Gwen Baumgardner: NEXT — THE G-7 SUMMIT KICKS OFF THIS WEEK.

GLOBAL LEADERS, INCLUDING PRESIDENT BIDEN, WILL DISCUSS THEIR CONTINUED EFFORTS TO TACKLE COVID-19 AS WELL AS HOW TO BETTER PREPARE FOR FUTURE PANDEMICS.

THEIR AGENDA ALSO INCLUDES CLIMATE CHANGE AND TRADE.

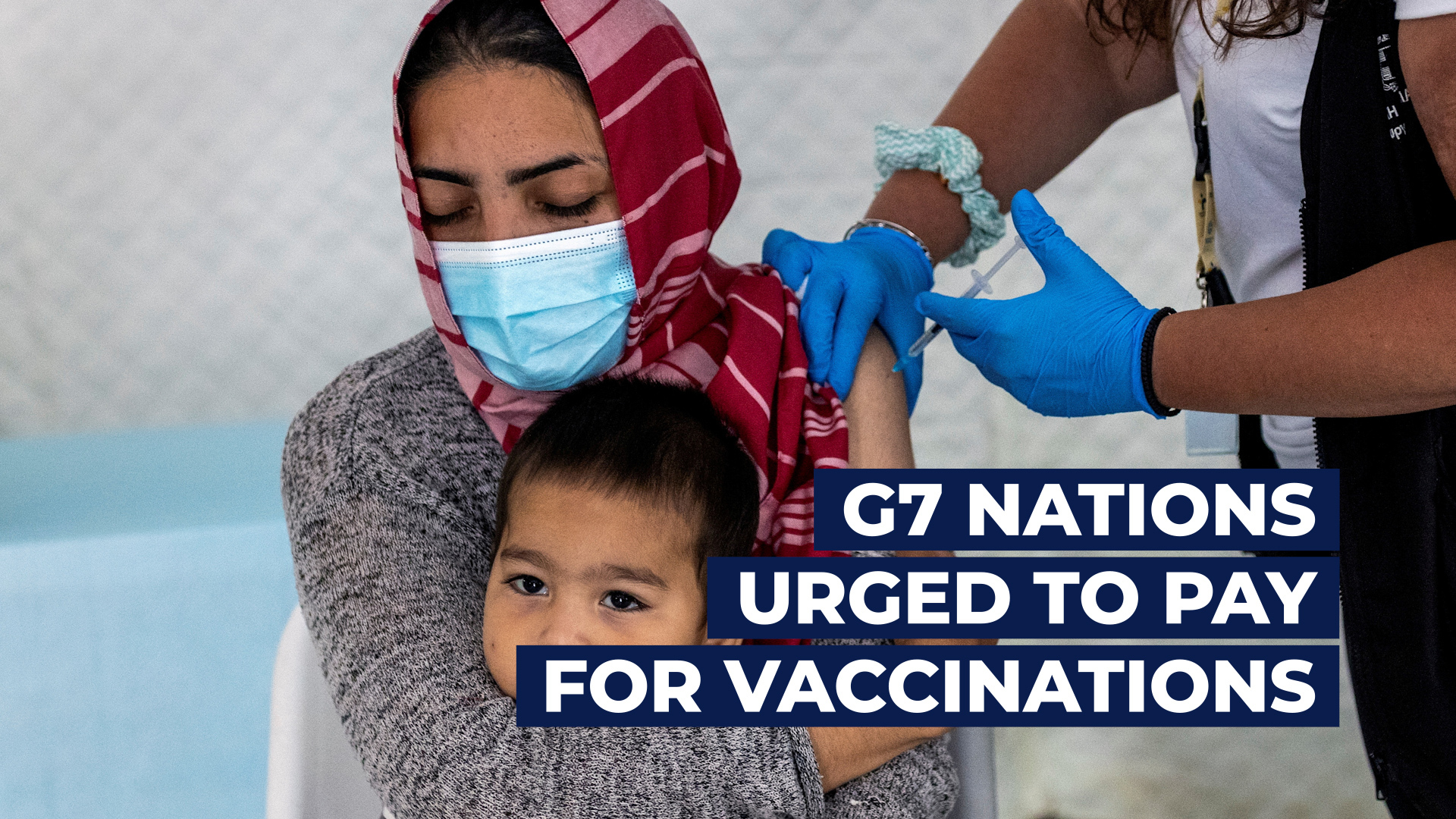

AHEAD OF THE SUMMIT — ONE HUNDRED FORMER PRESIDENTS — PRIME MINISTERS AND FOREIGN MINISTERS HAVE URGED THE G-7 NATIONS TO PAY FOR GLOBAL COVID-19 VACCINATIONS.

THE GOAL — PREVENT THE VIRUS FROM FURTHER MUTATING — AND END THE WORLDWIDE THREAT.

LAST WEEK, THE BIDEN ADMINISTRATION ANNOUNCED ITS PLANS TO DISTRIBUTE THE PROMISED 80 MILLION DOSES WORLDWIDE.

THE G-7 FINANCE MINISTERS MET IN LONDON PRIOR TO THE SUMMIT.

THE HEADLINE FROM THEIR MEETING — AN AGREEMENT TO SUPPORT A GLOBAL MINIMUM CORPORATE TAX OF AT LEAST 15 PERCENT.

U-S TREASURY SECRETARY JANET YELLEN — WHO WAS AT THE MEETING — HAILED THE AGREEMENT AS A STEP TOWARDS ENDING A QUOTE “RACE-TO-THE-BOTTOM IN CORPORATE TAXATION”.

Janet Yellen: “The global minimum tax would also help the global economy thrive by leveling the playing field for businesses and encouraging countries to compete on positive bases such as educating and training our workforces, and investing in research and development and infrastructure.”

THE FINANCE MINISTERS ALSO ENDORSED PROPOSALS TO MAKE THE WORLD’S BIGGEST COMPANIES PAY TAXES IN COUNTRIES WHERE THEY HAVE A LOT OF SALES, BUT NO PHYSICAL HEADQUARTERS.