Search

- All

- News

- Opinion

- Commentary

- Media Miss

As the dust starts to settle following the collapse of Silicon Valley Bank and Signature Bank in March, economists are warning of cracks in the system that started spreading even before the failures. Under conditions of banking turmoil, some are worried credit tightening will become a credit crunch. A credit crunch is a decline in lending…

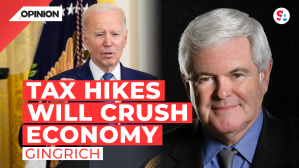

The partisan fighting over President Biden’s 2024 budget began the moment he unveiled the ambitious plan. The White House says the president’s fiscal strategy, which includes over $4 trillion in mandatory funds to shore up Medicaid, Medicare and Social Security, and nearly $900 billion in defense spending, will reduce the federal deficit by $3 trillion…

Finland is set to become the newest member of NATO today, doubling NATO’s presence along Russia’s borders. It is election day in Chicago, as two Democratic candidates are in a run-off for Chicago mayor. These stories and more highlight the daily rundown for Tuesday, April 4, 2023. Finland joins NATO as 31st member Finland will…

If Russia were to win the Ukraine War and push towards territory closer to Turkey, like in Moldova and Romania, Turkey would benefit from the security of being part of NATO. But Turkey, still reeling from massive earthquakes in February 2023, is a headache for NATO in many ways. Some Turkish companies and banks have…

Former President Donald Trump is expected to fly from Florida to New York today as he prepares to be arraigned on criminal charges; and OPEC has announced it’s slashing production of oil. These stories and more highlight the daily rundown for Monday, April 3, 2023. Trump to be arraigned Multiple media outlets are reporting former…

With seven interest rate increases last year, two so far in 2023, and two U.S. bank failures, the U.S. is still not currently in a recession. President Joe Biden continues to claim progress on the labor market and is counting on Fed Chairman Jerome Powell to strike the right balance on jobs and inflation to…

According to a report by Bain & Company, the Southeast Asian economy is forecasted to grow by 4-5% annually over the next ten years. Economists cite stable macroeconomics, a neutral political stance, and, unlike its demographically-challenged neighbors to the east (think China, Korea, and Japan), the region sports a young population. According to Straight Arrow…

When Silicon Valley Bank and Signature Bank collapsed in a matter of days, it was a stark reminder to the American people that U.S. banks do fail. More than that, while all uninsured depositors were spared in these two bank failures, that’s not always the case. Given the media storm around this month’s bank failures, it…

Banks in the U.S. fail nearly every year and depositors aren’t always made whole, like the federal government did at Silicon Valley Bank and Signature Bank in March. Since 1993, customers of 76 different institutions have lost money in a bank, from hundreds to millions, according to the Federal Deposit Insurance Corporation. Before the 2008…

Welcome back to trustworthy journalism.

At Straight Arrow News, we…

Report without partisan spin, earning distinctions from media bias experts at AllSides and Ad Fontes Media

Adhere to the highest standards for reporting transparency and credibility, as proven by NewsGuard’s 100/100 reliability rating