These are the top 5 business stories you consumed in 2024

By Simone Del Rosario (Business Correspondent), Emma Stoltzfus (Video Editor), Ali Caldwell (Motion Graphics Designer)

We made it through another election year where the economy was the top issue for voters. So which business stories grabbed you the most this year?

We know you came to Straight Arrow News for the unbiased, straight facts. Here are the top five business stories you watched and read at SAN.com.

Download the SAN app today to stay up-to-date with Unbiased. Straight Facts™.

Point phone camera here

#5: Progress or poverty? Patience running out for Argentina’s Milei 1 year in

We had enough to worry about here with the U.S. economy, but what really grabbed your attention was an economic experiment happening in South America. Voters in Argentina had just elected a brash, unconventional choice for president in Javier Milei.

He’s the guy who promised to take a chainsaw to the economy and carried a chainsaw at rallies. He has a friendship with President-elect Donald Trump and has been called a “mini Trump” in the past.

A year following his election, SAN checked in with economists to grade Milei’s year. Despite the poverty rate under his policies spiking to include more than half the population, he’s made serious progress on inflation and the economy is starting to grow. There’s real hope he can turn things around there if the people of Argentina don’t run out of patience.

#4: Warren Buffett keeps selling Apple stock to hoard cash. But why?

When Warren Buffett makes money moves, the world pays attention. So when financial disclosures showed he was regularly selling Apple stock and hoarding cash, you wanted to know why — or rather, what he knew.

“We will have Apple as our largest investment,” the Berkshire Hathaway CEO said in May. “But I don’t mind at all, under current conditions, building the cash position. I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.”

There it is from the horse’s mouth. However, an analyst quoted in our story speculated the Apple sale might have more to do with the death of Buffett’s right-hand man, Charlie Munger, who may have always been more comfortable with the company.

So far in 2024, Apple’s share price is up 36%.

#3: Conservatives want to give Dunkin’ Donuts the ‘Bud Light treatment’

The boycott of Bud Light was a huge business story in 2023, and by 2024, the beer still hadn’t recovered. But this year, conservatives found a new target in Dunkin’ Donuts and set out to give it the “Bud Light Treatment.”

The hashtag #BoycottDunkinDonuts splattered across social media after the CEO of Rumble said Dunkin’s parent company refused to advertise on the site because of its “right wing culture.” Rumble is a conservative counterpart to YouTube.

The boycott proved to be no Bud Light. Former Anheuser-Busch executive Anson Frericks correctly predicted in our story that the momentum would fizzle out because Dunkin is a privately-held company. Unlike with Bud Light, there’s no public data and regular industry reports to reinforce the success of the boycott.

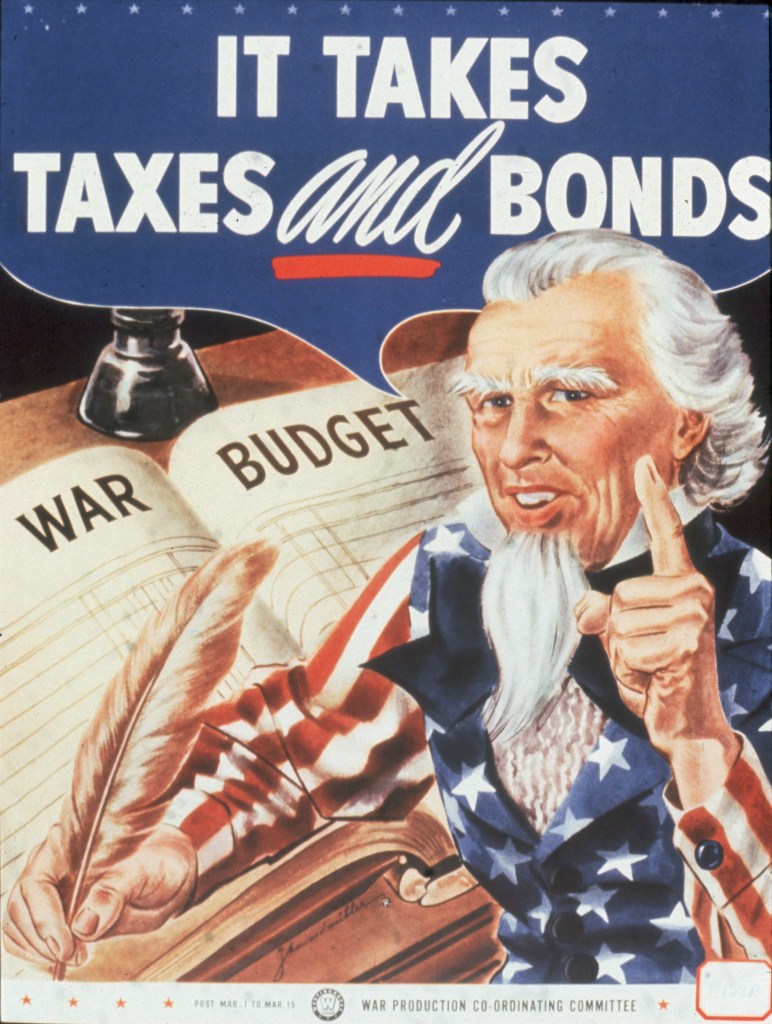

#2: The US breached $34 trillion in national debt. Here’s who owns every dime.

Your No. 2 story is a topic I could talk about every day of every year and never run out of things to say. In fact, there are a lot of reasons to talk about it right now. We’re talking about the U.S. national debt, which is at $36 trillion

We started the year by breaching $34 trillion in debt and set out to tell you who holds it all.

We knew you had a serious interest in which foreign countries hold the bag. Japan has the biggest purse, followed by China, then the U.K. But foreign governments account for less than a quarter of the whole pie. Private investors hold the biggest share, followed by foreign countries, U.S. government accounts and the Federal Reserve.

#1: Boeing strike strategy ‘baffles’ top aviation analyst. Where do talks go next?

When Boeing machinists walked off the job for the first time in 16 years, many thought the strike would be a quick one. But weeks in, management completely botched negotiations by releasing details of an offer to the media before the union had responded.

“I thought the arrival of new management with a lot of experience and understanding in the industry would make things different, but that doesn’t appear to be the case at all, I’m afraid,” said Richard Aboulafia, a top aviation analyst and managing director of Aerodynamic Advisory.

The story “Boeing strike strategy ‘baffles’ top aviation analyst” is at the top of our list. It would be nearly another month after this interview before machinists voted to return to work.

Get up to speed on the stories leading the day every weekday morning. Sign up for the newsletter today!

Learn more about our emails. Unsubscribe anytime.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

In the end, workers got Boeing up from a 25% raise to 38% over four years. It was new CEO Kelly Ortberg’s first test in a long line of challenges we’ll be talking about for years to come.

[Simone Del Rosario]

We made it through another election year where the economy was the top issue for voters. So which business stories grabbed you the most this year? We know you came to Straight Arrow News for the unbiased, straight facts. I decided to pull together the business stories you watched the most in 2024. These are your top 5.

We had enough to worry about here with the U.S. economy, but what really grabbed your attention is an economic experiment happening in South America. See, voters in Argentina had just elected a brash, unconventional choice for president in Javier Milei. He’s the guy who promised to take a chainsaw to the economy. He has a friendship with President-elect Donald Trump and has been called a “mini Trump” in the past.

A year following his election, we checked in with economists to grade Milei’s year. Despite the poverty rate under his policies spiking to include more than half the population, he’s made serious progress on inflation and the economy is starting to grow. There’s real hope he can turn things around there if the people of Argentina don’t run out of patience.

When this man makes money moves, the world pays attention. So when Warren Buffett kept selling Apple stock and hoarding cash, you wanted to know why – or rather, what he knew. The Oracle of Omaha said, Don’t worry, Apple is still Berkshire Hathaway’s largest investment.

Warren Buffett: But I don’t mind at all, under current conditions, building the cash position. I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.

Simone Del Rosario: There it is from the horse’s mouth. But an analyst quoted in our story speculated the Apple sell might have more to do with the death of Buffett’s right-hand man, Charlie Munger, who may have always been more comfortable with the company.

So far in 2024, Apple’s share price is up 36%.

The boycott of Bud Light was a huge business story in 2023, and by 2024 the beer still hadn’t recovered. But this year conservatives found a new target in Dunkin’ Donuts and set out to give it the “Bud Light Treatment.”

The hashtag Boycott Dunkin Donuts splattered across social media after the CEO of Rumble said Dunkin’s parent company refused to advertise on the site because of its “right wing culture.” Rumble is essentially the conservative counterpart to YouTube.

Was the boycott successful? It’s no Bud Light. The momentum fizzled out because Dunkin is a privately-held company and there’s no public data to reinforce the success of the boycott like there was with Bud Light.

Your No. 2 story is a topic I could talk about every day, every week of every year and never run out of things to say. In fact, there are a lot of reasons to talk about it right now. I’m talking about the U.S. national debt, which is at $36 trillion dollars.

We started the year by breaching $34 trillion in debt and set out to tell you who holds it all.

We knew you had a serious interest in which foreign countries hold the bag. Japan has the biggest purse, followed by China, then the U.K. But foreign governments account for less than a quarter of the whole pie. Private investors hold the biggest share, followed by foreign countries, U.S. government accounts, and the Federal Reserve.

Drumroll please – for the top business story of 2024.

When Boeing machinists walked off the job for the first time in 16 years, many thought the strike would be a quick one. But weeks in, management completely botched negotiations by releasing details of an offer to the media before the union had responded.

Richard Aboulafia: I thought the arrival of new management with a lot of experience and understanding in the industry would make things different, but that doesn’t appear to be the case at all, I’m afraid.

Simone Del Rosario: The story “Boeing strike strategy ‘baffles’ top aviation analyst” is the top of our list. It would be nearly another month before machinists would come back to work.

In the end, workers got Boeing up from a 25% raise to 38% over four years. It was new CEO Kelly Ortberg’s first test in a long line of challenges we’ll be talking about for years to come.

Straight to your inbox.

By entering your email, you agree to the Terms & Conditions and acknowledge the Privacy Policy.

MOST POPULAR

-

Getty Images

Getty Images

Biden considers commuting death row: Report

Watch 3:0222 hrs ago -

Reuters

Reuters

Driver kills at least two in Germany Christmas market attack

Watch 1:27Friday -

Getty Images

Getty Images

ICE deportations hit highest level since 2014: Report

Watch 1:35Friday -

Paramount Pictures and Sega of America, Inc.

Paramount Pictures and Sega of America, Inc.

Holiday box office showdown kicks off with ‘Sonic 3’ and ‘Mufasa: The Lion King’

Watch 2:47Friday

Trump’s proposed tariffs could violate his own trade deal with Canada and Mexico

By Simone Del Rosario (Business Correspondent), Brent Jabbour (Senior Producer), Emma Stoltzfus (Video Editor), Heath Cary (Motion Graphics Designer)

Experts say President-elect Donald Trump’s vow to put 25% tariffs on Mexico and Canada violates the trade agreement he negotiated during his first term. The U.S.-Mexico-Canada Agreement, or USMCA for short, fulfilled Trump’s 2015 campaign promise to terminate and replace NAFTA, America’s longstanding free-trade agreement with its neighbors.

Media Landscape

See who else is reporting on this story and which side of the political spectrum they lean. To read other sources, click on the plus signs below. Learn more about this dataBias Distribution

Trump Says U.S. Will Impose Massive Tariffs On Mexico, Canada And China From Day 1

Click to see story on HuffPostTrump: Huge tariffs coming for consumers who buy from China, Mexico and Canada

Click to see story on Raw StoryWhat will be impacted by Trump’s tariffs? Just about everything you touch

Click to see story on MSNBCExperts blast Trump over latest tariff announcement: ‘Enjoy your cheap avocados’

Click to see story on AlternetTrump threatens sweeping new tariffs on Mexico, Canada, and China

Click to see story on Daily KosTrump’s tariff policy: Into your own flesh

Click to see story on TAZElon Musk Might Have to ‘Bring Tomatoes Back From Space’ as Trump Tariffs Raise Food Costs in U.S.

Click to see story on The Daily BeastDonald Trump’s Big Tariff Plan Will Cost Americans

Click to see story on Vanity FairTrump’s tariff plan is an inflation plan

Click to see story on VoxTrump Threatens Mexico and Canada with 25% Tariffs

Click to see story on telesurtv.netHere’s How Badly Trump’s New Tariffs Threat Would Wreck the Economy

Click to see story on The New RepublicConcerns after Trump’s tariff threats: “No one can win a trade war”

Click to see story on AftonbladetDollar soars after Trump decision

Click to see story on شفق نيوزSlog AM: No Closures for Seattle Public Schools, Trump Proposes 25% Tariffs on Mexico and Canada, Governor Jay Inslee Announces New Youth Prison

Click to see story on The StrangerTrump is making protectionism with heads

Click to see story on nd-aktuell.deTrump Blows Up Canada and Mexico Trade Agreements On the Same Day

Click to see story on PolitiZoom‘Enjoy Your Cheap Avocados’: Trump Vows Big Tariffs On Mexico And Canada

Click to see story on National MemoTrump Announces Blanket Tariffs in His Bid to Crash the Economy

Click to see story on splinter.comRupee falls 3 paise to close at 84.32 against U.S. dollar

Click to see story on The HinduWhat do Trump’s tariffs on China, Mexico and Canada mean for American shoppers?

Click to see story on The IndependentDonald Trump promises 25 per cent tariff on products from Canada, Mexico

Click to see story on CBC NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Associated Press News“On January 20…”: Donald Trump Vows Big Tariffs On China, Canada, Mexico

Click to see story on NDTVTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Hindustan TimesDonald Trump vows to impose 25% tariff on all products from Canada and Mexico

Click to see story on USA TodayTrump vows 25 per cent tariff on all products from Canada, Mexico

Click to see story on Global NewsTrump says he’ll slap tariffs on Canada, China and Mexico on Day 1

Click to see story on abc NewsTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on CNNTrump threatens Mexico, Canada, China tariffs on first day

Click to see story on Sydney Morning HeraldTrump promises specific tariffs on China, Canada and Mexico

Click to see story on The Washington PostASX in the red, Ausse dollar drops on Trump tariff threat

Click to see story on ABC AustraliaClaudia Sheinbaum’s full letter to Donald Trump after announcing 25% tariffs to Mexico

Click to see story on InfobaeTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on CBS NewsUS economy: Trump announces trade tariffs against Mexico, Canada and China

Click to see story on Sueddeutsche ZeitungTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Los Angeles Times‘It is time for them to pay a very big price’: Donald Trump vows 25% tariff on Canadian products, leaders call for action

Click to see story on The Toronto StarTrump Plans 10% Tariffs on China Goods, 25% on Mexico and Canada

Click to see story on BloombergTrump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on Coast ReporterTrump says Mexico and Canada will get hit with 25% import tariffs on all goods once he takes office

Click to see story on Business InsiderTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Flin Flon ReminderTrump’s 25-per-cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on Rocky Mountain OutlookTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Sask TodayTrump threatens Canada, Mexico, China with tariffs

Click to see story on nprTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Star TribuneTrump promises 25% tariff on Mexico and Canada, extra 10% tariff on China

Click to see story on Al JazeeraEconomic policy: Trump: High tariffs on goods from China, Mexico and Canada

Click to see story on Zeit OnlineTrump threatens to raise tariffs on Mexico, China and Canada. Beijing: ‘No one will win’

Click to see story on La RepubblicaTrump says he plans to enact new tariffs on Canada, China and Mexico on his first day in his office

Click to see story on NBC NewsTrump threatens to punish Mexico, Canada and China with tariffs from day one

Click to see story on El PaisTrump’s Mexico tariff plan raises concerns for Korean firms

Click to see story on The Korea TimesTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 6 PhiladelphiaTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 13 HoustonTrump threatens to impose sweeping new tariffs on Mexico, Canada and China

Click to see story on Irish ExaminerFentanyl epidemic, Trump accuses China, Canada and Mexico: “You’ll send it to us.” Seizures increased with Biden

Click to see story on Il Fatto QuotidianoTrump vows massive tariffs on Mexico, Canada, and China on Day 1 of his presidency

Click to see story on Le MondeMost Asian markets drop, dollar gains as Trump fires tariff warning

Click to see story on InquirerTrump vows big tariffs on Mexico, Canada and China

Click to see story on DawnTrump’s 25 per cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on SooToday.comTrump’s Mexico, Canada and China import tariffs & SMSFs hit $1 trillion.

Click to see story on SBS NewsIn the news today: Tariffs mean pain for U.S. and Canada, leaders say

Click to see story on Barrie TodayTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc11 RaleighTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 7 NewsDonald Trump threatens Mexico and Canada with import tariffs of 25 percent

Click to see story on SpiegelTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc30 NewsTrump pledges 25% tariffs on Canada and Mexico; more on China too

Click to see story on Japan TodayTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Prince George CitizenTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Koco News5Trump pledges 25% tariffs on Canada and Mexico, more on China too

Click to see story on RapplerTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office – Boston News, Weather, Sports

Click to see story on WHDHTrump promises a 25% increase in Canadian customs taxes

Click to see story on TVA NouvellesEven before Trump is in office, he begins to make politics with the tariff club

Click to see story on der Standard ATCustoms duties: Donald Trump announces an increase on products from China, Canada and Mexico

Click to see story on LiberationTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on News & RecordTrump will impose tariffs on goods from Mexico and Canada on the first day

Click to see story on PolitikenWhat does Trump’s latest tariff plan mean for the U.S.?

Click to see story on PBS NewsHourTrump vows to quickly impose tariffs of 25 percent on goods from Canada and Mexico

Click to see story on PoliticoTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office – WSVN 7News | Miami News, Weather, Sports

Click to see story on WSVNTariffs: Donald Trump launches the offensive against China, Canada and Mexico

Click to see story on France InfoTrump promises 25% tariffs to Mexico and Canada and 15% to China on the first day he arrives at the White House

Click to see story on Eldiario.esTrump has promised tariffs on goods from China, Mexico and Canada

Click to see story on Novinky.czChina urges U.S. to safeguard drug-control cooperation

Click to see story on CGTNTrump Threatens New Tariffs on China, Canada and Mexico

Click to see story on Time MagazineTrump Pledges To Slap a 25% Tariff on ‘ALL Products’ From Canada and Mexico – Plus 10% on Imports From China

Click to see story on MediaiteCanadian and Mexican products | Donald Trump wants to impose 25% customs taxes

Click to see story on La PresseTrump threatens to impose sweeping new tariffs on Mexico, Canada and China

Click to see story on The JournalTrump Promises a 25% Tariff on Products From Mexico, Canada

Click to see story on U.S. NewsUK could strike back at Trump with taxes on Harleys and Jack Daniel’s

Click to see story on Politico EuropeTrump vows tariffs on China, Mexico and Canada on day one of his presidency

Click to see story on iNewsNo president yet, but already threatening with tariffs

Click to see story on NRC HandelsbladBlaž Bračić: If Trump raises tariffs, the US will face inflation and interest rate growth

Click to see story on RTV SlovenijaTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WCSHAnnouncement of US Criminal Tariffs for China, Mexico and Canada

Click to see story on delo.siTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on The Delaware County Daily TimesTrump: 25% tariffs for Canada and Mexico

Click to see story on Radio-CanadaPeso falls to P59 against dollar amid Trump’s tariff plans

Click to see story on Manila BulletinTrump’s 25 per cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on Bowen Island UndercurrentChina warns there would be no winners in trade war with US as president-elect Donald Trump vows more tariffs

Click to see story on Hong Kong Free PressTrump vows major tariffs on products from Mexico, Canada, China

Click to see story on TodayTrump’s 25 per cent tariff will cause equal pain to both sides, Canadian leaders say

Click to see story on National ObserverTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on CBS58Teslas, Hondas, and VWs may get price hikes if Trump’s tariffs extend to Mexico

Click to see story on Fast CompanyTrump announces additional 10% tariffs on China, 25% on Canada and Mexico: Asahi Shimbun Digital

Click to see story on AsahiTrump: Canada, Mexico Can Expect 25% Tariffs

Click to see story on NewserTrump pledges new tariffs on China, Mexico, and Canada

Click to see story on SemaforTrump’s Inflation-Stoking 25% Mexico and Canada Tariff Scheme

Click to see story on naked capitalismTrump’s 25 per cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on Thompson CitizenMexico’s peso and Canada’s dollar fall on Trump’s 25% tariff threats

Click to see story on RocketNewsTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on ABC57Trump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on The Lethbridge HeraldTrump Threatens Tariffs on Mexico and Canada

Click to see story on worldpoliticsreview.comTrump threatens China, Mexico and Canada with new tariffs

Click to see story on BBC NewsTrump promises a 25% tariff on products from Canada, Mexico

Click to see story on CTV News‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on ReutersDonald Trump says he will hit China, Canada and Mexico with new tariffs

Click to see story on NZ HeraldTrump says he will impose a 25% tariff on all products entering the US from Mexico and Canada

Click to see story on KIFITrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on KRDOTrump threatens new anti-drug tariffs on ‘day 1’ for China, Canada, Mexico

Click to see story on South China Morning Post‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on Channel News AsiaTrump vows an additional 10% tariff on China, 25% tariffs on Canada and Mexico

Click to see story on CNBCTrump’s latest tariff plan aims at multiple countries. What does it mean for the US?

Click to see story on KVIATrump pledges tariffs on Canada, Mexico and China

Click to see story on RTÉTrump says he will impose new tariffs on Canada, Mexico and China on first day

Click to see story on The HillNews24 Business | Dollar rises after Trump vows to hit Canada, Mexico with 25% import tariffs

Click to see story on News24Trump pledges 25 per cent tariff on Canadian products until border issues solved

Click to see story on Winnipeg Free PressTrump Says He Will Impose 25% Tariffs On Canada, Mexico On First Day Of Office And Extra Tariffs On China Until They ‘Pay Attention’ – AutoZone (NYSE:AZO), Hasbro (NASDAQ:HAS)

Click to see story on BenzingaDonald Trump threatens even higher tariffs on China, Canada and Mexico

Click to see story on NewsweekTrump vows to add 10 percent to export duties on goods from China over drug trafficking

Click to see story on IOLTrump promises more tariffs on goods from Canada, Mexico, China, says ‘Time to pay a very big price’

Click to see story on WIONDonald Trump threatens sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Sky News UKTrump pledges immediate tariffs on goods from Mexico, Canada and China

Click to see story on VOA NewsTrump vows 25% tariffs on Canada, Mexico on Day 1; more on China | Honolulu Star-Advertiser

Click to see story on Star AdvertiserPresident-elect Trump threatens Canada, Mexico, China with tariffs over border concerns

Click to see story on UPIDollar gains after Trump vows tariffs against Mexico and Canada

Click to see story on Live MintTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WPLGTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Michigan LiveTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Chicago TribuneTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WKMGTrump promises a 25 per cent tariff on products from Mexico, Canada

Click to see story on The Globe & MailTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on Day 1

Click to see story on Portland Press HeraldTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KCRA 3Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 7 ChicagoTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Pioneer PressTrump threatens sweeping new tariffs on Mexico, Canada on first day in office

Click to see story on Las Vegas Review-JournalTrump: Higher tariffs on goods from China, Mexico and Canada

Click to see story on Deutsche WelleDonald Trump vows massive tariff rises on goods from Mexico, Canada and China

Click to see story on RNZTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 7 LATrump threatens to raise tariffs for China, Canada and Mexico ‘from day one’. Beijing: ‘Nobody will win a trade war’

Click to see story on Corriere Della SeraTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on abc 7 NYTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WCVBTrump, 10% tariffs on China against drug trafficking in the US

Click to see story on ANSATrump pledges tariffs against Mexico, Canada and China

Click to see story on WLWTTrump threatened Canada, Mexico and China with new tariffs

Click to see story on Eesti RahvusringhäälingTrump Pledges Massive Tariffs on Day 1

Click to see story on Political WireTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WMURTrump’s 60% tariffs will ‘backfire’ on US and drive up prices, China warns

Click to see story on Alabama LiveTrump vows to impose 25% tariffs on goods from Mexico and Canada

Click to see story on France24Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Wral NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WLKYTrump’s latest tariff plan aims at multiple countries. What does it mean for the US?

Click to see story on KOB 4Trump threatens to raise tariffs on China after taking office. The reaction of the Chinese embassy in the US

Click to see story on Digi 24Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WESHTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WDSUTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KETVTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WYFFTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WTAETrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Helena Independent RecordTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KCCIWill Trump’s Tariffs Raise Prices? What To Know As He Targets Goods From Canada And Mexico

Click to see story on ForbesTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KMBCTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Denver PostTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WISNTreasury yields rise after Trump threatens tariffs and ahead of Fed minutes

Click to see story on MarketWatchTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Lincoln Journal StarTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WBAL-TVEuropean stock markets see red: “The selling pressure is on Donald Trump’s latest comments”

Click to see story on La LibreTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Wisconsin State JournalTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WPTZTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WMTWTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on MissoulianTrump threatens new tariffs on Mexico, Canada and China on first day in office

Click to see story on Syracuse NYTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WVTMTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Montana StandardTrump: 25 percent import tariff on neighboring countries and an additional tariff on China

Click to see story on ylePresident-elect Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Pittsburgh Post-GazetteTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WAPTTrump slams tariffs: ‘Stop illegal crossings and drug smuggling’

Click to see story on 24ur.comTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KOATTrump announces high tariffs on goods from China, Mexico and Canada

Click to see story on TagesschauTrump Pledges 25% Tariffs on Mexico, Canada and 10% on China

Click to see story on Wall Street JournalTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on KWWLTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on 9NEWS DenverTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WHNT 19 NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China

Click to see story on NY1Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on The ColumbianShould France’s wine industry fear a new Trump tariff?

Click to see story on The ConversationTrump promises a 25% tariff on products from Mexico, Canada

Click to see story on CP24Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WFAA 8abcTrump pledges tariffs against Mexico, Canada and China

Click to see story on WPBFTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on OPBTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WGALUnited States – What Trump wants to achieve with his punitive tariffs against Canada, Mexico and China

Click to see story on DeutschlandfunkTrump targets Mexico and Canada with tariffs, plus an extra 10% for China

Click to see story on Financial TimesTrump pledges Mexico, Canada, China tariffs over border, fentanyl

Click to see story on NewsNationTrump pledges tariffs against Mexico, Canada and China

Click to see story on WXIIDonald Trump announces increased tariffs for China, Canada and Mexico

Click to see story on Radio France InternationaleTrump pledges tariffs against Mexico, Canada and China

Click to see story on KSBWU.S. Rep. Grothman: Statement on President-Elect Trump’s tariffs on Mexico, Canada and China

Click to see story on Wispolitics.comTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WKYCTrump vows big tariffs on Mexico, Canada and China

Click to see story on Times of MaltaTrump plans tariffs on Mexico, Canada and China that could cripple trade – Hawaii Tribune-Herald

Click to see story on Hawaii Tribune-HeraldTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WJCLTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WBIRTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1

Click to see story on WAAY-TVTariffs Will Not Stop US-bound Migrants Or Drugs, Mexico Tells Trump

Click to see story on Barron'sTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Krem2 NewsTrump pledges tariffs against Mexico, Canada and China

Click to see story on KHBSStrong dollar paradox trolling Donald Trump

Click to see story on Asia TimesTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Scripps NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WATETrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KEYTTrump’s latest tariff plan aims at multiple countries. What does it mean for the US?

Click to see story on KESQTrump says he will impose a 25% tariff on all products entering the US from Mexico and Canada

Click to see story on KMIZCanadian officials blast Trump’s tariff threat and one calls Mexico comparison an insult

Click to see story on KTVBTrump says he will impose 25% tariff on all products from Canada, Mexico

Click to see story on Fox 11 LATrump’s latest tariff plan aims at multiple countries. What does it mean for the US?

Click to see story on KION‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on Investing.comTrump vows tariff hikes on goods from Mexico, Canada and China on Day 1

Click to see story on abc12/WJRTTrump’s tariff threats: Economists warn of trade war

Click to see story on zdf.deTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on WHO-DTTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KYMATrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KLFYGrassley says Trump’s 25% tariffs may be linked to renegotiating USMCA – Radio Iowa

Click to see story on Radio IowaTrump plans new tariffs on Canada, Mexico, China over drugs, migrants

Click to see story on Straight Arrow NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on marketbeat.comTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on KYTXTrump threatens to impose sweeping tariffs on Mexico, Canada and China on first day

Click to see story on PHL17Stock Market News: S&P and Nasdaq Composite Rise and Dow Down after Trump Threatens Tariffs

Click to see story on 247wallst.com‘No One Will Win a Trade War,’ China Says After Trump Tariff Threat

Click to see story on Inc.Trump Pledges New Tariffs on Mexico, Canada, and China to Address Immigration and Drug Issues – News Facts Network

Click to see story on News Facts NetworkTrump threatens tariffs against Mexico, Canada and China

Click to see story on WDVMTrump announces tariffs on Mexico, Canada, and China as part of first-day Executive Orders

Click to see story on BNO NewsChina’s been trying to ‘Trump-proof’ its economy amid his tariff threats, experts say

Click to see story on MyCentralOregon.comTrump vows new tariffs of 10% on China, 25% on Canada and Mexico

Click to see story on 美国之音Trump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on castanet.netTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on The RepublicTrump Threatens to Impose Sweeping New Tariffs on Mexico, Canada and China on First Day in Office

Click to see story on VINnewsTrump’s tariff plan: A bold move or a risky gamble?

Click to see story on intellinews.comTrump tariffs would put cross-border rail traffic in the crosshairs

Click to see story on trains.comTrump calls for 25% tariffs on imports from Canada and Mexico

Click to see story on supplychaindive.comA quick guide to Trump’s new tariffs

Click to see story on wakeuptopolitics.comTarget countries call Trump’s tariff threat counterproductive, plead for cooperation

Click to see story on Washington TimesTrump promises to impose 25% tariff on all goods from Mexico, Canada

Click to see story on TASS [🇷🇺-affiliated]‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on The Straits TimesTrump tariff ‘surprise’ pushes FTSE 100 into the red

Click to see story on Evening StandardTrump announces planned tariffs on China, Mexico, and Canada – Washington Examiner

Click to see story on Washington ExaminerOil Edges Lower as Trump Tariff Threats Pushes Dollar Higher

Click to see story on Financial PostTrump says he’ll impose 25% tariff on all products from Canada, Mexico until borders secured

Click to see story on National PostTrump pledges 25 per cent tariffs on Canada and Mexico

Click to see story on The West AustralianTrump announces increased tariffs for China, Canada and Mexico

Click to see story on Le FigaroTrump vows to slap new tariffs on key US trading partners

Click to see story on Russia Today [🇷🇺-affiliated]Gold falls as Trump tariff threat on Canada, Mexico aids dollar

Click to see story on Bangkok PostTrump promises tariffs for Mexico, Canada and China on first day in office

Click to see story on ObservadorTrump has promised to start a trade war with China and two neighbors

Click to see story on Lenta.RU [🇷🇺-affiliated]Trump promises to impose heavy tariffs on products from Mexico, Canada and China on his first day of government

Click to see story on la NacionTrump tariffs could hit hard – if they come off

Click to see story on Svenska DagbladetChina defends Mexico trade after Trump pledges fresh tariffs

Click to see story on NikkeiTrump Announces Demolishing Tariffs to Stop Immigration and Drug Trafficking · Global Voices

Click to see story on abcUp to 25 percent on everything: Trump announces tariffs against China, Mexico and Canada

Click to see story on n-tv.deCan Mexico Avoid Making the Drug War Even Bloodier?

Click to see story on Real Clear PoliticsTrump announces high tariffs on imports from Mexico, Canada and China

Click to see story on Die PresseTrump promises to apply 10% additional taxes on all products from China

Click to see story on SapoTrump threatens with strong tariffs on first day

Click to see story on Dagens Nyheter.Trump promises 25% tariffs to Mexico and Canada if they don’t close the border and 10% to China while they don’t stop the arrival of fentanyl

Click to see story on El MundoB.C. Premier David Eby reacts to Donald Trump’s 25 per cent tariff threat

Click to see story on Vancouver SunTrump threatens new tariffs on Mexico, Canada, China on first day in office

Click to see story on 9NewsTrump’s tariff pledge for China drives dollar up, pushes most Asian markets down

Click to see story on Firstpost NewsNew Trump tariffs pose ‘enormous risk’ to Quebec economy, Legault says

Click to see story on Montreal GazetteTrump vows additional tariffs on China, Canada and Mexico

Click to see story on Al BawabaTrump vows to implement new tariffs on Canada, China, and Mexico on first day in office

Click to see story on Just the NewsStock index futures tread cautiously as Trump threatens new tariffs (INDU)

Click to see story on Seeking AlphaTrump ‘beats’ the peso after promising 25% tariffs to Mexico in January: So goes the exchange rate

Click to see story on El FinancieroReturn of the ‘Tariff Man’

Click to see story on ReasonTrump announced 25% tariffs on imports from Mexico and Canada

Click to see story on La Nación, Grupo NaciónTrump threatens to slap tariffs on China, Canada and Mexico

Click to see story on NOSTrump says he will impose new tariffs on China, Canada and Mexico

Click to see story on The NationalCustoms fees: Trump declares trade war on Mexico, Canada and China

Click to see story on Le Point.frTrump says he will issue executive order to charge Canada, Mexico 25% tariff on goods upon taking office

Click to see story on Fox BusinessTrump vows: Tariffs on Mexico and Canada on his first day in office

Click to see story on Arutz ShevaDanish Industry: Trump’s tariffs are a negotiation proposal

Click to see story on Jyllands-PostenTrump is to introduce punitive tariffs against three countries

Click to see story on ExpressenTrump will sign 25% tariff on products from Mexico and Canada

Click to see story on Reforma‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on Colorado Springs GazetteTrump Vows 25% Tariff on Mexico and Canada

Click to see story on The Rio TimesTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Winnipeg SunTrump vows 25% tariff for Canada, Mexico, ramps up promised levies on China

Click to see story on Santa Clarita Valley SignalTrump pledges tariff hits on Mexico, Canada, China on day one

Click to see story on Australian Financial ReviewChina Issues Warning to Trump Over Tariffs: ‘No One Will Win’

Click to see story on DNyuzTrump’s Tariff Threat Rattles Canada

Click to see story on Oil PriceTrump vows tariffs on China, Mexico, Canada over border

Click to see story on American Military NewsA New Approach to Covering Trump

Click to see story on The BulwarkWill Trump actually enact tariffs he’s proposing?

Click to see story on WSBT‘No one will win a trade war,’ China says after Trump tariff threat

Click to see story on Denver GazetteTrump Vows Steep Tariffs On Canada, Mexico, And China To Combat Drugs And Illegal Immigration

Click to see story on Yeshiva World NewsDonald Trump promised to impose tariffs on products from Mexico, China and Canada on the first day of his government

Click to see story on El UniversoTrump Will Do Nothing to Revive a Dying Am. Dream

Click to see story on RealClearMarketsTrump vows massive taxes on goods from Mexico, Canada and China on Day One

Click to see story on End Time HeadlinesTrump: Tariffs with “good morning” to Mexico, Canada and China

Click to see story on KathimeriniTrump vows 25% tariff on Canada, premiers call to meet with Trudeau

Click to see story on tj.newsTrump tariff threat to China, Mexico and Canada roils global markets

Click to see story on BizNews.comAustrian chancellor says he had ‘very friendly’ call with Trump

Click to see story on The Star Kuala LumpurTrump triggers market turmoil as he announces tariff plan – latest updates

Click to see story on The TelegraphTrump Vows 25 Percent Tariff for Canada, Mexico, Ramps Up Promised Levy on China

Click to see story on The Epoch TimesTrump vows day one tariffs on China, Canada and Mexico over fentanyl, immigration

Click to see story on Anadolu AjansıLILLEY: Trump tells Trudeau to fix border problems or get hit with 25% tariffs

Click to see story on Toronto SunTrump to Impose Tariffs on Imports from Canada, Mexico, China

Click to see story on LatestlyTrump is preparing for a huge tariff war after his inauguration

Click to see story on OrigoDonald Trump heads for trade war with Canada, Mexico and China: ‘Tariffs until the invasion of drugs and illegal migrants stops’

Click to see story on De TelegraafTrump Unveils Tariff Ultimatums Against Canada, Mexico, And China

Click to see story on The Daily WireTrump announces massive tariffs on Mexico, Canada, and China

Click to see story on The BlazeTrump Pledges Tariffs on Canada, Mexico, and China in Sweeping Trade Policy Announcement

Click to see story on RedStateTrump Vows 25% Levy For Canada, Mexico; Ramps Up Promised Tariffs On ‘Drug-Pushing’ China

Click to see story on Zero HedgeBREAKING: Canadian premiers demand action from Justin Trudeau after Trump threatens 25% tariffs over illegal immigration, drug smuggling

Click to see story on The Post MillennialTrump promises tariffs on China, Mexico, Canada once in office

Click to see story on Daily SabahPresident-Elect Trump Vows Tariffs Against Mexico, Canada Amid Incoming Migrant Caravan

Click to see story on The Free Press (Tampa)Trump Announces Tariffs for Day 1

Click to see story on TownhallTrump declares trade war on US neighbours with 25% tariffs on Mexican goods

Click to see story on The US SunNeither China, Nor US Will Benefit From Waging Trade War

Click to see story on Sputnik Globe [🇷🇺-affiliated]Trump says he will raise tariffs on goods imported from Mexico, Canada and China

Click to see story on ProtothemaTrump pledges 25% tariff on all products from Canada and Mexico

Click to see story on True North NewsTrump’s ’Day 1’ Announcement Sends Dems and The Media Into State of Panic

Click to see story on Conservative BriefTrump will cause chaos with his tariffs threats

Click to see story on The Spectator WorldDollar Strengthens After Trump Rolls Out Tariff Plans

Click to see story on Guido FawkesTrump Threatens Day One Tariffs On China, Canada, Mexico

Click to see story on Investor's Business DailyASIA TODAY Trump: extra 10% tariffs on Chinese products. Beijing: war without winners

Click to see story on asianews.itWill Trump be a friend to workers?

Click to see story on Spiked‘Trump Effect’ trends on X as Mexico and Canada presidents scramble over tariff threat · American Wire News

Click to see story on American Wire NewsTrump tells Canada, Mexico: Stop migrants, Fentanyl

Click to see story on NEWSRAELJUST IN: Trump Announces Plans For Tariffs On Mexico, Canada If They Fail To Stop Illegal Immigration

Click to see story on TrendingPoliticsTrump Threatens Mexico, Canada, and China With Massive Punishments for Enabling the Border Invasion

Click to see story on NOQ ReportTrump Threatens Mexico, Canada, and China With Massive Punishments for Enabling the Border Invasion

Click to see story on America First ReportTrump Vows 25% Tariffs on Goods From Mexico, Canada Over Border Crisis

Click to see story on Le·gal In·sur·rec·tionCanada, Mexico Bend the Knee to Trump 24 Hours After Tariff Threats

Click to see story on The Maine WirePoilievre: “I only care about Canada.”

Click to see story on The Counter SignalPresident-Elect Trump Targets Mexico, Canada, and China with Heavy Tariffs over Fentanyl Crisis – Tennessee Star

Click to see story on Tennessee StarTrump threatens Mexico, Canada tariffs over border security

Click to see story on wng.orgTrump says he will issue executive order <br/>to charge Canada, Mexico 25% tariff on <br/>goods upon taking office

Click to see story on LucianneTariffs on China or Mexico, Not Both

Click to see story on aei.orgTrump vows tariffs on foreign partners over drug, migrant crises – Advertising and Donations – advertising-newsandtimes.com

Click to see story on Fox NewsTrump Vows Huge Tariffs if Mexico, Canada Do Not Block Migrants, Drugs

Click to see story on BreitbartTrump Announces 25% Tariff on All Products From Mexico and Canada Until Illegal Alien Invasion is Stopped, Will Impose Additional Tariff on China Over Fentanyl

Click to see story on The Gateway Pundit‘Ridiculous’: Trump reveals monumental action he’ll take on Day One in office * WorldNetDaily * by Joe Kovacs

Click to see story on WNDTrump’s Shocking 25% Tariff Threat: What It Means for Canada and Mexico – Will It Spark a Trade War?

Click to see story on The Published ReporterPresident Trump Announces 25 Percent Tariff on all Mexican and Canadian Imports, Effective January 20th – Until Border is Secure – The Last Refuge

Click to see story on The Last RefugeTrump Will Impose 25% Tariffs on Day One On Mexico, China, Canada Until They Stop Flow of Illegal and Fentanyl into the U.S. – Geller Report

Click to see story on Geller ReportTrump Threatens Tariffs: China, Mexico, Canada Told To Play Ball or PAY UP

Click to see story on WLTReportPresident Trump Threatens To Impose Massive Tariffs On Canada, Mexico & China On First Day Of Administration * 100PercentFedUp.com * by Danielle

Click to see story on 100% FED UP!Canada And Mexico Came Running When Trump Posted THIS

Click to see story on Clash DailyBREAKING: Trump Slaps Mexico and Canada With 25% Tariff to End Illegal Alien Invasion – Unveils Tough Plan to Halt China’s Fentanyl Crisis – Defiant America

Click to see story on Defiant AmericaThePatriotLight – Trump Announces Plans For Tariffs On Mexico, Canada If They Fail To Stop Illegal Immigration

Click to see story on thepatriotlight.comChina’s Diplomatic Response to Trump’s Effective Tariff Plan – Real News Now

Click to see story on realnewsnow.com‘Ridiculous’: Trump Reveals Monumental Action He’ll Take Against Canada And Mexico On Day One In Office ⋆ Conservative Firing Line

Click to see story on Conservative Firing LineTrump promises Jan. 20 executive order charging Mexico and Canada 25 percent and raise China tariff to 35 percent until border secured and fentanyl shipments stop

Click to see story on dailytorch.comUntracked Bias

Trump promises 25% tariffs on Mexico and Canada against ‘drug invasion’ and ‘illegal immigrants’

Click to see story on GloboTrump threatens to impose sweeping new tariffs on Mexico, Canada and China

Click to see story on Shropshire StarTrump says he will impose 25% tariffs on Mexico and Canada

Click to see story on UOLTrump threatens Canada, Mexico with 25% tariffs

Click to see story on Otago Daily TimesEuropean stock markets fall after Trump’s announcement of new tariffs

Click to see story on Noticias ao MinutoTrump has imposed high tariffs on goods from China, Canada and Mexico: he was abused by drugs and illegals

Click to see story on ZN.UA Зеркало неделиTrump promises to raise duties for Mexico, Canada and China on the very first day

Click to see story on Korrespondent.netTrump pledges 25 per cent tariffs on Canada and Mexico

Click to see story on PerthNowTrump announces high import duties on Canada, Mexico and China

Click to see story on Het NieuwsbladTrump, 25% tariffs on Mexico and Canada against drugs and migrants

Click to see story on Quotidiano NazionaleTrump threatens to impose taxes on goods from Mexico, Canada, and China soon after taking office. Beijing warns that “no one wins”

Click to see story on Jornal ExpressoChina resilient against external shocks amid U.S. 60% potential tariff threat

Click to see story on EcnsWhy gamers fear Trump’s tariffs

Click to see story on rnd.deDonald Trump has already sealed the fate of imported goods

Click to see story on IndexChina responds to Donald Trump’s threat to increase tariffs: “No one will win a trade war”

Click to see story on Stirile Antena 1 ObservatorTrump threatens sweeping new tariffs on Mexico, Canada and China

Click to see story on StvTrump’s Bold Agenda: Tariffs, Taxes, and Transformation

Click to see story on DevdiscourseDonald Trump threatens to impose taxes on assets from Mexico, Canada and China soon after taking office

Click to see story on IOL PortugalTrump threatens China, Mexico and Canada with devastating tariffs if they do not stop the entry of fentanyl and immigrants

Click to see story on La VanguardiaTrump: High tariffs on goods from Mexico and Canada

Click to see story on ORF.at NewsTrump varsler 25 prosent toll på varer fra Canada og Mexico

Click to see story on NRKTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Jamaica GleanerTrump threatens to impose new taxes on imports from Mexico, Canada and China

Click to see story on SIC NotíciasTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Orillia MattersTrump will impose tariffs on goods from Mexico and Canada on the first day

Click to see story on Ekstra BladetWill impose 25 per cent tariff on all imports from Canada, Mexico: Trump

Click to see story on MathrubhumiPresident of Mexico warns Trump that taxes will not stop drugs or immigration

Click to see story on DnoticiasTrump Announces 25% Tariffs for Mexico and Canada From First Day of Government · Global Voices

Click to see story on Aristegui NoticiasTrump vows to punish Canada, Mexico on Day 1 of inauguration – The Zambian Observer

Click to see story on The Zambian ObserverTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Newmarket TodayTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Midland TodayTrump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on Collingwood TodayAfter Trump’s announcements, Stellantis falls on the stock market, European automotive stocks in the red

Click to see story on Sud OuestTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Thorold TodayTrump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on Elora Fergus TodayTrump: High tariffs on goods from China, Mexico and Canada

Click to see story on stern.deTrump promises to impose 25% tariffs on goods from China and Mexico due to the flow of fentanyl and immigrants to the US

Click to see story on EL ESPAÑOLTrump promises 25 percent tariffs on Canada and Mexico

Click to see story on svt NyheterTrump hits Mexico, Canada and China

Click to see story on siol.netTrump threatens to impose tariffs on Mexico, Canada and China from the first day of his new term

Click to see story on El PeriódicoGerman stock markets tumble into the negative following Trump’s harsh tariff announcements

Click to see story on focus.deDonald Trump promises to impose 25% taxes on imports from Mexico and Canada; why the decision?

Click to see story on El TiempoDonald Trump Buries Globalization: Prohibitive Tariffs from Day One of Returning to the White House

Click to see story on RzeczpospolitaChina has enough trouble without Trump, but it has a master plan

Click to see story on telex.huIbex 35 twists under 11,600 with Trump’s new tariff scare

Click to see story on 20minutosChina warns that “nobody will win a trade war,” following Trump’s announcement of tariff increases

Click to see story on El DebateDonald Trump promises punitive tariffs on goods from Canada and Mexico on his first day on the job

Click to see story on VGTrump is relaunching the trade war with Canada, Mexico and China

Click to see story on 20 MinutesTrump vows big tariffs on Mexico, Canada and China

Click to see story on ARY NewsTrump wants to tax all products from Mexico, Canada and China by up to 25%

Click to see story on Jovem Pan NewsTrump threatens to impose 25% tariffs on Mexico and Canada on its first day of mandate

Click to see story on ProcesoThe dollar sustains decline amid the announcement of new tariffs for China, Mexico and Canada by Donald Trump

Click to see story on La TerceraTrump: High tariffs on goods from China, Mexico and Canada

Click to see story on Wort.luThe German minister warns of a trade war with the USA

Click to see story on aktuality.skTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China on Day 1 – Egypt Independent

Click to see story on Egypt IndependentTrump’s threats of tariffs are sending currency markets into turmoil

Click to see story on CNN GreeceTrump will impose 25% of tariffs on Mexico from his first day of mandate; he demands to stop “invasion” of migrants and drugs

Click to see story on El UniversalStock market: Reacts to imported pressures

Click to see story on NaftemporikiThree Countries in Trump’s Crosshairs: ‘I Will Sign All Necessary Documents’

Click to see story on Do RzeczyTrump announces tariffs on China, Mexico and Canada

Click to see story on Jornal de NegóciosChina and Germany want dialogue with Trump over import tariffs

Click to see story on rd.nlWhy does Donald Trump love tariffs so much?

Click to see story on City AMTrump threatens 25% tariffs on Mexico and Canada if they don’t close the border

Click to see story on El ConfidencialTrump promises high tariffs on day 1 — China warns of consequences

Click to see story on watson.ch/Trump’s 25 per cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on Battlefords NOWTrump pledged 25 per cent tariff on Canadian products until border issues solved

Click to see story on meadowlakeNOWTrump makes China, Canada and Mexico “pay a very high price,” but when will “mini-China” follow Europe?

Click to see story on Gazet van AntwerpenTrump announces tariffs on imports from Mexico and Canada

Click to see story on Revista OesteTrump Tests Xi’s Appetite To Play Ball With Early Tariff Threat

Click to see story on NDTV ProfitTrump says he will tax products from Mexico and Canada on 25%; China’s tariff will be 10%

Click to see story on CartaCapitalDonald Trump vows to slap 25% tariffs on Mexico, Canada, 10% tariffs on China

Click to see story on Business RecorderTrump announces high tariffs on goods from China, Mexico and Canada

Click to see story on LVZ – Leipziger VolkszeitungTrump promises to impose tariffs on goods from Canada, Mexico and China

Click to see story on seznamzpravy.czTrump has promised new tariffs on China, Mexico and Canada

Click to see story on Il PostEquity Markets Retreat, Dollar Gains As Trump Fires Tariff Warning

Click to see story on IBTimes AustraliaTrump vows day-one tariffs on Mexico, Canada and China

Click to see story on Capital FM KenyaAggressive tariffs on day one: Trump will increase tariffs on all products from Canada and Mexico

Click to see story on El Tiempo LatinoTrump vows to raise tariffs on Chinese, Canadian, Mexican imports

Click to see story on القدس العربيTrump vows – on day 1 – to impose a 25% tariffs on Canada and Mexico on ALL IMPORTS and an additional 10% tariff increase on ALL Chinese goods

Click to see story on MSNChina’s been trying to ‘Trump-proof’ its economy amid his tariff threats, experts say

Click to see story on WBALChina responds to Donald Trump’s threat to increase tariffs: “No one will win a trade war”

Click to see story on Stirile Pro TVTrump announces increased tariffs for China, Canada and Mexico

Click to see story on rts.chMexican peso falls behind Trump’s plans to impose 25% tariff on imports from Mexico

Click to see story on Bloomberg LineaTrump announces tariffs on goods from Canada and Mexico on his first day on the job

Click to see story on E24Trump to impose new tariffs on China, Mexico and Canada on his first day

Click to see story on 444.huInvestors react to Trump’s tariff threats: Creating uncertainty

Click to see story on borsen.dkPresident-elect Trump promises tariffs to China, Mexico and Canada across the border

Click to see story on larepublica.coIn the news today: Tariffs mean pain for U.S. and Canada, leaders say

Click to see story on CFJC Today KamloopsTrump has promised tariffs on goods from Canada, Mexico and China. He wants to impose them on his first day in office

Click to see story on Aktuálně.czTrump calls for further tariffs on goods from China, Canada and Mexico

Click to see story on RÚVUS: Trump will increase tariffs on China and Mexico by the flow of fentanyl and immigrants

Click to see story on rpp.peEconomist on Trump’s tariff threats: – Keeps the world on the torture bench

Click to see story on NettavisenDonald Trump Talks Tariffs, China’s Currency Hits Lowest Level in Months

Click to see story on Business Insider (Poland)Trump also hits neighboring countries with hefty import tariffs

Click to see story on De TijdWhat have Mexico, Canada and China said about Trump’s tariff ‘threats’?

Click to see story on Portafolio.coTrump is threatening a trade war with the largest partner of the USA, justifying it by importing drugs

Click to see story on Denník NTrump promises to impose tariffs on goods from China, Mexico and Canada on first day of presidency

Click to see story on babel.uaTrump pledges 25 per cent tariff on Canadian products until border issues solved

Click to see story on Chek newsTrump threatens China, Mexico and Canada with new tariffs

Click to see story on Netwerk24Dollar gains after Trump vows tariffs against Mexico, Canada and China – Blue Water Healthy Living

Click to see story on Blue Water Healthy LivingTrump announces tariffs against China, Mexico and Canada

Click to see story on inFranken.deDonald Trump will impose tariffs on China, Canada and Mexico and already impact on the stock markets

Click to see story on ÁmbitoTrump announces tariffs on Mexico, Canada and China: trade tensions on the rise

Click to see story on Il Sole 24 OreTrump has promised tariffs on goods from Canada, Mexico and China

Click to see story on Česká televizeBarely elected, Donald Trump will increase tariffs for China, Canada and Mexico

Click to see story on Le TempsTrump promises 25% tariffs to Mexico and Canada against drugs and “illegal migrants”

Click to see story on The Washington HispanicJohn Deere holds a bet for Mexico despite Trump

Click to see story on El EconomistaWalmart Alerts Shoppers: Expect Price Hikes If Trump’s $3 Trillion Tariff Plan Takes Effect

Click to see story on IBTimes UKTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on BIV NewsTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Moose Jaw TodayPremier Furey Urges Meeting with PM Over Trump’s Proposed Tariffs

Click to see story on VOCMTrump pledges tariffs against Mexico, Canada and China

Click to see story on MOR-TVTrump Promises Immediate Tariffs on Mexico, Canada, and China – The Global Herald

Click to see story on The Global HeraldTrump to put staggering 25% tariff on all products from Mexico and Canada

Click to see story on Express USDonald Trump announces that he will implement tariff of 25% products from Mexico from this date

Click to see story on TV AztecaTrump threatens 25% tariffs on imports from Mexico and Canada

Click to see story on VilaWeb.catTrump already announces 10% tariffs on China and 25% on Mexico and Cánada

Click to see story on infoLibre.esTrump plans to impose sweeping tariffs on Mexico, Canada and China on first day

Click to see story on NXSTDR’s US correspondent on Trump’s new customs threat: ‘It will really hurt ordinary Americans’

Click to see story on DRDonald Trump returns: What does “America First” mean for Mexico and the world?

Click to see story on ADN 40Trump vows 25% tariffs on Canada, Mexico over illegal immigration

Click to see story on GistReelMorning Bid: Trump’s tariff post sends markets scrambling

Click to see story on BizTocStock futures are flat as traders assess new Trump tariff threats: Live updates

Click to see story on UpstractDonald Trump announces new tariffs for Canada, Mexico and China

Click to see story on MediafaxUSA: Trump promises high tariffs from day 1

Click to see story on az Aargauer ZeitungTrump confirms punitive tariffs against neighboring countries and China: – Time for them to pay a high price

Click to see story on www.dn.noTrump said he’ll charge up to an extra 25% on imports from Mexico, Canada, and China. Here’s what the US buys from them the most.

Click to see story on JingletreeEquity markets retreat, dollar gains as Trump fires tariff warning

Click to see story on ZawyaWorld trade in tension in the shadow of Trump over Mexico

Click to see story on Revista Merca2.0Trump threatens Canada, Mexico, China with tariffs

Click to see story on KPBSMost Asian Markets Drop, Dollar Gains As Trump Fires Tariff Warning

Click to see story on Cryptocurrency News | Cryptocurrency Prices | Market CapDonald Trump strongly warns Mexico and Canada over migration and drug trafficking

Click to see story on Prensa LibreTrump vows big tariffs on Mexico, Canada and China

Click to see story on Tuko.co.ke – Kenya news.Trump is hitting Canada, Mexico, and China with tariffs on his first day as president

Click to see story on REVOLT TVTrump vows to slap 10% tariffs on China, 25% tariffs on Mexico, Canada

Click to see story on Business TimesTrump launches tariff war on the first day of his presidency

Click to see story on Magyar HangTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on InnisfilToday.caTrump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on ElliotLakeToday.comTrump sets off a tariff war with Mexico, China and Canada two months after taking office

Click to see story on El IndependienteTrump vows new Canada, Mexico, China tariffs that threaten global trade

Click to see story on CDE NewsTrump threatens to impose new tariffs on Mexico, Canada and China on first day in office

Click to see story on News Talk 94.1/AM 1600Trump’s 25-per-cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on CambridgeToday.caTrump promises huge border tax for Mexico and Canada right after inauguration

Click to see story on The World Without Fake News!Trump tariffs could hit hard – if they come off

Click to see story on hbl.fiTrump wants high tariffs on goods from China, Mexico and Canada

Click to see story on vol.atTrump’s 25-per-cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on StratfordToday.caTrump vows big tariffs on Mexico, Canada and China

Click to see story on Yen.com.gh – Ghana news.Trump roils markets with tariff threat on China, Mexico, Canada | Nancy Cook & Brian Platt

Click to see story on BusinessMirrorTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on PressNewsAgencyTrump’s tariff plan could raise prices, blow up his own trade deal with Mexico and Canada

Click to see story on SuperHits 103.7 COSY-FMTrump threatens to impose sweeping new tariffs on Mexico, Canada and China on first day in office

Click to see story on Daily Lead PakistanTrump pledges 25-per-cent tariff on Canadian products until border issues solved

Click to see story on The NOTL LocalTrump’s Tariff Threats Weigh on CAD and AUD; Dollar and Yen Gain Ground – Action Forex

Click to see story on Action ForexGeenStijl: Big Bad Trump Threatens Import Tariffs Until ‘Invasion of Drugs and Immigrants’ Stops

Click to see story on geenstijl.nlDonald Trump launches an offensive on tariffs against China, Canada and Mexico

Click to see story on InternazionaleDonald Trump threatens 25% tariff on products from Canada, Mexico

Click to see story on World ABC NewsTrump has promised tariffs on goods from Canada, Mexico and China

Click to see story on Deník.czDonald Trump promises 25% tariffs to Mexico and Canada against drugs and “illegal migrants”

Click to see story on www.diariolibre.comHong Kong Stocks Teeter Near Two-Month Low Amid Trump’s New Tariff Threats on China

Click to see story on Automobile News and Trends – You must read this !Trump Vows Huge Tariffs if Canada, Mexico Do Not Block Migrants, Fentanyl – Conservative Angle

Click to see story on Conservative AngleNoroña, president of the Senate of Mexico, exploded against Donald Trump for a new tariff

Click to see story on Time NewsTrump’s latest tariff plan aims at multiple countries. What does it mean for the US?

Click to see story on Usa news siteTrump launches offensive against China, Canada and Mexico, “no one will win a trade war” warns Beijing

Click to see story on World Today NewsD. Trump put everyone on their feet with a single statement: 25% tariffs – also for Mexico and Canada

Click to see story on vz.ltTrump threatens to impose new tariffs on Mexico, Canada and China on their first day in the presidency Agencies The Voice of the Interior

Click to see story on La VozTrump threatens 25 per cent tariff on all imports from Canada and US unless something is done at the border

Click to see story on NorfolkToday.caEquity markets retreat, dollar gains as Trump fires tariff warning

Click to see story on FOX 28 SpokaneTrump pledges tariffs against Mexico, Canada and China

Click to see story on The Baltimore PostTrump’s toll weblog submit sends out markets dashing

Click to see story on India Daily MailDonald Trump vows 25% tariff on all products from Canada, Mexico on first days in office

Click to see story on insaugaNo one is a winner in the trade war, warns China

Click to see story on trend.skAustralian National Review – Trump’s Tariffs: What Do They Mean for the EU?

Click to see story on Australian National ReviewTrump will impose 25% tariff on products from Mexico and Canada, from the first day of mandate

Click to see story on VanguardiaDollar Rises as Trump Vows Immediate Tariffs

Click to see story on Barchart.comTrump vows to slap new tariffs on key US trading partners – The Press United | International News Analysis, Viewpoint

Click to see story on ThePress United | International News Analysis, ViewpointDonald Trump says planning to impose tariffs on China, Mexico and Canada. What about India?

Click to see story on Latest For MeTrump Threatens to Impose Sweeping New Tariffs on Mexico, Canada and China

Click to see story on GV WireTrump bets on a trade war and announces tariffs on Mexico, Canada and China

Click to see story on El PluralTrump confirms that he will impose 25% tariff on Mexico from his first day

Click to see story on Reporte IndigoStock exchanges fall after Trump’s announcement to impose tariffs on China, Canada and Mexico

Click to see story on El CronistaHow Trump’s tariffs could drive up the cost of batteries, EVs, and more

Click to see story on MIT Technology ReviewSenate President and Morena’s leader reject Trump’s announcement to impose a 25% tariff on Mexico’s products

Click to see story on NODALDonald Trump will impose 25% tariff on Mexico and Canada from day 1 of his government

Click to see story on SDPnoticias.comMonreal claims Trump’s imposition of tariffs goes against T-MEC

Click to see story on 24 HorasTrump plans new trade tariffs

Click to see story on Fiji Broadcasting CorporationTrump hits China, Canada, and Mexico with tariff announcement in new “trade war”

Click to see story on TAG24Trump vows big tariffs on Mexico, Canada and China

Click to see story on Insider PaperCanada stresses its importance to U.S. after Trump tariff announcement

Click to see story on NewsdiaryonlineTrump’s 25-per-cent tariff equals pain on both sides of border, Canadian leaders say

Click to see story on Loonie PoliticsTrump announces sweeping tariffs on China, Mexico, and Canada, sparking global trade tensions

Click to see story on BreezyScrollTrump’s Dramatic Tariff Plan, and a Cease-Fire Takes Shape in Lebanon

Click to see story on MondialNewsTrump says he’ll slap tariffs on Canada, China and Mexico on Day 1

Click to see story on News/Talk 94.7 & 970 WMAYTrump ups the ante on tariffs, vowing massive taxes on goods from Mexico, Canada and China

Click to see story on AlKhaleej TodayWill hit China, Canada, Mexico with tariff hikes on Day 1 in office: Trump

Click to see story on Sambad EnglishTrump vows new Canada, Mexico, China tariffs that threaten global trade

Click to see story on The CitizenTrump announces 25% tariffs to Mexico and Canada since January 20

Click to see story on Periódico Expreso – Más Cerca de TiThe real numbers behind Trump’s Canada tariff threat

Click to see story on The LogicTrump proposes 25% tariffs to Mexico and Canada to curb drugs and migration

Click to see story on GestionTrump Announces Tariffs for U.S. Main Trade Partners

Click to see story on BAE NegociosTrump’s tariff plan could raise prices, blow up his own trade deal with Mexico and Canada

Click to see story on Northwest NewsradioTrump Scares Canada and Mexico Before He Even Takes Office: Threatens 25% Additional Tariffs

Click to see story on Tr724What do Trump’s proposed tariffs look like?

Click to see story on Business ReportTrump promises more tariffs on China and Mexico for the flow of fentanyl and immigrants

Click to see story on Proceso DigitalAuto stocks lead losses in Europe on Trump’s tariff risk – Global Rubber Market News

Click to see story on Global Rubber MarketsHere’s What Canada, Mexico & China Said About Donald Trump’s Tariffs

Click to see story on MandatoryTrump announces he will raise tariffs

Click to see story on pme.chTrump vows new Canada, Mexico, China tariffs that threaten global trade – LankaXpress

Click to see story on LankaxpressTrump says hell slap tariffs on Canada, China and Mexico on Day 1 – Everett Post

Click to see story on Everett PostStock market: Dax starts with losses, Trump tariffs weigh on Porsche and Volkswagen shares, Bitcoin at $95,000

Click to see story on manager magazin“Nobody Will Win a Trade War”: China Responds to Trump’s Tariff Threat · Global Voices

Click to see story on Telemundo 44 Washington DCTrump says hell slap tariffs on Canada, China and Mexico on Day 1 – Connect FM | Local News Radio | Dubois, PA