Seth Harris:

We’re beginning to hear from folks on Wall Street the R word, the discussion of recession. Now, I don’t think that this report tells us that we’re headed for recession. Certainly, the GDP numbers don’t give us any indication that we’re headed for recession. The second quarter, GDP numbers were good, solid numbers, not booming, but very good for this deep into a growth cycle in the United States. So we’re doing fine, but as folks on Wall Street begin to start talking about it, that can become a downward spiral, as it becomes a decision making point for businesses, if you think that we’re going to shrink, if the economy is going to slow and shrink. You don’t invest in hiring people, you don’t invest in capital equipment, you don’t invest in expansion, you don’t invest in inventories. And so that is the concern.

Simone Del Rosario:

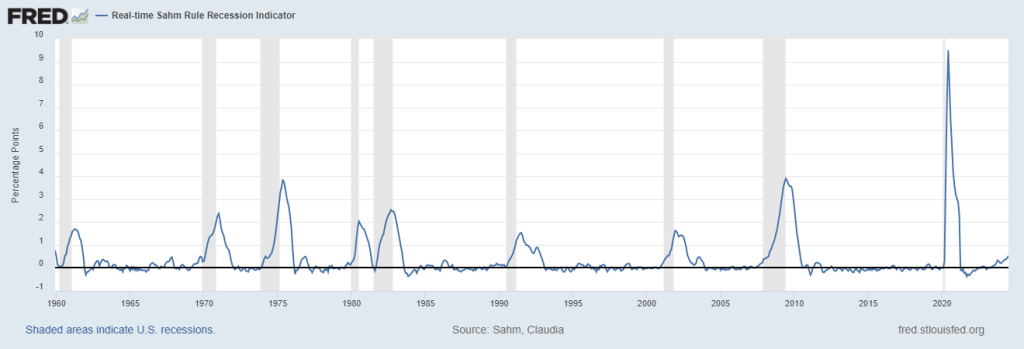

Part of why people want to talk about recessions right now, especially after this report comes out, is because of something called the Sahm rule. I’ll just explain to it really quickly for our audience who isn’t steeped in this. But it was developed by an economist, Claudia Sahm, and it says that the US economy has entered a recession if the three month average of the national unemployment rate has risen by half a percent or more from the previous year low. So at 4.3% on a technical basis, we have triggered the Sahm rule. However, Claudia herself said that the Sahm rule, on its face, is probably overstating the current labor market’s weakness because of everything that’s been happening with our labor market, from the pandemic to a really rapid increase in immigration right now, what do you make of all of this? Because, you know, across the networks, everybody’s going to be talking about the SOM rule today.

Seth Harris:

I think a literal application of Claudia’s rule to this situation is too pessimistic. But I do want to emphasize this very important point, if you don’t see job growth broadly across the economy, as we had for months and months and months, almost every sector was growing for an extended period of time, even a little bit, even if it’s growing just a little bit, then you have an indication that there are challenges in the economy, that some industries are sending a signal that They’re no longer able to grow. They’re no longer able to increase output. They don’t feel that there are markets available out there for what they’re producing. If healthcare is driving job growth, as it is this month but it is driving a meaningful portion of this top line job number. That is not a good sign for the economy. We do want to see health care growth. We need increases in health care services. We also want to hold down prices in health care and to the extent possible, but we need to see growth in sort of the core industries of our economy, manufacturing, construction, retail, leisure and hospitality, transportation and warehousing, and we’re not seeing that. It’s been a couple of months now that we have not seen that those are meaningful warning signs for the economy.

Simone Del Rosario:

I want to turn to the Federal Reserve right now.

If they use their speaking opportunities between now and September to more strongly send that message that, hey, we are where the data tells us we need to be. We need to cut in September. If they start going out there all these governors and saying, Yep, September. It is September. It is wait for September. Will that help?

Seth Harris:

Let me just say we’ve seen a meaningful sell off in equity markets around the world, not just in the United States, but certainly here in the United States over the course of the last several days, and a part of that is recession concerns, which is, in my view, a gross overreaction to what we’re seeing right now. We certainly are not seeing numbers that suggest that a recession is imminent, or the recession is even intermediate term concern. It can be a longer term concern, but I don’t think we can see it as an intermediate term concern. It’s possible that the Fed can calm some of those fears, but as you know, equity traders run as a herd, and they don’t always hear outside influences, but I think they’re going to be looking for it. And Chairman Powell, I think, to his credit, has been quite sensitive to the fact that when he speaks, people actually listen. And so I expect that we’re going to begin to see some indications from governors that they’re rethinking they’re looking closely, they’ll indicate the kinds of things they’re looking at, the kinds of things that are raising concerns. No one is going to say, hey, here’s how I’m going to vote. That’s not how they do things at the Fed, but they are going to begin to give us a sign.

Simone Del Rosario:

We’ve got about a week and a half before we find out what the latest inflation numbers are, and there will be, you know, several different data points that the Fed will get to look at before and during their September meeting. So we’ve heard your final thoughts. I want to just give you an opportunity. Is there anything else that we haven’t talked about yet that you wanted to address at this point?

Seth Harris:

I would just say to those who are listening, because I have a lot less influence than people at the Fed and people in government and actual economists. I’m not an economist. But this is not a crisis. This is not the beginning of recession. This is not the end of the world. This is a weaker report than we had hoped. It is not a bad report, objectively, it is not a bad report. I’ve lived through a lot of really bad reports during my time in government. This is not that. This is a softer than we would like report. It is a warning sign. It is a signal to decision makers that they need to start. Making some hard decisions, but my hope is that folks aren’t going to run into the streets with their hair on fire and and declare the recession is coming. The recession is coming. That is not what these numbers suggest to us, but there is a need to act.

And the Federal Reserve and I would also say employers have should continue to look at their employees, their workers, as the valuable assets that they are. Employers have been hugging their employees tightly over the course of the last several years because they don’t want to have to go into the labor market to find somebody better. They’re not going to find somebody better. They’ve got great workers working for them. They need to listen to their workers, continue to hug them tightly and because I think that we’re going to see a policy response soon.