[JACK ALYMER]

SCHOOL BUSES HAVEN’T CHANGED MUCH IN DECADES.

THE ICONIC BIG YELLOW VEHICLE HAS BEEN AN AMERICAN STAPLE.

BUT THE WAY KIDS ACROSS THE COUNTRY GET TO SCHOOL IS NOW CHANGING.

MORE ELECTRIC SCHOOL BUSES ARE HITTING U.S. ROADWAYS THAN EVER BEFORE.

JUMPING BY MORE THAN TWO HUNDRED PERCENT SINCE THE START OF 20-22.

THERE ARE NOW ELECTRIC BUS COMMITMENTS IN FORTY NINE STATES AND THE E.P.A. PROJECTS THAT BY 20-27 NEARLY A THIRD OF ALL SCHOOL BUSES MADE WILL BE EVS.

THE PUSH TO ELECTRIFY IS BEING FUELED PARTLY BY A FEDERAL REBATE PROGRAM, PUMPING BILLIONS OF DOLLARS FROM THE BIPARTISAN INFRASTRUCTURE LAW INTO SCHOOL SYSTEMS ACROSS THE COUNTRY.

THE GOAL – TO REPLACE EXISTING FLEETS WITH ZERO-EMISSION MODELS.

[KAMALA HARRIS]

“I’m so excited about these electric school buses. And when I think about what we have been able to do through the infrastructure law, what it means is that we have now invested and that’s the announcement today $5 billion over the next five years.”

[JACK ALYMER]

TO KEEP UP WITH GROWING DEMAND, ONE OF AMERICA’S OLDEST SCHOOL BUS MANUFACTURERS, BLUE BIRD, IS EVOLVING.

THE COMPANY IS CONSTRUCTING A NEW EV BUILD-UP CENTER WHICH THEY SAY, WILL INCREASE PRODUCTION CAPACITY FIVE-FOLD.

THIS WOULD ULTIMATELY ALLOW BLUE BIRD TO OUTPUT AROUND FIVE THOUSAND ELECTRIC BUSES A YEAR.

[PHIL HORLOCK]

“This is our new zero emission electric school bus. It is extremely quiet. It has plenty of power. We even had to install a noise generator to emit some type of noise because it is super quiet. Phantom power and you’ll be amazed.”

[JACK ALYMER]

THE COMPANY’S CEO SAYS THEY ARE ANTICIPATING THOUSANDS OF ORDERS FOR THESE VEHICLES – WITH AN ESTIMATED VALUE OF ONE BILLION DOLLARS OVER THE NEXT FIVE YEARS.

EXPERTS ARE ON BOARD WITH THE PLAN. CITING A NUMBER OF POTENTIAL BENEFITS COMING FROM THE TRANSITION.

A STUDY BY THE WORLD RESOURCES INSTITUTE FOUND THAT ELECTRIFYING THE FULL U.S. SCHOOL BUS FLEET BY 20-30 WOULD SIGNIFICANTLY REDUCE GREENHOUSE GAS EMISSIONS.

THE AMOUNT WOULD BE EQUIVALENT TO TAKING TWO MILLION CARS OFF THE ROAD.

EACH ELECTRIC SCHOOL BUS PRODUCES LESS THAN HALF THE EMISSIONS OF THEIR DIESEL OR PROPANE-POWERED COUNTERPART.

[KEVIN MATTHEWS]

“When you convert that to zero emissions, the air quality improvement is even significantly higher. So the overall benefits are quite high for the environment for the children and for the communities where the school buses operate.”

[JACK ALYMER]

THERE ARE ALSO FEWER HEALTH RISKS WHEN COMPARED TO THE MORE THAN FORTY TOXIC AIR CONTAMINANTS COMING FROM THE EXHAUST FUMES OF DIESEL BUSES.

[MICAEL REGAN]

“It’s good for the children because they’re breathing cleaner air. And it’s good for the parents because they can feel good sending their kids to school, knowing that one child or their children might have one less asthma attack because they’re not exposed to diesel pollution. So this is a win win win.”-EPA Administrator Michael Regan

[SCOTT BUXBAUM]

“Our students riding on the buses, our staff driving the buses, you know, right now, there’s pollution everyday coming in on our diesel fleet … Electrification is where it’s going.”

[JACK ALYMER]

ACCORDING TO THE ELECTRIC SCHOOL BUS INITIATIVE, THEY SAVE SCHOOL DISTRICTS MONEY TOO.

A REDUCTION OF SIX-THOUSAND DOLLARS A YEAR ON AVERAGE OPERATIONAL COSTS.

[TIMOTHY SHANNON]

“Clean air, zero emission electric school buses after running them for over two years, we have found significant reduction in cost of operation, about 80% reduction in maintenance costs. Overall, the running of electric vehicles is much less expensive than running a diesel vehicle.”

[JACK ALYMER]

BUT THE PLAN IS NOT WITHOUT ITS CRITICS.

OPPONENTS SAY A MASS ADOPTION OF ELECTRIC SCHOOL BUSES JUST ISN’T PRACTICAL.

WHILE MAINTENANCE COSTS FOR E-VS ARE LOWER THAN THOSE OF COMBUSTION ENGINE BUSES – THE UPFRONT EXPENSE IS 3-TO-4 TIMES HIGHER.

THAT PUTS THE PRICE TAG OF A NEW BIG YELLOW BUS AT AROUND THREE-HUNDRED-AND-FIFTY-THOUSAND TO FOUR-HUNDRED-FIFTY-THOUSAND-DOLLARS.

THE RANGE OF THESE E-V BATTERIES IS ANOTHER FACTOR.

THEIR AVERAGE RANGE – CAPPED AT AROUND ONE-HUNDRED-MILES.

AS IF FIELD TRIPS WEREN’T HARD ENOUGH FOR BUS DRIVERS.

RURAL COMMUNITIES ARE ALSO VOICING CONCERNS.

THE SCARCITY OF EV CHARGERS AND THE TOLL ELECTRIC SCHOOL BUSES WOULD TAKE ON THEIR LOCAL POWER GRID – ARE TOP OF MIND FOR MANY.

[ROBERT AUTH]

“I’d be all for this if the technology was ready to roll, and to transport our children safely in the cabins, back and forth to school …It’s not working properly at this time, the technology is not there yet to be implemented.”

[JACK ALYMER]

OFFICIALS ARE HOPING GOVERNMENT FUNDING WILL HELP CLEAR THESE HURDLES, BY MAKING CHARGING TECHNOLOGY MORE WIDELY AVAILABLE AND BY REDUCING THE COSTS FACED BY SCHOOL DISTRICTS.

[SUE GANDER]

“What … the bipartisan infrastructure act … did was create a new $5 billion Clean School Bus program. One half of that funding 2.5 billion is dedicated solely to funding electric school buses infrastructure.”

[JACK ALYMER]

AND THE CLOCK IS TICKING TO FACE THESE CHALLENGES.

THERE ARE DEADLINES ACROSS THE COUNTRY, WITH MANY MANDATING A PUSH TO PURCHASE ONLY ELECTRIC SCHOOL BUSES GOING FORWARD.

SO WHILE WHAT’S UNDER THE HOOD COULD BE CHANGING QUICKLY, AT LEAST THE ICONIC YELLOW PAINT JOB SEEMS TO BE HERE TO STAY.

Why is Argentina’s economy so bad? Does Javier Milei have the answers?

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below. Learn more about this dataSimone Del Rosario: People in Argentina are ready to take a chainsaw to their economy. You may have heard a little about who they just elected president. Javier Milei is a shaggy-haired, rockstar-esque, eccentric economist who fashions himself an anarcho-capitalist.

People call him Argentina’s Trump, but President Trump never destroyed the U.S. Central Bank. Milei has said he wants to blow up the country’s central bank, but that’s not all. He’s vowed to shutter entire government agencies and trash the Argentine peso, with hopes of making the U.S. dollar the national currency.

Javier Milei: This is not a task for the lukewarm, not a task for the cowardly, and much less for the corrupt.

Simone Del Rosario: And after years of calling those in Congress corrupt, Milei doesn’t have a ton of friends there, which’ll make it hard to pass his more extreme policies.

Give ‘Em Hell, Harry: You want a friend in this life, get a dog.

Simone Del Rosario: Advice Milei takes to heart. He cloned his beloved former dog, Conan, producing five genetic matches. The English mastiffs, he says, are his children and his political advisers.

Argentina man: I personally didn’t vote for him because I felt it was like a leap into the void. God willing he surprises us.

Argentina man: Between the two options, I think the best one was him. Milei comes from the outside, so he convinced me more.

Javier Milei: With me, the decline ends and we regain power. Long live freedom, damn it.

Simone Del Rosario: So why did Argentina’s voters overwhelmingly elect a man who’s promising to blow up the economy? Probably because it’s been a disaster for decades.

Laurence Kotlikoff: Did Argentina ever have a single crisis that put it down, you know, produce a great depression or lead everybody to leave the country? No, it’s been a series of many crises through the years.

Simone Del Rosario: A century ago, Argentina was one of the wealthiest countries in the world. Rich in natural resources. Fertile land. On parity with the United States.

Laurence Kotlikoff: Argentina, in 1920, had 85% of our per capita GDP. They were almost as rich as we are. Today, they have 14%. It’s all due to running these policies over a century. So this is a slow train wreck.

Simone Del Rosario: A train wreck many economists say started under Juan Domingo Perón. A three-time populist president first elected in 1946 who ruled on socialism with a side of fascism.

Perón drastically expanded social welfare programs, nationalized industries, monopolized foreign trade, and pushed wages higher.

As a result, growth in Argentina paled in comparison with countries it once competed with. The peso lost value. And inflation took hold.

Though Perón was eventually overthrown in a military coup, Peronism persisted. Perón was even brought back from exile for a third term. And Peronist candidates have largely dominated the political landscape.

Argentina woman: I am a Peronist, and whoever is the Peronist candidate, I will always vote for Peronism.

Simone Del Rosario: Milei’s opponent, Sergio Massa, was the Peronist candidate in the presidential race. And voters this time resoundingly rejected those ideals.

Try shopping within your budget in Argentina when prices literally change by the day.

Argentina woman: Whatever you buy one week, the next it will be priced differently.

Simone Del Rosario: Think inflation in the U.S. is bad? While the U.S. peaked at around 9% this cycle, people in Argentina are looking at 143% in annual inflation, with the central bank predicting 185% by the end of the year. That’s not a fat finger error. Argentina is living through triple-digit inflation, among the highest in the world.

Despite generous government subsidies, 40% of the population lives in poverty. Meanwhile, the value of Argentina’s currency continues to plunge.

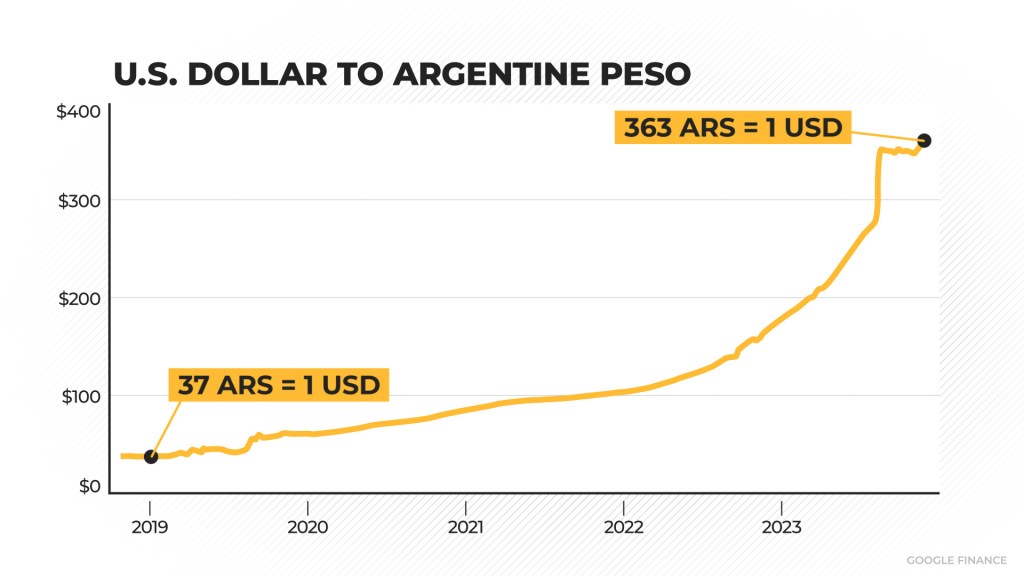

Five years ago, 37 Argentine pesos could buy one U.S. dollar. Today, it takes more than 360 pesos to make the same exchange.

With no faith in their own currency, people in Argentina literally stash U.S. dollars under the mattress for safekeeping, knowing any pesos they hold will rapidly lose value.

Many turn to the black market to buy elusive dollars, which in October went for nearly three times the listed exchange rate.

Here’s a country that boasts the second-largest economy in South America, behind Brazil. The World Bank sees it as a nation with significant opportunities. But they’ve been out of balance for decades.

Argentina has defaulted on its debt nine times. The last three have happened since the year 2000. Who would lend money to a nation that can’t pay its debts? Argentina is by far the biggest debtor to the International Monetary Fund, with about $44 billion in outstanding debt.

Stephanie Kelton: Countries like Argentina and Venezuela and a whole host of other countries, for in many cases very understandable reasons, take on debt that is denominated in currencies that are not their own. So they get loaded up with debt, they get IMF loans and the rest of it. Some countries just don’t have much of a choice. They don’t have domestic energy resources, they don’t have access to food and medicine and technologies, they’ve got to import these things. And to get those real resources they often have to acquire so-called hard currencies, they need the U.S. dollar or the euro or the pound. So they get indebted in currencies that they can’t issue. And then it’s no surprise when, you know, a country like Argentina that can do very well for a period of time because it’s a big exporter of things like soybeans, if soybean prices are very high and rising, well all of a sudden Argentina is doing very well. And then when commodity markets take a tumble and prices come crashing down, all of a sudden, you’re not earning the foreign exchange that you need to service debt that you’ve taken out in other people’s currencies. So you can get a debt crisis in a country like that.

Simone Del Rosario: And this year, with the drought, Argentina’s economy is expected to contract by 2.5%.

Laurence Kotlikoff: We’re kind of Argentina in the making.

Simone Del Rosario: Argentina serves as a cautionary tale for other economies. A scary story told to say, don’t follow this path or you too might end up here. As total U.S. debt flirts with $34 trillion, American economists are quick to compare the fundamentals.

Kevin Hassett: That we’ve increased it so much that for example, our debt relative to our national income, to our GDP, is about 40% higher than it is in Argentina, a country that everybody knows is potentially in trouble.

Simone Del Rosario: Will U.S. spending spiral the country to Argentina’s depths? Economist Stephanie Kelton says there’s one clear difference between an Argentina and the U.S., or even Japan, which holds twice as much debt as the U.S. when compared to the size of their economies.

Stephanie Kelton: Japan, the U.S., the UK, Australia, Canada, these governments are currency issuers, right. They’re not going to run out of their own currency. They never have to borrow it from anyone in order to be able to spend.

Simone Del Rosario: One of Milei’s chief pledges, dollarizing Argentina’s economy, would mean letting another country drive its currency destiny. But doing so would eliminate a lifeline that has for decades fueled Argentina’s inflation: printing pesos to cover the country’s overspending.

The U.S. has no control over whether a country adopts the dollar. And experts doubt Argentina could come up with enough dollars to transition. But the U.S. Treasury has warned countries in the past that dollarizing is not a substitute for sound fiscal policy.

Simone Del Rosario:

The worldwide gaming market is worth about $350 billion. Luxury goods bring in the same. Believe it or not, this odd couple teams up time and time again. Here are some of the biggest gaming-luxury collabs in this week’s Five For Friday.

PlayStation’s paired with Nike in the past, but their work with Balenciaga in 2020 is on another level. Yeah, the shirts and hoodies look kinda basic, but they still fetched $675 and $875 respectively. Consoles were hard to get at the time and these threads cost more than one anyway. Balenciaga kept leaning in, the entire Fall 21 fashion show had a video game motif. They also took items into the virtual world with Fortnite skins.

100 Thieves is a gaming lifestyle brand with Esports teams and a content creation house. The crew includes big gaming names like Nadeshot, Valkyrae and CouRage. In the summer of 2021 they partnered with Gucci for their own branded version of the fashion house’s Off the Grid Backpack. Basically made it red and threw a 100 Thieves logo on it. But the exclusive collection of 200 packs brought in $2500 bucks each. Pretty pricey when you can snag a JanSport for $70. OK Boomer.

In 2019 Louis Vuitton launched a collab with one of the most popular games on the planet, League of Legends. The collection had 40 pieces, most north of a grand, and the most expensive was this $5,600 leather jacket. Outfitting yourself in head to toe Louis V League gear in real life could cost more than $10 grand. For the basement dweller types who haven’t hit luxury rich, a character skin costs 10 bucks in game currency.

When you think speed and video games… you probably think of Sonic the Hedgehog. But don’t count out Mario when he’s behind the wheel of his Kart. Luxury watchmaker TAG Heuer was savvy to this. They partnered with the world famous plumber for 2 models of Formula 1 Mario Kart watches. The “affordable” option went for 43 hundred while the more luxurious model ran you $25 grand. They sold out right away, so the demand’s there.

Pokémon is one of the hottest IPs around. Remember when PokémonGO had folks trespassing trying to catch em all? I do. Pokémon has had a ton of collabs, the latest with Tiffany & Co, which went on sale November 29th. They enlisted Daniel Arsham to design the jewelry using the iconography from his Pokémon art exhibition, A Ripple in Time. The collection features Pikachu-centric jewelry, the most expensive of which goes for $29K. Not to mention the Pokeball in Tiffany blue is absolutely stunning.

YouTuber Logan Paul once bought a Pikachu Illustrator card for more than $5 Milly. Can my husband get anything for this binder of Pokemon cards? No? {dumps binder in trash. effect shows poof of smoke and fire} I better get outta here. That’s Five for Friday. I’m Simone Del Rosario. It’s Just Business.

[Jack Alymer]

YOU’RE LOOKING AT A PROTEST PLAYING OUT ON THE HIGH SEAS.

THIS CONFLICT IN THE PACIFIC IS OVER THE FUTURE OF THE OCEAN FLOOR.

HERE’S WHAT’S GOING ON:

A GROUP OF GREENPEACE ACTIVISTS BOARDED THIS DEEP SEA MINING VESSEL LAST WEEK.

THE SHIP’S GOAL IS CONDUCT RESEARCH ON THE POTENTIAL EXTRACTION OF VITAL RESOURCES USED TO CREATE ELECTRIC VEHICLES.

SO, WHY ARE ENVIRONMENTALISTS PROTESTING IT?

[Greenpeace]

“We cannot transition to a green future by degrading one of the most intact ecosystems on our planet. It’s just complete greenwash, there are other solutions out there that we know exist. And that’s what we should be pursuing, not going forward with another exploitation of our planet, which we know from history leads to nature destruction, increased climate change.”

[Jack Alymer]

GREENPEACE PLACED KAYAKS BENEATH THE VESSEL – EFFECTIVELY BLOCKING RESEARCHERS FROM DEPLOYING EQUIPMENT AND THEN PROCEEDED TO BOARD THE SHIP.

THEY SAY DEEP SEA MINING EFFORTS IN THIS REGION COULD CAUSE HARM TO OVER 5-THOUSAND DIFFERENT SPECIES OF MARINE LIFE.

AND THEY SAY THEY WON’T LEAVE – UNTIL THEIR DEMANDS ARE MET.

[Greenpeace]

“We’re here to say that we want them to leave this area and stop their deep sea mining exploration. Otherwise, we’re going to stay and continue our disruption … we plan to remain here until they leave the area.”

[Jack Alymer]

THE METALS COMPANY, WHOSE SUBSIDIARY RUNS THE SHIP, WANTS TO POSITION THEMSELVES AS A THE WORLD’S LARGEST SUPPLIER OF METALLIC RESOURCES NEEDED FOR GREEN ENERGY INITIATIVES.

THEY SAY THEIR VESSEL IS CONDUCTING LEGALLY MANDATED SCIENTIFIC RESEARCH.

RESEARCH THAT AIMS TO LOCATE SMALL ROCKS ON THE SEABED KNOWN AS POLYMETALLIC NODULES.

THEY CONTAIN A VARIETY OF ELEMENTS – MANY VITAL TO THE PRODUCTION OF EMERGING TECHNOLOGIES LIKE ELECTRIC VEHICLES.

IT’S A POTENTIAL GOLD MINE – SOME ESTIMATES PUTTING THE VALUE OF THESE NODULES IN THE TRILLIONS.

[Gerard Barron]

“This is like a battery in a rock. So we have nickel, we have copper, cobalt, and manganese. And as we know, the world is moving into a more sustainable sort of mood, which means that we want to move away from fossil fuels, and we want to electrify the fleet and use renewable energy. But to do that, we’re going to need a lot of metals. So the question for society is, where are we going to get them from?”

[Jack Alymer]

THE METALS COMPANY’S CEO ESTIMATES THE AMOUNT OF NODULES FOUND IN JUST A FRACTION OF THE PACIFIC OCEAN’S SEAFLOOR COULD POWER ABOUT TWO-HUNDRED-EIGHTY-MILLION EVS.

TO PUT IT IN PERSPECTIVE – THAT’S NEARLY THE NUMBER OF *ALL CARS CURRENTLY ON THE ROAD IN THE U-S.

STUDIES HAVE FOUND EXTRACTING RESOURCES FROM THESE NODULES WOULD BE LESS HARMFUL TO THE PLANET THAN IT WOULD BE TO MINE THEM ON LAND.

[Gerard Barron]

“There’s no rain forests to destroy in our area. There’s no risk of any child labor or human rights violations. And there’s no impact on sequestered carbon … I think when we look at all of those aspects, we have to give ocean metals the chance it deserves.”

[Jack Alymer]

BUT GREENPEACE MAINTAINS THE RISK IS STILL TOO GREAT.

[GREENPEACE]

“Over 800 scientists have signed an open letter from 44 different countries around the world saying that so little is known about these areas, that we can’t just go in and start extracting and destroying an ecosystem that we know so little about.”

[Jack Alymer]

SCIENTIFIC EXPERTS CONSULTED BY GREENPEACE SAY THERE’S STILL NOT ENOUGH INFORMATION TO JUSTIFY THE SPEED IN WHICH THE METALS COMPANY IS MOVING AHEAD.

GREENPEACE TELLING STRAIGHT ARROW NEWS, “DEEP SEA MINERS HAVE NO CREDIBILITY AND ARE SHOWING THEIR TRUE COLORS, USING THE EXACT SAME TRICKS AS THE OIL INDUSTRY TO WREAK DAMAGE ON OUR PLANET WHEN IT HAS ALREADY HAD FAR TOO MUCH.”

IT’S AN ASSERTION THE METALS COMPANY HAS CHALLENGED, SAYING “GREENPEACE’S ACTIONS TO STOP THE SCIENCE SUGGEST A FEAR THAT EMERGING SCIENTIFIC FINDINGS MIGHT CHALLENGE THEIR MISLEADING NARRATIVE ABOUT THE ENVIRONMENTAL IMPACTS OF NODULE COLLECTION, AS OUR DATA HAS JUST BEGUN TO DO.”

[Gerard Barron]

“Greenpeace don’t agree with me, they would rather we not start a new extractive industry in the ocean … And ocean health is of course one of the very important issues but there are other issues that need to be taken into account. And resource is one of them. This resource is like having three tier one world class assets combined.”

[Jack Alymer]

THE COMPANY ALSO CRITICIZED GREENPEACE FOR HOW THE GROUP CHOSE TO PROTEST, ACCUSING THE ACTIVISTS OF PUTTING ALL THOSE ON BOARD THE MINING VESSEL AT RISK.

WITH THE PROTEST NOW STRETCHING INTO ITS SECOND WEEK, A LEGAL BATTLE NOW LOOMS ON THE HORIZON.

THE METALS COMPANY HAS FILED FOR AN INJUNCTION TO STOP GREENPEACE, POINTING TO INTERNATIONAL LAWS THEY SAY THE ACTIVISTS BROKE. REITERATING CLAIMS THEIR CREW WAS JEOPARDIZED BY THIS DEMONSTRATION.

[Gerard Barron]

“Our activists are extensively trained for this protest, and we absolutely wouldn’t do it. If it wasn’t safe to do so … I think what we would say is what’s really dangerous and unsafe is letting companies like the metals company destroy one of the last untouched and least known about ecosystems on our planet for profit.”

[Jack Alymer]

GREENPEACE HAS RESPONDED FURTHER BY TELLING US “THIS INDUSTRY THAT CLAIMS TO BE GREEN IS NOW THREATENING TO TAKE ENVIRONMENTAL ACTIVISTS TO COURT.

A HEARING ON THE MATTER HAS ALREADY BEEN HEARD BY A DUTCH COURT, AS BOTH SIDES ARE NOW EXPECTING A DECISION WITHIN THE COMING DAYS.

[EMMA STOLTZFUS]

EXTREME WEATHER ROCKED THE US THIS YEAR. SUMMER BROUGHT A MASSIVE HEAT WAVE THROUGHOUT THE WORLD, TRIGGERING STORMS, BREAKING RECORDS AND GENERALLY MAKING LIFE MISERABLE. UNDER THE WAVES, THE OCEAN WAS ALSO HEATING UP, CAUSING A WIDESPREAD CORAL BLEACHING EVENT.

[DR. CINDY LEWIS, DIRECTOR | KEYS MARINE LABORATORY]

CORAL RESTORATION IS AN IMPORTANT PART OF SALVAGING THE ECOSYSTEM DOWN HERE, TRYING TO SAVE THESE CORALS. AND THIS HEATWAVE THIS SUMMER CAME SO FAST, SO HARD, AND SO EARLY THAT IT WAS VERY DIFFICULT TO PREPARE FOR IT.

[EMMA STOLTZFUS]

THAT’S DR. CINDY LEWIS, THE DIRECTOR OF THE KEYS MARINE LABORATORY.

WHEN TEMPERATURE SPIKES STRIKE, CORAL NORMALLY CAN’T JUST MIGRATE TO COOLER WATERS. AT LEAST, NOT WITHOUT A LOT OF HELP. DR. LEWIS’ LAB AND SEVERAL OTHER ORGANIZATIONS JUMPED IN TO SAVE THE FRAGILE CORAL NURSERIES OFF THE FLORIDA KEYS. THEY HOSTED AROUND 5,000 SPECIMENS IN SPECIAL CONTAINERS ON LAND DURING THE OCEAN HEAT WAVE.

[DR. CINDY LEWIS]

IT WAS HOT AND WE HAD DAYS, 90 TO 94 DEGREE AIR TEMPERATURE DAYS, WITH HEAT INDEXES OVER 115 DEGREES — AND WE’RE TRYING TO MAINTAIN CORAL AT 85 DEGREES TO 86 DEGREES, WHICH WAS WAY BETTER THAN WHAT THEY WERE SEEING ON THE REEF. WE WERE GETTING REPORTS BETWEEN 88 AND 92 DEGREES ACTUALLY ON THE REEF WHERE THESE CORALS CAME FROM.

THE BIGGER CHALLENGE WAS FEEDING THESE CORALS AND CLEANING THE TANKS AND ASSESSING THESE CORALS EVERY SINGLE DAY. 5,000 CORALS WITH AN ARMY OF PROBABLY 50 TO 100 PEOPLE OVER THE COURSE OF THE SUMMER, ROTATING THROUGH AND SPENDING HOURS AND HOURS OUT THERE IN 90 TO 94 DEGREE WEATHER.

[EMMA STOLTZFUS]

THE WATERS AROUND FLORIDA, AND MUCH OF THE WORLD, STAYED AT BLEACHING ALERT LEVEL TWO FOR SEVERAL MONTHS. THIS CAUSED A SPREADING UPHEAVAL IN THE FRAGILE CORAL ECOSYSTEM, CAUSING THEM TO EXPEL THEIR SYMBIOTIC ALGAE AND TURN WHITE FROM STARVATION. LEVEL TWO IS THE HIGHEST POINT ON NOAA’S ALERT SCALE, WARNING THAT SEVERE MORTALITY AND BLEACHING ARE LIKELY.

[DR. CINDY LEWIS]

THEY LOOK LIKE BIG GIANT SNOWFLAKES. BUT IN REALITY, IT’S NOT A GOOD THING. — WE JUST STARTED GETTING WATER TEMPERATURES DOWN TO NORMAL LEVELS WITHIN THE LAST MAYBE THREE TO FOUR WEEKS. SO THEY HAD TO SURVIVE FROM JULY, AUGUST, SEPTEMBER AND THROUGH HALF OF OCTOBER. AND THAT’S A LONG TIME FOR THEM TO MAINTAIN, TO LIVE AT THAT UPPER LEVEL OF TEMPERATURE TOLERANCE.

[EMMA STOLTZFUS]

IN SOME PLACES THE SURFACE OCEAN TEMPERATURE REACHED CRITICAL LEVELS, RAISING WARNING FLAGS AROUND THE WORLD, INCLUDING THE WHITE HOUSE.

[ALLISON CRIMMINS, DIRECTOR | FIFTH NATIONAL CLIMATE ASSESSMENT]

WATERS OFF THE COAST OF FLORIDA HIT 101 DEGREES FAHRENHEIT, EXPOSING OUR NATION’S PRECIOUS CORAL REEFS TO HOT-TUB-LEVEL TEMPERATURES. CLIMATE IMPACTS ARE COSTING LIVES, DISRUPTING LIVELIHOODS, AND THREATENING THE PEOPLE, PLACES, AND PASTIMES WE CARE ABOUT.

[EMMA STOLTZFUS]

NOW THE OCEAN HAS COOLED DOWN ENOUGH FOR THOSE CORALS TO BEGIN THE RETURN JOURNEY TO THE OCEAN. THE CONCLUSION OF A SIGNIFICANT OPERATION THAT STILL REQUIRES A VARIETY OF QUALIFICATIONS TO BE MET.

CINDY LEWIS, DIRECTOR | KEYS MARINE LABORATORY

FIRST, THE REEFS HAD TO BE COOL. SECOND, THEY HAD TO BE INSPECTED VISUALLY TO DETERMINE THAT THEY WERE HEALTHY. AND THEN WITH THAT HEALTH CERTIFICATE IN HAND, THEN WE’RE ALLOWED TO BRING THEM BACK TO THEIR NURSERIES WHERE THEY ORIGINATED FROM.

THERE IS JUST AN UNDERTONE OF AMAZING EXCITEMENT WITH EVERYBODY THAT’S ON SITE, MOVING THESE CORALS, GETTING THEM BACK INTO COOLERS, AND BACK TO THE BOATS, AND DIVING TO GET THEM BACK DOWN TO THE NURSERIES. AND EVERYBODY IS JUST SO EXCITED THAT EVERY CORAL RETURNED IS A SUCCESS. YES, WE’VE LOST SOME — BUT THE ONES THAT SURVIVED, IT’S A HUGE SUCCESS.

Simone Del Rosario:

If your only reference to the U.S. Marshals Service is Tommy Lee Jones in The Fugitive, here’s part of what the real agency actually does: Seize millions in goods procured by criminals and sell it off on behalf of federal courts. So here’s a short movie on that: The most interesting and expensive scores auctioned by U.S. Marshals in this week’s Five For Friday.

The value of U.S. Marshals’ stash ballooned in 2021 and 2022 thanks to crypto seizures, according to the Bloomberg analysis. The government timed the market perfectly, making $39.5 million from a Bitcoin sale in 2021 when a single coin brought in nearly $60k. They made another $12.6 million in Bitcoin from a dark-web drug dealer and roughly the same in Ethereum from another dark web entrepreneur. In a more old school situation, they sold about $100 grand in gold bullion in 2019 from a woman who trafficked weed across the country.

Art is one of the best ways to launder money. Just saying. These scores came out of the $4 billion dollar 1MBD scandal. Andy Worhol’s Round Jackie, literally a round portrait of Jackie Kennedy, sold for a cool mill. Ed Ruscha’s Bliss Bucket sold for $370 grand. And a movie poster for 1927’s Metropolis sold for $1.1 million. We heard Leo DiCaprio has one of these.

Trading cards have traded up to first-class investments. Unfortunately the bad guys know it too. Last year, Marshals auctioned off an elusive Charizard Pokemon Card for $43,000. Sounds like a lot, but the knucklehead they busted for stealing $85 grand in COVID relief funds paid $58k for it. A 1952 Mickey Mantle card went on the Marshals block, too, for $105,000, but the quality was just a 7 out of 10. The same card with a 9.5 rating went for $12.6 million last year, the most expensive sports card ever sold. Moral of the story, kids, don’t play with the cards.

Criminals can be somewhat predictable. U.S. Marshals auctioned off 44 Rolexes in 2018 alone. The most expensive Rolex was the “Everose” Gold Sky-Dweller which went for $33 grand, but the most expensive watch in recent years was the $269,000-dollar Richard Mille Black Phantom timepiece. Other luxury goods included Hermes bags for $26k and 12 pairs of Louboutins for a paltry $6k, which seems like a pretty good deal.

Here are some of the sweetest rides on the auction block. An Irish sport horse named Cinda fetched $60K in 2020. A 2014 Ferretti yacht brought in $3.2 mil at auction, while a pair of Boston Whaler Outrage Motor Boats sold for $815,000, taken from a guy who defrauded lottery winners. Now, you gotta be bold to buy a plane, but this 1994 Raytheon Hawker 800 sold for $405,000. And you know supercars are all the rage with society’s underbelly. Marshals got $760k for the 1991 Ferrari F40 seized from a guy that stole $13 million from Veterans Affairs.

If you’re looking for something more useful, there’s a 4 bedroom houseboat that sold in 2020 for $354,000. It had 7 TVs but no smoke detectors. Priorities. That’s Five for Friday. I’m Simone Del Rosario. It’s Just Business.

Jack Aylmer, Reporter

WHEN IT COMES TO LITHIUM-ION BATTERY PRODUCTION, THERE’S NO QUESTION CHINA LEADS THE WAY.THE NATION ACCOUNTS FOR 77% OF ALL BATTERY MANUFACTURING CAPACITY. POLAND AND THE UNITED STATES ARE NEXT WITH JUST 6%. CHINA CURRENTLY CONTROLS BETWEEN 60 TO 100% PERCENT OF THE MINING OR REFINING FOR THE VARIOUS MINERALS NEEDED TO MAKE THESE BATTERIES.EXPERTS SAY THE U.S. IS “10 to 20 YEARS BEHIND ASIA IN COMMERCIALIZATION OF BATTERY TECHNOLOGY.”IT’S A MARKET CHINA IS BETTING BIG ON AS WESTERN GOVERNMENTS PUSH TO TRANSITION TO EVS. EXPERTS PREDICT DEMAND WILL INCREASE 700% BY 2035.

John Quelch, former associate in research at Harvard’s Fairbank Center for Chinese Studies and fellow of the Harvard China Fund:

“When we’re talking about battery technology, battery technology is really a derived demand. That is responding to the demand level for electric vehicles.”Jack Aylmer, Reporter

LITHIUM-ION TECHNOLOGY POWERS EVS, WHICH BY SOME ESTIMATES.. COULD REACH 86% OF GLOBAL VEHICLE SALES BY 2030. SO, WITH CHINA DOMINATING THE BATTERY SECTOR, IT’S NOT SURPRISING THE COUNTRY HAS SPEARHEADED THE EV TRANSITION.

John Quelch

“The Chinese have been very aggressive in motivating the purchase of electric vehicles, which represent a much higher percentage of new vehicle sales in China than they do in the United States.

Jack Aylmer, Reporter

CHINA CHARGED UP ITS EV SALES AFTER BEIJING ROLLED OUT A $72 BILLION PACKAGE OF TAX BREAKS FOR THE INDUSTRY OVER THE SUMMER. DURING THE FIRST HALF OF THIS YEAR, CHINA ACCOUNTED FOR 55% OF ALL ELECTRIC VEHICLES SOLD. AT THE SAME TIME, THE U.S. WAS RESPONSIBLE FOR 13% OF GLOBAL EV SALES.AS A RESULT, CONGRESSIONAL MEMBERS HAVE URGED THE ENERGY DEPARTMENT TO BOOST U.S. LITHIUM BATTERY PRODUCTION, OR FACE GETTING LEFT IN THE DUST BY CHINA AMID AN ANTICIPATED EV-DRIVEN FUTURE.

Simone Del Rosario:

Could not be more annoying. These days, some of the nation’s biggest stores, like Walmart, are rethinking the self-checkout strategy. But why keep ’em around at all? Here are 5 reasons self-checkout SHOULD be dumped in this week’s Five For Friday.

First of all, it’s not my job. When these things first hit stores all the way back in 1987, developers said they were solving the number one shopper complaint, long checkout lines. But self checkout lines are formidable in their own right. Of course it takes longer, you’re not a professional cashier and where’s your discount for scanning your own stuff? Self-checkout’s been blamed for slashed cashier jobs, now self-checkout lines are backed up and there aren’t enough cashiers to open another register to get us all outta here.

So you’re thinking. “I’m not a pro, but how hard can this be?” Famous last words. You gotta figure out how scan your shoppers card, get your reusable bags in the right place. And you’re off to the races until you hit that big stack of produce. Is this a shallot or an onion? A roma or Campari tomato? What if the sticker’s missing? Oy vey.

You’ve fought through up to this point. But now you need to unwind. Just try scanning that 6 pack of beer and you know what comes next. {Please wait, Help is on the way. You’re order contains an age restricted item.} Now ya gotta wave down a real human and hope it’s not a Friday at 5:30 when everyone’s trying to get their hooch. This one could be corrected with some AI facial recognition in the future. What could possibly go wrong?

No matter how tech savvy you are, these things can be somewhat unreliable. You know, when you move an item you just scanned too fast OR too slow. {please place item in the bagging area.} And now I’m publicly arguing with a robot saying “I DID.” Then there are those items that aren’t marked properly or the machine just doesn’t feel like working that day. And guess what? I’m back waiting for the great and powerful oz to help me out.

These machines were really all about the bottom line, so it’s not a surprise theft is what’s driving retailers to rethink it all. Hey, we have a whole series on retail shrink! Anyway, a 2016 study found self-checkouts generate a 4% shrink rate all by themselves, more than double the average. Researchers say self-checkouts can be a gateway tempting upstanding folks until they’re petty criminals. There are all kinds of weird scanning tricks people use, but I’m not out here trying to feed your addiction..

And then there’s Amazon Go, where you just walk out with stuff and it figures out how to charge your Prime account like magic. {Go ahead leave. Um. Just walk out. Here I go. Eeeeeh} That’s Five For Friday. I’m Simone Del Rosario. It’s Just business.

Jack Aylmer

THE DEMAND FOR LITHIUM IS GROWING. EXPECTED TO NEARLY DOUBLE WORLDWIDE IN THE NEXT FIVE YEARS.

Keith Phillips, CEO Piedmont Lithium

‘It’s white gold, it’s the next rush.’ Everyone’s focused on lithium, it’s white gold is the next rush.”-

Jack Aylmer

THE CRITICAL MINERAL IS CRUCIAL PART OF ELECTRIC VEHICLE BATTERY PRODUCTION. AND NOW – ONE OIL GIANT IS MAKING A PLAY TO BE ONE OF THE INDUSTRY’S TOP SUPPLIERS.

EXXON MOBIL ANNOUNCED PLANS THIS WEEK TO MEET THE NEED FOR LITHIUM BY THE END OF THE DECADE – ACQUIRING THE RIGHTS TO 120-THOUSAND ACRES OF LAND IN SOUTHERN ARKANSAS.

THAT’S HOME TO THE SMACKOVER FORMATION – A REGION CONSIDERED TO BE THE MOST PROLIFIC LITHIUM DEPOSIT IN ALL OF NORTH AMERICA.

Robert Mintak, Standard Lithium – CEO

Arkansas sits on one of the world’s largest lithium resources … There’s no better place to build a lithium business than south Arkansas.

Jack Aylmer

EXXON MOBILE PLANS TO START DIGGING SOON – AND WILL PRODUCE BATTERY GRADE VERSIONS OF THE METAL BY 20-27.

Dan Ammann, President of ExxonMobil Low Carbon Solutions

We’re betting on the big trend of electrification, you know, through the growth of this lithium business here today.”

Jack Aylmer

THE COMPANY IS THE LATEST NAME IN BIG OIL TO INVEST IN VARIOUS ASPECTS OF E-Vs. CHEVRON, B-P, AND SHELL ARE ALL GETTING INTO THE GAME.

LIKE EXXON, CHEVRON IS EXPLORING PUTTING FUNDS TOWARD LITHIUM MINING EFFORTS. THE COMPANY’S CEO CONFIRMING TO AXIOS THEY ARE CONSIDERING THEIR OPTIONS IN THIS ARENA.

BP ANNOUNCED LAST MONTH IT WOULD PURCHASE ONE-HUNDRED-MILLION-DOLLARS WORTH OF TESLA SUPERCHARGERS, AND IS GEARING UP TO SPEND ONE-BILLION-DOLLARS ON CHARGING INFRASTRUCTURE BY 20-30.

AND SHELL IS CREATING ITS OWN NETWORK OF EV CHARGING STATIONS, CURRENTLY OPERATING ONE-HUNDRED-AND-FORTY-THOUSAND WORLDWIDE.

SHELL PLANS TO INCREASE THAT TOTAL TO UPWARDS OF TWO-AND-A-HALF-MILLION BY 20-30.

MEANWHILE, OIL REFINING GIANT KOCH INDUSTRIES IS INVESTING HUNDREDS OF MILLIONS IN THE U-S BATTERY SUPPLY CHAIN. MAKING THEM ONE OF THE BIGGEST INVESTORS IN THE SECTOR OUTSIDE OF AUTOMAKERS.

RETURNING TO EXXON MOBILE, THE COMPANY SAYS THEIR MOVE INTO LITHIUM WILL HELP SUPPORT THE PRODUCTION

OF MORE THAN 1-MILLION ELECTRIC VEHICLES ANNUALLY BY 20-30.

ARKANSAS GOVERNOR SARAH HUCKABEE SANDERS VOICED SUPPORT FOR THE PROJECT, ADDING THAT HER ADMINISTRATION WILL CONTINUE TO CUT TAXES AND SLASH RED TAPE TO MAKE ENDEAVORS LIKE THIS POSSIBLE.

Sarah Huckabee Sanders, Arkansas Governor

“I’m not being dramatic when I say this has the potential to transform our state … some estimate that the natural state could produce 15% of the world’s finished lithium supply. That is huge for Arkansas and for America.”-

Jack Aylmer

CURRENTLY, LESS THAN ONE PERCENT OF LITHIUM IS PRODUCED IN THE UNITED STATES, LEAVING AMERICAN AUTOMAKERS IN NEED OF AN INCREASED DOMESTIC SUPPLY OF THE MINERAL.

-Jim Holder, Autocar Editorial Director

“You can see with the most popular electric cars that one of the things holding up the production of them is the rate of which the batteries can be produced. So there is definitely pressure on the battery makers to respond.”

Jack Aylmer

THAT’S THE NEED EXXON MOBIL IS HOPING TO FILL, AS THE ARKANSAS LAND THEY WILL MINE IS ESTIMATED TO HOLD ENOUGH LITHIUM TO POWER ABOUT FIFTY MILLION ELECTRIC VEHICLES.

–Dan Ammann, President of ExxonMobil Low Carbon Solutions

“We’re going to be ramping up domestic production of lithium, which is a critical mineral for the energy transition that’s currently being imported from elsewhere in the world.”

Jack Aylmer

AND WITH EVS EXPECTED TO SURPASS TWO THIRDS OF GLOBAL CAR SALES BY 20-30, THE OIL INDUSTRY IS LOOKING AT WAYS TO BE A PART OF THE ANTICIPATED WIDESPREAD ADOPTION OF THESE VEHICLES IN THE COMING YEARS.

Simone Del Rosario:

Inflation has come way down from its 9.1% peak, so why don’t we feel any better about prices? We did the math and here’s how much prices have really gone up over the past 3 years in this week’s Five For Friday.

The price of a place to lay your head is up 18 percent since September 2020, according to CPI’s shelter index. Redfin says the median asking rent is over $2,000 a month. It was under $1,700 before the inflation train left the station. And forget about breaking out of the renting class to buy. The average sales price of a new home jumped from around $400 grand three years ago to $513k today.

Filling up the fridge in your home is just as bad. Groceries cost 21% more than three years ago, but food inflation has luckily slowed down a lot this year. Eggs have gone from an average $1.35 a dozen to $2.07 now, but who can forget that near $5 spike in January? Milk is up 52 cents to $3.97 a gallon, and a pound of chicken went from $1.54 to $1.90. It may seem small but those cents add up at the register.

Now the cost of eating out has gone up 20% over the last three years and that price inflation is still heating up. When restaurants reopened after COVID lockdowns, many employees didn’t come back. Some just flat out moved on. And the demand for restaurant workers pushed wages up 20% between 2020 and 2022. There are still a lot of openings, forcing some places to turn to robots. Let’s just hope they don’t go rogue.

If you’ve tried to buy a car in the last few years, you know prices are crazy. The CPI says new cars are selling for 22% more than 3 years ago. Kelley Blue Book says the average cost is more than $48,000, 10 grand more than in September 2020. Meanwhile, the price of used vehicles is up, uhh, 22%. The average used car now sells for $27,000, according to Consumer Reports. To make matters worse, the average loan on that used car has an interest rate of more than 11%.

Here’s the kicker, the energy index is up 49% since September 2020. A lot of that has to do with the price at the pump, which is up 73% from those pandemic lows three years ago. Demand roared back during the pandemic while production stalled a bit, and Bob’s your uncle. Higher gas prices, hitting $5 bucks a gallon over the summer of ‘22. But you know the cure for high prices is high prices! Domestic oil production is expected to hit a record in 2023.

So we’ve spent a lot the past three years. But a lot of things are off their absolute highs and some things that have even fallen the last 2 years, like electronics and rental cars. So buy a TV and feel better about yourself. That’s Five For Friday. I’m Simone Del Rosario and it’s Just Business.