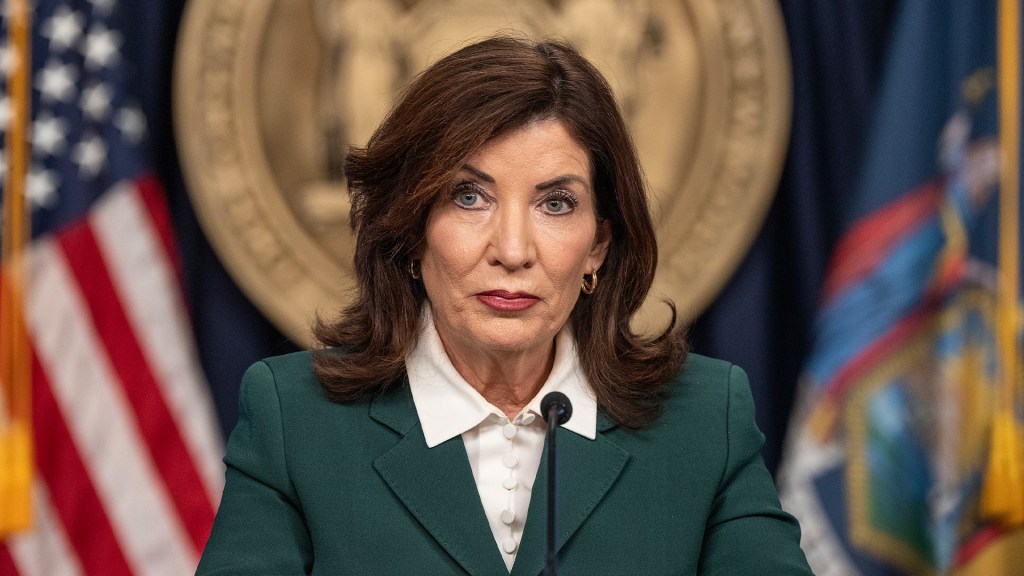

Simone Del Rosario

Policies by former President Donald Trump would add more than twice as much to the national debt as policies by Vice President Kamala Harris. That’s according to a bipartisan analysis by the Committee for a Responsible Federal Budget.

The middle estimate for Harris’ plans increases the debt by $3.5 trillion through 2035, whereas Trump’s middle estimate adds $7.5 trillion.

On the low end of the range, Harris adds nothing while Trump adds $1.45 trillion.

And on the high end, both candidates deliver an enormous hit to the national debt, which is at about $35.7 trillion. Also, it costs more than a trillion dollars in interest payments to maintain the current debt load.

I want to bring in Mark Goldwein, Senior Vice President and senior policy director at the Committee for a Responsible Federal Budget. Mark, I just want to start off, if you could give me the top-line takeaway from this massive analysis.

Marc Goldwein: Sure. Well, the bottom line is that we are already adding tremendously to the national debt under current law, and both candidates would make that even worse, especially President Trump. We find that President Trump would add seven and a half trillion to the debt in our base case analysis, and vice president Harris would add 3.5 trillion to the debt.

Simone Del Rosario: Why should voters care about the debt?

Marc Goldwein: Look, debt is eating our our income growth. Debt is what causes inflation, what causes high interest rates, and what causes interest payments to now be the second largest government program, larger than defense, larger than Medicare, and leaving less room for us to invest in just about anything else.

Simone Del Rosario: So your your middle estimates for both candidates show that Harris would add about three and a half trillion to the debt over the next decade. Trump would add seven and a half trillion in debt. What are the policies that are specifically adding to the debt for these two different candidates?

Marc Goldwein: Yeah, so for vice president Harris, it it’s extension of some parts of the tax cuts from 2017 it’s a very big child tax credit, and then it’s a bunch of spending on everything from paid leave to childcare to long term care to preschool, partially paid for with taxes on the rich and on corporations. For President Trump. It’s mostly just a lot of tax cuts. We have a full extension of that tax cuts and Jobs Act, getting rid of the cap on the stall deduction, no taxes on tips, no taxes on overtime, no taxes on Social Security benefits. And then on top of that, deportations and higher spending on defense, again, partially offset, mainly with tariffs, but in neither case are those offsets covering the costs.

Simone Del Rosario: Do your tariff estimates also include that 60% tariff on China?

Marc Goldwein: We do. Our central estimate assumes that there’s a 10% universal tariff. It’s 60% on China, and in addition, there’s some retaliatory tariffs on a one off basis. But the important thing with these tariffs is, if they work as intended, they will reduce trade, and so they don’t raise as much revenue as you might think. You know, just taking 10% of all of our imports, for example, yeah,

Simone Del Rosario: Although Trump on the campaign trail and at the Economic Club in New York, he has said that his tariffs are going to be paying for all of these tax cuts. So your analysis clearly points to something different.

Marc Goldwein: That’s right, the tariffs could pay for some of the tax cuts, but they’ll barely cut. They’ll barely cover the no taxes on tips and no taxes on overtime. They aren’t going to cover, you know, the 8 trillion plus of tax cuts that President Trump is proposing.

Simone Del Rosario: And then, on the other hand, Marc, there is no guarantee that a potential president Harris would get those tax hikes on the rich that she’s looking for.

Marc Goldwein: That’s right. Look, in both the cases, these are highly speculative, because we’re analyzing what they’re calling for, not what will actually happen in the real world. These offsets are hard. It’s hard to get taxes on the rich, taxes on corporations, tariffs, lower drug prices. It’s also hard to get some of the spending. So these are not predictions of what will happen. These are estimates of what would happen if the candidate’s plans were enacted in full.

Simone Del Rosario: So what should voters do with this information?

Marc Goldwein: They should demand offsets. Look, a debt is just tax on future generations. It’s a huge burden in terms of slower income growth, higher interest rates, higher inflation. And we need the candidates to be paying for their promises, and if they can’t, we need those promises to be scaled way back.

Simone Del Rosario: What aren’t you hearing from the candidates that you wish you were hearing at this point in the race?

Marc Goldwein: Social Security is nine years from insolvency. I’m not hearing a plan from either candidate to prevent that 21% across the board, cut that’s scheduled to happen under current law.

Simone Del Rosario: And peel back the curtain for me a little bit and just explain how you guys went about this analysis. I assume it took you a very long time to do so.

Marc Goldwein: Right. So look, we went through painstakingly for both candidates websites, through their platforms, through their speeches, we talked to the campaign staff, we looked at news articles, and we tried to discern what are official campaign policies, how do we interpret them, and how much do they cost? And each step of the way, we need to make a lot of choices, which is why we have a low cost estimate and a high cost estimate reflecting the range of possibilities, along with our central estimate. This was, you know, I have to give credit to I have an amazing staff that put many, many, many hours into this over the last year, estimating every last policy, including policies that didn’t even make it to the finish line because they were rejected or because they were the. Policies from the Biden campaign that didn’t make it over to the Harris campaign, but it’s an incredible amount of work, and I recommend you checking out the report@crfb.org it’s it’s pretty lengthy, but we have a short summary at the front that I think gives all the most important details.

Simone Del Rosario: And here at straight arrow news. We’re about unbiased, straight facts. We like to bring nonpartisan information to people so that they can decide for themselves as they get ready to vote in this upcoming election. Talk to me whether you know. How should people interpret these findings? Are they at all partisan?

Marc Goldwein: Look, we don’t endorse a particular candidate, and we didn’t go in this trying to come up with a particular outcome. This is just the math. We looked at the candidate’s plans, and this is what we think they would add to the debt. You then need to weigh that against the benefits of whatever the tech candidates are offering. So one voter might say, sure they add a trillion dollars to the debt, but it’s for this very important policy, or sure they balance the budget. Neither of them do, but let’s say they did, but they do in this awful way. So fiscal policy, how much they add to the debt should be just one consideration among many. I happen to think it’s a pretty darn important one, because our debt is headed to the largest share of the economy it’s ever bid. We’re head to record levels of debt. And I do fear we have a debt crisis on the on the horizon if we don’t do something. But you need to vote based on on what matters most to you, and this information is just meant to inform your decision, not to dictate it.

Simone Del Rosario: Well, I want to thank you and your team for your analysis. Mark goldwein, Senior Vice President and senior policy director at the Committee for a Responsible Federal Budget, we rely on you guys often to get the straight facts when it comes to how these policies impact our debt and impact our country. So thank you so much Mark.

Marc Goldwein: Thanks for having me.