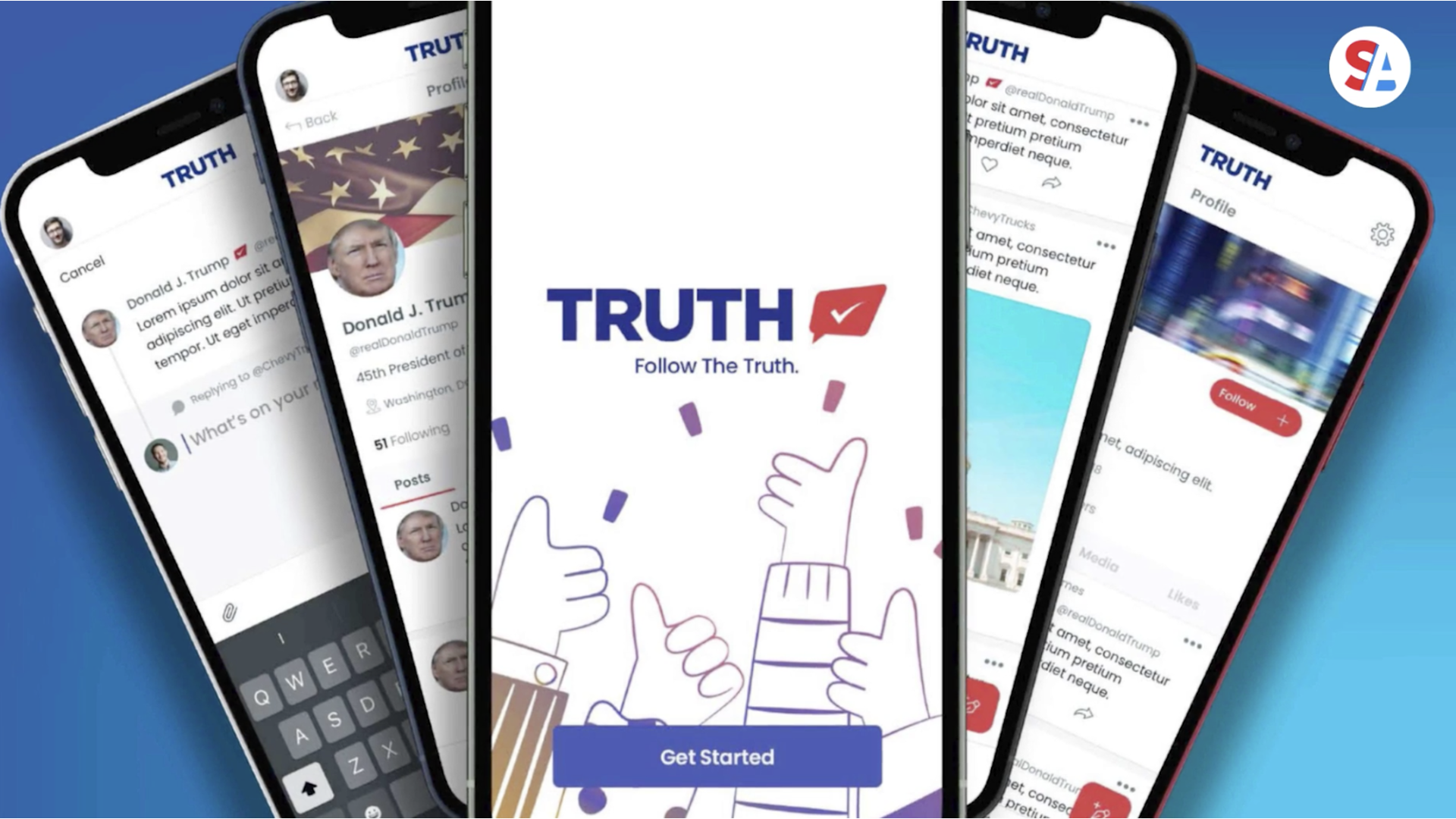

Simone Del Rosario: WHEN FORMER PRESIDENT DONALD TRUMP UNVEILED HIS NEW SOCIAL MEDIA VENTURE THIS WEEK – HE DID SO WITH THE BACKING OF ABOUT 300 MILLION DOLLARS ALREADY COMMITTED TO HIS TECHNOLOGY COMPANY.

THE TRICK IS – A LOT OF THE INVESTORS WHO PUT UP THAT MONEY – HAD NO IDEA IT WAS GOING TO TRUMP.

THAT’S BECAUSE HIS PRIVATE TECH COMPANY MERGED WITH A SO-CALLED BLANK-CHECK COMPANY, ONE OF WALL STREET’S HOTTEST FADS.

THE OFFICIAL TERM IS SPECIAL PURPOSE ACQUISITION COMPANY, OR SPAC.

ALSO CALLED BLANK-CHECK COMPANIES, SPACS FIRST GO PUBLIC AND RAISE MONEY FROM INVESTORS WITH THE GOAL OF FINDING A PRIVATE COMPANY TO MERGE WITH. BUT THE INVESTORS HAVE NO IDEA WHAT THAT PRIVATE COMPANY WILL BE.

IN THIS CASE, THE SPAC, DIGITAL WORLD ACQUISITION – RAISED NEARLY 300 MILLION DOLLARS LAST MONTH FROM INVESTORS. AND ALL THE INVESTORS KNEW, WAS THAT DIGITAL WORLD WAS LOOKING TO INVEST IN “MIDDLE-MARKET EMERGING GROWTH TECHNOLOGY-FOCUSED COMPANIES.”

TRUMP’S COMPANY FIT THAT BILL, AND THE MERGER DETAILS WERE DISCUSSED ONLY AT THE HIGHEST LEVELS BEFORE GOING PUBLIC WITH THE NEWS THIS WEEK.

AT LEAST ONE HEDGE FUND MANAGER SOLD HIS ENTIRE STAKE IN DIGITAL WORLD RIGHT AFTER LEARNING IT WAS MERGING WITH TRUMP’S COMPANY.

BOAZ WEINSTEIN TOLD THE NEW YORK TIMES, “MANY INVESTORS ARE GRAPPLING WITH THE HARD QUESTIONS ABOUT HOW TO INCORPORATE THEIR VALUES INTO THEIR WORK. FOR US, THIS WAS NOT A CLOSE CALL.”

BUT WHILE HE MADE A SLIGHT PROFIT – HE MISSED OUT ON THE INCREDIBLE GAINS THE COMPANY SAW AFTER ANNOUNCING THE MERGER.

DIGITAL WORLD’S STOCK WENT UP OVER THREE HUNDRED PERCENT THE FIRST DAY.

I’M SIMONE DEL ROSARIO FROM NEW YORK IT’S JUST BUSINESS.