Simone Del Rosario:

Why do experts think a Trump economy equals a stronger dollar while a Harris economy weakens the dollar? Let’s get into it.

In October, the dollar strengthened on the odds that former President Donald Trump would win the presidency. But as voters head to the polls Tuesday, hedge funds are hedging their bets in currency, no longer as confident in the Trump trade.

Citigroup strategists believe a Trump victory could see the dollar rally 3%, whereas a Harris victory could see the dollar fall around 2%.

So what makes Trump’s plans bullish for the dollar?

Investors believe if Trump wins, his tax cuts and tariffs will push up inflation. Tax cuts would give consumers more disposable income in the near term, while tariffs will make goods more expensive. Both add to inflationary pressures.

If inflation rises, it’s more likely the Federal Reserve will be forced to keep rates higher. The Fed is currently in a rate-cutting cycle as inflation is near its 2% target. Its next rate cut decision comes two days after Election Day.

If rates are higher, the return on U.S. assets is higher and the dollar becomes more attractive.

Tariffs could also decrease global growth and that could attract more investors to safe-haven assets, of which the dollar is one.

While the dollar has strengthened on the so-called Trump trade, the euro, the Mexican peso and the Chinese yuan have weakened as those regions anticipate more tariffs in a Trump presidency.

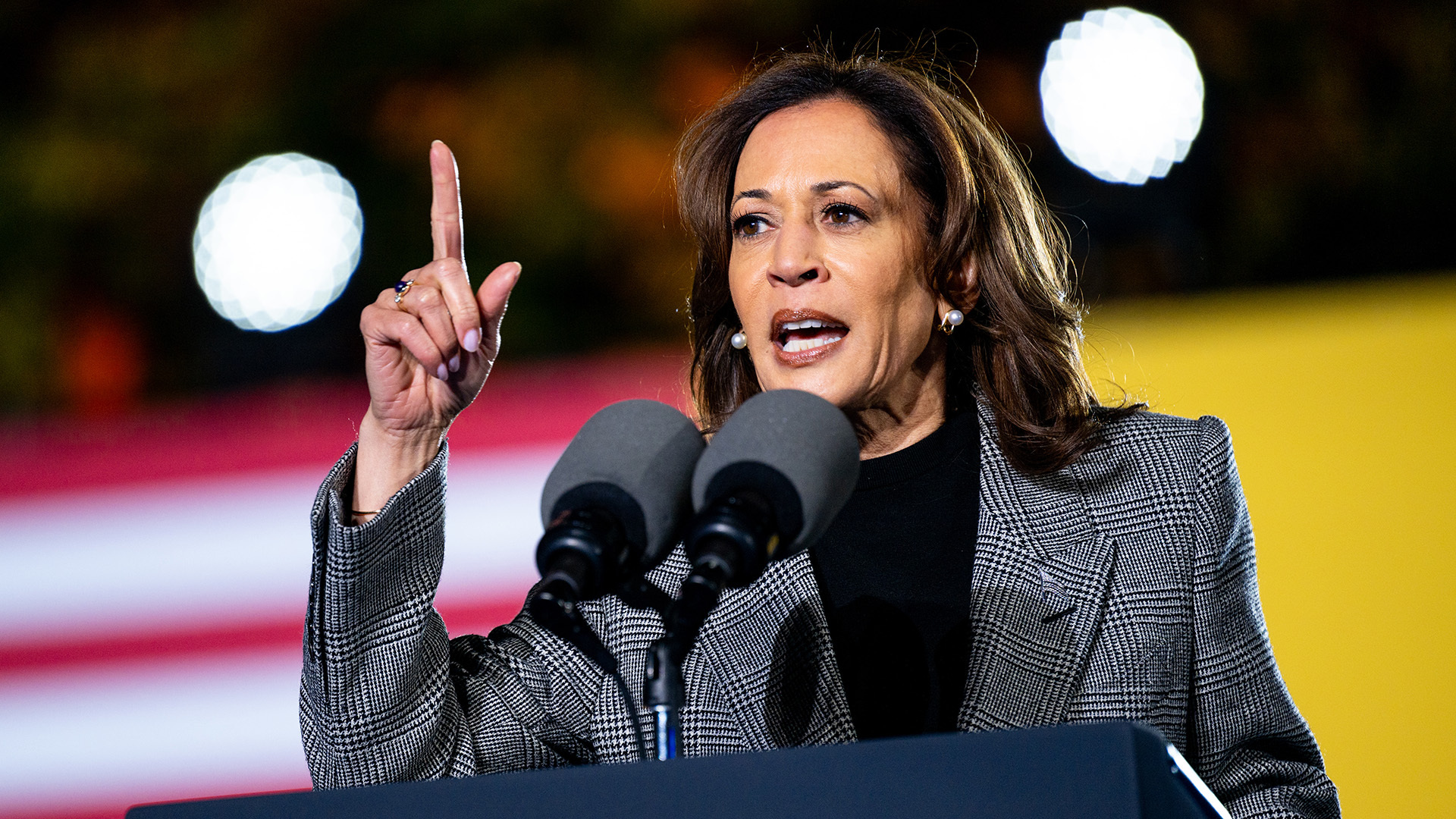

On the contrary, a Harris presidency could weaken the dollar. Traders would be unwinding those Trump bets and tariff concerns would go away. They’d be replaced by new concerns about the potential impact of higher taxes and more business regulations.

Analysts expect the greenback to give up gains made during the Trump trade, while currencies of major exporters to the U.S. could see a boost.

To learn more about what other assets fit into the Trump trade, search “Trump markets” for this story at SAN.com or the Straight Arrow News app.