Top 3 takeaways from JPMorgan Chase’s First Republic Bank acquisition

By Simone Del Rosario (Business Correspondent), Brent Jabbour (Producer), Emma Stoltzfus (Editor)

Media Landscape

This story is a Media Miss by the right as only 22% of the coverage is from right leaning media. Learn moreBias Distribution

Untracked Bias

Move over, Silicon Valley Bank. First Republic Bank is now the second-largest bank failure in U.S. history. Three of the top 30 U.S. banks have now failed in less than two months.

The bidding process stretched into the night. Early Monday morning, federal authorities approved JPMorgan Chase’s bid to take over First Republic’s assets. Here are three things to know about Chase’s takeover.

Exception to the rule

JPMorgan Chase, already the nation’s largest bank, will now take over First Republic Bank, which had $229.1 billion in assets and $103.9 billion in deposits as of April 13, according to the FDIC. The FDIC said Chase agreed to purchase “substantially all” of First Republic’s assets, in addition to assuming all deposits.

That said, authorities had to carve out an exception to allow the largest U.S. bank to get even bigger. The 1994 Riegle-Neal Act prohibits banks from making acquisitions that would push its share of nationwide deposits over 10%. Chase already holds more than 10% of the nation’s deposits, which would have technically made it ineligible. But authorities were prepared to make that exception, specifically requesting that JPMorgan Chase make a bid for First Republic.

In the end, Chase’s offer to take nearly the entire bank was reportedly the cleanest and best deal for the FDIC, which expects its deposit insurance fund to take a $13 billion hit. Bloomberg reports that other bids would have cost the FDIC billions more.

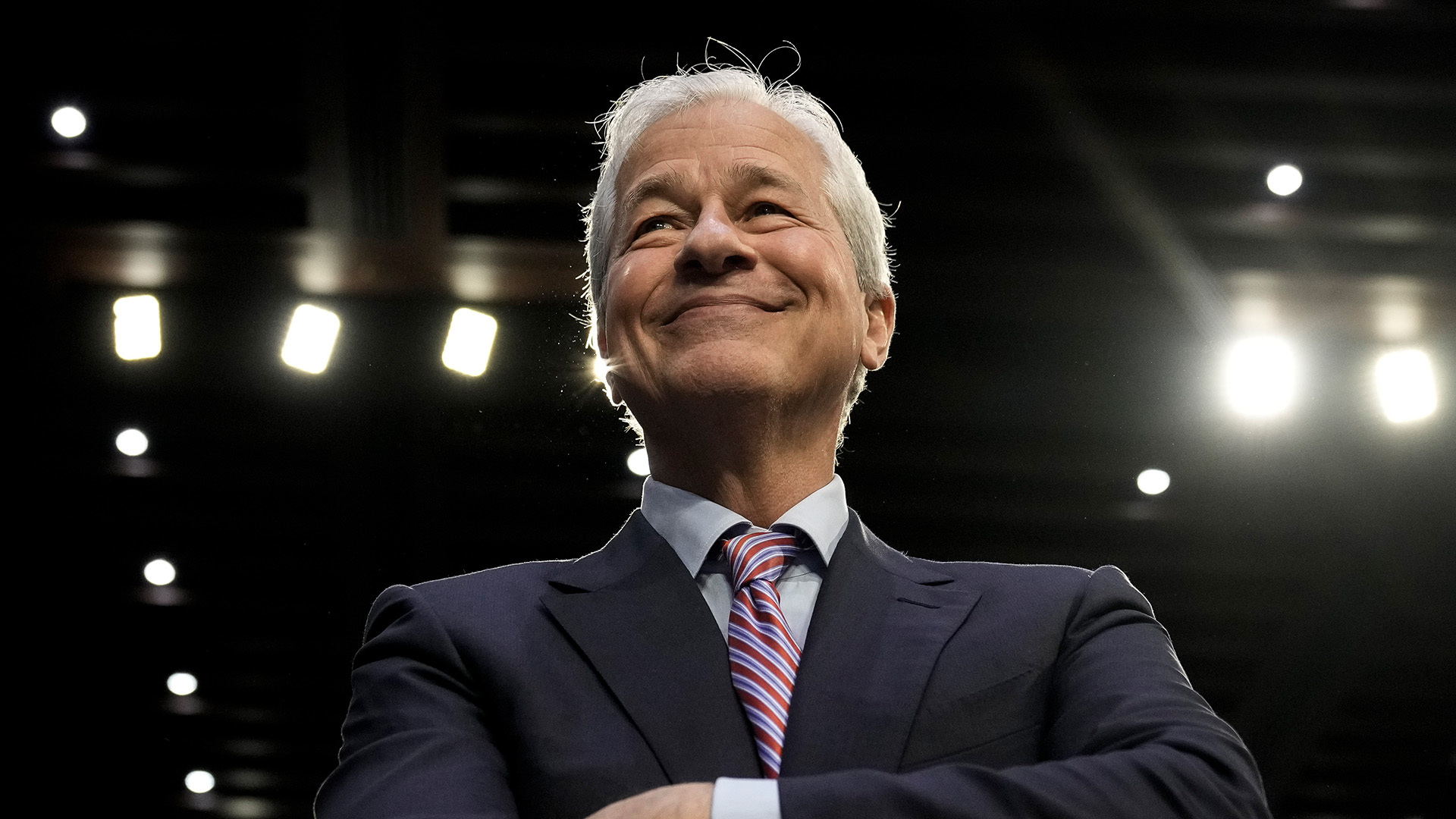

Chase to the rescue: Take two

It’s not the first time JPMorgan Chase has come to First Republic’s rescue. Back in March, CEO Jamie Dimon led efforts to inject $30 billion in deposits into First Republic when it was first starting to falter following the collapses of SVB and Signature Bank. In all, 11 of the biggest U.S. banks rallied behind a rescue package to stabilize First Republic, including Bank of America, Citigroup and Wells Fargo. Of the $30 billion provided, Chase ponied up $5 billion.

On Monday, Chase leaders insisted there is no conflict of interest between the bank being an adviser to First Republic, followed by a bidder for First Republic. In an analyst call, executives said the two teams were separate. Chase CFO Jeremy Barnum vowed Monday to repay the other banks for the rescue deposits they contributed.

Chase’s complicated bank buyout history

JPMorgan Chase’s history of helping failing financial institutions likely led to it carving out some protections this time around. Following the 2008 financial crisis, federal regulators requested that JPMorgan step in and rescue investment bank Bear Stearns and Washington Mutual, the latter of which remains the largest bank failure in U.S. history.

Coming to the feds’ aid in 2008 burned Dimon pretty hard in the years that followed. Chase was held legally liable for billions of dollars in fines and settlements levied against the banks it inherited. Ultimately, Dimon said that he regretted saving the banks for that reason and wouldn’t have made the same decision again.

With First Republic’s saga now complete, Dimon said Monday, “This part of the crisis is over.” But he still left the door open for a smaller institution to fail, noting that bank failures will always happen.

SIMONE DEL ROSARIO: MOVE OVER, SILICON VALLEY BANK. FIRST REPUBLIC BANK IS NOW THE SECOND BIGGEST BANK FAILURE IN U-S HISTORY. THREE OF THE TOP 30 U.S. BANKS HAVE NOW FAILED IN LESS THAN TWO MONTHS. HERE ARE THREE THINGS TO KNOW ABOUT THE LARGEST U-S BANK BUYING FIRST REPUBLIC.

JPMORGAN CHASE WON THE OVERNIGHT BIDDING FOR FIRST REPUBLIC’S ASSETS, WHICH TOTAL AROUND 229 BILLION DOLLARS, WITH 104 BILLION IN TOTAL DEPOSITS. BUT AUTHORITIES HAD TO CARVE OUT AN EXCEPTION TO ALLOW THE NATION’S LARGEST BANK TO GET EVEN BIGGER. THE 1994 RIEGLE-NEAL ACT PROHIBITS BANKS FROM MAKING ACQUISITIONS THAT’LL PUSH ITS SHARE OF NATIONWIDE DEPOSITS OVER 10%. CHASE ALREADY HAS MORE THAN 10% OF THE NATION’S DEPOSITS, WHICH SHOULD HAVE TECHNICALLY MADE IT INELIGIBLE. BUT FEDS WERE PREPARED TO MAKE THAT EXCEPTION, SPECIFICALLY REQUESTING THAT JPMORGAN CHASE MAKE A BID. IN THE END, CHASE’S OFFER TO TAKE NEARLY THE ENTIRE BANK WAS REPORTEDLY THE CLEANEST AND BEST DEAL FOR THE FDIC. THE FDIC EXPECTS ITS DEPOSIT INSURANCE FUND TO TAKE A 13 BILLION DOLLAR HIT, WHILE OTHER BIDS WOULD HAVE REPORTEDLY COST IT BILLIONS MORE.

THIS ISN’T THE FIRST TIME CHASE HAS COME TO FIRST REPUBLIC’S RESCUE. BACK IN MARCH, CEO JAMIE DIMON LED EFFORTS TO INJECT 30 BILLION DOLLARS IN DEPOSITS INTO FIRST REPUBLIC, WHEN IT WAS FIRST STARTING TO FALTER FOLLOWING THE COLLAPSES OF SVB AND SIGNATURE BANK. IN ALL, 11 OF THE BIGGEST U-S BANKS RALLIED BEHIND A RESCUE PACKAGE TO STABILIZE FIRST REPUBLIC, INCLUDING BANK OF AMERICA, CITIGROUP AND WELLS FARGO. OF THE $30 BILLION, CHASE HAD PONIED UP $5. CHASE INSISTS THERE’S NO CONFLICT OF INTEREST BETWEEN THE BANK BEING AN ADVISER TO FIRST REPUBLIC, FOLLOWED BY A BIDDER FOR FIRST REPUBLIC. LEADERS SAID THE TWO TEAMS WERE SEPARATE.

WHILE CHASE’S CFO VOWED MONDAY TO REPAY THE OTHER BANKS FOR THE RESCUE DEPOSITS THEY CONTRIBUTED.

LASTLY, CHASE’S STORIED HISTORY OF HELPING FAILING FINANCIAL INSTITUTIONS LIKELY LED TO IT CARVING OUT SOME PROTECTIONS THIS TIME AROUND. FOLLOWING THE 2008 FINANCIAL CRISIS, FEDERAL REGULATORS REQUESTED THAT JPMORGAN STEP IN AND RESCUE INVESTMENT BANK BEAR STEARNS AND WASHINGTON MUTUAL – WHICH IS THE LARGEST BANK FAILURE IN U-S HISTORY. COMING TO THE FEDS’ AID IN 2008 BURNED DIMON PRETTY HARD IN THE YEARS THAT FOLLOWED. CHASE WAS HELD LEGALLY LIABLE FOR BILLIONS OF DOLLARS IN FINES AND SETTLEMENTS LEVIED AGAINST THE BANKS HE INHERITED. ULTIMATELY, DIMON SAID HE REGRETTED SAVING THE BANKS FOR THAT REASON AND WOULDN’T DO IT AGAIN.

WITH THE FIRST REPUBLIC BANK SAGA NOW COMPLETE, WHAT’S NEXT? DIMON SAID MONDAY, “THIS PART OF THE CRISIS *IS OVER.” BUT STILL LEFT THE DOOR OPEN FOR A SMALLER BANK TO FAIL.

I’M SIMONE DEL ROSARIO, IN NEW YORK IT’S JUST BUSINESS.

Media Landscape

This story is a Media Miss by the right as only 22% of the coverage is from right leaning media. Learn moreBias Distribution

Untracked Bias

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

DOJ investigating UnitedHealth over Medicare Advantage billing: Report

Read4 hrs ago -

Reuters

Reuters

Diddy’s defense attorney abruptly requests withdrawal from case

Watch 1:4017 hrs ago -

Getty Images

Getty Images

Judge allows CNN lawsuit potentially worth billions to continue

Read20 hrs ago -

Reuters

Reuters

It’s a bird, it’s a plane, it’s the first video of Alef Aeronautics’ flying car

Watch 2:1322 hrs ago