SIMONE DEL ROSARIO: WHEN WE THINK ABOUT ENERGY IN THE PERSIAN GULF – OIL IS THE OBVIOUS PRODUCT.

THAT’S WHERE WE FIND MORE THAN HALF OF THE WORLD’S OIL RESERVES.

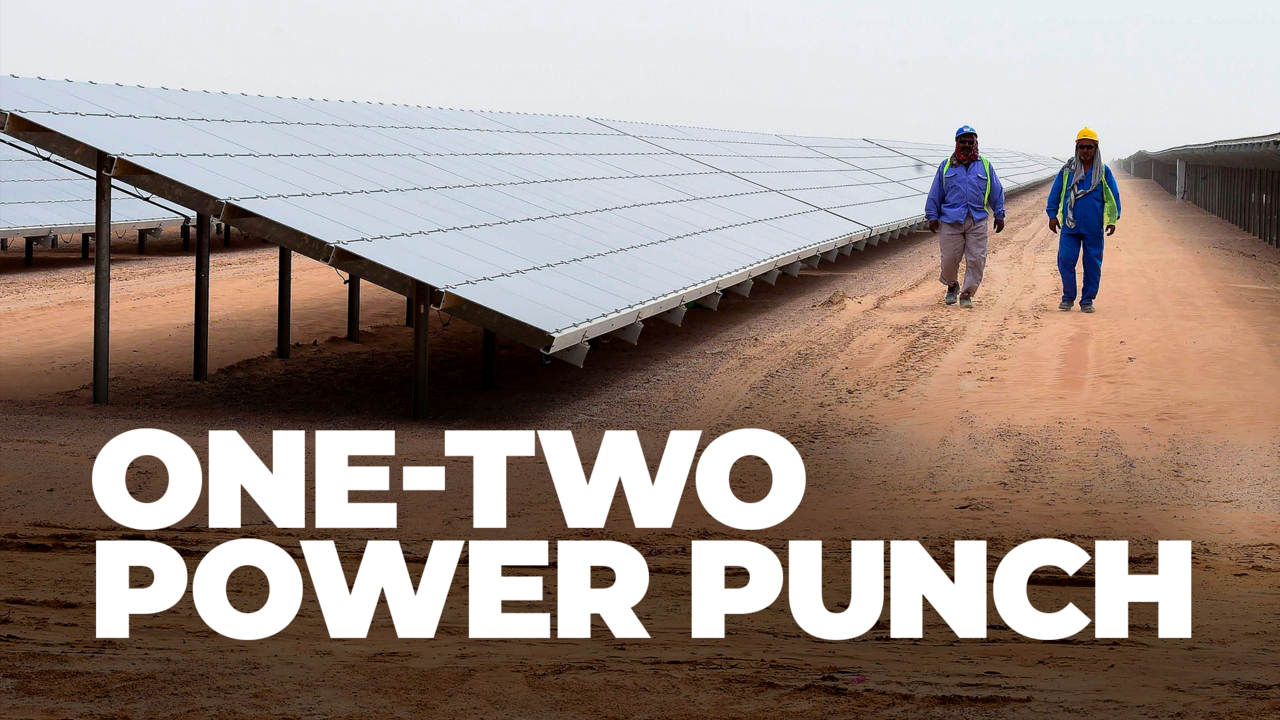

BUT AT LEAST ONE NATION THERE IS LOOKING TO BECOME A DUAL THREAT.

ACCORDING TO THE WALL STREET JOURNAL – THE UNITED ARAB EMIRATES IS EMERGING AS ONE OF THE WORLD’S BIGGEST STATE FINANCIERS OF CLEAN ENERGY … WHILE STILL MAINTAINING ITS INFLUENTIAL STATUS AS AN OIL INVESTOR.

TRYING TO PROVE COMPETING INTERESTS CAN COMPLEMENT…THE GULF STATE’S GOAL IS NET ZERO EMISSIONS BY 2050 – SAME AS THE U-S.

WHILE COMMITTING $400 MILLION TO HELP DEVELOPING NATIONS SWITCH TO CLEAN ENERGY, AND WITH THE U-S: $4 BILLION TO TRANSFORM AGRICULTURE IN THE FACE OF CLIMATE CHANGE.

THE U-A-E’S BET IS MORE THAN A DIVERSIFICATION PLAY – IT’S A DIPLOMATIC ONE TOO: PAYING FAVOR TO THE WEST’S CLIMATE GOALS WHILE INVESTING IN A GROWING SECTOR.

BUT THIS EMERGING CLEAN-ENERGY PLAYER IS RUNNING INTO HICCUPS WITH THE TRIED AND TRUE.

FRENCH PRESIDENT EMMANUEL MACRON: “Excuse me sorry to interrupt.”

SIMONE DEL ROSARIO: IN A HOT CAM MOMENT AT THE G7 SUMMIT – FRENCH PRESIDENT EMMANUEL MACRON IS OVERHEARD TELLING PRESIDENT JOE BIDEN ABOUT HIS CALL WITH THE UAE PRESIDENT ON THE POSSIBILITY OF INCREASING OIL PRODUCTION.

FRENCH PRESIDENT EMMANUEL MACRON: “I am at the maximum, maximum. This is what he claims.”

SIMONE DEL ROSARIO: NOTING SAUDI ARABIA ALSO BARELY HAS ROOM TO BOOST UNDER THE CURRENT OPEC AGREEMENT.

THE WEST HAS BEEN TRYING TO GET OPEC TO INCREASE OIL OUTPUT TO OFFSET RUSSIAN PRODUCTION – PUNISHED BY SANCTIONS OVER THE WAR.

OIL PRICES HAVE GONE UP ABOUT 50% SINCE THE START OF THE YEAR. MEANWHILE BIDEN WILL BE IN THE MIDDLE EAST IN JULY – WHERE OIL TALKS ARE ON THE TABLE.

IN NEW YORK FOR JUST BUSINESS I’M SIMONE DEL ROSARIO.