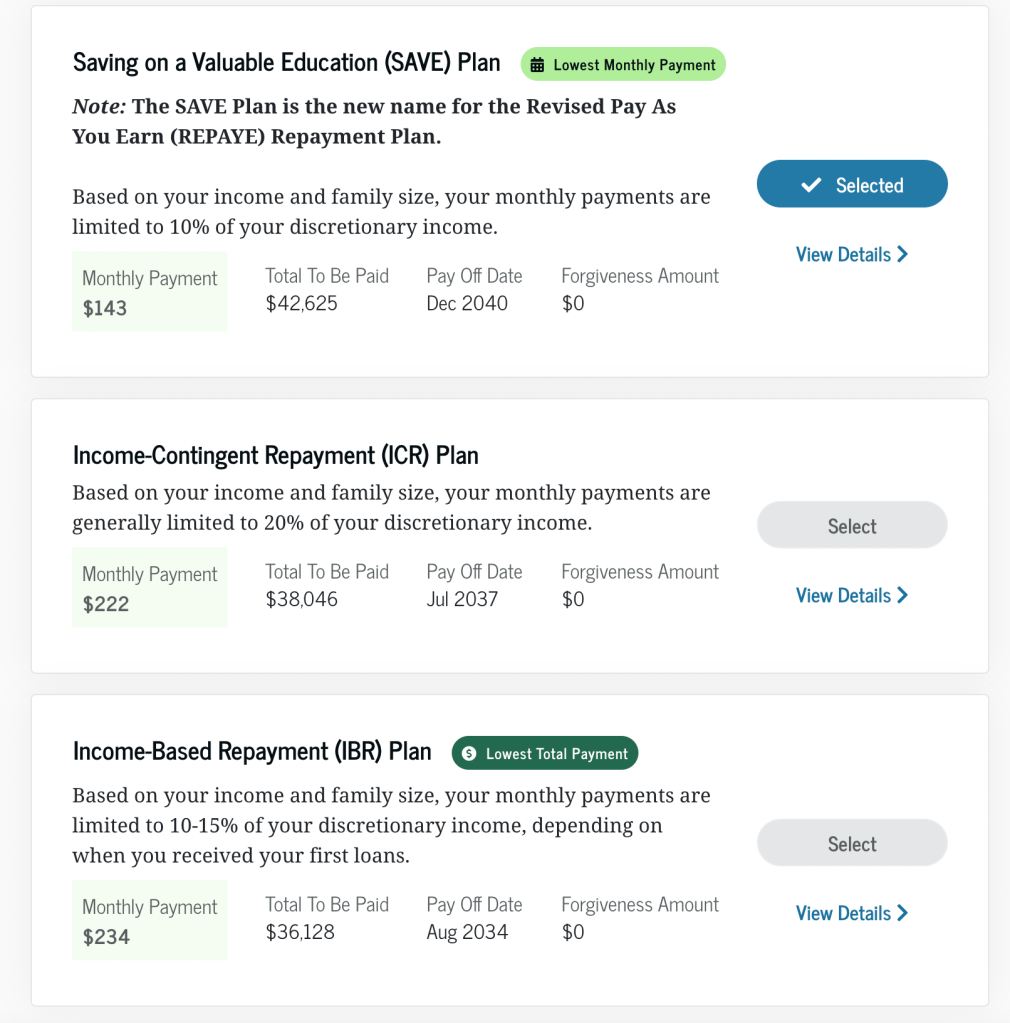

Later in the process, borrowers can estimate their monthly payments and choose from different payment plans. Some offer lower monthly payments for longer payoffs and ultimately a higher price tag. Other plans let borrowers pay more per month but ultimately less overall with a shorter payoff period.

Now, this is the process for people who are doing an income driven repayment plan for the first time, there’s a separate application for borrowers already on an IDR plan. You can check it out at studentaid.gov/idr. You can even do a demo before you start the real application. Straight from DC, I’m Ray Bogan.