Simone Del Rosario: Taxpayer-funded sports stadiums, deal or no deal? In two days this week, two cities committed nearly $1.5 billion in public money to keep their NFL teams in town.

But did taxpayers get a say? In both Charlotte and Jacksonville, city councils made the calls.

Charlotte committed $650 million in taxpayer dollars for stadium renovations to keep the Panthers in town for the next 20 years.

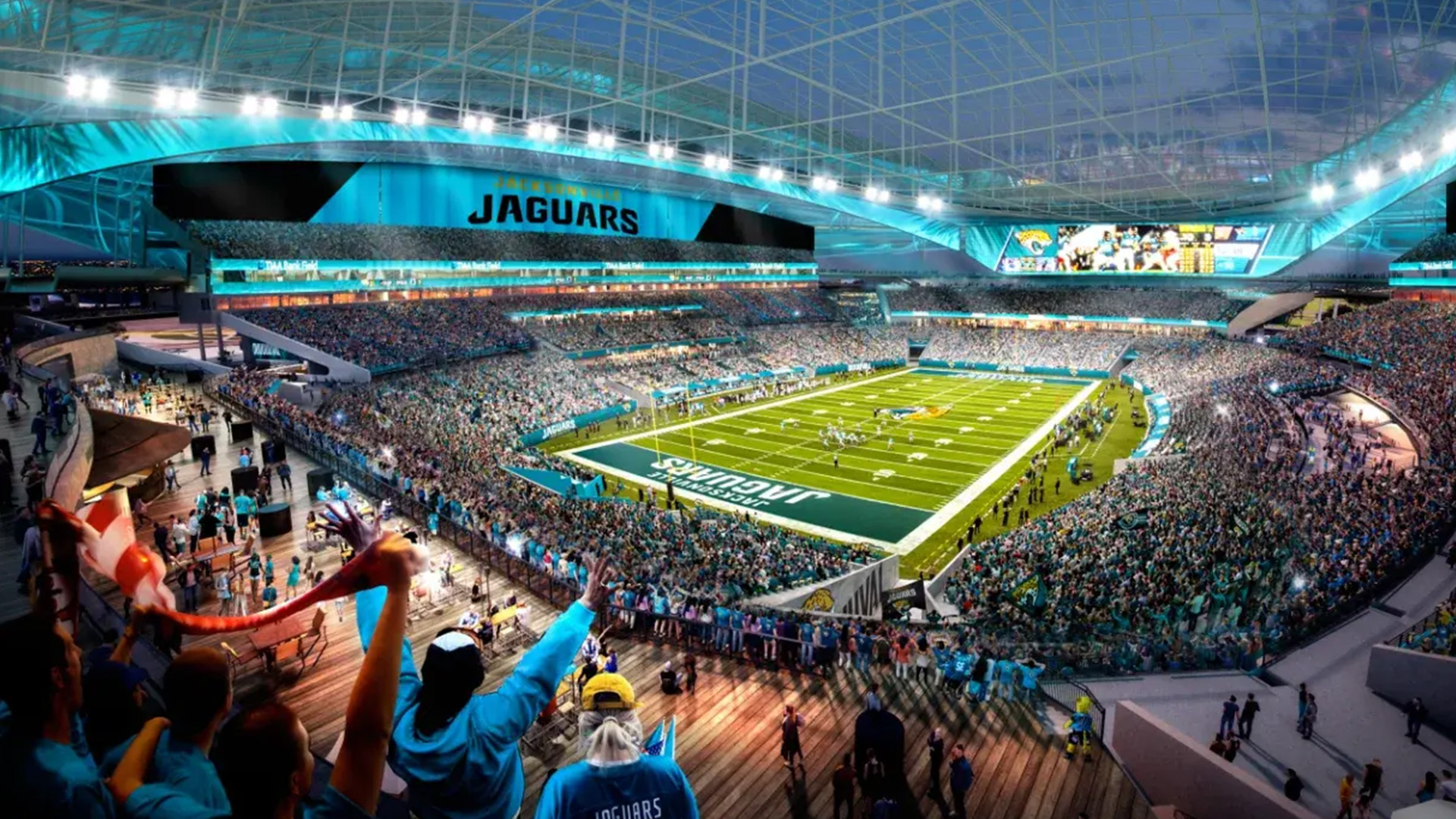

While Jacksonville city council is giving $775 million in public funds to renovate the Jaguars EverBank stadium. That’s in exchange for a 30-year commitment to squash those pervasive relocation rumors.

Victor Matheson: The entire city council of Jacksonville can fit in the owner’s box. The entire electorate of Jacksonville can’t.

Simone Del Rosario: Before the Jacksonville city council voted 14-1 in favor of the funds, Jacksonvillians stepped up to the mic.

Jacksonville resident: Many of us who came out here today took off work just to tell you how repulsed we were about this new stadium.

Jacksonville resident: Not one dime is going to the community that this proposal was made around. It’s shameful.

Simone Del Rosario: While Jacksonville’s mayor sang a different tune.

Jacksonville mayor Donna Deegan: We can reach historic generational progress when we focus and we work together for a singular goal. Together.

Simone Del Rosario: But does it do what she said…create generational progress? The numbers don’t lie, we’re talking with sports economist and professor at the College of the Holy Cross, Victor Matheson.

The argument to taxpayers, when you put up these levels of public funds for stadium is that the city will get it back in the economic benefit. Do you find that to be to the case?

Victor Matheson: Well, so economists who are not associated with the leagues or the teams have been looking at this, this idea, for over 30 years now, and it is the overwhelming consensus of independent economists that spending money on public stadiums, spending taxpayer money is an extremely poor use of public money. The approximate amount of economic impact you get from stadiums is somewhere between zero and very low.

Simone Del Rosario: Zero and very low. Would you say that there’s not a single case where public funds for a stadium are worthwhile?

Victor Matheson: So you can probably argue for some level of public funding. It’s a level of public funding that is way below that we were seeing in cases like Jacksonville and Charlotte this year and the amount that are being proposed for other stadium proposals, for example, a new Kansas City stadium for both the Royals and the chiefs. So there is a public role for things like infrastructure, certainly putting in millions, or even 10s of millions of dollars to make sure that people can get to the businesses they want to get to. That’s a core function of government. We can also understand that, to at least some extent, sports teams are a public good that are enjoyed by everyone, not just the fans of the team. So we’ve have studies of that about the feel good effect that a team has. As a matter of fact, we have an academic study on Jacksonville itself, talking about what the feel good effect was back when the original stadium was built, and it was about $30 million so in today’s money, we would probably be, you know, 5070, maybe even $100 million you could justify, but nowhere close to the $600 million In subsidies that we’ve been seeing recently for NFL stadiums.

Simone Del Rosario: Okay, you’ve caught my interest. What is the feel good economics behind it? What goes into that?

Victor Matheson: So feel good economics is you ask people, okay, we know how much people are willing to pay actually, for tickets, because we can actually see those people buy tickets. But what you do is you ask a bunch of people who aren’t season ticket holders who don’t buy jerseys, who don’t go to games. And you say, Well, how much would you be willing to spend in in the way of increased taxes every year just to have this team in town, even if you never plan on going right? So that captures what people who aren’t otherwise paying for the stadium and for the team would be willing to spend, and people fill out basically questionnaires asking those sort of questions. And we see this all over the place and again for Jacksonville, the Jacksonville folks, again, 20 years ago, said that they valued the team, collectively as a city, at about $30 million in terms of value, even if you don’t go to the games, even if you don’t watch the games at home on TV.

Simone Del Rosario: Yeah, and it stretches a lot further, or farther than just the city in question. I was looking into this a little bit more, and especially when public funds are used, and then you add in these like tax exempt bonds, this ends up being federally subsidized, doesn’t it? So someone in Nebraska could be paying for a little piece of a different stadium project that’s nowhere near them.

Victor Matheson: No even it gets even worse, right? So a deal like the Buffalo Bills, it’s not just that someone in Nebraska is paying for the Buffalo Bills. Someone in Boston, who’s a Patriots fan pays for part of the stadium of their arch rivals, someone in Boston who’s a Red Sox fan pays for part of the Yankee Stadium. So obviously, that’s great for the Yankees. Great for the bills, not so great for taxpayers around the rest of the country.

Simone Del Rosario: And Victor. You can explain that phenomena better than I can about why these taxpayers across the country are paying for this too.

Victor Matheson: So sometimes it’s just explicit, right? So sometimes the tax subsidies that you’re getting for billing stadiums are being paid for not just by the city or the county in which a stadium takes place, but might be state subsidies. So that’s pretty obvious, right? So in the case of the Buffalo Bills, about half of the subsidy for the stadium came from New York state money. Most of that money is coming from folks on Long Island. Most of that money is coming from folks in New York City, because that’s where all the money is in New York. It’s not in it’s not in Buffalo, right? It’s not in Albany, it’s not in Rochester. So that’s coming from places outside of upstate New York. The other thing that can happen is if, if a stadium is paid for at least in part, with tax exempt bonds, what that means is that the owners of those bonds are getting a lower interest rate because they don’t have to pay taxes on those bonds. But guess what that means? The federal government that runs on taxes has to collect. Taxes some other place because they’re not collecting taxes on this set of bonds. And a group of economists worked on that a few years ago and published that work and found that the total amount of municipal bond subsidy was in the was in the billions of dollars of subsidies to professional sports teams from regular taxpayers all across the country, whether they have a professional franchise in their state or not.

Simone Del Rosario: Let’s take it back down to the city level here. Why do public funds continue to be used when to your point, independent economics proves that it’s bad economics.

Victor Matheson: One of the reasons is because owners are terrible to their customers, right? And in order to get a get a an opportunity to make more money, they are willing to sell out their existing customers, all of the leagues, all of the big leagues, the NFL, the National Basketball League, Major League Baseball, these leagues have exactly the same number of teams today that they had 20 years ago, which means that what essentially, when you set a fixed number of franchises, that means that gives a lot of leverage to every franchise, because if someone else wants a team, they have to steal it from another city, and Jacksonville was a place that Is that could be very high on the list of franchises that could be stolen. Same thing with Buffalo Bills. These are both small, these are both small metropolitan areas. And there’s probably better other better places in the country to put a team. If you are a regular business, you just open up a new team. There a new shop, there a new business there, right? But if you’re the NFL, you want to extract money out of local taxpayers by threatening relocation of that team, and that’s exactly and explicitly what was done in Jacksonville. The city leaders say we are justifying this, not on economic reasons, but because we are terrified that we’ll lose this team if we don’t give into the extortion of Shaheed Khan, the owner of the Jaguars.

Simone Del Rosario: Yeah, and I’m speaking as a San Diego Chargers fan who dealt with what happens when voters do not approve stadium funds and the team goes.

Victor Matheson: Right, so you lose your team. And that’s that’s San Diego. And of course, the big difference there between what went on in Jacksonville, and what went on in San Diego is San Diego voters had the option to decide what how they wanted to spend their money. And they said, Hey, we love the chargers, but we don’t love spending a billion dollars of our taxpayer money to enrich a billionaire team owner. We’d rather spend that money on, for example, a better Convention Center to keep so that we can continue to have a great comic con. Tony Hawk was there campaigning against the stadium. Said, Hey, you’d rather have that money spent on skateboard parks around San Diego than on a new stadium. And so the voters got a chance, but the voters in Jacksonville didn’t get a chance because the team owners and the city council, they know that these stadium projects are unpopular. The voters in Charlotte also another stadium project that was approved this week, they didn’t get a chance. So it’s taxpayers not getting the opportunity to actually have a say about how their money gets spent. Of course, one of the reasons that city councilors are much more giving of funds than taxpayers. Is the city councilors. They get wined and dined by the team owners. The entire city council of Jacksonville can fit in the owner’s box the entire electorate of Jacksonville can’t?

Simone Del Rosario: I love that analogy, and when they put this issue in front of voters, increasingly, voters are saying, No, we’re seeing that in Kansas City right now. Voters rejected that sales tax for the new downtown ballpark and renovations to arrowhead, and now there’s talk of potentially moving the Kansas City teams over to Kansas City, Kansas. I know a lot of people don’t you know that aren’t familiar with the area. Don’t know that there’s two Kansas cities right next to each other. There, what would Kansas gain by giving those teams the state benefits that they would be looking for?

Victor Matheson: So from a dollars and cents issue, not much the amount of additional economic activity that Kansas will gain because of the chiefs moving across the state line is, by every measure, less than what they will lose in in taxpayers subsidies building that stadium. So this is not a great deal for them. And and again, no one’s considering putting this in front of Kansas voters. They’re only considering putting it in front of Kansas, Kansas lawmakers, again, taking it out of the hands of the taxpayer, putting into the hands of politicians, is what team owners. Team owners want, because it’s a whole lot easier to convince a small number of legislators than it is to convince a large number of taxpayers that you should enrich. Which the already billionaire owners in the NFL or major league baseball or the NBA.

Simone Del Rosario: And who decides whether it goes to vote or it goes to city council?

Victor Matheson: Often, it’s the City Council itself. Alright. Occasionally, you do get things that taxpayer coalitions will force things to go to the ballot but but often, owners will use a tricks to try to keep things off the ballot. So they will call us something, even if it’s a complete uh, demolishing of a stadium and rebuilding a new stadium in the same place you might just keep a tiny bit of the stadium in place. So you can laughably call it a remodeling. And therefore the City Council says, oh, no, no. This isn’t a new stadium project. This is, this is just repairs and maintenance of the addition of the existing stadium. So therefore, this doesn’t have to come before a vote. As a matter of fact, that’s exactly what happened in Chicago when the new Soldier Field was built. At the time, just the rehabilitation of the old Soldier Field cost more than any Stadium in US history, yet they cleverly called it a remodel by keeping a handful of old stone columns from the original stadium in the new design. And therefore it didn’t have to become go before the voters, where it was looking very unlikely like the voters wanted to hand over their money again to a billionaire owner,

Simone Del Rosario: This is a tough topic, because the facts are what they are. You pointed it out. And if you look at a number of research out there, the facts are, is that the the economics of any kind of publicly funded stadium, especially to the tune of hundreds of millions of dollars like we’re seeing in these latest deals, is just not good for the taxpayer. But I’m going to ask us to put on our devil’s advocate hat. What does a stadium project do for the area? There has to be some economic benefit, even if it doesn’t pay for itself.

Victor Matheson: So we do know that stadiums, first of all, they are going to generate some revenue in the area. They just generally don’t generate enough revenue to pay for, you know, the the bond payments on a billion dollar stadium or a $2 billion stadium, they do, generally not in the NFL, but in other in other leagues where you have games more often, such as major league baseball or NBA, they often cause some level of gentrification of the local area around the stadium, and so you know, again, you’ll get you’ll get money being spent at local bars and restaurants, at retail right around in the area. We do know that professional sports are pretty good, actually, at changing where money is spent in a local economy. The problem is they’re just not very good at generating new economic activity in an economy. So either they’re just having people spend money at the stadium or the area around the stadium, rather than in other entertainment options in the area, or they, or they, they serve to have people spend money on football rather than other types of entertainment options.

Simone Del Rosario: I’m glad you brought this up, because then we get to talk about the transfer of wealth that you’re alluding to right now, where research shows that the regional economy remains unchanged if a stadium moved, say, 20 minutes down the road. So it’s just the specific location that gets the boom in economic benefit, but that doesn’t it just it’s flat for the rest of the region, isn’t that, right? So Arlington, you know the ballparks there, or the stadiums there. Sorry, I’m baseball minded.

Victor Matheson: So again, there’s, there’s no doubt that you will have a change in how money is spent in a local area. If you’re in Atlanta, a new baseball stadium in Cobb County really relocates some economic activity out of Fulton County Downtown up to Cobb County, where the new stadium is. It also relocates money within Cobb County from restaurants and bars around the county to a small, more concentrated district called the battery, right around where the stadium is. Same thing happens when the Washington Wizards and the Washington Capitals float the idea of moving out of DC into into Virginia. Again, it doesn’t change the total amount of economic activity that occurs in the metro area, but it does change where some of that spending occurs and and importantly, in the cases both of Kansas and Missouri as well as Washington, DC and Virginia, it changes, you know, the side of a of this imaginary line right from from Missouri to Kansas or from DC to Virginia, which is it does have certainly some economic impact, but again, it’s more changing up who gets the money, not how much money is actually out there.

Simone Del Rosario: We’ve got the Olympics coming up in a month now, and there’s always a lot of conversation where Olympics are being hosted about the investment. That goes into that for certain infrastructure projects, stadiums, etc. And I’m thinking specifically, we just talked to someone who was crucial in getting the 96 Atlanta games there, and he made a really good point that while that was actually largely a privately funded affair, the investment that was made for the Atlanta Olympics wouldn’t have been spent. Otherwise it was something that was done, that infusion of spending in the area was done specifically because the Olympics were coming to town. Can the same argument be made? And I guess do you even agree with that level of the argument that something like the Olympics brings in an infusion of spending that wouldn’t actually be there otherwise, can the same argument be made for stadiums with Jacksonville not be spending $775 million on some other benefit to the city, if it weren’t for the stadium renovations, right?

Victor Matheson: So again, the in the Atlanta case, you did spend, you know, several billion dollars bringing the event there in terms of construction, and you also brought in several billion dollars of tourist money that was part of that. And with all these cases, it’s not as if that tourist money’s not a good thing. This is a little different than the case of of Jacksonville. You know, Jacksonville Jaguars regular season games. Most of the people coming to those games are local residents who are just spending their money there, rather than elsewhere in the Jacksonville economy. When you’ve got a mega event like the Atlanta Olympics or the Paris Olympics coming up, this is bringing new money from the outside into the city. And so of course, that is a benefit to the economy. The question though, is, how much did it cost you to bring that money in? So a typical Olympic Games will definitely bring in for a summer Olympics Games, at least $5 billion of additional spending into the city that hosts them. The problem is, most of the recent summer Olympics have cost in excess of 10 billion to host them. So again, it’s no one’s denying that you’re bringing in a lot of economic activity. The question is, what is it costing you to bring in that activity? And do you get any sort of lasting legacy of a cost? If it costs you more to bring this in than you’re getting right away, do you at least get some sort of legacy out of that? And most of the evidence suggests there’s not a particularly big legacy either, because in the case of the Olympics, no one needs a 10,000 seat swimming pool after the Olympics is done, no one needs a world class track facility or a or a velodrome. After all, the Olympics fans are gone.

Simone Del Rosario: Victor, a lot of gems in this interview. Thank you so much for your time. Victor Matheson,

Victor Matheson: It’s my pleasure. Thank you.