SIMONE DEL ROSARIO: IS IT TIME FOR THE GOVERNMENT TO RECONSIDER HOW MUCH OF YOUR BANK DEPOSITS ARE INSURED? RIGHT NOW IT’S $250-K. BUT PEOPLE OFTEN ASSUME ALL OF THEIR MONEY IS SAFE IN THE BANK.

ERIC FOSTER, CO-FOUNDER, WOOP INSURANCE: If you really only believe that you have $250,000, that’s going to be safe in there, not only will you not deposit it, people are not going to spend money nearly as much that money will not be reinvested in the economy, because banks can’t loan it out to other businesses or other people.

SIMONE DEL ROSARIO: SOME ARE CALLING FOR THE FDIC CAP TO BE RAISED. IT WENT FROM 100K TO 250 DURING THE 2008 FINANCIAL CRISIS.

SEN. ELIZABETH WARREN: I think that lifting the FDIC insurance cap is a good move. Now the question is where’s the right number? Is it $2 million? Is it $5 million? Is it $10 million? Small businesses need to be able to count on getting their money to make payroll.

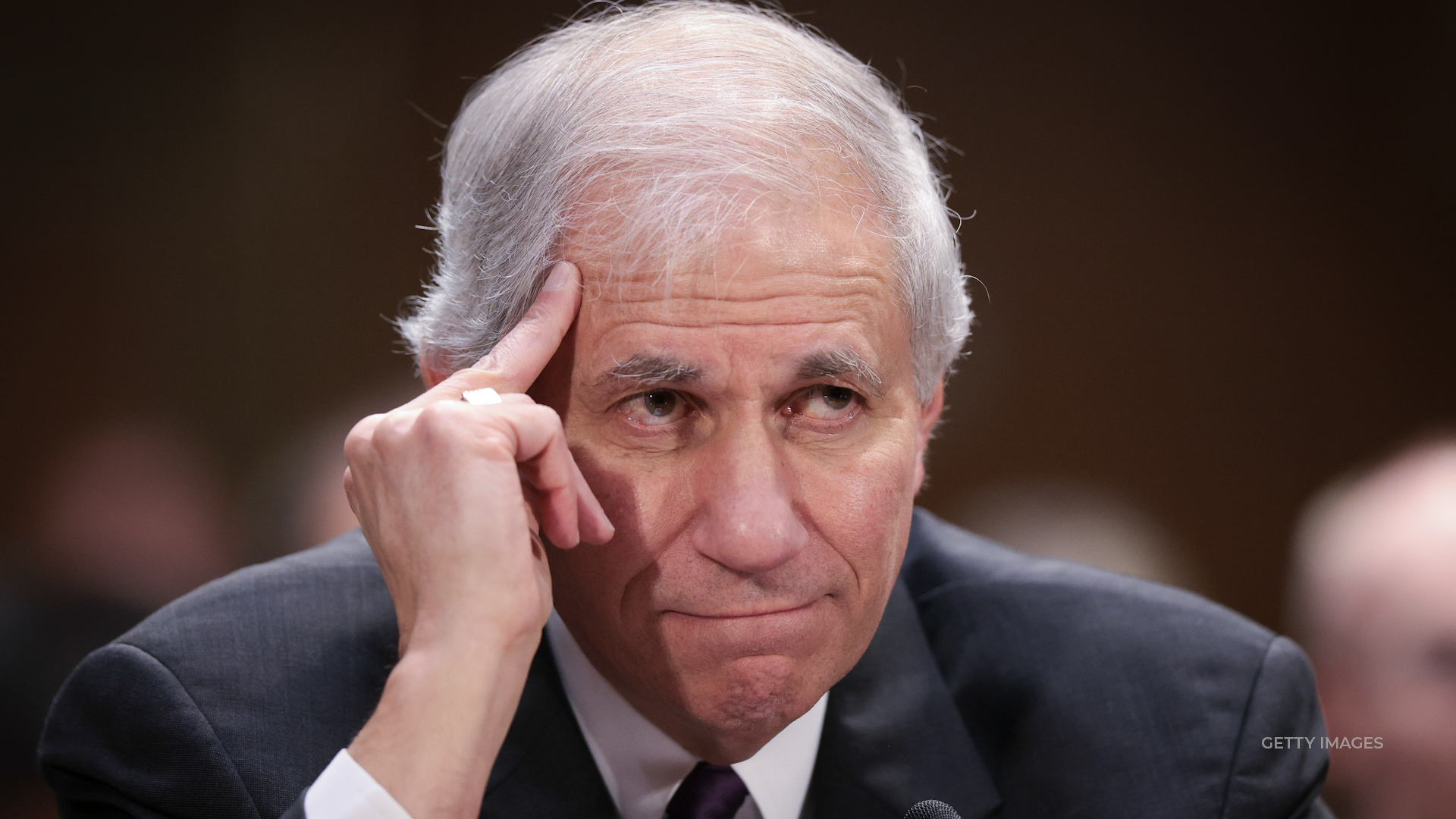

SIMONE DEL ROSARIO: FORMER FDIC CHAIR BILL ISAAC TELLS ME – HE’S NOT A FAN.

WILLIAM ISAAC, FORMER FDIC CHAIR: I think that would be a horrible idea and would destroy the free enterprise system that we have developed and the banking system that supports it.

SIMONE DEL ROSARIO: HERE’S HIS COUNTER PROPOSAL.

WILLIAM ISAAC, FORMER FDIC CHAIR: What we wanted to do was to put full insurance, full 100% deposit insurance on all business checking accounts that did not pay interest. The notion that small businesses need their checking account money available to them at all times, under almost all circumstances is absolutely correct. and it would be a huge benefit to our country or nation and the small business sector of the nation in particular, if we would protect non-interest bearing business checking account.

ERIC FOSTER, CO-FOUNDER, WOOP INSURANCE: Clearly, I’m biased that I’m going to like that proposal, particularly given the current current environment, I would say I don’t think there is, to my knowledge, a downside in doing that.