S&P drops ratings after Musk complains. Here are 5 recent blows to ESG.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below.

Learn more about this dataLeft 0%

Center 0%

Right 100%

HERE’S A HOT BUTTON ISSUE: ESG – RATING COMPANIES BASED ON ENVIRONMENTAL, SOCIAL AND CORPORATE GOVERNANCE. BECAUSE OF POLITICAL PRESSURE, THE INVESTMENT MOVEMENT IS LOSING STEAM. WE’VE GOT FIVE BLOWS TO ESG IN THIS WEEK’S FIVE FOR FRIDAY.

THE TERM ESG ALONE IS ENOUGH TO SET FOLKS OFF AND COMPANIES ARE TAKING NOTE. 48% OF COMPANIES THAT HAVE FACED BACKLASH SAY THEY ADJUSTED THEIR WORDING ACCORDING TO THE CONFERENCE BOARD. THE WORD SUSTAINABLE IS APPARENTLY MORE PALATABLE. LARRY FINK, THE CEO OF ESG PIONEER BLACKROCK SAID HE WON’T EVEN USE THE TERM BECAUSE IT’S BEEN “WEAPONIZED” AND “MISUSED” BY BOTH SIDES.

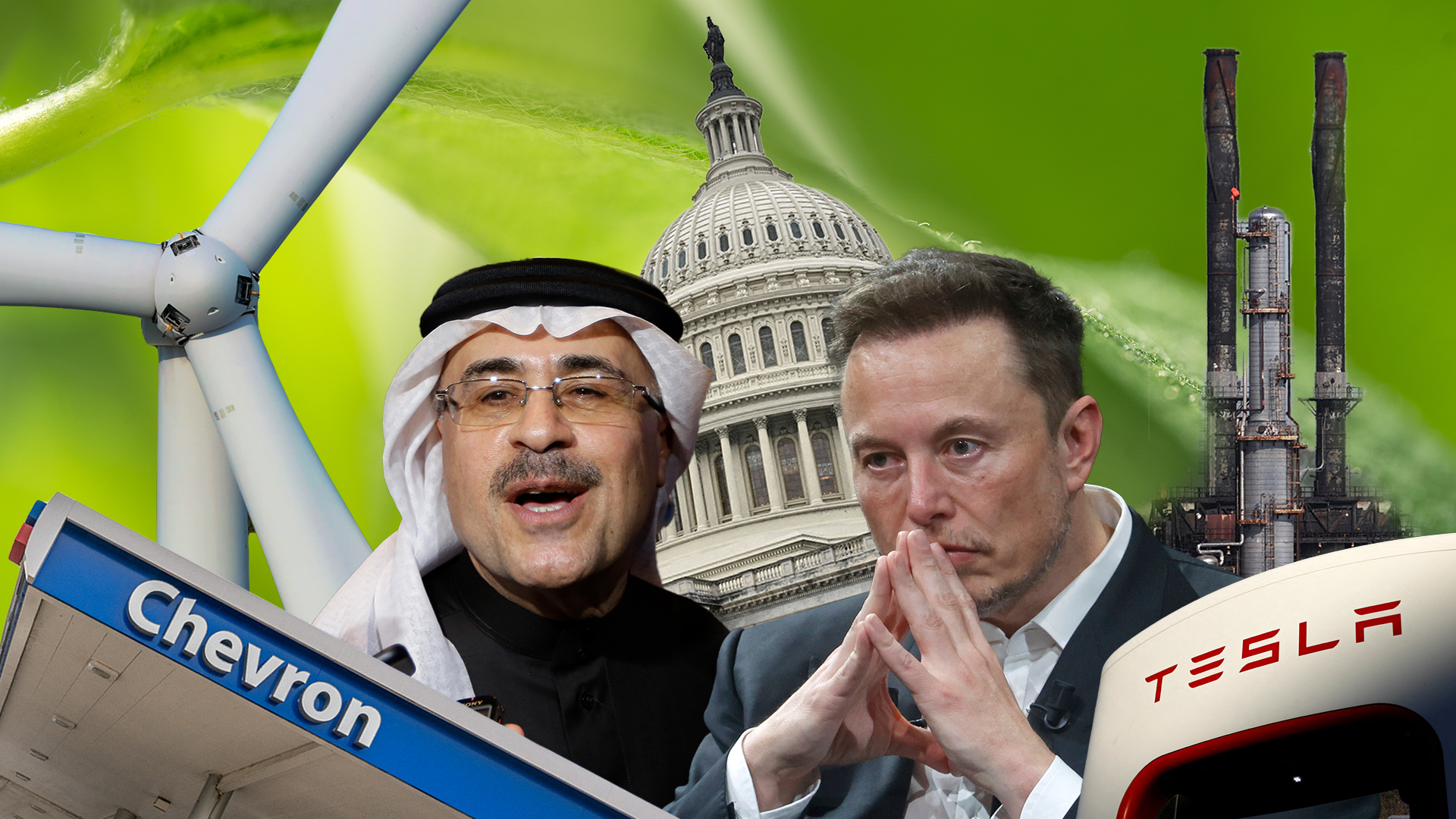

IN ANOTHER DEPARTURE FROM ITS ESG ROOTS, BLACKROCK JUST ADDED AN OIL GIANT TO ITS BOARD. CRITICS QUESTION HOW YOU CAN HIT ON THE “E” IN ESG WITH THE CEO OF THE WORLD’S BIGGEST OIL COMPANY AT YOUR TABLE. NOT TO MENTION THE HUMAN RIGHTS CONCERNS IN SAUDI ARABIA. FOR ITS PART, ARAMCO DOES HAVE PLANS TO HIT NET-ZERO EMISSIONS BY 2050. AND LATELY THE COUNTRY’S BEEN HEAVILY INVESTING IN SPORTS, RAISING QUESTIONS OF “SPORTSWASHING” THAT HUMAN RIGHTS RECORD.

WHEN WE THINK OF JULY, WE THINK INDEPENDENCE DAY. WELL THIS JULY, REPUBLICANS IN CONGRESS DUBBED IT “ESG MONTH.” THEIR AGENDA TO – THEIR WORDS – PROTECT INVESTORS FROM PROGRESSIVE ACTIVISTS – INCLUDED PUSHING POLICIES ON PROXY VOTING REFORM, RATING OVERSIGHT, AND SOMEHOW PROTECTING U.S. COMPANIES FROM E.U. REGULATIONS. IT’S WASHINGTON THOUGH, SO THEY DIDN’T GET ANYTHING DONE BEFORE THE AUGUST RECESS. AND HERE I WAS THINKING JULY WAS HOT DOG MONTH!

ONE OF THE BIG CRITICISMS OF ESG ACTIVISM IS COMPANIES BOWING TO THE DEMANDS OF A FEW LOUD SHAREHOLDERS. ONE OF THE BIGGEST ESG VICTORIES TO DATE IS TINY HEDGE FUND ENGINE NUMBER 1 DEFEATING EXXON IN 2021 IN A FIGHT OVER ITS CARBON FOOTPRINT. BUT THIS MAY, PROPOSALS TO CUT EXXON AND CHEVRON EMISSIONS GOT NO TRACTION AT SHAREHOLDER MEETINGS. IT WAS SO BAD, ACTIVISTS FAILED TO GET EVEN 20% OF CHEVRON SHAREHOLDERS TO COME ALONG FOR THE RIDE. .

ESG SCORES CAN BE CONTROVERSIAL. AND S&P GLOBAL JUST DROPPED SCORING FROM CREDIT ASSESSMENTS OF COMPANIES, FAVORING WRITTEN ANALYSIS INSTEAD. THE MOVE COMES ON THE HEELS OF ELON MUSK CALLING ESG THE DEVIL AFTER S&P GAVE TESLA A LOWER ESG SCORE THAN CIGARETTE MAKER PHILLIP MORRIS. YOU CAN STILL HIT UP MOODY’S FOR NOW IF YOU NEED THE CLEAR RATING SCALE.

GOING BACK TO ESG MONTH, JULY WAS ALSO ICE CREAM MONTH, PICNIC MONTH, AND ANTI-BOREDOM MONTH. THE MORE YOU KNOW, AM I RIGHT? THAT’S FIVE FOR FRIDAY. I’M SIMONE DEL ROSARIO. IT’S JUST BUSINESS.