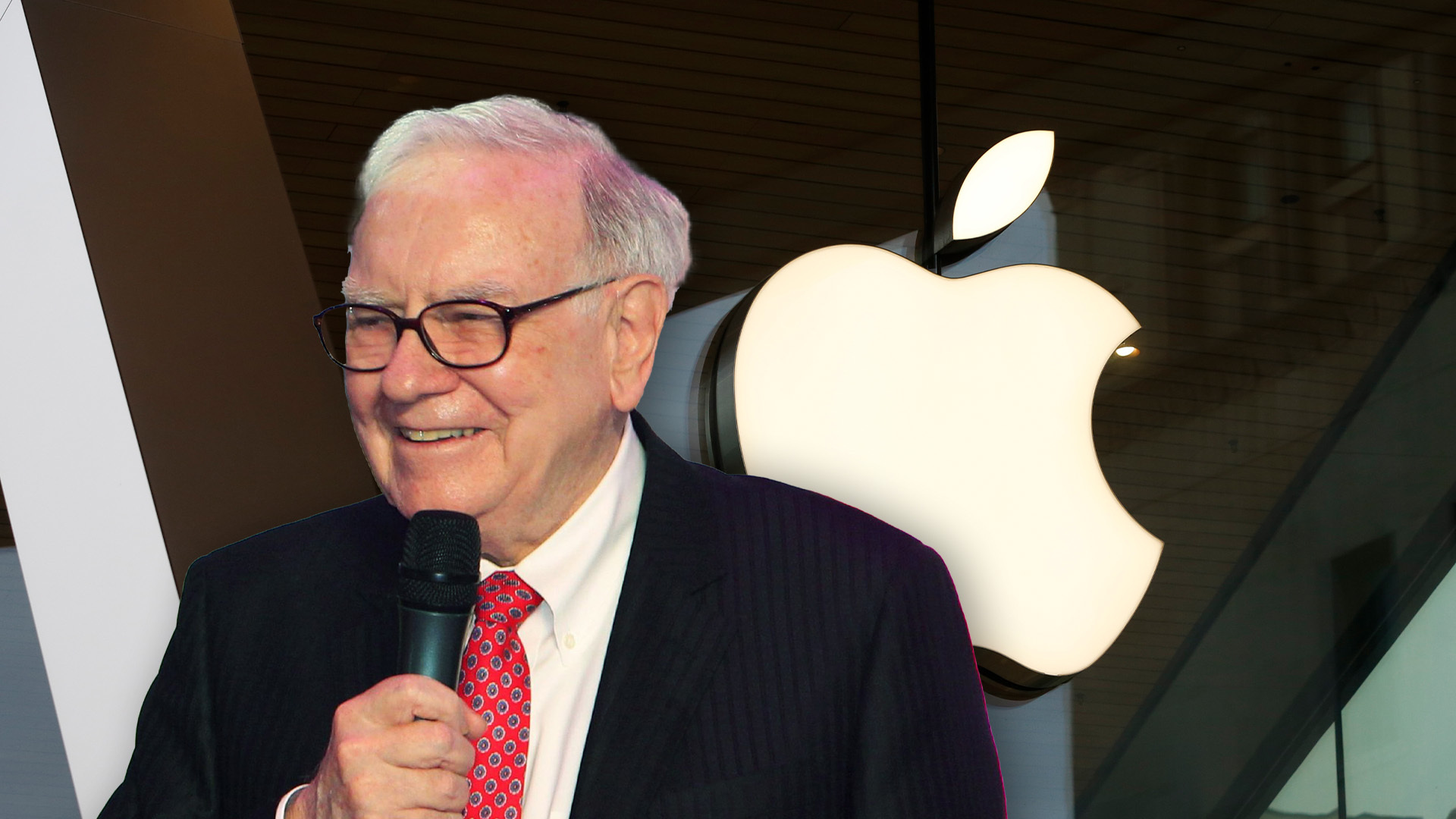

Warren Buffett keeps selling Apple stock to hoard cash. But why?

By Simone Del Rosario (Business Correspondent), Brent Jabbour (Senior Producer), Emma Stoltzfus (Editor)

Warren Buffett’s Berkshire Hathaway has been unloading a huge portion of its Apple holdings over the last nine months. The conglomerate’s cash on hand has skyrocketed as it sells off shares of one of the world’s most valuable companies.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Right

Untracked Bias

Berkshire offloaded roughly 25% of its Apple stock in the third quarter, according to its latest earnings report released Saturday, Nov. 2. Buffett’s company sold roughly 600 million shares of Apple so far in 2024, including 100 million shares in the third quarter.

Download the SAN app today to stay up-to-date with Unbiased. Straight Facts™.

Point phone camera here

Apple was the world’s most valuable company until Nvidia recently dethroned the iPhone maker on the strength of its artificial intelligence offerings.

Berkshire’s cash on hand grew to $325.2 billion at the end of the third quarter, up from roughly $276.9 billion at the end of the second quarter.

Buffett addressed the sale of Apple stock during Berkshire’s annual shareholder meeting in May 2024.

“We will have Apple as our largest investment,” he assured the crowd. “But I don’t mind at all, under current conditions, building the cash position. I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.”

Apple is still Berkshire Hathaway’s largest position. It holds 300 million shares in the company valued at around $70 billion. Still, that number is down from the $174 billion worth of Apple stock it held at the end of last year. Buffett also sold $10 billion worth of Bank of America stock during the third quarter.

During May’s meeting, Buffett said he doesn’t see a lot of inexpensive, quality equity opportunities. And considering the state of the country’s finances, he has indicated he expects capital gains taxes to rise and is locking in profits before then.

Get up to speed on the stories leading the day every weekday morning. Sign up for the newsletter today!

Learn more about our emails. Unsubscribe anytime.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

But analysts see other possibilities for why Berkshire Hathaway dumped so much Apple stock.

“The share sales began surely after the death of Charlie Munger,” Edward Jones analyst Jim Shanahan said of Buffett’s longtime business partner who passed away last year. “It just may be the case that Munger was always a lot more comfortable with Apple than Warren Buffett.”

But CFRA analyst Cathy Seifert said it’s more likely the stake in Apple was “starting to become an outsized percentage” of Berkshire’s portfolio.

Profits from Berkshire’s business were down 6% compared to last year, coming in at $10.1 billion, just missing expectations. Its stock hit all-time highs in September, briefly eclipsing a $1 trillion valuation.

Simone Del Rosario:

What does the Oracle of Omaha know that’s making him dump stock in the world’s most valuable company?

Scratch that, the second most valuable company, because NVIDIA just edged above it.

Warren Buffett’s Berkshire Hathaway offloaded about a quarter of its stake in Apple over the summer, according to earnings reported Saturday.

It marks the fourth straight quarter of dumping shares of the iPhone maker, totaling 600 million shares sold so far in 2024.

And while Berkshire’s dumping stock, it’s stockpiling cash. Cash on hand grew to more than $325 billion at the end of the third quarter, up from roughly $277 billion at the end of Q2.

Buffett says the sale doesn’t mean he’s soured on Apple.

Warren Buffett:

We will have Apple as our largest investment. But I don’t mind at all under current conditions, building the cash position. I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.

Simone Del Rosario:

Still, Apple is its biggest holding at around $70 billion, down from $174 billion at the end of last year. Buffett’s other big dump was Bank of America, where he offloaded $10 billion worth of shares.

Should Apple take it personally? Buffett warned investors he’d be building up reserves this year. He said he doesn’t see a lot of cheap, high-quality equity opportunities, while the other factor is his expectation taxes on capital gains will soon rise.

Warren Buffett:

They can change that percentage any year. And The percentage that they’ve decreed currently is 21% and I would say with the present fiscal policies, I think that something has to give, and I think that higher taxes are quite likely.

Simone Del Rosario:

But Edward Jones analyst Jim Shanahan says it may be more personal than a future tax burden. As personal as the death of Buffett’s right-hand man.

Shanahan says, “The share sales began surely after the death of Charlie Munger. It just may be the case that Munger was always a lot more comfortable with Apple than Warren Buffett.”

But CFRA analyst Cathy Seifert said it’s more likely the stake in Apple was “starting to become an outsized percentage” of Berkshire’s portfolio.

Profits from Berkshire’s business were down 6% compared to last year, coming in at $10.1 billion, just missing expectations. Its stock hit all-time highs in September, briefly eclipsing a $1T valuation.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Right

Untracked Bias

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Reuters

Reuters

Government shutdown looms as Senate Dems decide on budget bill

Watch 11:217 hrs ago -

Getty Images

Getty Images

Schumer says House bill to fund government lacks Senate votes

Watch 2:0813 hrs ago -

Getty Images

Getty Images

Immigration canceling out resident losses in largest metros

Read13 hrs ago -

Getty Images

Getty Images

New documentary reveals Stan Lee’s final years of alleged exploitation

Watch 3:0718 hrs ago