Check on your 401(k) for a boost. Here’s why stocks hit record highs this week.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below. Learn more about this data[Simone Del Rosario]

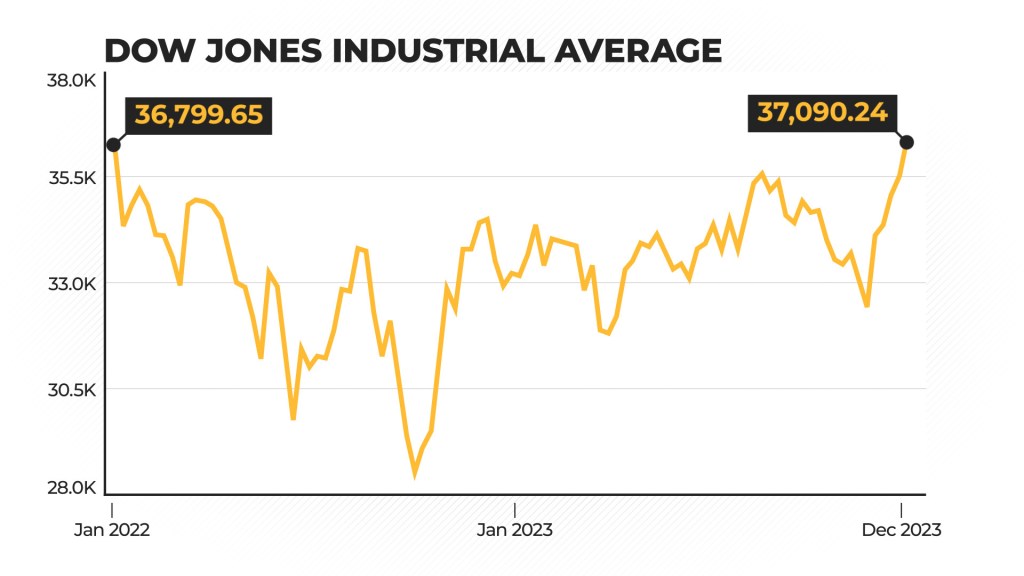

You might want to check in on your 401(k)…if you need a boost. Stocks are soaring and the Dow Jones hit a record high this week, erasing nearly two years of turmoil. The previous high was set in January 2022.

The S&P 500 is also close to its all-time high, with stocks up more than 23% this year. Here’s what you might have missed this week that has everyone in the holiday spirit.

On Wednesday, Federal Reserve Chair Jerome Powell stood in front of that podium and gave everyone the gift of hope: that rate hikes are over and cuts are coming. The Federal Reserve is projecting three rate cuts in 2024.

[Jerome Powell]

We are seeing, you know, strong growth that is, that is appears to be moderating. We’re seeing a labor market that is coming back into balance by so many measures, and we’re seeing inflation making real progress. These are the things we’ve been wanting to see.

[Simone Del Rosario]

Of course, Powell had plenty of words of caution – the economy’s been very unpredictable since the pandemic, things could always change – but the market just blew right past those warnings.

We also got the latest inflation reading this week. Overall consumer prices are up 3.1% on the year, while core inflation, what the Fed cares most about, is still at 4%, double the 2% inflation target. The Fed predicts we won’t get to that 2% target until 2026.

Ok, so that’s not the most positive economic news, but wholesale prices are giving us reason to be optimistic. The producer price index is what’s called a leading economic indicator. It gives us an idea of what’s coming down the pike for inflation. We learned this week wholesale prices are flat for November, better than predicted. And on an annual basis, they went up just 0.9%.

Meanwhile, gas prices are at their lowest point of the year. The national average sits around $3.10 a gallon while some analysts predict it could go below $3 by the end of the year. Triple A says more than half of all gas stations in the U.S. are already below that mark.