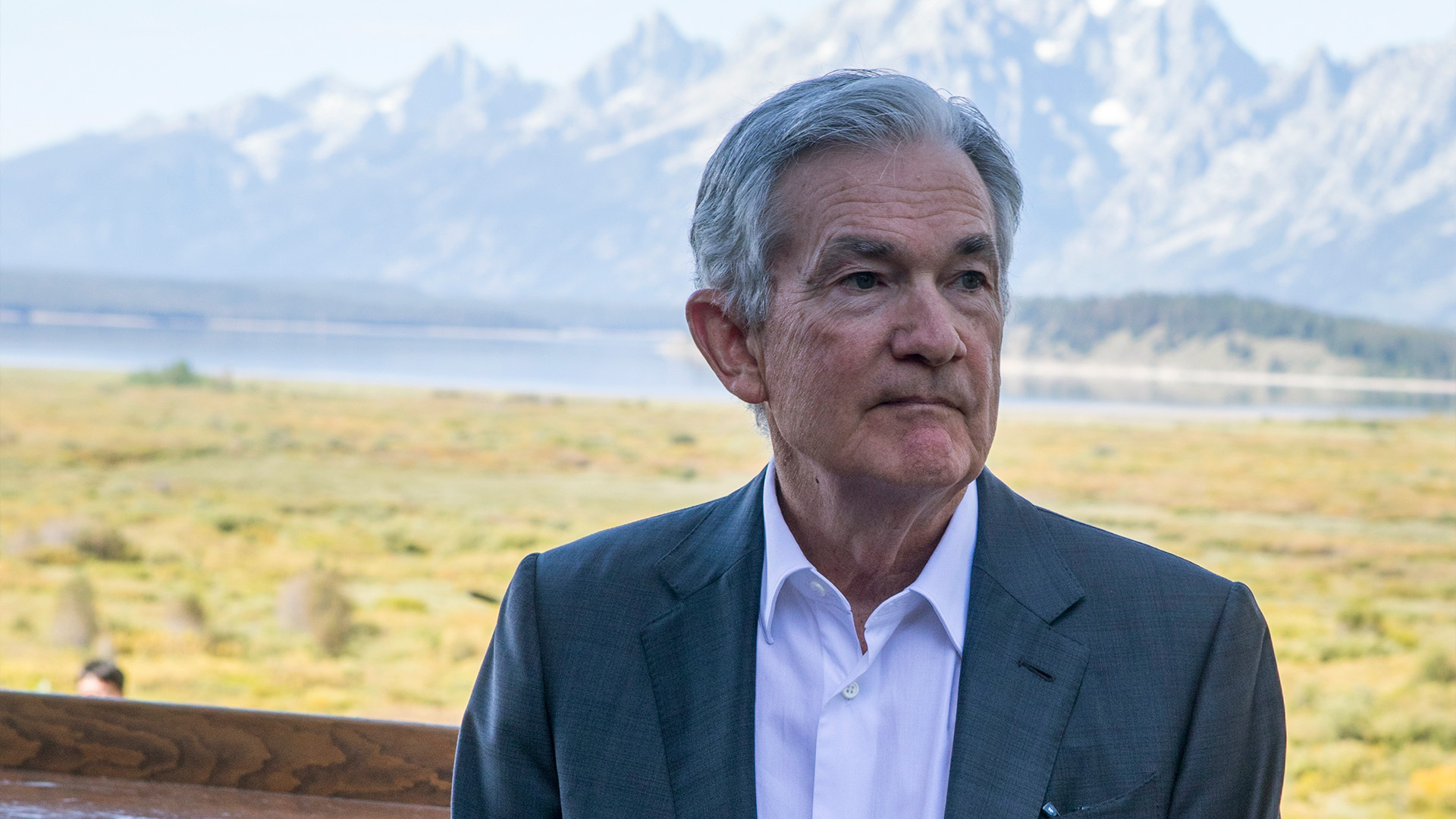

Simone Del Rosario: Jackson Hole, Wyoming, is known for its temperate summers, but Federal Reserve Chair Jerome Powell is probably feeling the heat turn up a bit ahead of his most-anticipated speech of the year.

Powell will speak Friday at the Kansas City Fed’s annual economic symposium at Grand Teton National Park.

Central bankers, policymakers, and investors around the world will be glued in for Powell to signal he thinks inflation has come down enough for a rate cut next month.

The elusive soft landing is on the line, especially in light of news the labor market is taking a turn.

Kathleen Hays: This is his opportunity to send us a clear message on some aspect of what the Fed is thinking about. He doesn’t have to do that. I don’t think it’s going to be just looking at the economy and inflation. He’ll probably put this in a bigger context. At the same time I think people are going to be waiting for him to just give us a little more guidance on where you’re leaning now.

Simone Del Rosario: On Wednesday, we did get the minutes from the Fed’s last meeting in July, where the Fed decided to keep rates the same two days before a disappointing jobs report rocked people’s views of the labor market.

The vast majority of people in that meeting expressed that it would likely be appropriate to cut rates in September. That said, several made comments that they could have also gotten behind a cut in July, which didn’t happen.

And here’s the kicker: Many participants noted that reported payroll gains might be overstated, and some noted the easing labor market faced a higher risk of more serious deterioration.

And here’s what happened after that meeting: Two days later, the latest jobs report showed the unemployment rate spiked up to 4.3% from 4.1%. Stock markets around the world had a bit of a field day with that one. A recession indicator called the Sahm Rule triggered. Some people called for the Fed to step in and make an emergency rate cut, an idea that others smacked down as ridiculous.

And then, this week, we got confirmation that payroll gains have been drastically overstated, just as many of those Fed members suspected.

Danielle DiMartino Booth: Since January of 2023, we’ve seen one downward revision after another to the data. It’s become systematic.

Simone Del Rosario: The latest Labor Department revision shows the U.S. economy added 818,000 fewer jobs than previously reported over 12 months ending March 2024.

That’s about a 30% hit to what we thought the economy added. It doesn’t mean those jobs were lost, it means they were never there in the first place. Therefore, while the labor market was still strong over those 12 months, it wasn’t on quite the tear we were told it was.

It’s worth noting, these estimates will not be finalized until February 2025.

Danielle DiMartino Booth: And it takes a lot of time for the Bureau of Labor Statistics data to work its way into subsequent revisions for the Bureau of Economic Analysis data for GDP.

Simone Del Rosario: All of these moving parts are putting the Fed’s soft landing scenario at risk. A soft landing is being able to come down from too-high inflation without triggering a recession.

Inflation has come down quite a bit. The Fed’s preferred inflation measurement is at 2.6%, pretty close to its 2% target. And the softening labor market is all the more reason to act.

In Powell’s speech Friday, listeners will hope to hear from him that a soft landing is still in sight.

Kathleen Hays: We know the Fed’s going to be cutting rates. We know they’re going to normalize. So it’s more of a question of when and how much and how fast.

Simone Del Rosario: Complicating matters is the upcoming election. The Federal Reserve is a politically independent body and they would never want to be seen as carrying water for one party or another.

There is only one meeting before the election, that’s the September meeting. Taking politics out of it, most economic signs point to the need to cut rates in September. But that will likely give the economy a boost, and that’s why in an interview with Bloomberg, Donald Trump says cutting before the election is “something that they know they shouldn’t be doing.”

The next Fed meeting starts the day after Election Day, but don’t expect the Fed to wait that long with the labor market showing these cracks.

We’ll bring you the biggest takeaways from Powell’s speech Friday, so download the Straight Arrow News app and enable notifications so you don’t miss it.