X adds new money feature while company is ‘barely breaking even’

By Simone Del Rosario (Anchor), Jodie Hawkins (Senior Producer), Bast Bramhall (Video Editor)

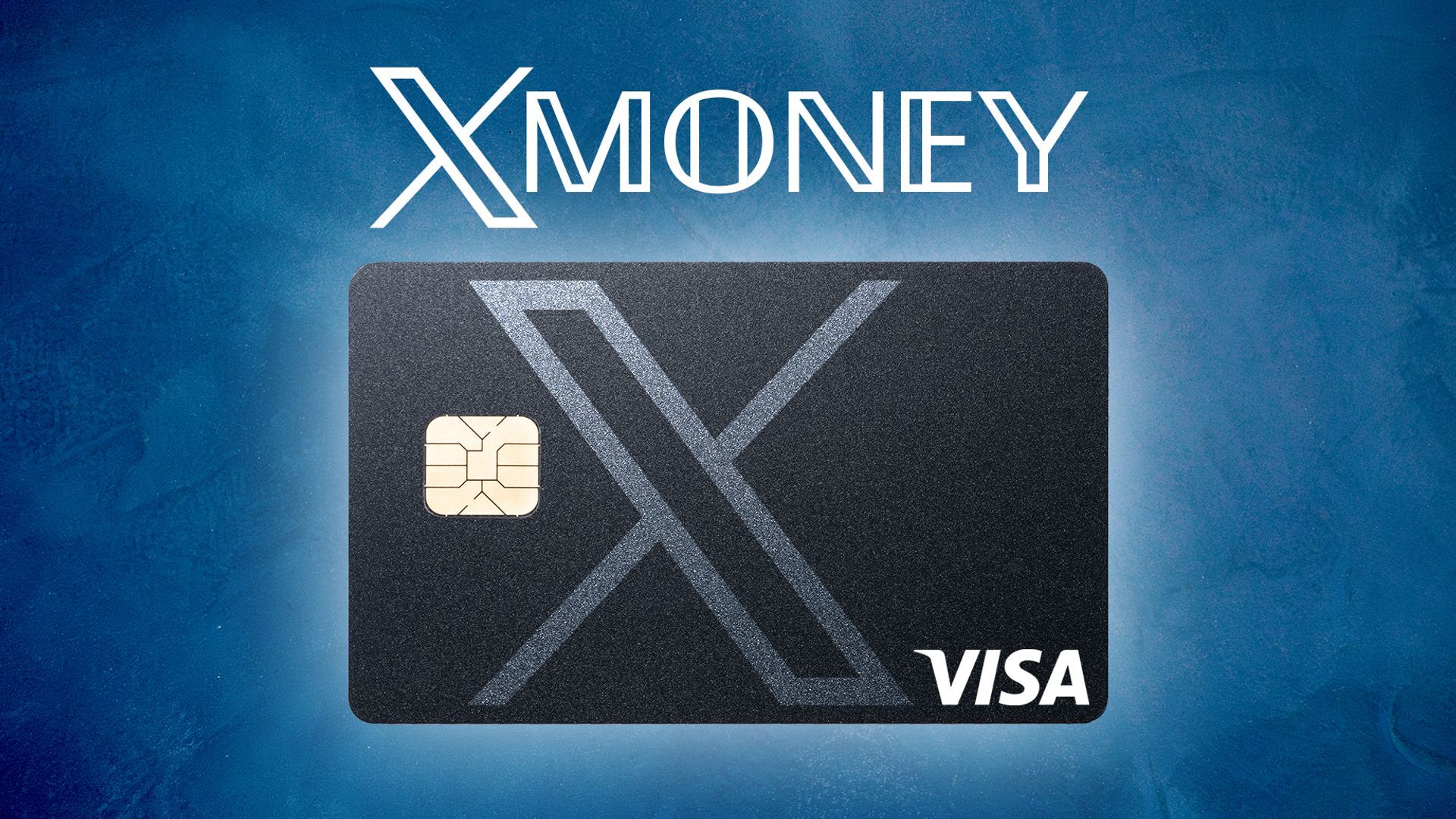

Elon Musk said from the start he wanted X to be an “everything app.” Now, X is taking that first step, striking a deal with the largest U.S. credit card network.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Right

Untracked Bias

X CEO Linda Yaccarino announced Tuesday, Jan. 28, that Visa will be the first partner of the “X Money Account” service. Users will be able to instantly fund their X wallet through Visa Direct and connect debit cards for peer-to-peer transactions, like Zelle or Venmo.

X is hoping to capitalize on the rapid growth of digital payments. The space saw a huge increase in demand during the COVID-19 pandemic, with people getting more comfortable shopping online and also gravitating toward touchless payments.

Yaccarino said X Money customers can also instantly transfer funds to their bank account from the platform.

Download the SAN app today to stay up-to-date with Unbiased. Straight Facts™.

Point phone camera here

What does the future hold for X Money?

The newly created X account for the finance feature describes it as. “for all your money moves, powered by X, launching in 2025.”

Yaccarino says the feature will come later this year.

According to the website, “X Payments” is currently licensed as a money transmitter in 40 states and Washington, D.C.

Yaccarino mentioned that the announcement is the first of many for X Money this year, but the app will face stiff competition from established companies like Venmo, Zelle and Apple, which is the most-used digital wallet.

Is X dealing with financial struggles?

Despite being owned by the richest person in the world, Musk has long claimed the company is in a “dire situation” from a revenue standpoint.

Now, Musk reportedly gave employees an updated view of the situation in an email obtained by The Wall Street Journal.

“Our user growth is stagnant, revenue is unimpressive, and we’re barely breaking even,” he wrote.

After the Journal report came out, Musk denied sending the email. The Journal also reported that banks are preparing to sell off some of the $13 billion in debt they loaned Musk to finance his deal to buy Twitter, now called X.

Banks don’t typically hold onto this kind of debt for this long, but when things get volatile, they may keep it on the books to avoid selling at a loss.

Get up to speed on the stories leading the day every weekday morning. Sign up for the newsletter today!

Learn more about our emails. Unsubscribe anytime.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

Musk paid a high price from the start. He bought Twitter in 2022 for $44 billion and later tried to back out of the deal, but a court held him to it.

Since acquiring X, he’s made several changes, including its name, verified program and now a paid membership.

[Simone Del Rosario]

ELON MUSK SAID FROM THE START HE WANTED X TO BE AN “EVERYTHING APP.” THIS WEEK X IS TAKING THAT FIRST STEP, STRIKING A DEAL WITH THE LARGEST U-S CREDIT CARD NETWORK.

X C-E-O LINDA YACCARINO ANNOUNCED TUESDAY VISA WILL BE THE FIRST PARTNER OF “X MONEY.” USERS WILL BE ABLE TO INSTANTLY FUND THEIR X WALLET THROUGH VISA DIRECT AND CONNECT DEBIT CARDS FOR PEER-TO-PEER TRANSACTIONS, LIKE ZELLE OR VENMO.

X IS HOPING TO CAPITALIZE ON THE RAPID GROWTH OF DIGITAL PAYMENTS. THE SPACE SAW A HUGE INCREASE IN DEMAND WITH THE COVID-19 PANDEMIC, WITH PEOPLE GETTING MORE COMFORTABLE SHOPPING ONLINE AND ALSO GRAVITATING TOWARD TOUCHLESS PAYMENTS.

YACCARINO SAYS X MONEY CUSTOMERS CAN ALSO INSTANTLY TRANSFER FUNDS TO THEIR BANK ACCOUNT FROM THE PLATFORM.

THE NEWLY CREATED X ACCOUNT FOR THE FINANCE FEATURE DESCRIBES IT AS: “FOR ALL YOUR MONEY MOVES, POWERED BY X – LAUNCHING IN 20-25.”

YACCARINO SAYS THE FEATURE WILL COME LATER THIS YEAR.

THE WEBSITE SAYS X PAYMENTS IS CURRENTLY LICENSED AS A MONEY TRANSMITTER IN 40 STATES AND WASHINGTON, D.C.

YACCARINO TEASED THAT IT’S THE FIRST OF MANY X MONEY THIS YEAR, BUT THE FUTURE EVERYTHING APP WILL FACE STIFF COMPETITION FROM ESTABLISHED COMPANIES LIKE VENMO, ZELLE AND APPLE, WHICH IS THE MOST-USED DIGITAL WALLET.

AS X TRIES TO BUILD NEW REVENUE STREAMS, WE’RE GETTING A CLEARER PICTURE OF THE COMPANY’S FINANCIAL STRUGGLES.

DESPITE BEING OWNED BY THE RICHEST PERSON IN THE WORLD – MUSK HAS LONG CLAIMED THE COMPANY IS IN A “DIRE SITUATION” FROM A REVENUE STANDPOINT. NOW, MUSK REPORTEDLY GAVE EMPLOYEES AN UPDATED VIEW OF THE PICTURE IN AN EMAIL OBTAINED BY THE WALL STREET JOURNAL.

“OUR USER GROWTH IS STAGNANT, REVENUE IS UNIMPRESSIVE, AND WE’RE BARELY BREAKING EVEN,” HE WROTE.

OR DID HE? AFTER THE JOURNAL REPORT CAME OUT, MUSK DENIED SENDING THE EMAIL.

THE JOURNAL REPORTS BANKS ARE PREPARING TO SELL OFF SOME OF THE 13 BILLION DOLLARS IN DEBT THEY LOANED MUSK TO FINANCE HIS DEAL TO BUY TWITTER, NOW CALLED X.

BANKS DON’T TYPICALLY HOLD ONTO DEBT LIKE THIS FOR THIS LONG, BUT WHEN THINGS GET VOLATILE, THEY MAY KEEP IT ON THE BOOKS TO AVOID SELLING AT A LOSS.

MUSK PAID A HIGH PRICE FROM THE START. HE BOUGHT TWITTER IN 2022 FOR 44 BILLION DOLLARS. HE LATER TRIED TO BACK OUT OF THE DEAL BUT A COURT HELD HIM TO IT.

SINCE ACQUIRING X, HE’S MADE SEVERAL CHANGES, INCLUDING ITS NAME, VERIFIED PROGRAM AND NOW A PAID MEMBERSHIP.

FOR SAN I’M SIMONE DEL ROSARIO.

FOR ALL YOUR LATEST NEWS HEADLINES – DOWNLOAD THE STRAIGHT ARROW NEWS APP TODAY.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Right

Untracked Bias

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

US to halt offensive cyber operations against Russia: Reports

Watch 1:087 hrs ago -

Reuters

Reuters

Trump announces new US crypto strategic reserve

ReadYesterday -

AP Images

AP Images

Pope Francis’ health condition stable, urges continued prayers for peace

ReadYesterday -

Reuters

Reuters

Singer-Songwriter, Angie Stone dead at 63

ReadSaturday