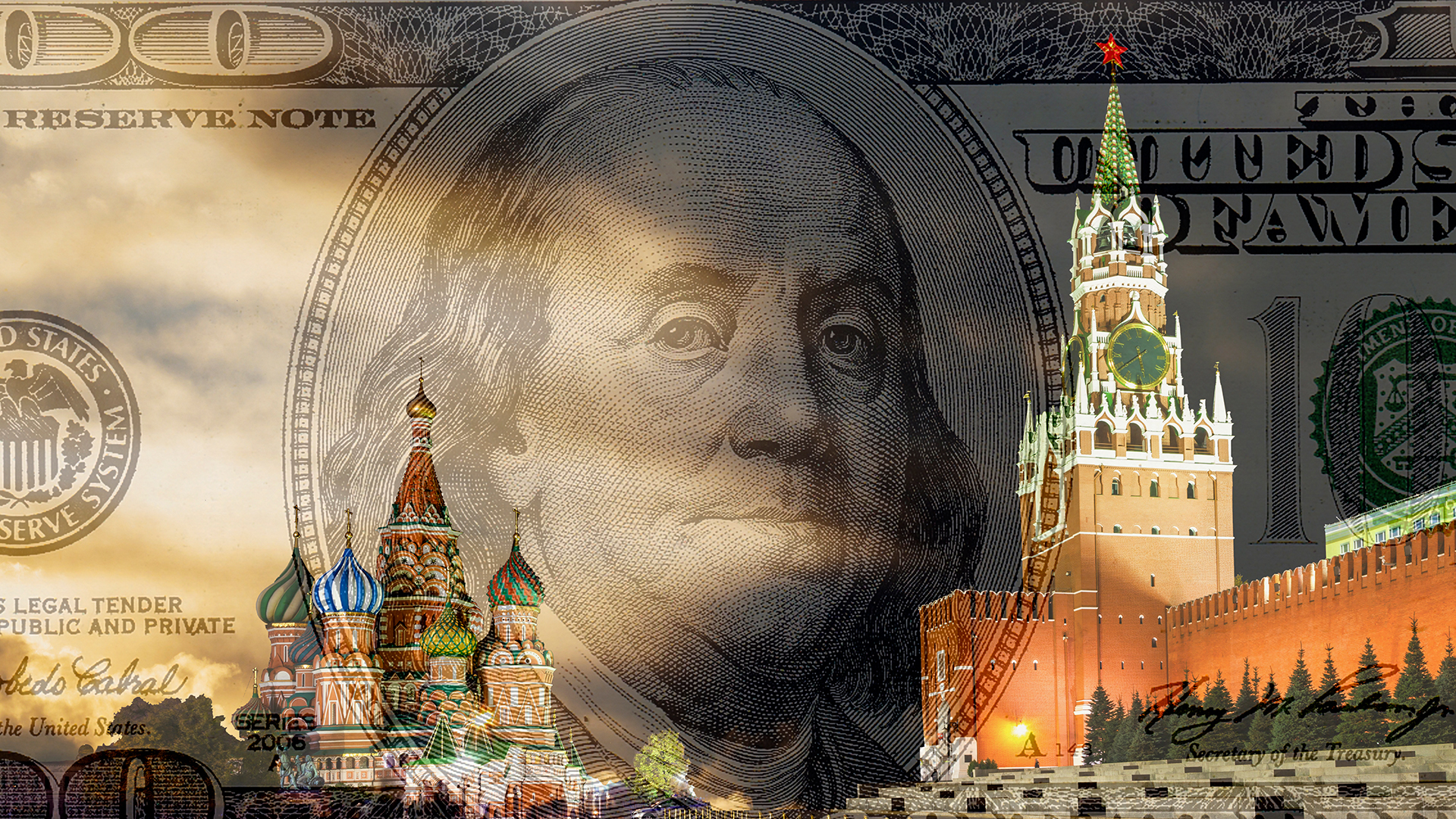

PETER ZEIHAN: Financial sanctions actually weaponized the U.S. dollar really for the first time against a significant state. I mean, when you do it against Iran or North Korea, it’s really pretty small, it doesn’t matter, Russia, Russia matters. And the Europeans made the decision as part of that process to basically make the Euro from a legal point of view a subsidiary of the U.S. dollar system. So you now have the three biggest currency blocs in the world, the dollar, the euro, and the yen that have basically moved into lockstep. And so if you want to have a currency system, you have to have one that is now outside three of the four largest economies in the world, and the remaining one, China, is not convertible. So you are saying that you would have to build an independent currency that trades alongside of these that is fully convertible to all of them that is not under their control? So then the question becomes, whose control is it under? Because if it’s an independent authority, wow, the best way to get what you want for your country is to bribe the hell out of that authority. And that’s one of the reasons why this just can’t work. You can really only have one.

BRENT JABBOUR: And Peter, is this why the idea of the BRICS currency can’t work because there’s no possible way that it kind of can’t be, you know, bought and paid for by somebody?

PETER ZEIHAN: Either it’s independent, in which case it’s the most corrupt system you can imagine, or one of the countries manages it, in which case that country manages it for his or her own economy, in which case everyone else is left on the outside. Even with the United States weaponizing the dollar, it is still the least bad option for everyone, even the Russians. One of the things that the Russians discovered when they dumped a bunch of money into the yuan is they went back a few months later and tried to pull it out and the Chinese were like, “No, no, that’s okay. We don’t want it back. You can keep it.” And they had to go back to basically pulling dollars off of international exchanges on the black market, and then flying gold around because it was really the only other option they had.

SIMONE DEL ROSARIO: And I read that Russia is holding about a third of the tracked world reserve currency in yuan, is that correct to your understanding?

PETER ZEIHAN: That sounds about right, yes.

SIMONE DEL ROSARIO: And that’s a significant stake there when you’re talking about global proportions for Russia to be holding a third.

PETER ZEIHAN: And as the Chinese have shown them, it’s not something they can do anything with.