[Simone Del Rosario]

How does paying no federal income tax sound? Now how would that work when individual income tax makes up half of the federal government’s annual revenue?

Donald Trump: This country can become rich with the use, the proper use of tariffs.

Joe Rogan: Did you just float out the idea of getting rid of income taxes and replacing it with tariffs? Were you serious about that?

Donald Trump: Yeah, sure. But why not?

Simone Del Rosario: It’s a prospect former President Donald Trump has proposed multiple times on the campaign trail.

Donald Trump: When we were smart, when we were a smart country, in the 1890s and all. This is when the country was relatively the richest it ever was. It had all tariffs. It didn’t have an income tax.

Simone Del Rosario: While income tax has been around for thousands of years, the United States has not. And when the Constitution granted Congress authority to impose taxes, most of them were excise taxes, taxes placed on specific goods, like alcohol and tobacco.

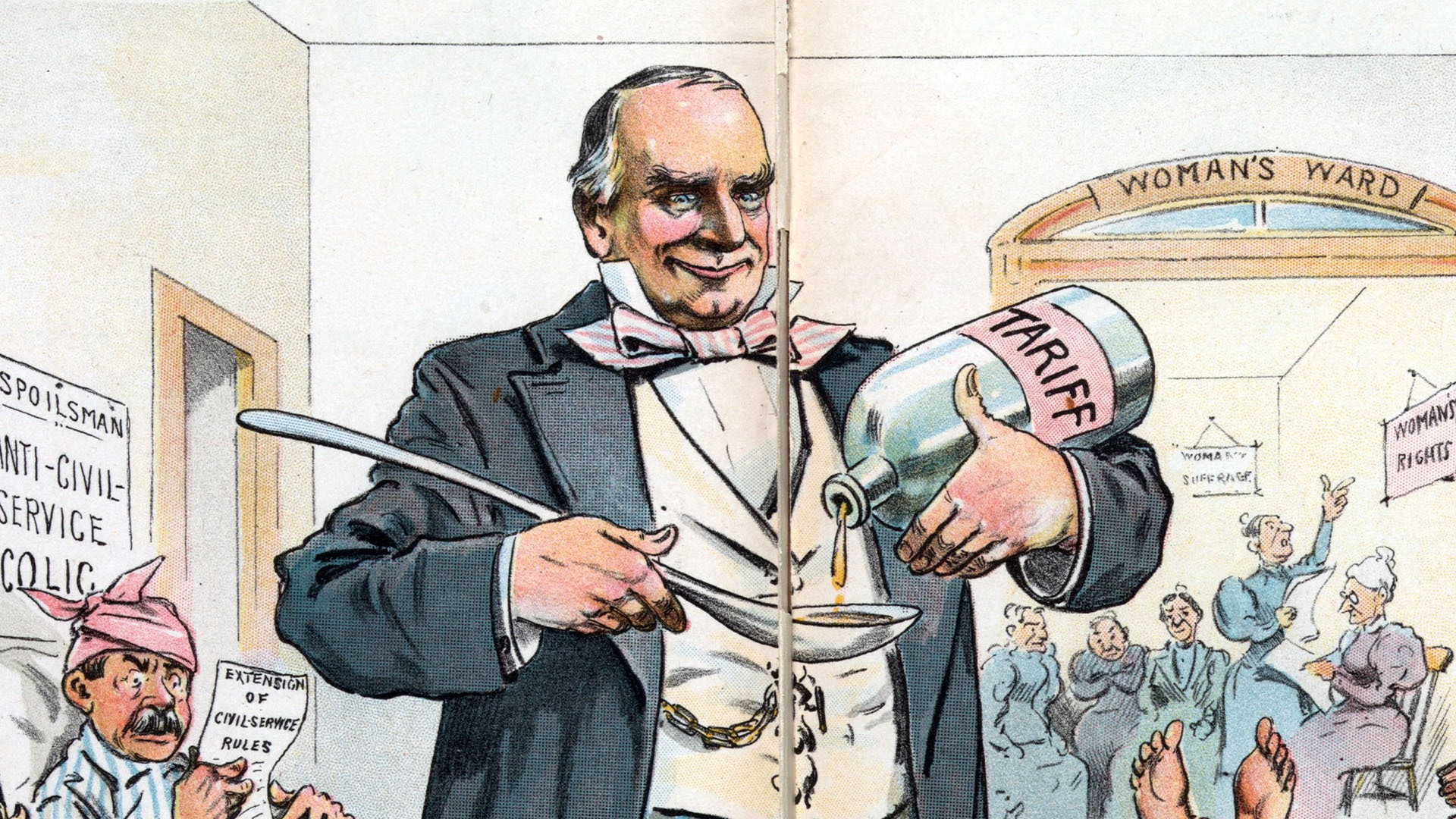

The country’s first income tax came in 1861 to raise money for the Civil War. It was a flat tax and later repealed in 1872. In 1890, the McKinley Tariff, named after then-Congressman William McKinley, raised the average duty on imports to around 50%.

Donald Trump: And then around in the early 1900s they switched over, stupidly, to frankly, an income tax.

Simone Del Rosario: This was the result of a years-long push by progressives to lower tariffs. The income tax became a fixture of U.S. tax policy via constitutional amendment in 1913.

David Walker: The country had grown too big and our industries were stable enough that it wasn’t realistic, nor was it necessary for us to be able to continue to raise most of our revenues through tariffs. Hello. I’m David M Walker, the immediate former Comptroller General of the United States, also a former trustee of social security and medicare, professor at the Naval Academy, and I am chairman of the Federal Fiscal Sustainability Foundation. I don’t think it’s feasible to go from from our current system to where we’re totally relying on tariffs. You know, it is possible to go from our current system to where we’re relying primarily, not exclusively, on a progressive consumption tax. But it would be a dramatic change from where we are right now, and government doesn’t tend to do things dramatically all at once.

Simone Del Rosario: For the record, David M. Walker served under Presidents Bill Clinton and George W. Bush. He has also run for office in Connecticut as a Republican. He tells me Trump’s proposal to replace income taxes with tariffs is not realistic today.

]David Walker: I think it’s important to understand that in 1912, right before the income tax came in the US, federal government was only 2.5% of the economy, 2.5% and now we’re approaching 25% of the economy and growing.

Simone Del Rosario: Ok, so the federal government today is a lot bigger. And for better or worse, federal spending plays a much more critical role in U.S. economic growth.

A lot has changed in this country since the turn of the 20th century. But what is remarkably similar is the debate around tariffs.

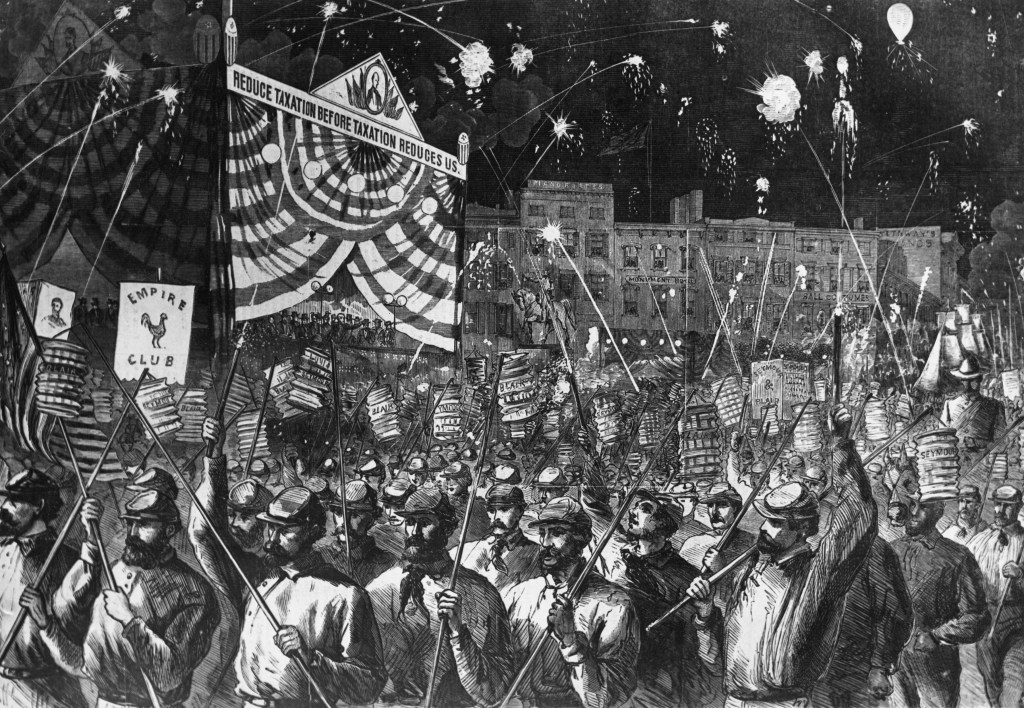

Let’s turn to the archives when that McKinley Tariff came about.

A New York Times article from 1890 reads: The Republican campaign orators and pamphlateers say that the various import duties levied by Congress are paid by the foreigners who send goods to America, and they deny point blank that the price of any article which may be called a necessary expense will be increased to Americans by the operation of the new tariff law … It is no longer necessary to meet theories with theories. Let the facts, which are multiplying every day, tell who it is that pays the onerous tariff taxes. They will answer that the American people pay these taxes and that the burden of them rests most heavily on the poor.

They then went paragraph by paragraph detailing how merchants are marking up everything from clothing to crockery (that’s tableware for those who don’t speak 1890s English), to groceries to horse clippers, all within weeks of the McKinley Tariff passing.

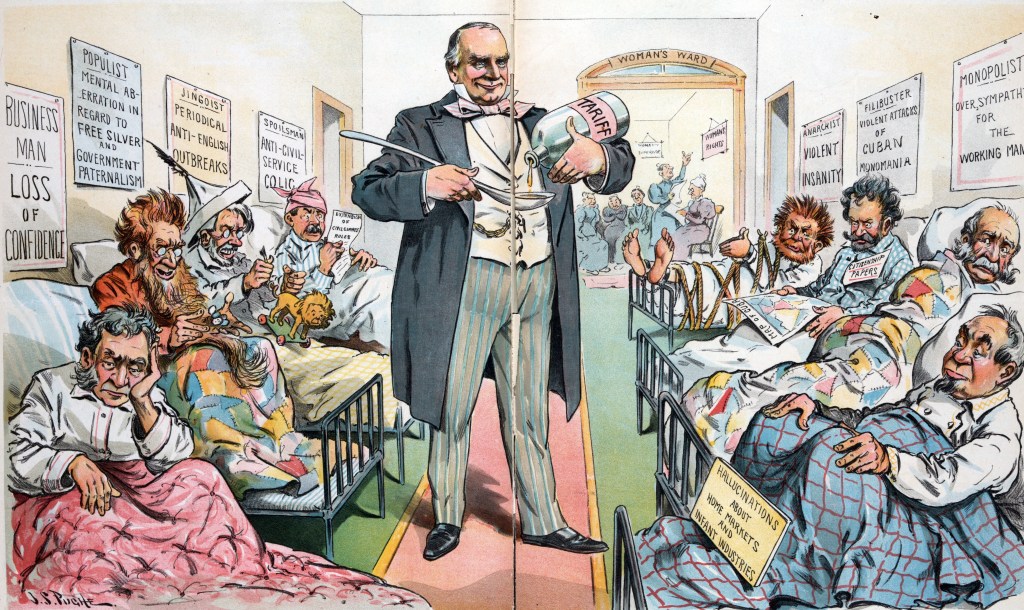

The tariffs proved pretty unpopular and Republicans lost dozens of House seats that election, including Congressman McKinley himself.

McKinley didn’t stay knocked down for long. He later became governor of Ohio and then president.

Donald Trump: A president who was assassinated named McKinley, he was the tariff king. He spoke beautifully of tariffs. His language was really beautiful.

Simone Del Rosario: Today Donald Trump makes the same claim of tariffs as Republicans in 1890. The same claim he made his first term as president.

Donald Trump: So we’re taking in many billions of dollars, there’s been absolutely no inflation and frankly, it hasn’t cost our consumer anything, it costs China.

CNBC report: A growing number of companies are filing lawsuits against the Trump administration demanding a reversal of the China tariff policy and refunds for tariff payments that these companies have already made.

Simone Del Rosario: Among the thousands of companies to sue was Tesla, the company that made current Trump surrogate Elon Musk rich.

Tesla had argued the tariffs were “arbitrary and capricious,” and said the administration “failed to consider relevant factors when making its decision, and failed to draw a rational connection between the facts found and the choices made.”

Economists and analysts across the board continue to say that Americans pay for tariffs.

Preston Brashers: The truth of it is that it is a tax. It is something that gets passed along to consumers, and in some cases, it’s going to be something that’s passed along to producers here in the United States when they’re buying products from overseas.

Donald Trump: It will be a certain tariff percentage, which will be higher than people had heard in the past, and we will be bringing in billions and billions of dollars, which will directly reduce our deficits.

Simone Del Rosario: And estimates consistently project the revenue tariffs would raise will not pay for Trump’s tax cut proposals. And they’re not talking about the lofty “get rid of income tax” idea.

Marc Goldwein: But the important thing with these tariffs is, if they work as intended, they will reduce trade, and so they don’t raise as much revenue as you might think.

Simone Del Rosario: The bipartisan Committee for a Responsible Federal Budget says campaign plans from Vice President Kamala Harris will increase debt by $3.5 trillion over the next decade, whereas Trump’s plans add $7.5 trillion to the debt.

David Walker: Let me give you the bottom line, Simone, okay. Neither major candidate for president has taken our deteriorating financial condition seriously. Both of them are making promises that will make our situation worse rather than better. But one also has to consider that this is what I call the silly season. Lots of promises are made and you have to assess what is the political feasibility of those promises happen[ing], and in some cases even what is the constitutionality of some of those things happening. I think what’s more realistic is you could see selected imposition of tariffs on certain goods from certain countries in order to try to help level the playing field and in order to try to help promote more domestic jobs. But you’re not going to see, I think, across the board approaches, and you’re not going to see, you know, a fundamental shift away from our historical revenue sources, because the gap is just too great.

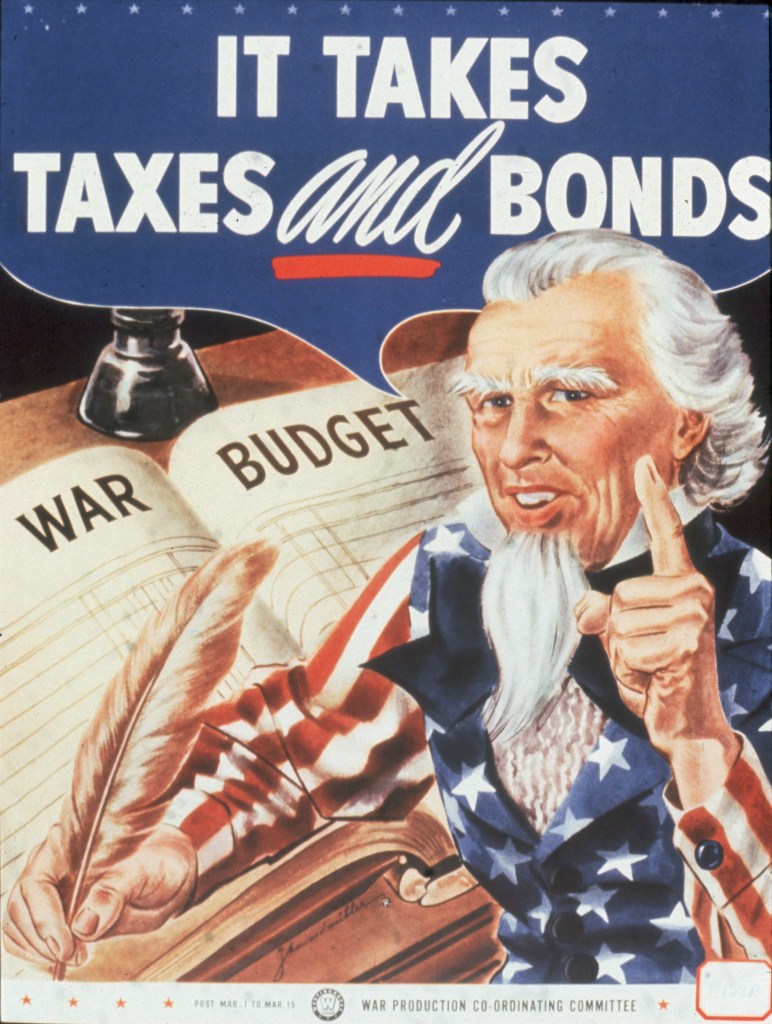

Simone Del Rosario: Even history shows where tariff-driven revenue fell short. Times of war.

The United States had to temporarily turn to an income tax to fund the Civil War.

The threat of war pushed remaining states to ratify the 16th Amendment, allowing Congress to tax incomes.

And during World War I and World War II, Congress dug deep into the income tax coffer to pay for it.

Famous New York lawyer Amos Pinchot led the charge pushing Congress to raise income tax rates on the wealthy ahead of American involvement in World War I.

He correctly predicted, “If we ever get a big income tax on in wartime, some of it – a lot of it – is going to stick.”