[Simone Del Rosario]

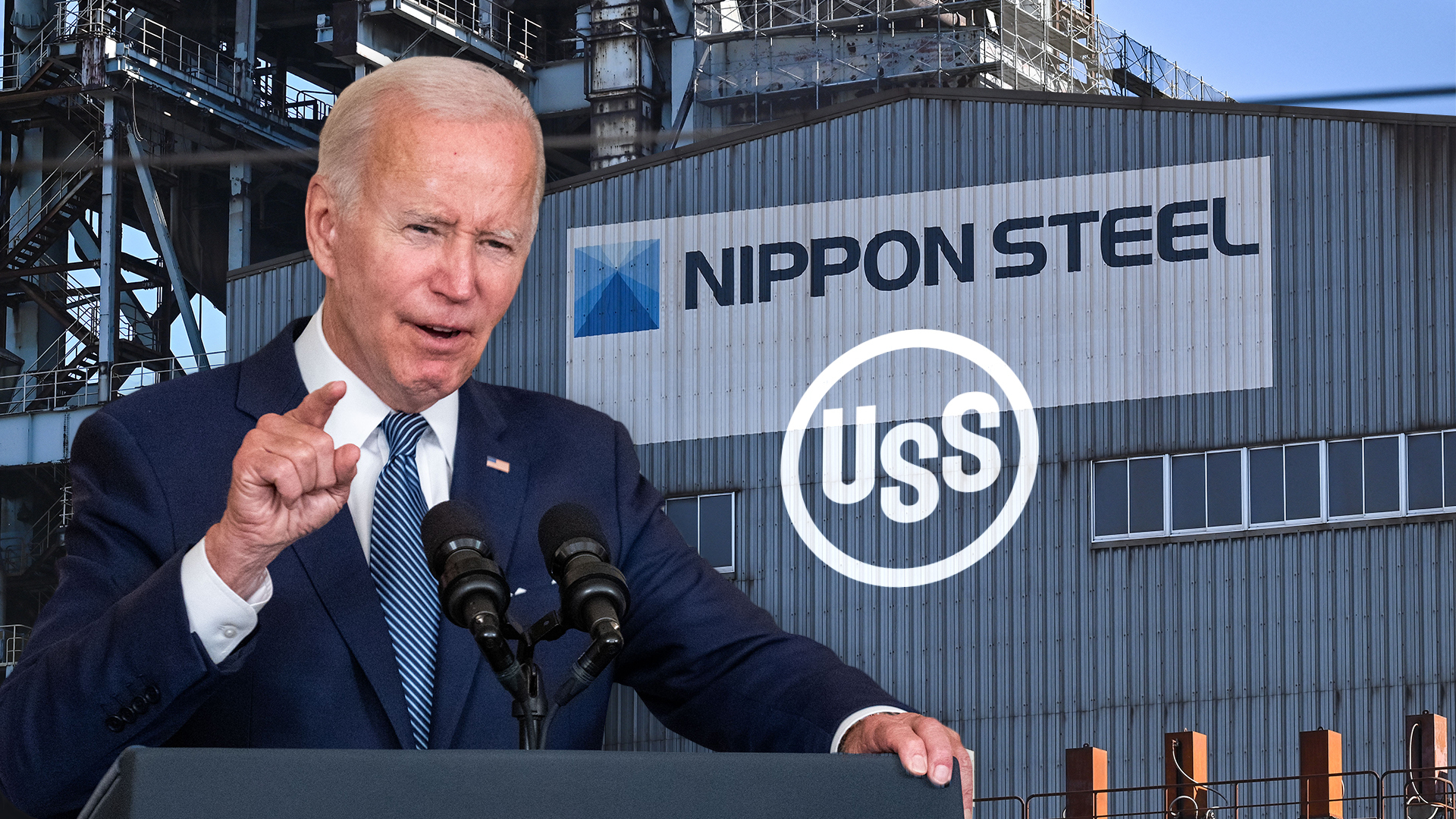

It’s an eleventh-hour push to save a $15 billion deal. Japan’s Nippon Steel says it will give the U.S. government veto power over any reduction in U.S. Steel’s production capacity if they allow the two to merge. That’s according to a document sent to the White House seen by the Washington Post.

For months, President Joe Biden has opposed the Nippon-U.S. Steel deal that could pose national security risks. Biden holds the deal’s fate in his hands with less than three weeks left in the White House. President-elect Donald Trump also opposes the takeover.

This last-ditch proposal to placate concerns would give veto power to a Trump White House.

Last week, the Committee on Foreign Investment in the United States finalized a review of the deal. They said Nippon’s bid could reduce domestic steel production which, in turn, could create national security risks.

The CFIUS panel failed to come to terms on whether to give approval for the deal or recommend the president block it. In the end, they left it up to Biden. The president can reject the deal or do nothing by the Jan. 7 deadline, which would effectively approve it.

As part of a new proposal sent to the White House this week, Nippon guaranteed it would not reduce production capacity at U.S. Steel facilities in Pennsylvania, Indiana, Alabama, Texas, California and Arkansas without approval from the U.S. Government.

Representatives from Nippon and U.S. Steel have been stumping for the deal for the past few months.

[Takashiro Mori]

we have been clear from the outset that there will be no job loss or plant closure because of this deal. If anything, we will need more steel workers to meet our vision for the future. We are not transforming jobs or production overseas, and we will protect us steel from unfair trade. We are not going to ship slabs from across the world to the United States. We believe steel is a local business, and the US customers should receive products produced from slabs made in United States.

[Simone Del Rosario]

Biden signaled he was against the deal for months, but has yet to take action since the matter officially hit his desk. Trump has tak en a similar stance.

[Donald Trump]

I will stop Japan from buying United States Steel. We have a foreign country that wants to purchase one of our greatest.

They shouldn’t be allowed to buy it. We have to make it work. Have to make it work. You don’t want to sell U.S. Steel.

[Simone Del Rosario]

But in the proposal, the companies say the situation for U.S. Steel will be dire if the deal doesn’t go through.

They say, “By providing assurances against reductions in production capacity — which assurances will be legally binding and enforceable by the U.S. Government — Nippon Steel is underscoring the ironclad nature of its commitments to U.S. Steel and its union-represented employees. By contrast, without this Transaction, given limited resources, U.S. Steel will revert to its pre-Transaction strategy of deprioritizing existing, union-represented facilities.”

Wall Street is hopeful the promise of veto power will power the deal through. U.S. Steel stock is up more than 8% since Monday, jumping as much as 14% on Tuesday, its biggest surge in more than a year.