Karah Rucker

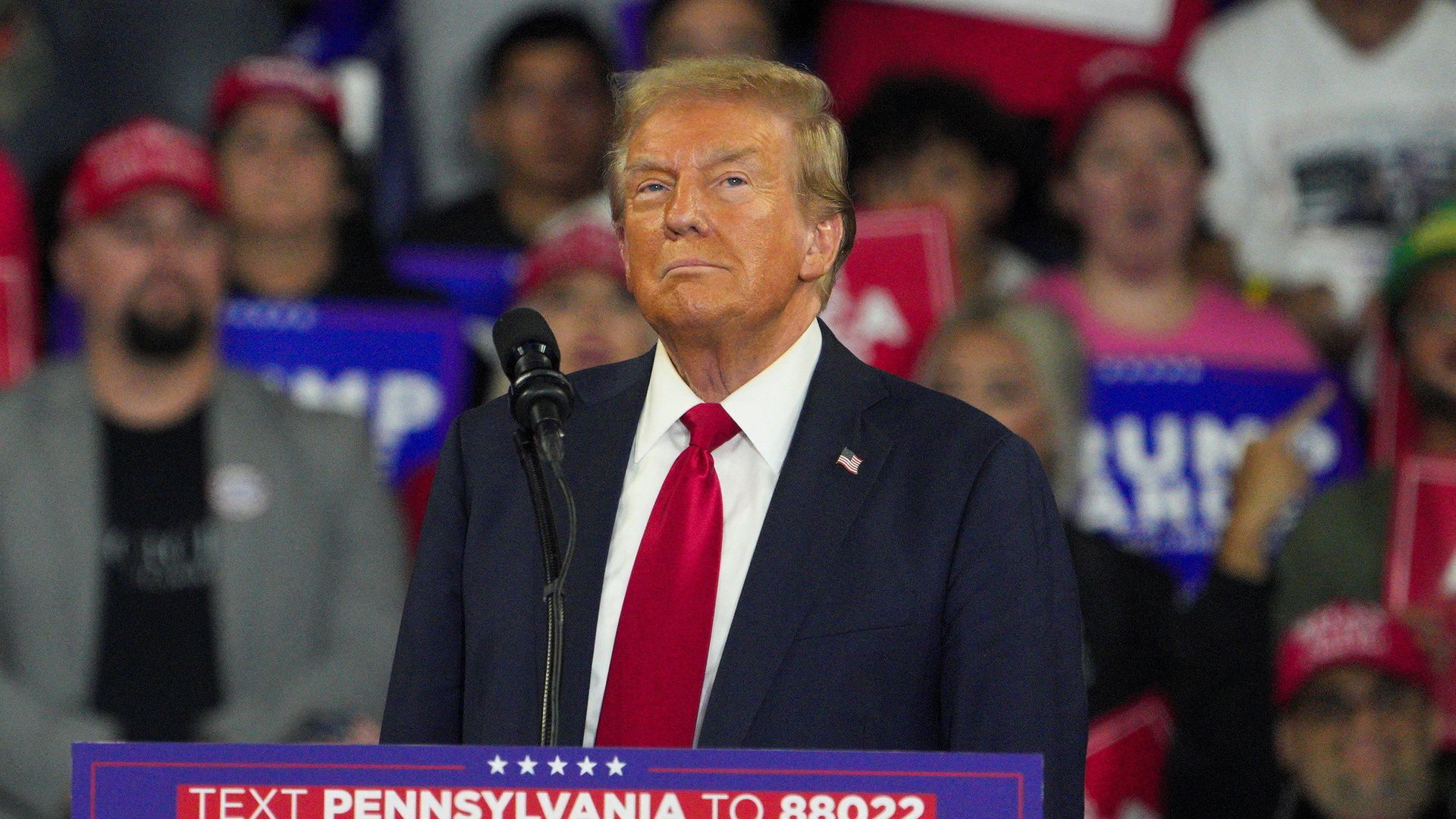

FORMER PRESIDENT DONALD TRUMP IS PLEDGING TO ELIMINATE WHAT HE CALLS ‘DOUBLE TAXATION’ ON AMERICANS LIVING ABROAD. THIS PROMISE COMES AS PART OF HIS BROADER PUSH TO REDUCE PERSONAL TAX BURDENS IF HE WINS A SECOND TERM IN THE 2024 ELECTION.

CURRENTLY, U-S CITIZENS LIVING OVERSEAS STILL NEED TO FILE INCOME, ESTATE AND GIFT TAX RETURNS WITH THE IRS. TRUMP’S PROPOSAL AIMS TO END THIS REQUIREMENT, A MOVE THAT COULD SIMPLIFY THE TAX OBLIGATIONS OF OVER 4 MILLION OF AMERICANS LIVING ABROAD AND POTENTIALLY LOWER THEIR TAX BILLS. OVER A MILLION OF THESE AMERICANS ALSO REPRESENT KEY SWING STATES.

HOWEVER, NOT EVERYONE IS CONVINCED. CRITICS WARN THE PLAN COULD ENCOURAGE WEALTHIER AMERICANS TO MOVE TO LOW-TAX COUNTRIES AND AVOID THEIR U-S TAX RESPONSIBILITIES ALTOGETHER. RIGHT NOW, AMERICAN EXPATRIATES CAN ALREADY TAKE ADVANTAGE OF TAX CREDITS AND EXCLUSIONS, BUT SOME STILL FACE SIGNIFICANT TAX LIABILITIES.

THIS PROPOSAL IS JUST ONE PART OF TRUMP’S SWEEPING TAX REFORM IDEAS, WHICH INCLUDE ELIMINATING TAXES ON OVERTIME, TIPPED WAGES AND SOCIAL SECURITY BENEFITS. EXPERTS ESTIMATE HIS TOTAL TAX PLAN COULD COST OVER 10 TRILLION DOLLARS IN THE NEXT DECADE. BUT WHETHER HE’LL BE ABLE TO IMPLEMENT THESE CHANGES WILL DEPEND HEAVILY ON CONGRESSIONAL APPROVAL.

A NOTABLE ASPECT OF THE CURRENT SYSTEM IS WHILE IT ADDS A LOT OF PAPERWORK… IT DOESN’T NECESSARILY MEAN ANY ADDITIONAL FINANCIAL BURDEN. EXPATS CURRENTLY GET U-S TAX CREDITS FOR TAXES THAT THEY PAY TO FOREIGN GOVERNMENTS… AND ANY INCOME OVER 126-THOUSAND IS EXEMPT.

FOR MORE UNBIASED UPDATES AND STRAIGHT FACTS… DOWNLOAD THE STRAIGHT ARROW NEWS APP OR VISIT SAN DOT COM.

FOR STRAIGHT ARROW NEWS… I’M KARAH RUCKER.