Supreme Court won’t revive Biden’s student loan debt forgiveness plan

By Lauren Taylor (Anchor), Shea Taylor (Producer), Zachary Hill (Video Editor)

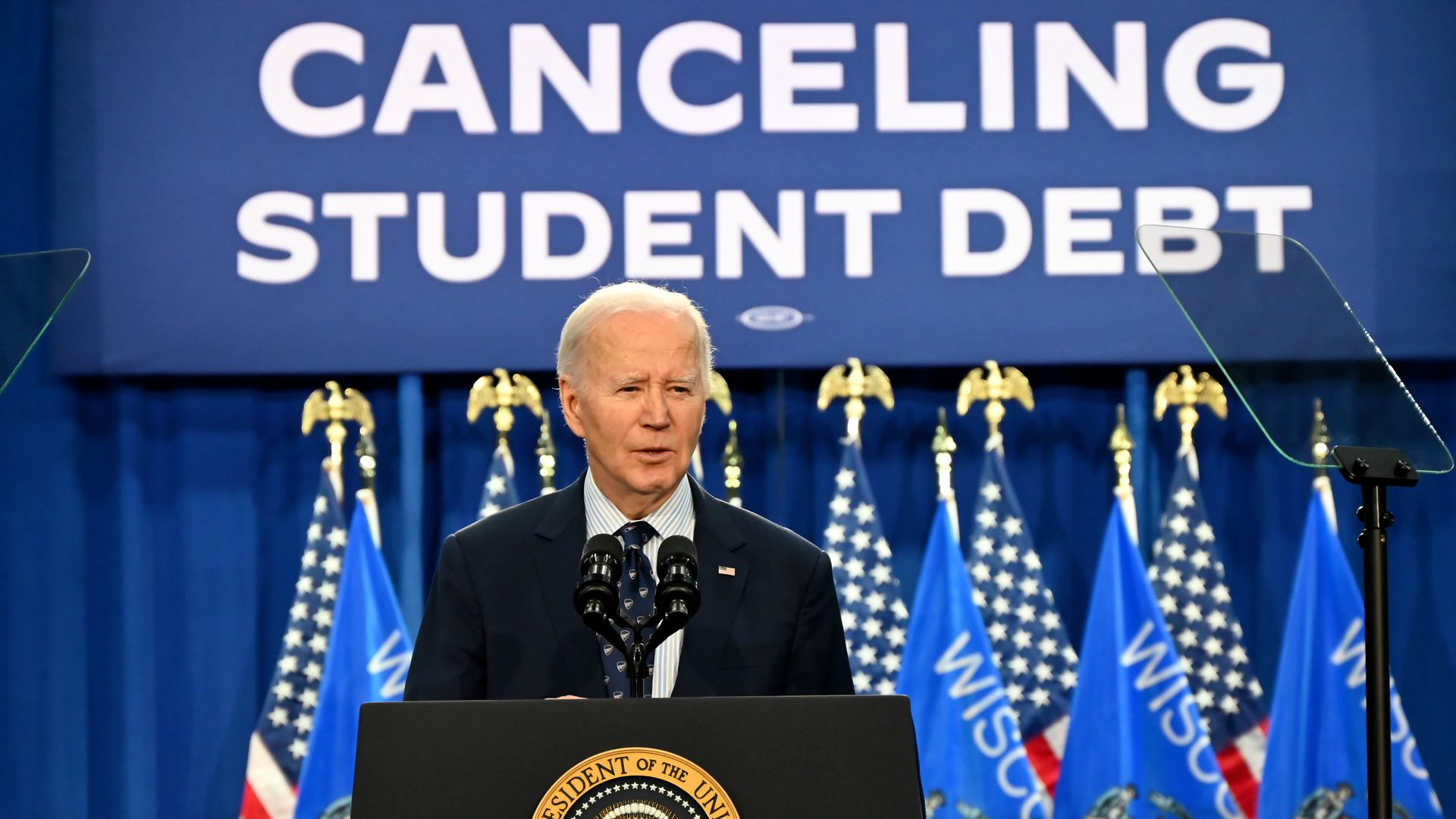

The U.S. Supreme Court dealt a significant setback to the Biden administration’s efforts to provide student debt relief, declining on Wednesday, Aug. 28, to reinstate the SAVE Plan, a key part of the administration’s broader strategy to ease the financial burden on millions of Americans. This decision leaves borrowers in limbo as legal challenges from GOP-led states continue to play out in the courts.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Untracked Bias

The SAVE Plan, rolled out in July 2023, is an income-driven repayment program that lowers monthly payments and offers earlier loan forgiveness for borrowers with smaller balances. Under the plan, borrowers with loans of $12,000 or less could see their debt wiped away after 10 years of payments, a reduction from the previous 20 to 25 years.

Download the SAN app today to stay up-to-date with Unbiased. Straight Facts™.

Point phone camera here

The plan also adjusts the percentage of discretionary income that borrowers must pay from 10% to 5%, with discretionary income redefined to exclude those earning less than 225% of the federal poverty line.

The Supreme Court’s decision to leave an injunction from the U.S. Court of Appeals for the 8th Circuit in place means that the program remains blocked for now. The Education Department had already paused loan payments for those enrolled in the SAVE Plan due to the ongoing legal battles.

This legal struggle follows the Supreme Court’s rejection last year of a more ambitious plan by the Biden administration that aimed to cancel over $400 billion in student loans, affecting more than 40 million Americans. The new SAVE Plan, though less sweeping, still faces fierce opposition, with critics arguing that it effectively forgives loans without proper congressional authorization.

The estimated cost of the SAVE Plan has been a major point of contention. While the Biden administration estimates the plan will cost nearly $156 billion over a decade, critics argue that the true cost could be as high as $475 billion.

[LAUREN TAYLOR]

THE SUPREME COURT DECLINED TO REINSTATE THE BIDEN ADMINISTRATION’S LATEST STUDENT DEBT CANCELLATION PLAN —

LEAVING MILLIONS OF BORROWERS IN LIMBO AS LEGAL CHALLENGES CONTINUE.

THE JUSTICES TURNED DOWN A REQUEST FROM THE JUSTICE DEPARTMENT — TO LIFT AN APPEALS COURT ORDER —

BLOCKING THE “SAVE PLAN” — AN INCOME-DRIVEN REPAYMENT PROGRAM —

DESIGNED TO LOWER MONTHLY PAYMENTS AND OFFER EARLIER LOAN FORGIVENESS.

THE SAVE PLAN IS PART OF PRESIDENT BIDEN’S BROADER EFFORT TO REDUCE THE FINANCIAL BURDEN

ON ABOUT 43-MILLION AMERICANS WITH STUDENT DEBT.

IT COMES AFTER A PREVIOUS PLAN, WHICH AIMED TO CANCEL OVER 4-HUNDRED BILLION DOLLARS IN LOANS, WAS STRUCK DOWN BY THE SUPREME COURT LAST YEAR.

THE PLAN’S ESTIMATED COST HAS BEEN A POINT OF CONTENTION —

WITH CRITICS ARGUING IT EFFECTIVELY FORGIVES LOANS WITHOUT PROPER AUTHORIZATION.

Media Landscape

See how news outlets across the political spectrum are covering this story. Learn moreBias Distribution

Left

Untracked Bias

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

Judge allows CNN lawsuit potentially worth billions to continue

Read17 hrs ago -

Reuters

Reuters

It’s a bird, it’s a plane, it’s the first video of Alef Aeronautics’ flying car

Watch 2:1318 hrs ago -

Getty Images

Getty Images

Democrats in Congress receive lowest approval rating in Quinnipiac poll history

Watch 2:5919 hrs ago -

Getty Images

Getty Images

AG Bondi reviewing Epstein documents for release, could hold client list

Watch 1:4819 hrs ago